Keywords: Nassau New York, Amended Loan Agreement, types Nassau New York Amended Loan Agreement is a legal document that outlines the modifications or changes made to an existing loan agreement in Nassau County, New York. This agreement is designed to reflect the new terms and conditions agreed upon by the lender and borrower to alter the original loan agreement. There might be various types of Nassau New York Amended Loan Agreements, each addressing different aspects and modifications. Some common types include: 1. Interest Rate Modification Agreement: This agreement focuses on revising the interest rate and associated terms of the loan. It may involve adjusting the fixed interest rate, converting it to a variable rate, or incorporating new conditions regarding interest calculation. 2. Term Extension Agreement: This type of amended agreement extends the original loan term. It allows borrowers to request additional time to repay the loan, providing them with more flexibility and potentially lower monthly payments. 3. Principal Modification Agreement: This agreement enables the borrower to modify the principal amount of the loan. It may involve reducing the principal balance, increasing it due to additional funds required, or addressing unforeseen circumstances affecting the initial loan amount. 4. Collateral Substitution Agreement: In this amended loan agreement, the borrower substitutes or replaces the collateral initially provided to secure the loan. This could be necessary if the borrower's circumstances change or if the lender requires a different form of security. 5. Payment Restructuring Agreement: This type of agreement focuses on restructuring the repayment schedule of the loan. It may involve modifying the installments, changing payment frequency, or adding a grace period to accommodate the borrower's financial situation. 6. Cross-Default Agreement: This amended loan agreement addresses defaults or breach of terms in multiple loans with the same borrower. It brings together different loan agreements and outlines the consequences and actions applicable if any one of the loans goes into default. Nassau New York Amended Loan Agreement is a critical legal instrument used to ensure transparency and clarity when modifying the terms of a loan. It protects the interests of both the lender and borrower by documenting the agreed-upon changes accurately and comprehensively. Consulting legal professionals is advised to ensure compliance with local laws and to guarantee that the agreement meets the specific needs of the parties involved.

Nassau New York Amended Loan Agreement

Description

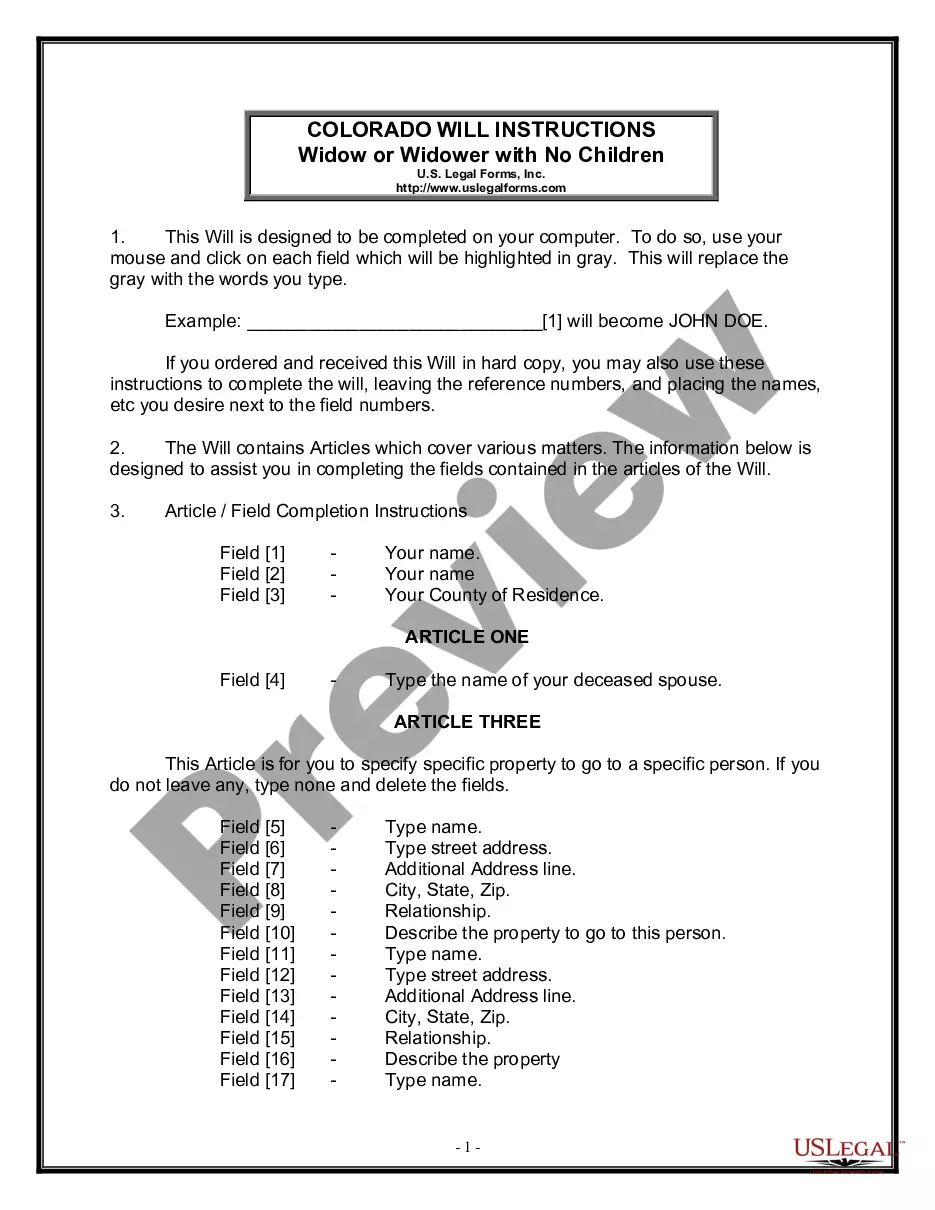

How to fill out Nassau New York Amended Loan Agreement?

Laws and regulations in every area vary from state to state. If you're not an attorney, it's easy to get lost in a variety of norms when it comes to drafting legal paperwork. To avoid pricey legal assistance when preparing the Nassau Amended Loan Agreement, you need a verified template valid for your region. That's when using the US Legal Forms platform is so beneficial.

US Legal Forms is a trusted by millions online collection of more than 85,000 state-specific legal forms. It's a great solution for professionals and individuals looking for do-it-yourself templates for different life and business situations. All the documents can be used multiple times: once you pick a sample, it remains accessible in your profile for further use. Therefore, when you have an account with a valid subscription, you can just log in and re-download the Nassau Amended Loan Agreement from the My Forms tab.

For new users, it's necessary to make a couple of more steps to get the Nassau Amended Loan Agreement:

- Take a look at the page content to ensure you found the correct sample.

- Use the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your requirements.

- Use the Buy Now button to get the template once you find the proper one.

- Choose one of the subscription plans and log in or create an account.

- Choose how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the document in and click Download.

- Complete and sign the template in writing after printing it or do it all electronically.

That's the simplest and most economical way to get up-to-date templates for any legal purposes. Locate them all in clicks and keep your paperwork in order with the US Legal Forms!