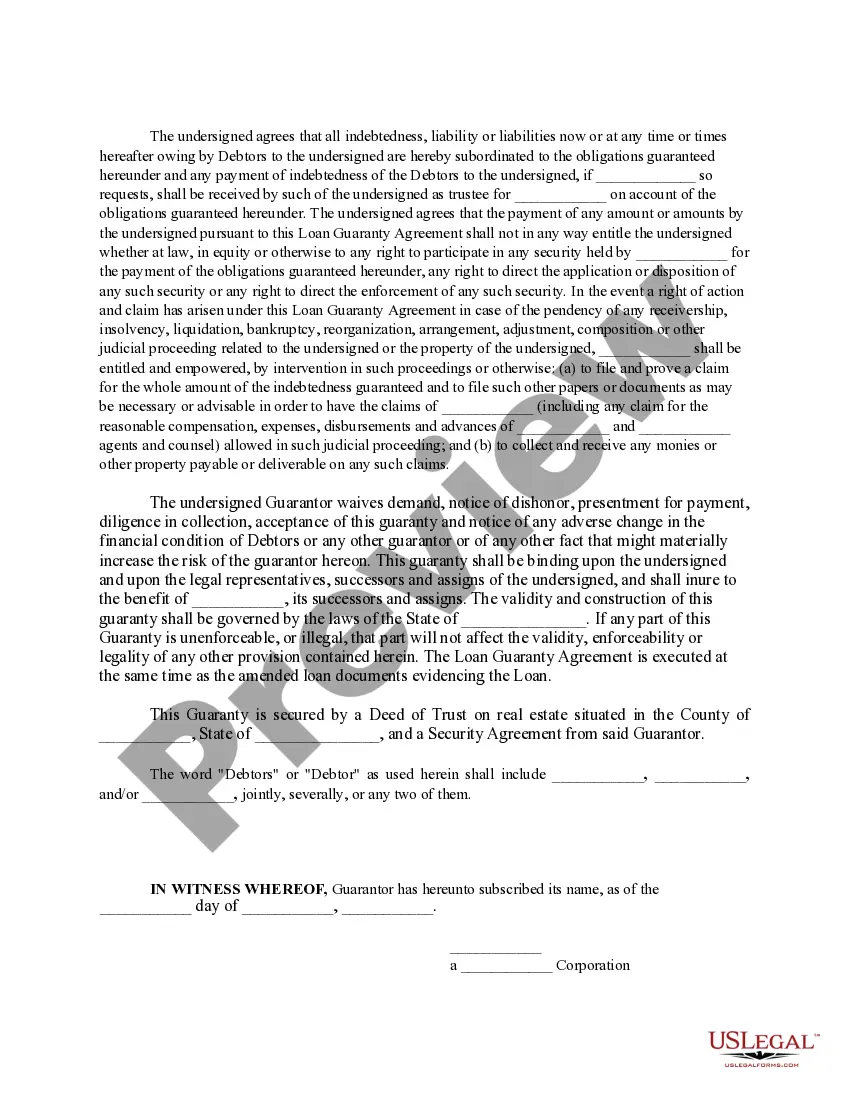

San Antonio Texas Loan Guaranty Agreement is a legally binding document that protects a lender's interests by providing a guarantee in the event of a borrower's default on a loan in San Antonio, Texas. This agreement serves as a crucial component of the lending process and ensures the security of the lender's investment. It contains various key clauses and terms that both the lender and borrower must agree upon and abide by. The San Antonio Texas Loan Guaranty Agreement outlines the terms and conditions of the loan guaranty, including the rights and responsibilities of both parties involved. It establishes the financial obligations of the guarantor, who pledges to fulfill the repayment obligations of the borrower if they are unable to meet them. The guarantor essentially serves as a co-signer for the loan, providing an additional layer of security for the lender. There are different types of San Antonio Texas Loan Guaranty Agreements depending on the specific circumstances and requirements of the loan. Some common variations include: 1. Personal Guaranty: This type of agreement involves an individual guarantor who pledges personal assets and resources to ensure loan repayment if the borrower defaults. The guarantor's personal credit and financial strength are key factors in determining the loan's approval. 2. Corporate Guaranty: In this scenario, a corporation or business entity serves as the guarantor, assuming responsibility for loan repayment in case of default by the borrower. The corporation's financial position and creditworthiness play a significant role in securing the loan. 3. Limited Guaranty: A limited guaranty agreement places restrictions on the guarantor's liability, protecting them from being held responsible for the entire loan amount. Instead, their liability is limited to a specific amount or duration as specified in the agreement. 4. Joint and Several guaranties: This type of loan guaranty agreement involves multiple guarantors who are jointly responsible for the repayment of the loan. In case of default, each guarantor can be pursued individually for the full loan amount without the obligation to first seek repayment from other guarantors. In conclusion, the San Antonio Texas Loan Guaranty Agreement is a critical legal document that outlines the obligations, responsibilities, and rights of both lenders and borrowers. It ensures the lender's financial security in the event of a borrower's default. Different types of guaranty agreements exist to accommodate various situations, including personal guaranty, corporate guaranty, limited guaranty, and joint and several guaranties.

San Antonio Texas Loan Guaranty Agreement

Description

How to fill out San Antonio Texas Loan Guaranty Agreement?

Creating forms, like San Antonio Loan Guaranty Agreement, to manage your legal affairs is a challenging and time-consumming task. A lot of circumstances require an attorney’s participation, which also makes this task expensive. However, you can consider your legal matters into your own hands and take care of them yourself. US Legal Forms is here to the rescue. Our website comes with over 85,000 legal documents crafted for various cases and life situations. We make sure each form is compliant with the regulations of each state, so you don’t have to worry about potential legal problems compliance-wise.

If you're already familiar with our services and have a subscription with US, you know how effortless it is to get the San Antonio Loan Guaranty Agreement template. Simply log in to your account, download the form, and personalize it to your requirements. Have you lost your form? Don’t worry. You can get it in the My Forms folder in your account - on desktop or mobile.

The onboarding flow of new users is just as straightforward! Here’s what you need to do before getting San Antonio Loan Guaranty Agreement:

- Make sure that your document is specific to your state/county since the rules for creating legal documents may vary from one state another.

- Discover more information about the form by previewing it or going through a brief description. If the San Antonio Loan Guaranty Agreement isn’t something you were hoping to find, then use the header to find another one.

- Sign in or register an account to start using our service and download the form.

- Everything looks good on your side? Hit the Buy now button and choose the subscription option.

- Select the payment gateway and type in your payment information.

- Your form is ready to go. You can go ahead and download it.

It’s an easy task to locate and purchase the needed template with US Legal Forms. Thousands of businesses and individuals are already taking advantage of our rich library. Subscribe to it now if you want to check what other advantages you can get with US Legal Forms!

Form popularity

FAQ

Definition of guaranty (Entry 1 of 2) 1 : an undertaking to answer for the payment of a debt or the performance of a duty of another in case of the other's default or miscarriage. 2 : guarantee sense 3. 3 : guarantor. 4 : something given as security (see security sense 2) : pledge used our house as a guaranty for the

A guaranty of payment is an independent agreement by a person or an entity to pay the loan when it goes into default. Even if the borrower is unable or unwilling to pay back the loan, the Bank can require the guarantor to pay it back.

A guarantee is a promise by one party (the guarantor) to another party (the guaranteed party) to be responsible for the due performance of the obligations of another party (the principal) to the guaranteed party if the principal fails to perform such obligations.

A person who acts as a guarantor under a GUARANTEE. GUARANTY, contracts. A promise made upon a good consideration, to answer for the payment of some debt, or the performance of some duty, in case of the failure of another person, who is, in the first instance, liable to such payment or performance.

3) Liability In a contract of guarantee, the liability of a surety is secondary. This means that since the primary contract was between the creditor and principal debtor, the liability to fulfill the terms of the contract lies primarily with the principal debtor.

The person who gives the guarantee is called the 'surety'; the person in respect of whose default the guarantee is given is called the 'principal debtor', and the person to whom the guarantee is given is called the 'creditor'. A guarantee may be either oral or written. "

Guaranty and Security Agreement means the Guaranty and Security Agreement executed by the Credit Parties in substantially the form of Exhibit E-2 pursuant to which the Credit Parties (a) unconditionally guaranty on a joint and several basis, payment of the Indebtedness, and (b) grant Liens and a security interest on

Guaranty and Security Agreement means the Guaranty and Security Agreement executed by the Credit Parties in substantially the form of Exhibit E-2 pursuant to which the Credit Parties (a) unconditionally guaranty on a joint and several basis, payment of the Indebtedness, and (b) grant Liens and a security interest on

In a contract of guarantee, there are three parties to a contract namely surety, principal debtor and creditor whereas in case of indemnity there are only two parties to a contract, promisor, and promisee.

A guaranty agreement is a contract between two parties where one party agrees to pay a debt or perform a duty in the event that the original party fails to do so. The party who makes the guaranty is called the guarantor. An agreement of this nature is often used in real estate, insurance, or financial transactions.