[Your Name] [Your Address] [City, State, ZIP] [Email Address] [Phone Number] [Date] [Recipient's Name] [Recipient's Designation] [Mortgage Company Name] [Company Address] [City, State, ZIP] Subject: Response to Inquiry — Mortgage Company Dear [Recipient's Name], I hope this letter finds you in good health. I am writing in response to your recent inquiry regarding mortgage options in San Jose, California. As a leading mortgage company specializing in the San Jose area, we are pleased to provide you with detailed information regarding our services and options available to you. San Jose, fondly known as the "Capital of Silicon Valley," is a vibrant city nestled in the heart of California's tech hub. It offers a diverse and thriving community, bustling with a variety of cultural activities, recreational opportunities, and a strong job market. With its ideal location and attractive lifestyle, San Jose has become a highly sought-after destination for prospective homeowners and real estate investors. At [Mortgage Company Name], we understand the unique needs and requirements of individuals looking to secure a mortgage in the San Jose area. As a result, we offer several specialized mortgage programs to cater to your specific needs. Here are some of the key options we provide: 1. Fixed-Rate Mortgages: Our fixed-rate mortgage programs ensure that your interest rate remains consistent throughout the loan term. This option offers stability and predictable monthly payments, making it ideal for those seeking long-term financing solutions. 2. Adjustable-Rate Mortgages (ARM's): ARM sallow borrowers to take advantage of lower initial interest rates, which are subject to adjustment during the loan term. This option is suitable for individuals who plan to relocate or refinance within a shorter timeframe. 3. Jumbo Loans: San Jose's real estate market often surpasses conventional loan limits due to high property values. Our jumbo loan program enables borrowers to secure financing for properties exceeding standard conforming loan limits. 4. FHA Loans: The Federal Housing Administration (FHA) provides loans with lower down payment requirements and more flexible qualification criteria. FHA loans are a popular option for first-time homebuyers and those with limited credit history. 5. VA Loans: For our esteemed veterans and active-duty military personnel, we are proud to offer VA loans, which include competitive interest rates, no down payment requirement, and reduced closing costs. 6. Refinancing Options: If you already own a home in San Jose, our mortgage company can assist you with refinancing your existing mortgage, potentially reducing your interest rate, lowering monthly payments, or accessing cash out for home improvements or other needs. 7. Personalized Customer Service: Our experienced mortgage professionals are dedicated to providing individualized guidance and support throughout the entire mortgage process. We will work closely with you to understand your goals, financial situation, and guide you towards the best mortgage option for your requirements. For a more detailed understanding of each mortgage program, I have enclosed our comprehensive brochure highlighting the features, benefits, and eligibility criteria. Feel free to reach out to our knowledgeable mortgage team at [Phone Number] or [Email Address] if you have any further questions or require assistance in initiating your mortgage application. Thank you for considering [Mortgage Company Name] as your mortgage partner. We are committed to helping you achieve your homeownership dreams in San Jose, California. We eagerly await the opportunity to provide you with prompt, reliable, and personalized mortgage services. Yours sincerely, [Your Name]

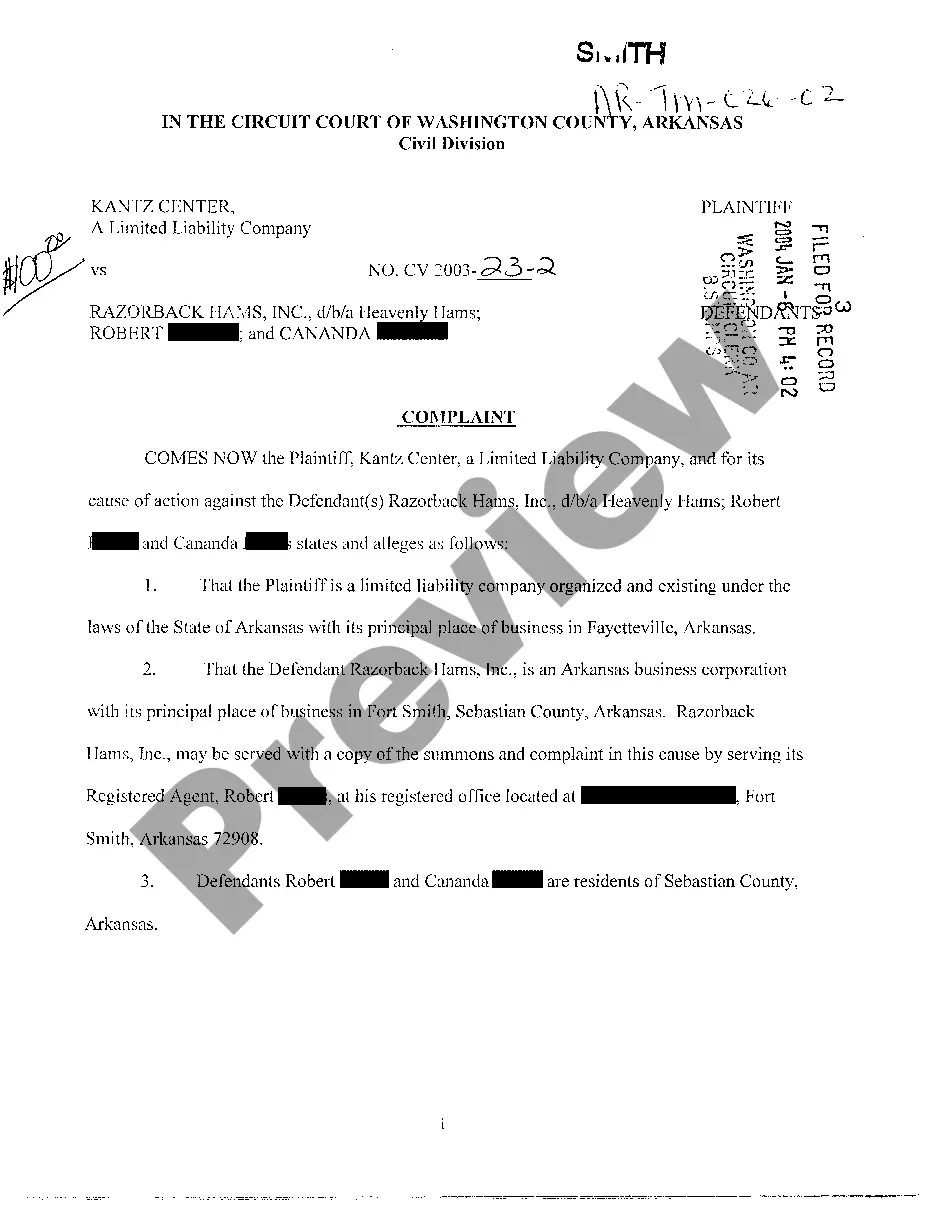

San Jose California Sample Letter for Response to Inquiry - Mortgage Company

Description

How to fill out San Jose California Sample Letter For Response To Inquiry - Mortgage Company?

How much time does it usually take you to draw up a legal document? Since every state has its laws and regulations for every life sphere, finding a San Jose Sample Letter for Response to Inquiry - Mortgage Company meeting all regional requirements can be exhausting, and ordering it from a professional attorney is often expensive. Many web services offer the most common state-specific documents for download, but using the US Legal Forms library is most advantegeous.

US Legal Forms is the most comprehensive web catalog of templates, grouped by states and areas of use. Aside from the San Jose Sample Letter for Response to Inquiry - Mortgage Company, here you can get any specific document to run your business or personal deeds, complying with your regional requirements. Professionals check all samples for their actuality, so you can be certain to prepare your documentation properly.

Using the service is pretty straightforward. If you already have an account on the platform and your subscription is valid, you only need to log in, choose the needed sample, and download it. You can pick the file in your profile at any moment later on. Otherwise, if you are new to the website, there will be some extra actions to complete before you get your San Jose Sample Letter for Response to Inquiry - Mortgage Company:

- Check the content of the page you’re on.

- Read the description of the template or Preview it (if available).

- Look for another document using the corresponding option in the header.

- Click Buy Now when you’re certain in the chosen file.

- Select the subscription plan that suits you most.

- Register for an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Change the file format if needed.

- Click Download to save the San Jose Sample Letter for Response to Inquiry - Mortgage Company.

- Print the sample or use any preferred online editor to complete it electronically.

No matter how many times you need to use the purchased template, you can find all the samples you’ve ever saved in your profile by opening the My Forms tab. Try it out!