King Washington Amended Uniform Commercial Code Security Agreement is a legal document that outlines the terms and conditions for securing a potential debtor's collateral in a commercial transaction. This agreement follows the guidelines set forth in the Uniform Commercial Code (UCC) and is specific to the state of Washington. This description will delve into the important aspects and types of this agreement, using relevant keywords for a comprehensive understanding. Keywords: King Washington, Amended UCC, security agreement, collateral, commercial transaction. The King Washington Amended Uniform Commercial Code Security Agreement serves as a crucial legal instrument utilized in commercial transactions within the jurisdiction of Washington State. This agreement is pursuant to the Uniform Commercial Code, which ensures uniformity and clarity in commercial transactions nationwide. The primary objective of this agreement is to secure the interests of creditors or lenders by establishing a legal claim over the debtor's collateral as collateral for the debt owed. Collateral refers to any assets or property that the debtor provides as security, ensuring the availability of assets to satisfy the debt in case of default. By executing this agreement, debtors grant a security interest to creditors, granting them the right to recover the collateral should the debtor fail to fulfill their obligations. There are various types of King Washington Amended Uniform Commercial Code Security Agreements, each tailored to specific scenarios or needs: 1. Real Estate Security Agreement: This type of security agreement is relevant when the collateral involved is real estate or immovable property. It establishes a lien on the property, providing the lender with a first priority claim in case of foreclosure or default. 2. Personal Property Security Agreement: This agreement pertains to the use of personal property as collateral. Personal property encompasses tangible assets like vehicles, machinery, inventory, or intangible assets such as patents, trademarks, or copyrights. It enables the creditor to claim and sell the collateral to recover the debt owed. 3. Inventory Financing Agreement: Specifically designed for businesses engaged in inventory management, this agreement allows creditors to secure loans against the inventory held by a business. It ensures that the lender has priority access to the inventory if the debtor defaults. 4. Accounts Receivable Financing Agreement: This type of agreement focuses on using a company's outstanding accounts receivable as collateral. Creditors gain the rights to collect payments from the accounts receivable to repay the debt. King Washington Amended Uniform Commercial Code Security Agreements provide a legal framework to protect the rights of both creditors and debtors in commercial transactions. By understanding the specific types and relevant keywords within the agreement, parties can ensure compliance with the UCC and safeguard their financial interests.

King Washington Amended Uniform commercial code security agreement

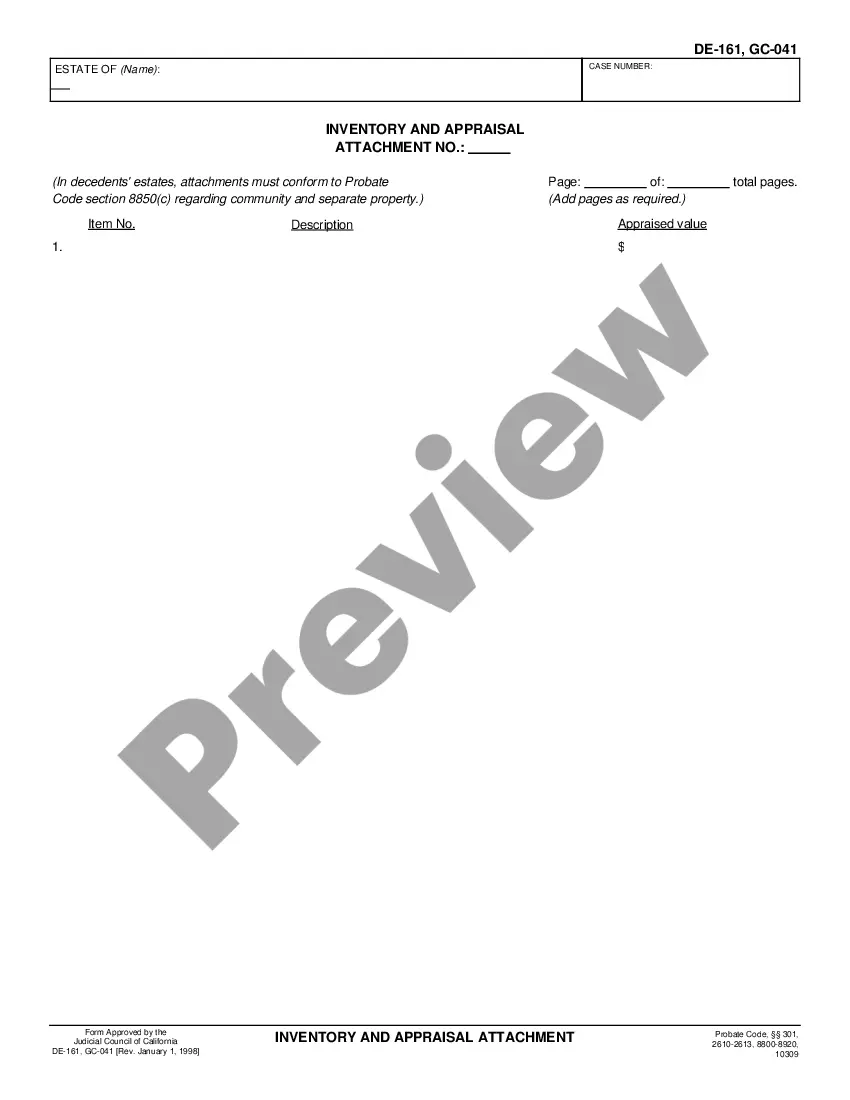

Description

How to fill out King Washington Amended Uniform Commercial Code Security Agreement?

Draftwing documents, like King Amended Uniform commercial code security agreement, to take care of your legal affairs is a tough and time-consumming task. Many cases require an attorney’s involvement, which also makes this task expensive. Nevertheless, you can take your legal matters into your own hands and take care of them yourself. US Legal Forms is here to save the day. Our website features more than 85,000 legal documents crafted for a variety of cases and life situations. We ensure each form is compliant with the regulations of each state, so you don’t have to be concerned about potential legal problems compliance-wise.

If you're already familiar with our website and have a subscription with US, you know how effortless it is to get the King Amended Uniform commercial code security agreement form. Go ahead and log in to your account, download the template, and customize it to your requirements. Have you lost your form? No worries. You can get it in the My Forms folder in your account - on desktop or mobile.

The onboarding flow of new users is just as easy! Here’s what you need to do before getting King Amended Uniform commercial code security agreement:

- Make sure that your template is specific to your state/county since the rules for writing legal documents may vary from one state another.

- Learn more about the form by previewing it or going through a quick description. If the King Amended Uniform commercial code security agreement isn’t something you were hoping to find, then take advantage of the search bar in the header to find another one.

- Log in or create an account to start using our service and get the document.

- Everything looks great on your side? Click the Buy now button and choose the subscription plan.

- Select the payment gateway and enter your payment information.

- Your template is all set. You can try and download it.

It’s easy to locate and buy the needed document with US Legal Forms. Thousands of businesses and individuals are already taking advantage of our extensive library. Sign up for it now if you want to check what other advantages you can get with US Legal Forms!

Form popularity

FAQ

Although the UCC-1 Financing Statement does not require signatures, any attachment such as the legal description or special terms and conditions may require the signature of the Debtor.

Generally, a secured creditor may seek to enforce its rights on its collateral upon a borrower's default. A secured creditor's remedies include an Article 9 sale, the right to sell the collateral to a third party in a private or public sale without judicial proceedings.

Article 9 is a section under the UCC governing secured transactions including the creation and enforcement of debts. Article 9 spells out the procedure for settling debts, including various types of collateralized loans and bonds.

The debtor must authenticate the security agreement by signing a statement that announces the intention to grant a security interest in the property specifically outlined in the security agreement.

For a security interest to attach, the following events must have occurred: (A) value must have been given by the Secured Party; (B) the Debtor must have rights in the collateral; and (C) the Secured Party must have been granted a security interest in the collateral.

The court noted that the California Commercial Code provides that a person may file a UCC-1 only if the debtor authorizes the filing by (1) authenticating a security agreement; (2) becoming bound as debtor by a security agreement; or (3) acquiring collateral in which a security interest is attached.

Debtor's rights in collateral. In such cases, the business will sign a conditional sales contract, which is also considered a security agreement, and which, under UCC sales rules, will give the business the necessary rights in the purchased items to use them as collateral.

A security agreement is a document that provides a lender a security interest in a specified asset or property that is pledged as collateral. Security agreements often contain covenants that outline provisions for the advancement of funds, a repayment schedule, or insurance requirements.

In order for a security interest to be enforceable against the debtor and third parties, UCC Article 9 sets forth three requirements: Value must be provided in exchange for the collateral; the debtor must have rights in the collateral or the ability to convey rights in the collateral to a secured party; and either the

Security agreement. (The UCC uses the term "authenticate" to include the possibility of electronic signatures.) A security agreement normally will contain a clear statement that the debtor is granting the secured party a security interest in specified goods.