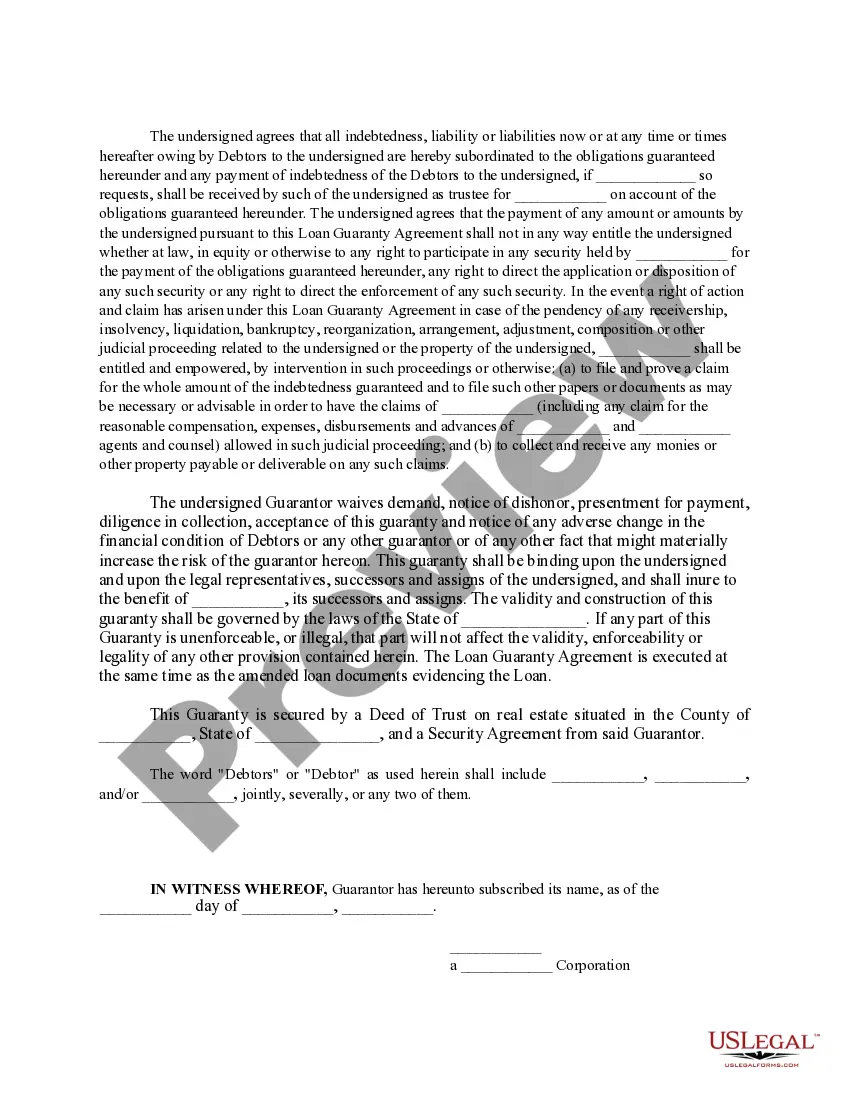

Los Angeles, California Loan Guaranty Agreement is a legal contract that outlines the terms and conditions of a loan guarantee in Los Angeles, California. This agreement serves as a legally binding tool between a lender and a guarantor, ensuring the repayment of a loan in case the borrower defaults. The Los Angeles Loan Guaranty Agreement provides financial security to lenders and encourages them to lend money to individuals or businesses, even if they don't have solid credit scores or collateral. This agreement is crucial for obtaining loans, especially for loans that involve substantial amounts of money. There are different types of Los Angeles, California Loan Guaranty Agreements that can be categorized based on the purpose or nature of the loan. These types include: 1. Personal Loan Guaranty Agreement: This agreement is used when an individual acts as a guarantor for a personal loan. It can be used for various purposes such as financing education, purchasing a vehicle, or covering medical expenses. 2. Business Loan Guaranty Agreement: This agreement is commonly used for commercial loans, where a business owner or a third-party guarantor guarantees the repayment of a loan taken by the business. It helps businesses secure loans for expansion, inventory purchase, or equipment upgrades. 3. Real Estate Loan Guaranty Agreement: This agreement is specific to loans related to real estate transactions in Los Angeles, California. It can be used for various purposes such as buying property, refinancing, or construction projects. The guarantor pledges his or her personal assets to ensure the repayment of the loan. 4. Small Business Administration (SBA) Loan Guaranty Agreement: This type of agreement is designed to facilitate loans for small businesses in Los Angeles, California. The SBA guarantees a portion of the loan, reducing the risk for lenders and making it easier for small business owners to obtain financing. Overall, Los Angeles, California Loan Guaranty Agreements play a crucial role in the lending landscape by providing security for lenders and enabling borrowers to access funds that might otherwise be unattainable. It is important for both lenders and guarantors to fully understand the terms and conditions outlined in the agreement before entering into this legal commitment.

Los Angeles California Loan Guaranty Agreement

Description

How to fill out Los Angeles California Loan Guaranty Agreement?

Preparing legal documentation can be cumbersome. Besides, if you decide to ask an attorney to write a commercial agreement, documents for proprietorship transfer, pre-marital agreement, divorce papers, or the Los Angeles Loan Guaranty Agreement, it may cost you a lot of money. So what is the best way to save time and money and draw up legitimate documents in total compliance with your state and local regulations? US Legal Forms is a great solution, whether you're searching for templates for your individual or business needs.

US Legal Forms is largest online catalog of state-specific legal documents, providing users with the up-to-date and professionally checked templates for any use case collected all in one place. Consequently, if you need the latest version of the Los Angeles Loan Guaranty Agreement, you can easily locate it on our platform. Obtaining the papers takes a minimum of time. Those who already have an account should check their subscription to be valid, log in, and select the sample with the Download button. If you haven't subscribed yet, here's how you can get the Los Angeles Loan Guaranty Agreement:

- Look through the page and verify there is a sample for your area.

- Check the form description and use the Preview option, if available, to make sure it's the sample you need.

- Don't worry if the form doesn't suit your requirements - search for the right one in the header.

- Click Buy Now when you find the required sample and select the best suitable subscription.

- Log in or register for an account to pay for your subscription.

- Make a payment with a credit card or via PayPal.

- Opt for the document format for your Los Angeles Loan Guaranty Agreement and save it.

When finished, you can print it out and complete it on paper or import the samples to an online editor for a faster and more convenient fill-out. US Legal Forms allows you to use all the paperwork ever purchased many times - you can find your templates in the My Forms tab in your profile. Try it out now!