Wayne Michigan Agreement to Continue Business Between Surviving Partners and Legal Representative of Deceased Partner

Description

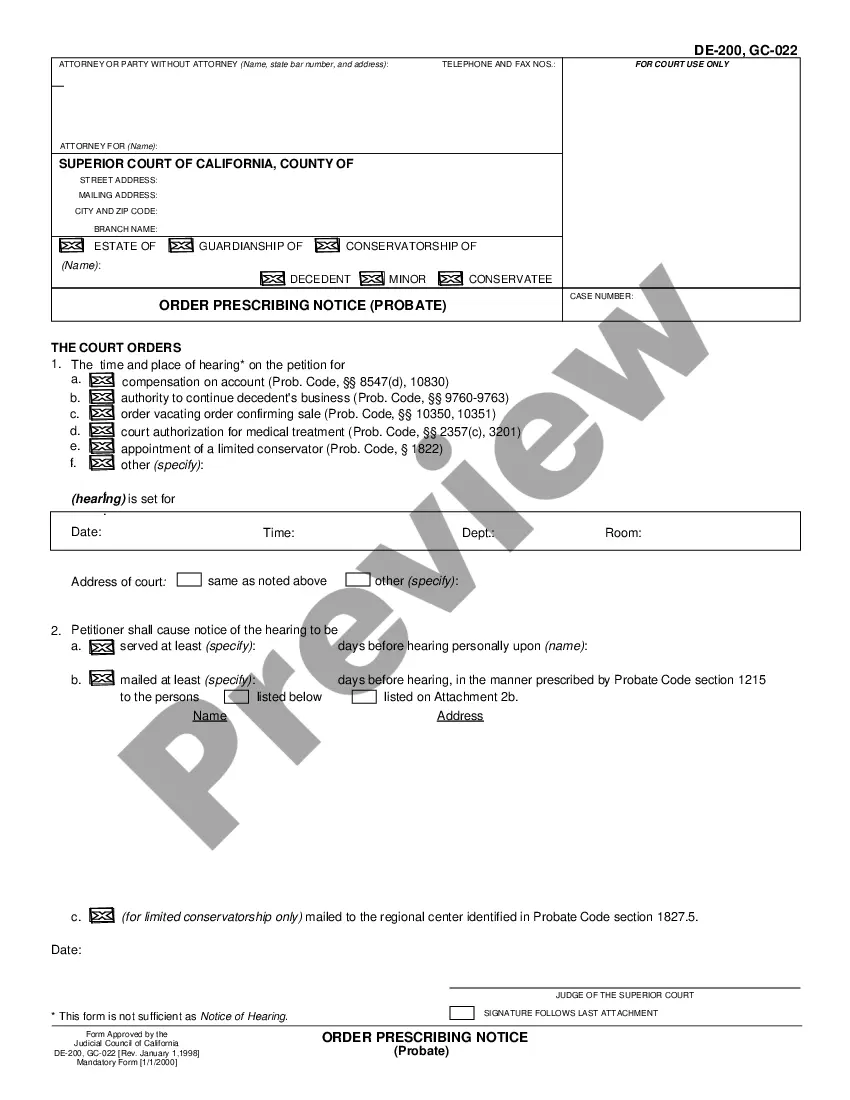

How to fill out Wayne Michigan Agreement To Continue Business Between Surviving Partners And Legal Representative Of Deceased Partner?

How much time does it normally take you to draw up a legal document? Given that every state has its laws and regulations for every life scenario, finding a Wayne Agreement to Continue Business Between Surviving Partners and Legal Representative of Deceased Partner meeting all regional requirements can be stressful, and ordering it from a professional attorney is often costly. Numerous online services offer the most popular state-specific documents for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most comprehensive online collection of templates, collected by states and areas of use. In addition to the Wayne Agreement to Continue Business Between Surviving Partners and Legal Representative of Deceased Partner, here you can get any specific document to run your business or personal affairs, complying with your county requirements. Professionals verify all samples for their validity, so you can be sure to prepare your paperwork correctly.

Using the service is pretty simple. If you already have an account on the platform and your subscription is valid, you only need to log in, choose the required sample, and download it. You can retain the file in your profile anytime in the future. Otherwise, if you are new to the platform, there will be a few more steps to complete before you obtain your Wayne Agreement to Continue Business Between Surviving Partners and Legal Representative of Deceased Partner:

- Check the content of the page you’re on.

- Read the description of the template or Preview it (if available).

- Look for another document utilizing the corresponding option in the header.

- Click Buy Now once you’re certain in the selected file.

- Choose the subscription plan that suits you most.

- Register for an account on the platform or log in to proceed to payment options.

- Make a payment via PalPal or with your credit card.

- Change the file format if needed.

- Click Download to save the Wayne Agreement to Continue Business Between Surviving Partners and Legal Representative of Deceased Partner.

- Print the sample or use any preferred online editor to complete it electronically.

No matter how many times you need to use the acquired template, you can find all the samples you’ve ever downloaded in your profile by opening the My Forms tab. Try it out!

Form popularity

FAQ

Aggregate Theory Therefore, unless you and the other partners have made an agreement that the partnership will continue intact after a partner dies, the general partnership dissolves after the death of a partner.

Partnerships automatically dissolve if any partner dies or becomes bankrupt, unless otherwise agreed. Thus partnerships should have a written partnership agreement, with provisions that permit the partnership to continue.

On the death of a partner, subject to any contract to the contrary, the partnership ceases to exist. Here, the contract on the contrary means the partnership need not be dissolved if it is expressly mentioned in the partnership deed that the remaining partners (not a partner) can continue the firm's business.

After the Death of a Business Partner The deceased's estate takes over their share of the partnership. A transfer happens of the other partner's share to you on a payment to the estate. You buy the share of the partnership using a financial formula.

Partnership assets continue as such on death. Regardless of how title is held, they continue to be partnership assets. There is no right of survivorship or right to acquire the deceased person's share.

Business partnership agreement. A properly arranged and funded agreement is a legally binding contract that spells out exactly what is to happen if one of the business's owners dies. It generally calls for the survivors to buy the deceased owner's share in the business from his or her heirs.

Firm, stands dissolved automatically on death of one partner. Continuance of business after such death would not tantamount to continuance of earlier partnership. In the absence of a contract to the contrary, the insolvency of any of the partner may dissolve the firm.

Being in a so called common law partnership will not give couples any legal protection whatsoever, and so under the law, if someone dies and they have a partner that they are not married to, then that partner has no right to inherit anything unless the partner that has passed away has stated in their will that they

As there is only one surviving partner, the partnership cannot continue and it will be dissolved as from the date of the partner's death.

The death of a partner in a two-person partnership will terminate the partnership for federal tax purposes if it results in the partnership's immediately winding up its business (Sec. 708(b)(1)(A)). If this occurs, the partnership's tax year closes on the partner's date of death.