A Franklin Ohio Purchase Agreement by a Corporation of Assets of a Partnership is a legal document that outlines the terms and conditions of a transaction in which a corporation acquires the assets of a partnership based in Franklin, Ohio. This agreement serves as a legally binding contract between the involved parties and ensures a smooth transfer of assets and responsibilities. Keywords: Franklin Ohio, Purchase Agreement, Corporation, Assets, Partnership These agreements may vary based on specific circumstances and the nature of the transaction. Here are a few potential types of Franklin Ohio Purchase Agreements by a Corporation of Assets of a Partnership: 1. Asset Purchase Agreement: This type of agreement outlines the purchase of specific assets from the partnership by the corporation. It identifies the assets being sold, their value, and conditions of transfer. 2. Business Purchase Agreement: In this agreement, the corporation purchases the entire business, including its assets, liabilities, contracts, licenses, and goodwill. It defines the scope of the acquisition and any relevant conditions or restrictions. 3. Intellectual Property Purchase Agreement: If the partnership holds valuable intellectual property assets, such as patents, trademarks, or copyrights, this type of agreement focuses on their acquisition by the corporation. It includes provisions for transfer, ownership, and licensing, if applicable. 4. Real Estate Purchase Agreement: In cases where the partnership owns real estate assets, such as land, buildings, or leases, this agreement specifies the terms of their purchase and transfer. It covers property descriptions, purchase price, financing arrangements, and any contingencies. 5. Stock Purchase Agreement: Rather than acquiring individual assets, the corporation may choose to purchase the partnership's stock or ownership interests. This agreement details the sale of ownership shares, including their valuation, terms, restrictions, and any associated warranties or representations. In all of these scenarios, the Franklin Ohio Purchase Agreement by a Corporation of Assets of a Partnership ensures a legally binding transaction by defining the rights, obligations, and expectations of both parties involved. It typically includes sections addressing purchase price and payment terms, representations and warranties, indemnification, confidentiality, dispute resolution, and any other relevant provisions for a successful acquisition.

Franklin Ohio Purchase Agreement by a Corporation of Assets of a Partnership

Description

How to fill out Franklin Ohio Purchase Agreement By A Corporation Of Assets Of A Partnership?

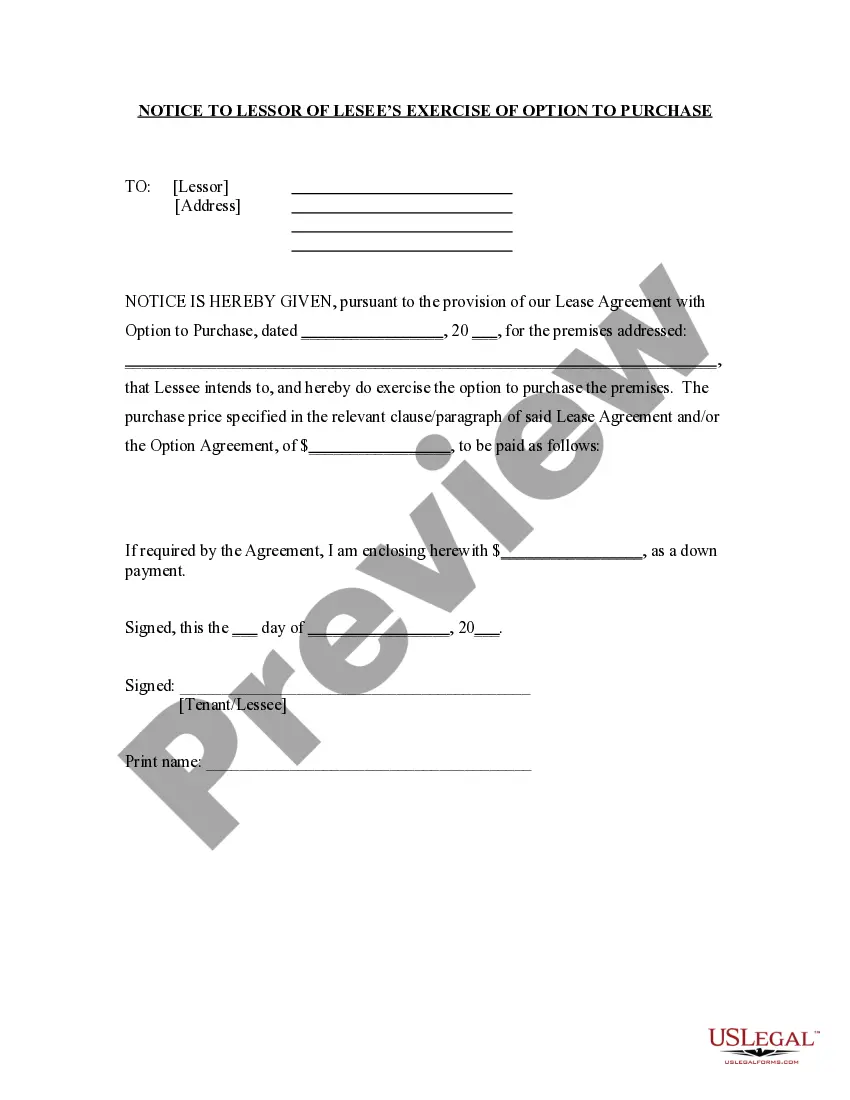

Draftwing documents, like Franklin Purchase Agreement by a Corporation of Assets of a Partnership, to manage your legal matters is a tough and time-consumming process. Many situations require an attorney’s involvement, which also makes this task not really affordable. Nevertheless, you can consider your legal affairs into your own hands and take care of them yourself. US Legal Forms is here to the rescue. Our website features more than 85,000 legal forms created for different cases and life situations. We ensure each document is compliant with the regulations of each state, so you don’t have to worry about potential legal pitfalls associated with compliance.

If you're already aware of our services and have a subscription with US, you know how straightforward it is to get the Franklin Purchase Agreement by a Corporation of Assets of a Partnership template. Simply log in to your account, download the template, and customize it to your requirements. Have you lost your document? Don’t worry. You can get it in the My Forms tab in your account - on desktop or mobile.

The onboarding process of new users is just as simple! Here’s what you need to do before downloading Franklin Purchase Agreement by a Corporation of Assets of a Partnership:

- Ensure that your template is compliant with your state/county since the regulations for writing legal documents may differ from one state another.

- Find out more about the form by previewing it or reading a brief description. If the Franklin Purchase Agreement by a Corporation of Assets of a Partnership isn’t something you were looking for, then use the header to find another one.

- Log in or create an account to begin utilizing our website and get the form.

- Everything looks great on your end? Hit the Buy now button and choose the subscription option.

- Pick the payment gateway and type in your payment details.

- Your form is ready to go. You can try and download it.

It’s easy to find and buy the appropriate document with US Legal Forms. Thousands of organizations and individuals are already benefiting from our rich library. Sign up for it now if you want to check what other perks you can get with US Legal Forms!