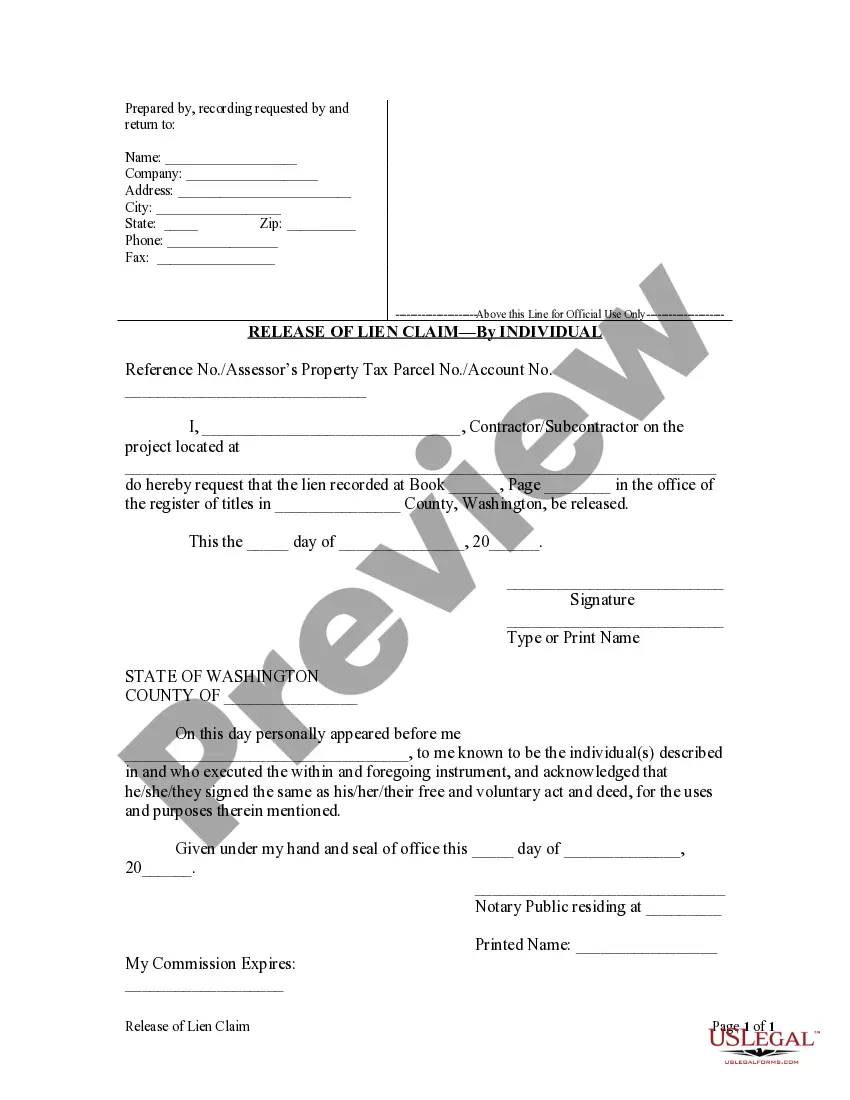

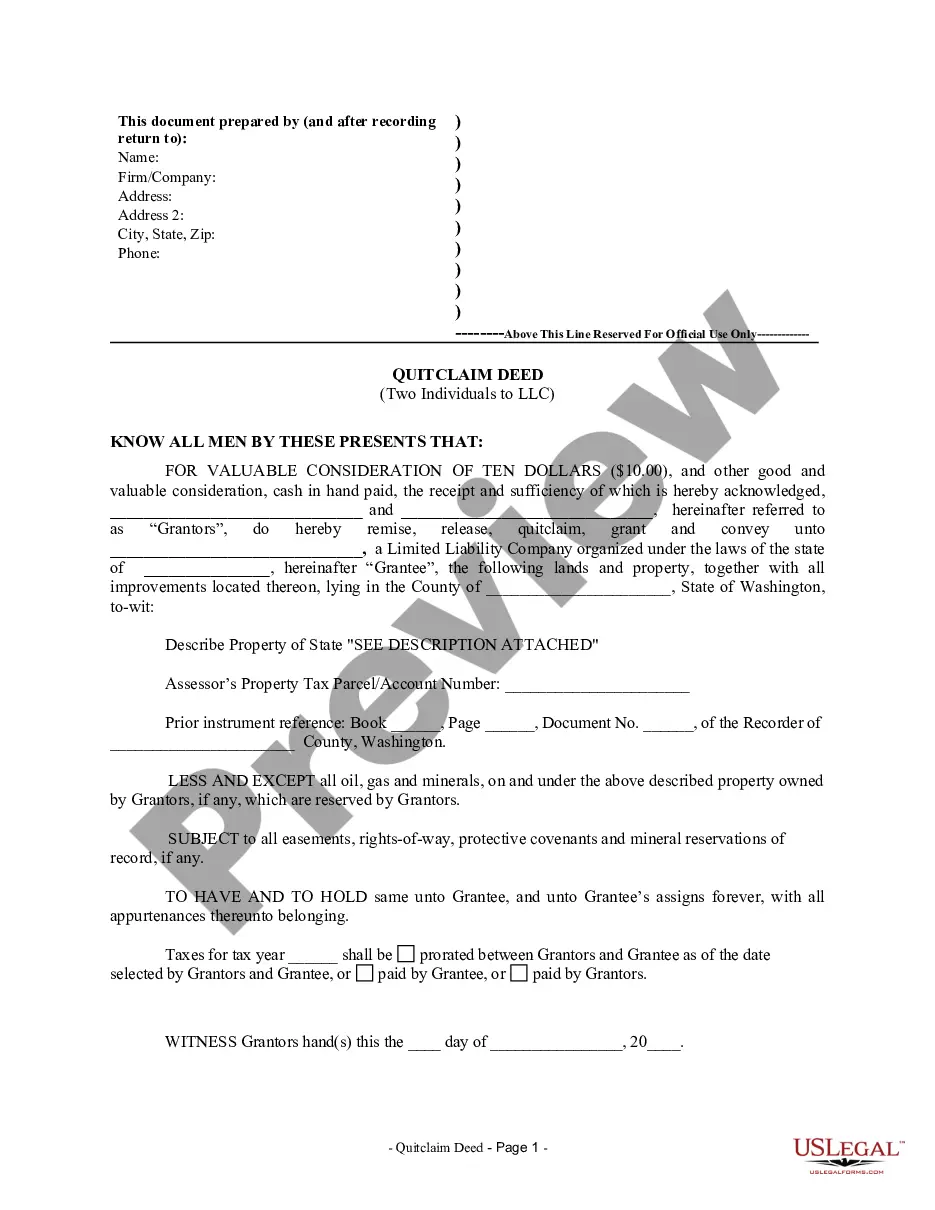

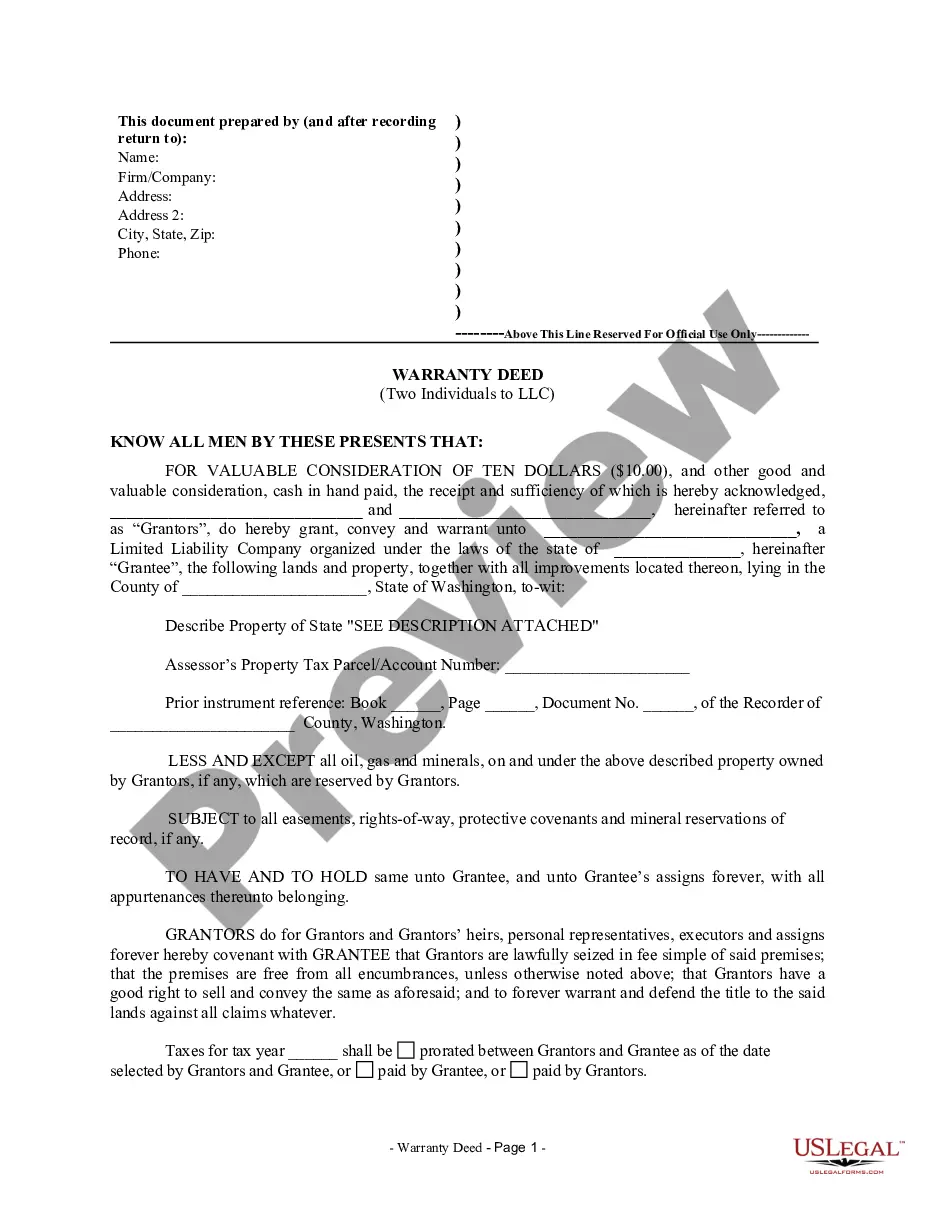

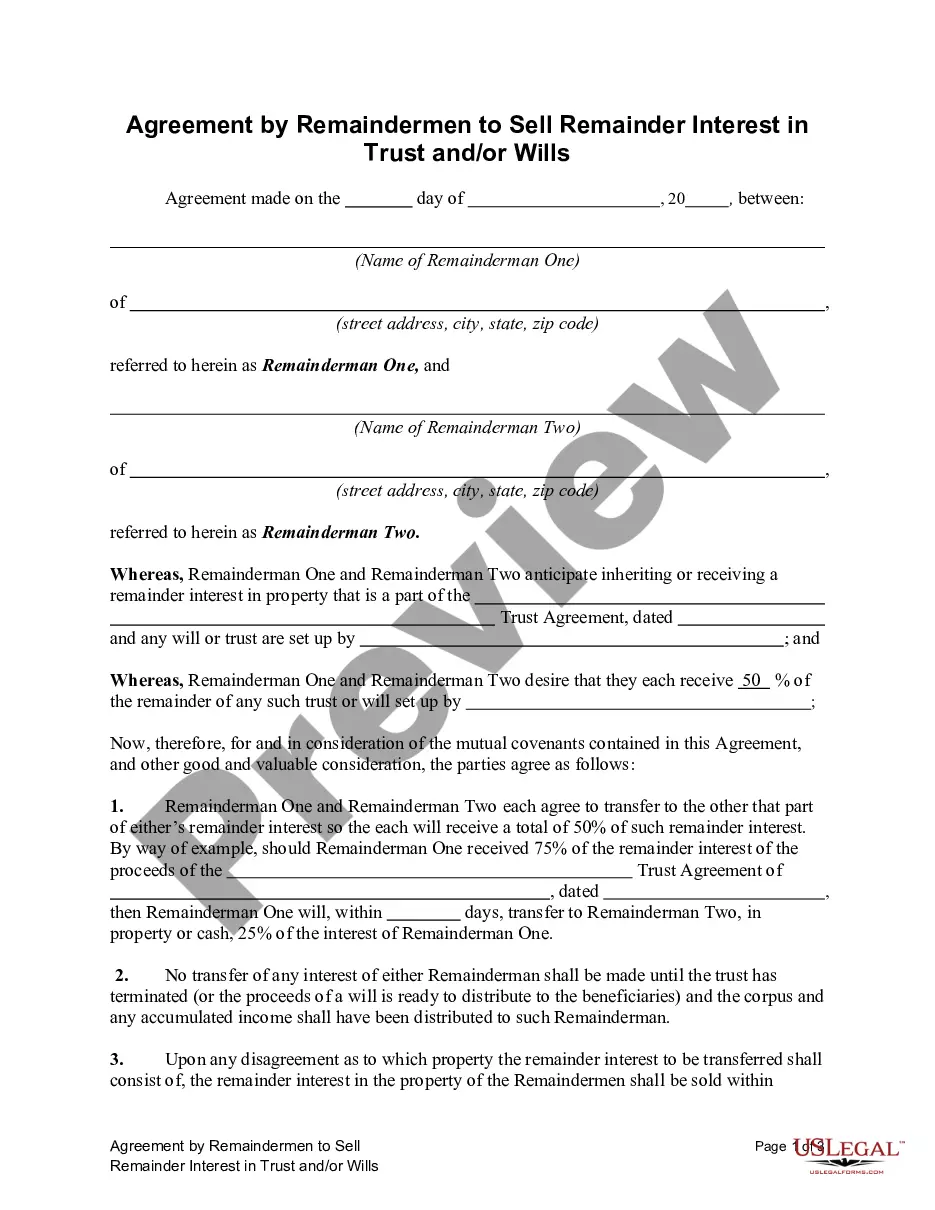

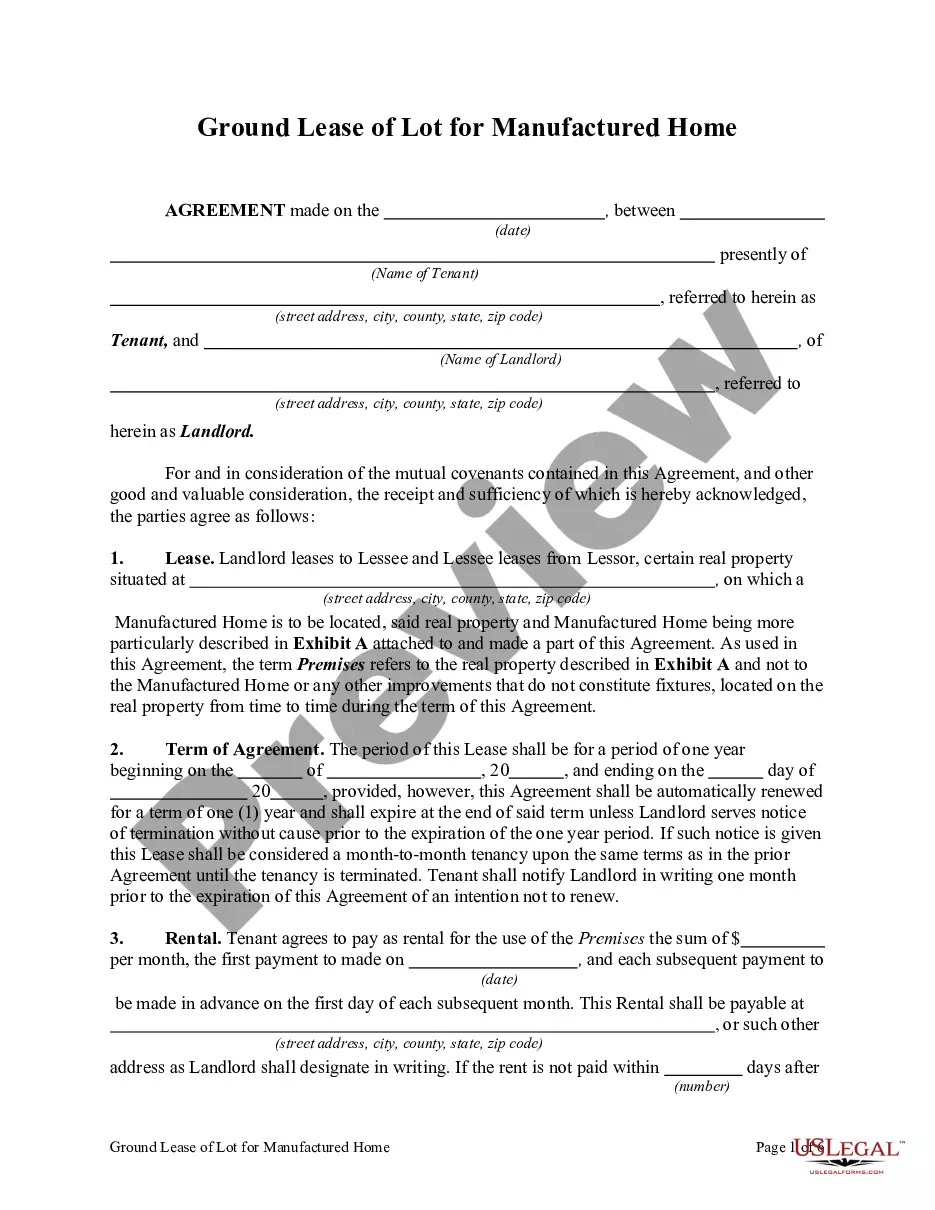

San Diego, California Amended Loan Agreement is a legal document that outlines the modified terms and conditions associated with a loan agreement in the city of San Diego, located in the state of California. This agreement serves as an amendment to the original loan agreement, reflecting changes made to accommodate the needs of the involved parties. The San Diego, California Amended Loan Agreement encompasses various elements of the financial arrangement, including the loan amount, interest rate, repayment schedule, collateral, and any additional clauses or provisions that may be specific to the agreement. It is crucial for both lenders and borrowers to carefully review and understand the amended terms to ensure a mutually beneficial outcome. These amended loan agreements in San Diego, California can take various forms based on the specific circumstances, such as refinancing an existing loan, modifying the repayment terms, or adjusting the interest rate due to market fluctuations. Some commonly observed types of San Diego, California Amended Loan Agreements include: 1. Refinanced Loan Agreement: This type of amended agreement occurs when the borrower decides to refinance an existing loan to take advantage of lower interest rates or improve cash flow by extending the repayment period. 2. Loan Extension Agreement: In some cases, borrowers may encounter difficulties in meeting the initial loan repayment terms, leading to negotiations with the lender to extend the loan duration and adjust the payment schedule to alleviate financial strain. 3. Interest Rate Adjustment Agreement: When interest rates change significantly, lenders and borrowers may mutually agree to amend the loan agreement, altering the interest rate while keeping other terms intact to align with the current market conditions. 4. Collateral Modification Agreement: If the collateral initially pledged to secure the loan becomes insufficient or no longer suitable, a collateral modification agreement may be necessary to update and redefine the acceptable collateral items. Regardless of the type of San Diego, California Amended Loan Agreement, it is essential for all involved parties to retain legal counsel to ensure the agreement accurately reflects their intentions and protects their respective rights and obligations. By diligently reviewing and comprehending the specific terms and conditions, both lenders and borrowers can effectively navigate the amended loan agreement, fostering a transparent and productive financial relationship.

San Diego California Amended Loan Agreement

Description

How to fill out San Diego California Amended Loan Agreement?

Draftwing documents, like San Diego Amended Loan Agreement, to take care of your legal affairs is a challenging and time-consumming process. A lot of circumstances require an attorney’s participation, which also makes this task expensive. However, you can consider your legal issues into your own hands and handle them yourself. US Legal Forms is here to save the day. Our website features over 85,000 legal forms intended for different cases and life circumstances. We ensure each document is compliant with the regulations of each state, so you don’t have to be concerned about potential legal issues compliance-wise.

If you're already familiar with our services and have a subscription with US, you know how easy it is to get the San Diego Amended Loan Agreement template. Simply log in to your account, download the template, and customize it to your requirements. Have you lost your document? No worries. You can find it in the My Forms folder in your account - on desktop or mobile.

The onboarding flow of new users is fairly simple! Here’s what you need to do before downloading San Diego Amended Loan Agreement:

- Ensure that your template is specific to your state/county since the rules for writing legal documents may differ from one state another.

- Learn more about the form by previewing it or going through a quick intro. If the San Diego Amended Loan Agreement isn’t something you were looking for, then use the header to find another one.

- Sign in or register an account to start using our service and download the document.

- Everything looks good on your end? Hit the Buy now button and choose the subscription plan.

- Select the payment gateway and type in your payment details.

- Your template is good to go. You can try and download it.

It’s easy to find and buy the appropriate template with US Legal Forms. Thousands of businesses and individuals are already benefiting from our extensive collection. Sign up for it now if you want to check what other advantages you can get with US Legal Forms!