Title: Understanding the Maricopa Arizona Amended Loan Agreement: Types and Key Aspects Introduction: The Maricopa Arizona Amended Loan Agreement is a legally-binding contract that outlines specific terms and conditions related to the borrowing and repayment of funds within the Maricopa, Arizona region. This agreement plays a crucial role in ensuring transparency, accountability, and mutual understanding between borrowers and lenders in financial transactions. In this article, we will delve deeper into the details of the Maricopa Arizona Amended Loan Agreement, highlighting its different types and important keywords to aid your understanding. Types of Maricopa Arizona Amended Loan Agreement: 1. Personal Loan Agreement: This type of loan agreement is designed for individuals seeking financial assistance for personal reasons, such as education, medical expenses, home improvements, or purchasing assets. 2. Business Loan Agreement: Aimed at entrepreneurs and businesses, this agreement covers loans acquired for start-ups, expansion, working capital, equipment purchases, or any other business-related activities. 3. Real Estate Loan Agreement: Focusing on real estate transactions, this type of agreement governs loans used for purchasing, refinancing, or renovating properties within Maricopa, Arizona. 4. Auto Loan Agreement: Specifically tailored for purchasing vehicles, this agreement outlines the terms and conditions for loans taken to finance automobiles, motorcycles, or any other motorized vehicle. Key Aspects of the Maricopa Arizona Amended Loan Agreement: 1. Loan Amount: Specifies the principal amount borrowed, which is the initial sum of money provided to the borrower. 2. Interest Rate: Determines the percentage charged by the lender as compensation for borrowing funds and is a crucial factor in understanding the overall cost of the loan. 3. Repayment Terms: Outlines the duration of the loan, often described in months or years, and details the repayment schedule, including installments, frequency, and due dates. 4. Late Payment Fees: Specifies the penalties or additional charges that may apply if the borrower fails to make timely repayments, encouraging punctual repayment behavior. 5. Collateral and Security: Addresses whether the loan requires collateral, such as property, vehicles, or other assets, to secure the borrowed amount. It also outlines the consequences of defaulting on the loan. 6. Prepayment Conditions: Describes the possibility of repaying the loan in full before the specified term, including any associated fees or penalties. 7. Termination and Amendment: Outlines the circumstances under which the agreement can be terminated or modified, including applicable procedures, rights, and obligations. Conclusion: The Maricopa Arizona Amended Loan Agreement serves as a vital tool for borrowers and lenders within the region. By understanding the agreement's various types and key aspects, individuals and businesses can make informed financial decisions, ensuring strong financial relationships and successful loan transactions.

Maricopa Arizona Amended Loan Agreement

Description

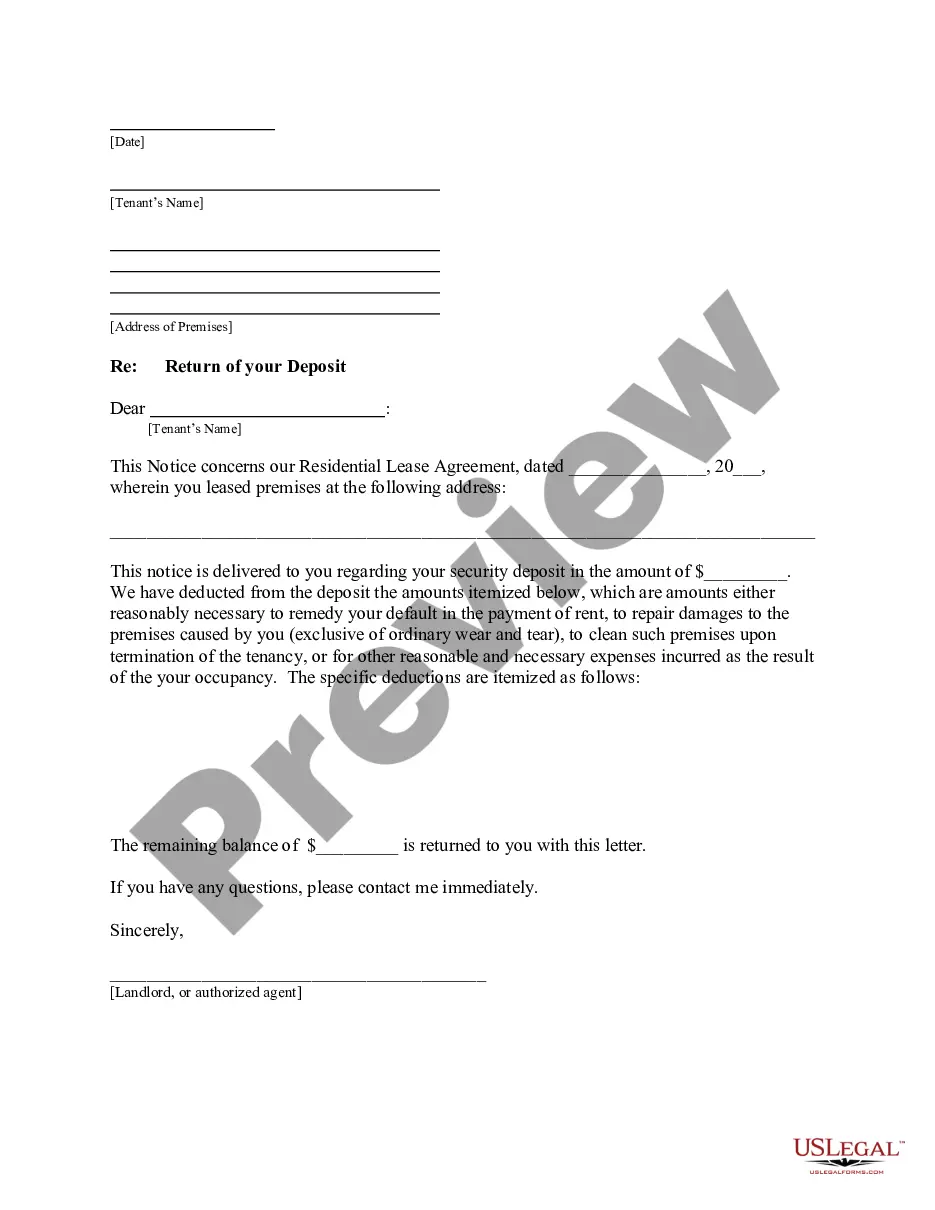

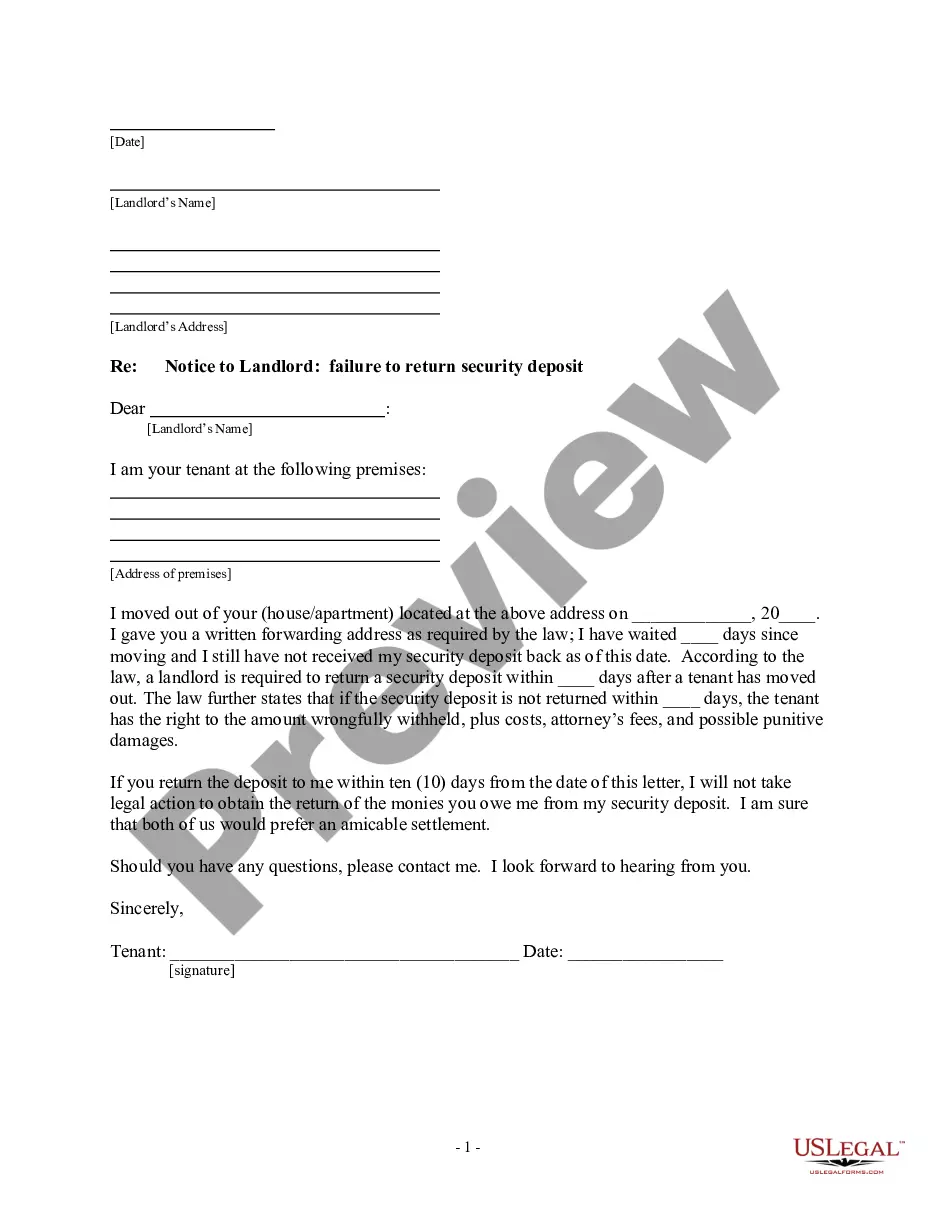

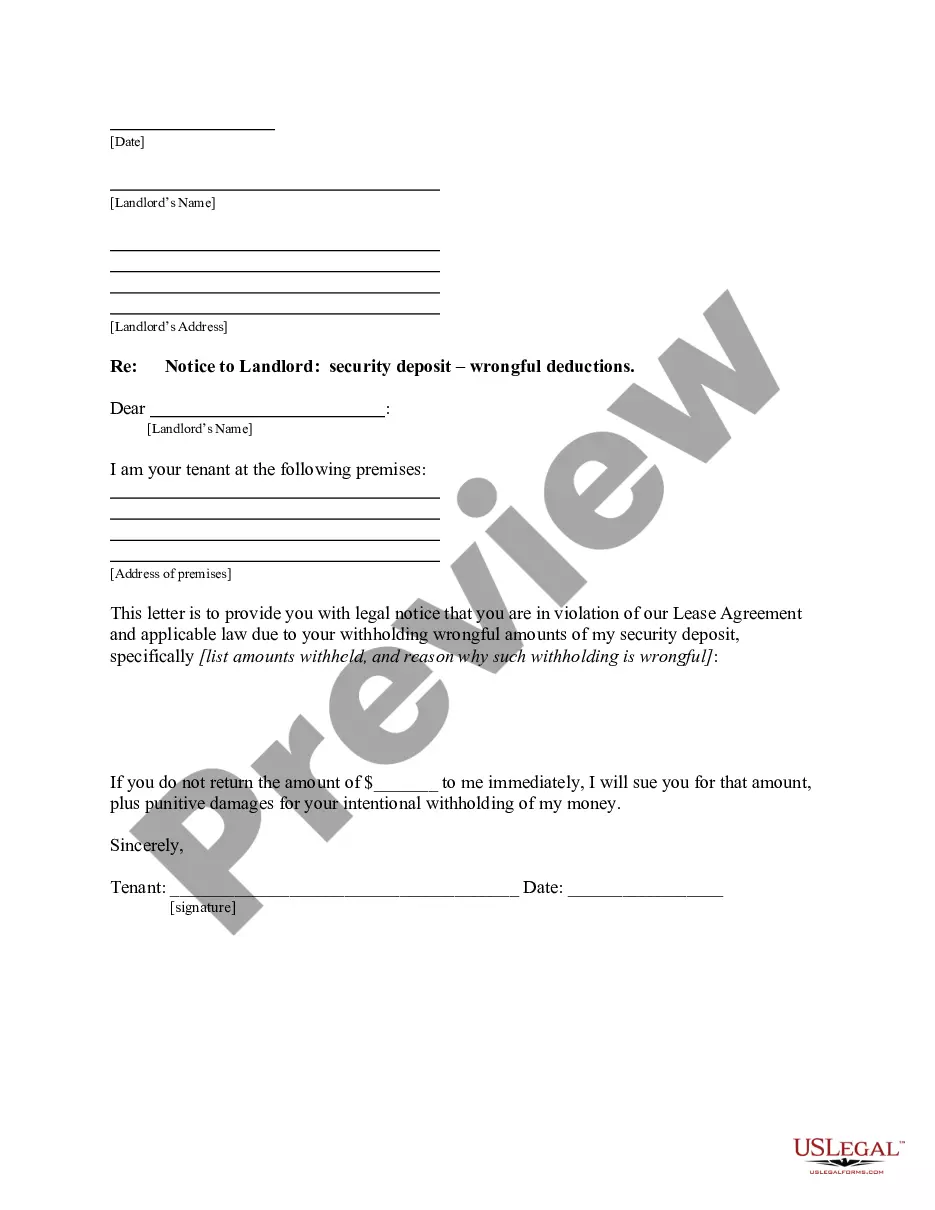

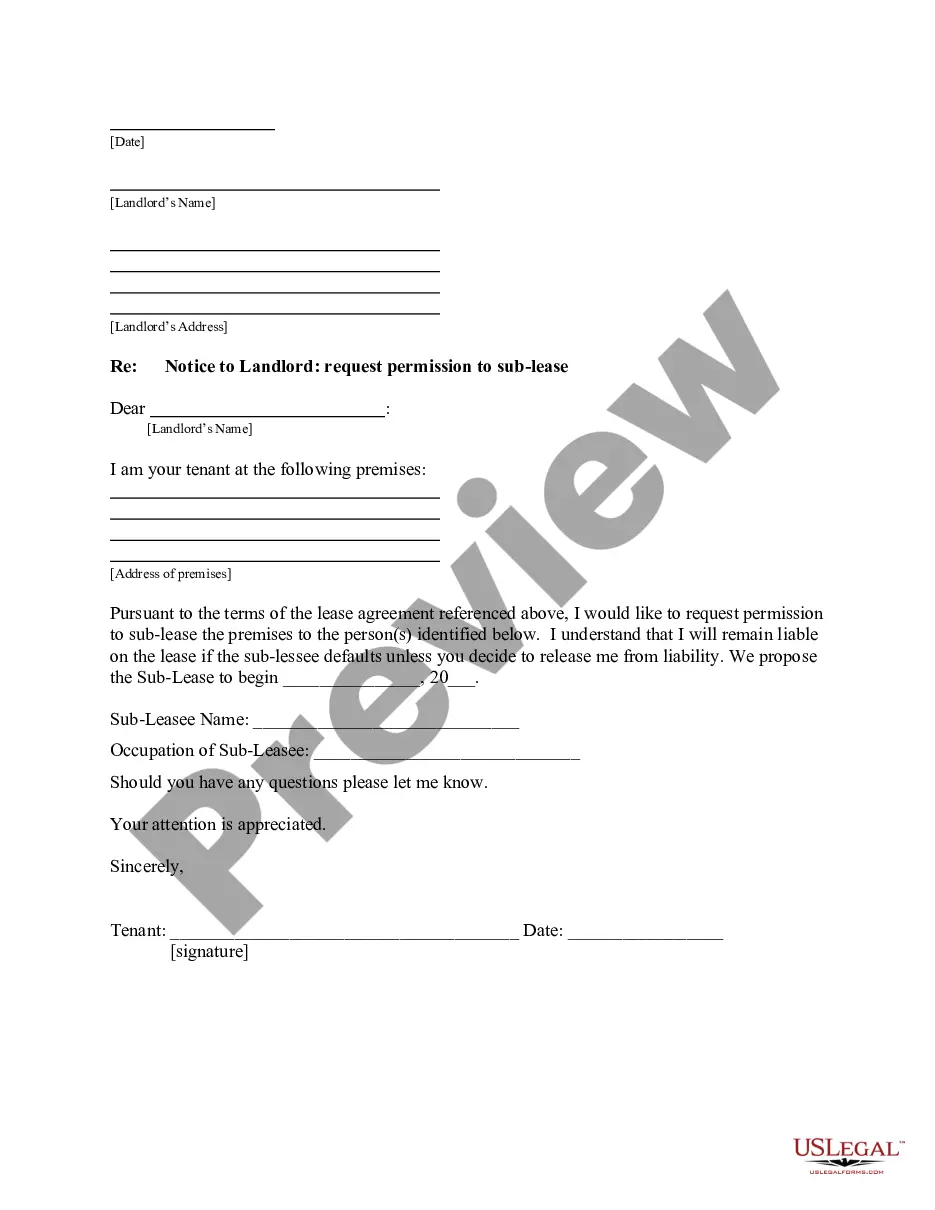

How to fill out Maricopa Arizona Amended Loan Agreement?

Draftwing paperwork, like Maricopa Amended Loan Agreement, to take care of your legal matters is a tough and time-consumming task. Many situations require an attorney’s involvement, which also makes this task expensive. Nevertheless, you can acquire your legal matters into your own hands and take care of them yourself. US Legal Forms is here to save the day. Our website features over 85,000 legal documents crafted for different cases and life circumstances. We ensure each document is compliant with the laws of each state, so you don’t have to be concerned about potential legal pitfalls associated with compliance.

If you're already aware of our website and have a subscription with US, you know how straightforward it is to get the Maricopa Amended Loan Agreement form. Go ahead and log in to your account, download the form, and customize it to your needs. Have you lost your document? Don’t worry. You can get it in the My Forms tab in your account - on desktop or mobile.

The onboarding flow of new customers is just as easy! Here’s what you need to do before downloading Maricopa Amended Loan Agreement:

- Ensure that your template is compliant with your state/county since the regulations for creating legal documents may vary from one state another.

- Learn more about the form by previewing it or reading a brief intro. If the Maricopa Amended Loan Agreement isn’t something you were hoping to find, then use the header to find another one.

- Log in or register an account to start utilizing our website and get the form.

- Everything looks good on your end? Hit the Buy now button and choose the subscription option.

- Select the payment gateway and type in your payment information.

- Your template is good to go. You can try and download it.

It’s an easy task to find and purchase the needed document with US Legal Forms. Thousands of organizations and individuals are already benefiting from our rich library. Sign up for it now if you want to check what other benefits you can get with US Legal Forms!