Subject: Allegheny, Pennsylvania — Your Trusted Mortgage Partner! Dear [Client's Name], Thank you for reaching out to our mortgage company regarding your recent inquiry. We are thrilled to assist you in your mortgage journey and provide you with comprehensive information about Allegheny, Pennsylvania's housing market and our mortgage loan options. Allegheny, Pennsylvania, is a vibrant region known for its rich history, diverse culture, and strong economy. Located in the western part of the state, Allegheny County encompasses the City of Pittsburgh, numerous charming suburbs, and scenic countryside. Let us guide you through the key aspects of Allegheny, Pennsylvania, and our mortgage services: 1. Mortgage Options: — Fixed-Rate Mortgage: Lock in a stable interest rate for the entire loan term. — Adjustable-Rate Mortgage (ARM): Benefit from an initial fixed period with potential rate adjustments later. — FHA Loans: Perfect for first-time homebuyers with lower down payment requirements. — VA Loans: Our commitment to serving veterans, active-duty military personnel, and their families. — Jumbo Loans: Financing options beyond the conventional loan limits for high-value properties. — Refinance: Explore options to potentially lower monthly payments or access equity. 2. Allegheny, Pennsylvania Housing Market: — Diverse Neighborhoods: Choose from urban living in Pittsburgh, tranquil suburbs, or scenic countryside settings. — Affordable Homes: Enjoy a reasonable cost of living coupled with a wide range of housing options. — Thriving Job Market: Allegheny boasts a strong economy driven by industries like healthcare, technology, finance, and education. — Cultural and Sporting Events: Experience the city's vibrant arts scene, world-class museums, sports teams, and outdoor recreational activities. 3. Our Mortgage Company's Commitment: — Personalized Service: Our experienced mortgage professionals will guide you through the entire process, ensuring your needs are met. — Competitive Rates: We offer competitive interest rates and terms to provide you with financing options tailored to your situation. — Fast and Efficient Processes: We understand the time sensitivity in mortgage transactions and strive to empower you with quick decision-making. — Exceptional Customer Support: Count on us to address any concerns or questions you may have at every step of the way. To help you make an informed decision, we have attached additional information regarding our mortgage processes, interest rates, and the necessary documentation for your application. We appreciate the opportunity to assist you in achieving your homeownership dreams. Please feel free to contact our dedicated team at [contact number] or visit [website] to begin your mortgage journey today. We look forward to working with you. Warm regards, [Your Name] [Your Title] [Company Name]

Allegheny Pennsylvania Sample Letter for Response to Inquiry - Mortgage Company

Description

How to fill out Allegheny Pennsylvania Sample Letter For Response To Inquiry - Mortgage Company?

Whether you intend to start your company, enter into a deal, apply for your ID update, or resolve family-related legal issues, you need to prepare specific documentation meeting your local laws and regulations. Finding the right papers may take a lot of time and effort unless you use the US Legal Forms library.

The platform provides users with more than 85,000 expertly drafted and verified legal templates for any personal or business occasion. All files are collected by state and area of use, so opting for a copy like Allegheny Sample Letter for Response to Inquiry - Mortgage Company is quick and easy.

The US Legal Forms library users only need to log in to their account and click the Download button next to the required template. If you are new to the service, it will take you a few more steps to obtain the Allegheny Sample Letter for Response to Inquiry - Mortgage Company. Adhere to the guidelines below:

- Make sure the sample fulfills your personal needs and state law regulations.

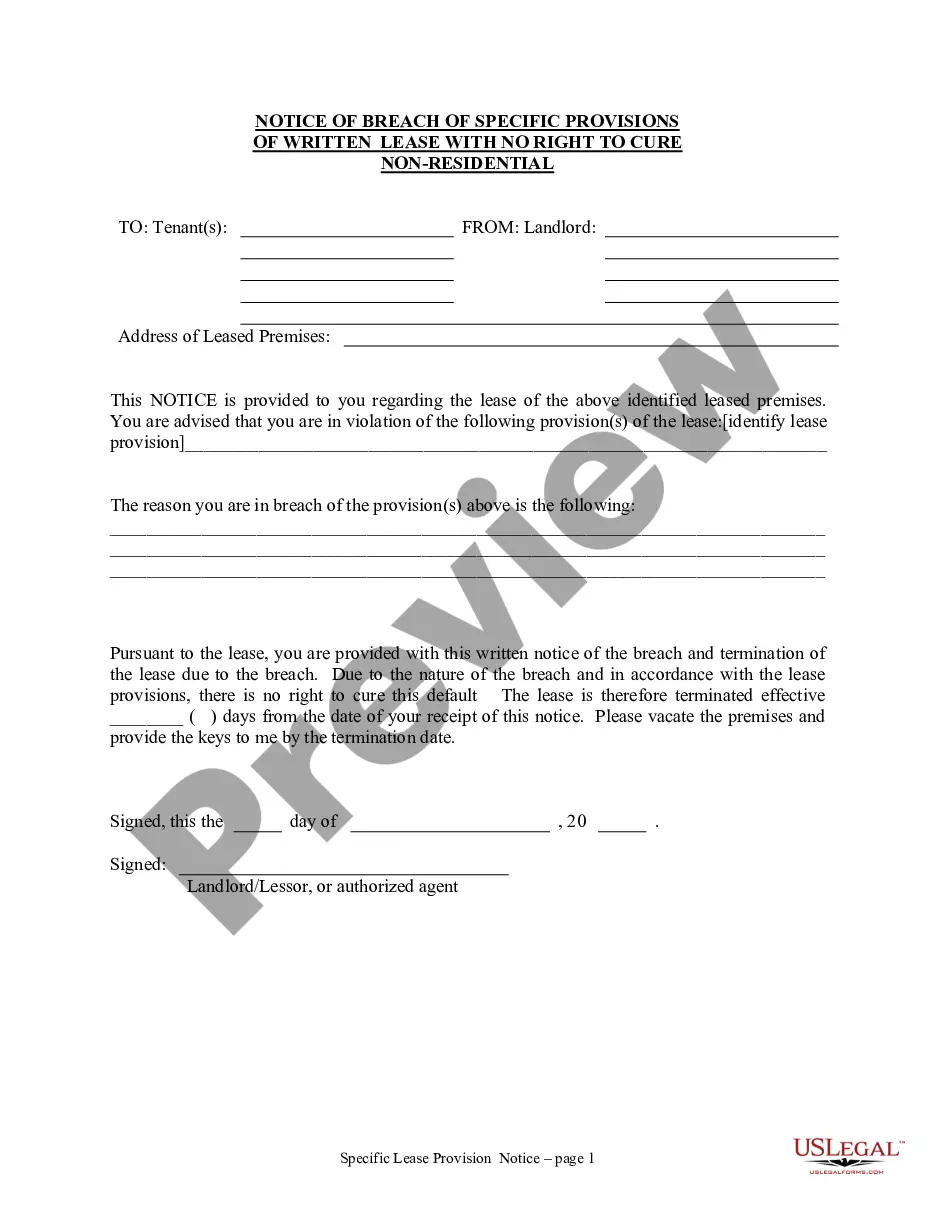

- Look through the form description and check the Preview if there’s one on the page.

- Utilize the search tab specifying your state above to locate another template.

- Click Buy Now to get the file once you find the proper one.

- Opt for the subscription plan that suits you most to proceed.

- Log in to your account and pay the service with a credit card or PayPal.

- Download the Allegheny Sample Letter for Response to Inquiry - Mortgage Company in the file format you require.

- Print the copy or complete it and sign it electronically via an online editor to save time.

Documents provided by our library are multi-usable. Having an active subscription, you are able to access all of your previously acquired paperwork at any time in the My Forms tab of your profile. Stop wasting time on a endless search for up-to-date official documents. Sign up for the US Legal Forms platform and keep your paperwork in order with the most extensive online form library!