The Maricopa Arizona Amended Uniform Commercial Code (UCC) security agreement is a legal document that governs the transactional nature of secured transactions in Maricopa, Arizona. The UCC provides a uniform framework, applicable nationwide, to ensure consistency and clarity in commercial transactions. Within Maricopa, this agreement outlines the rights and obligations of the parties involved, particularly the debtor and the secured party, regarding the collateral used to secure a loan. The Maricopa Arizona Amended UCC security agreement establishes a comprehensive set of rules and provisions that pertain to the creation, perfection, priority, and enforcement of security interests. By adhering to this agreement, lenders and borrowers can protect their respective interests in goods, accounts, inventory, equipment, and other assets. The security agreement also serves as notice to third parties about the existence of a security interest and any potential restrictions on the collateral. There are various types of Maricopa Arizona Amended UCC security agreements that cater to different types of secured transactions. Some of these include: 1. Purchase Money Security Agreement (PSA): This agreement is used when a debtor borrows funds to purchase specific collateral, such as equipment or inventory. The lender's security interest in the acquired assets takes priority over other creditors if properly perfected. 2. Blanket Security Agreement: This type of agreement allows a lender to secure the debtor's current and future assets as collateral. It provides flexibility to borrowers who may need to obtain additional financing without creating new security agreements for each loan. 3. Floating Lien Agreement: A floating lien security agreement permits a lender to secure the debtor's assets that may change in quantity and nature over time, like inventory or accounts receivable. This type of agreement allows the debtor to continue using and selling the collateral in the ordinary course of business. 4. Non-possessory Security Agreement: Unlike a possessor security agreement, a non-possessory agreement does not require the creditor to physically possess the collateral. It allows the debtor to retain possession while granting the lender a security interest in the assets. It is crucial for borrowers and lenders in Maricopa, Arizona, to fully understand the provisions outlined in the Amended UCC security agreement. Compliance with the agreement's requirements ensures the enforceability of security interests and protects the interests of all parties involved in secured transactions.

Maricopa Arizona Amended Uniform commercial code security agreement

Description

How to fill out Maricopa Arizona Amended Uniform Commercial Code Security Agreement?

Laws and regulations in every area differ from state to state. If you're not a lawyer, it's easy to get lost in various norms when it comes to drafting legal documentation. To avoid expensive legal assistance when preparing the Maricopa Amended Uniform commercial code security agreement, you need a verified template valid for your county. That's when using the US Legal Forms platform is so beneficial.

US Legal Forms is a trusted by millions online catalog of more than 85,000 state-specific legal forms. It's an excellent solution for professionals and individuals looking for do-it-yourself templates for various life and business situations. All the forms can be used many times: once you obtain a sample, it remains available in your profile for future use. Thus, if you have an account with a valid subscription, you can simply log in and re-download the Maricopa Amended Uniform commercial code security agreement from the My Forms tab.

For new users, it's necessary to make a few more steps to get the Maricopa Amended Uniform commercial code security agreement:

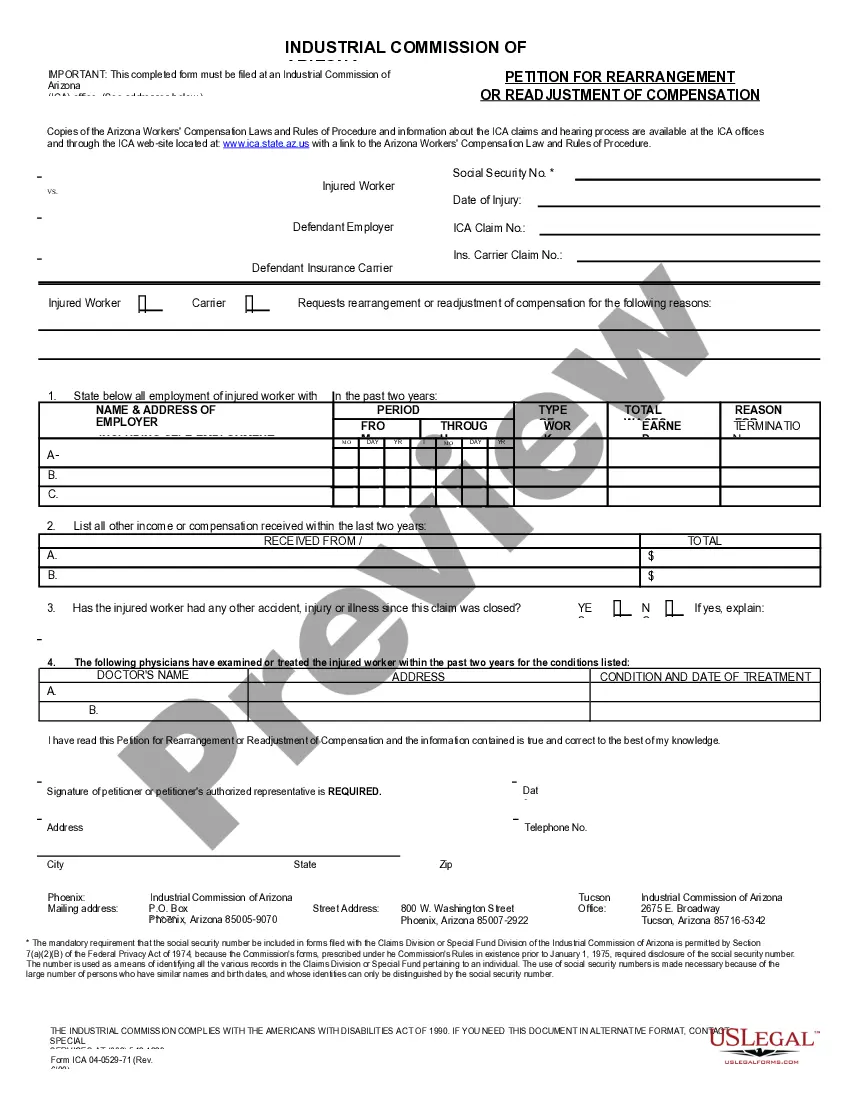

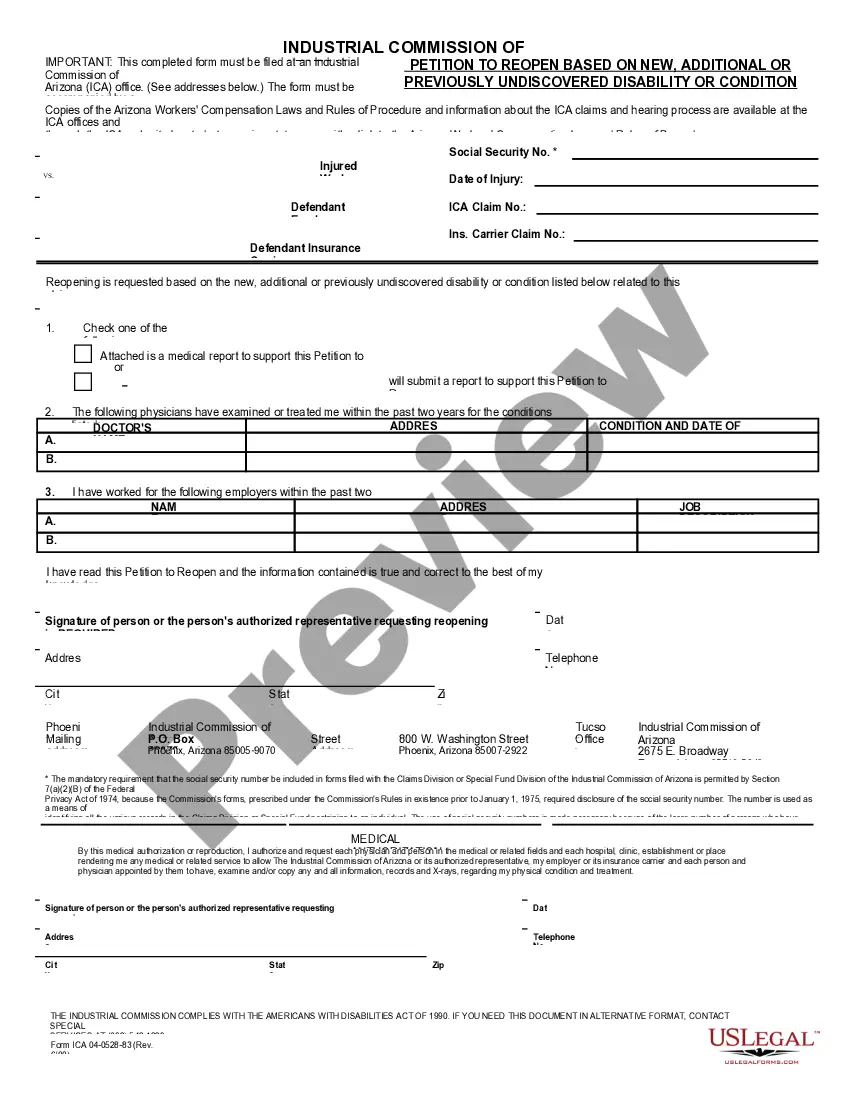

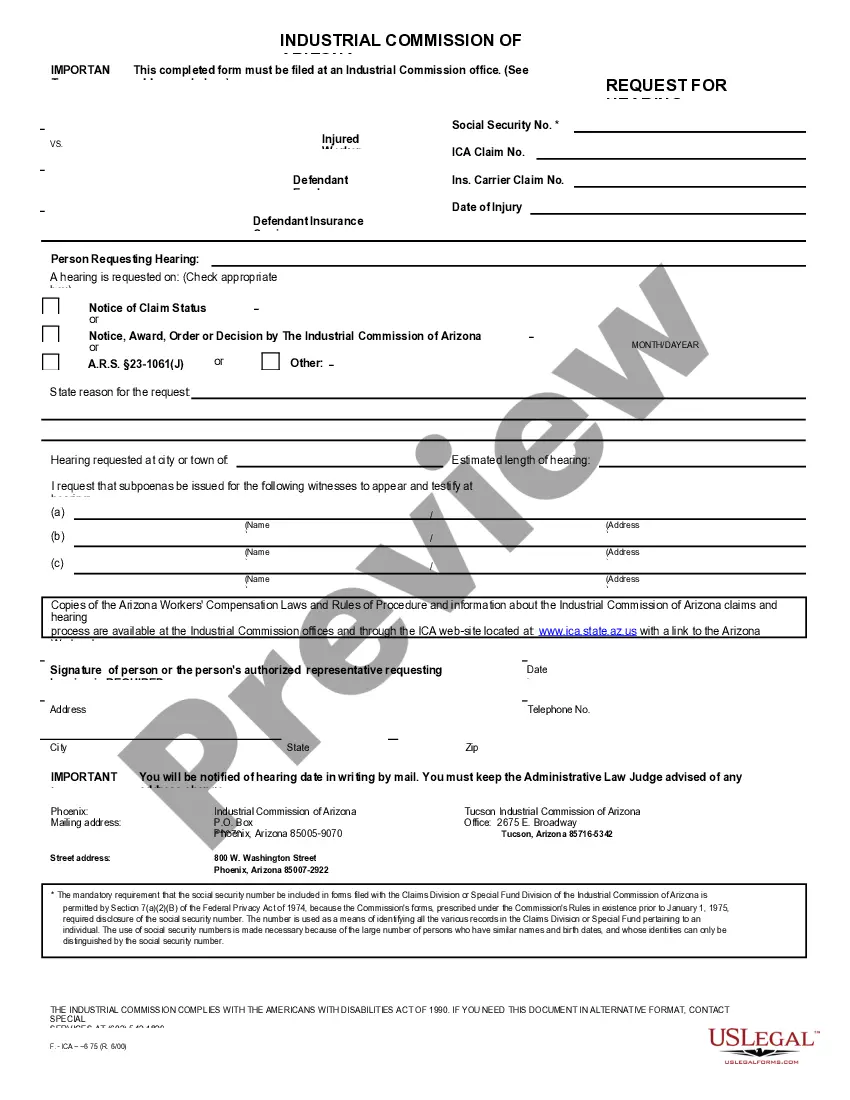

- Examine the page content to ensure you found the right sample.

- Take advantage of the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your criteria.

- Utilize the Buy Now button to obtain the document when you find the correct one.

- Opt for one of the subscription plans and log in or create an account.

- Decide how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the file in and click Download.

- Fill out and sign the document on paper after printing it or do it all electronically.

That's the simplest and most cost-effective way to get up-to-date templates for any legal purposes. Locate them all in clicks and keep your paperwork in order with the US Legal Forms!