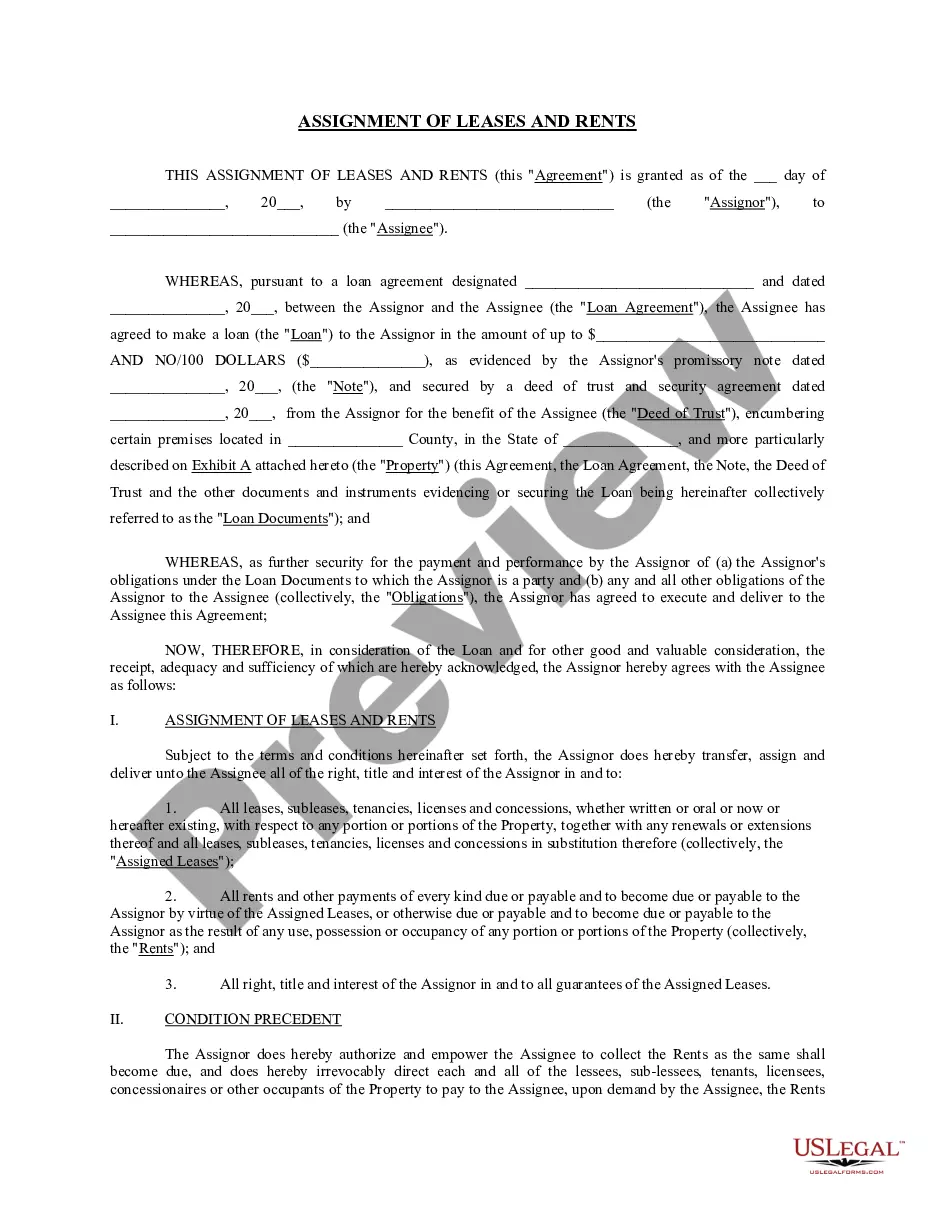

The Kings New York Purchase Agreement by a Corporation of Assets of a Partnership is a legal document that outlines the terms and conditions involved in the acquisition of assets from a partnership by a corporation in the state of New York. This agreement serves as a formal agreement between the two parties, ensuring a smooth transfer of ownership and protecting the rights and responsibilities of both the partnership and the corporation involved. Keywords: Kings New York Purchase Agreement, Corporation, Assets, Partnership, Acquisition, Transfer of Ownership, Legal document, Terms and Conditions, Rights and Responsibilities. Types of Kings New York Purchase Agreement by a Corporation of Assets of a Partnership: 1. Asset Purchase Agreement: This type of purchase agreement focuses specifically on the acquisition of assets from a partnership by a corporation. It includes details such as the identification and description of the assets being transferred, the purchase price, payment terms, conditions precedent, representations and warranties, and other provisions necessary to complete the transaction. 2. Stock Purchase Agreement: In some cases, instead of acquiring individual assets, a corporation may choose to purchase the stock or ownership interests of a partnership. This agreement governs the purchase of the partnership's shares or equity interests by the corporation, outlining the terms of the transaction, such as the purchase price, closing conditions, representations, warranties, and indemnities. 3. Merger Agreement: When a corporation and a partnership decide to merge and combine their assets and operations, a merger agreement is used. This agreement outlines how the two entities will converge and become one, addressing aspects such as the exchange ratio of ownership interests, treatment of partnership assets and liabilities, governance structure of the merged entity, and other relevant provisions necessary to effectuate the merger. 4. Joint Venture Purchase Agreement: In cases where a partnership and a corporation decide to form a joint venture, a joint venture purchase agreement may be employed. This agreement determines the terms of the new venture, including contributions, responsibilities, profit-sharing arrangements, management structure, termination conditions, and other essential provisions necessary for the successful establishment and operation of the joint venture. These are some various types of Kings New York Purchase Agreements by a Corporation of Assets of a Partnership that may exist depending on the specific circumstances and objectives of the parties involved. It is crucial for both parties to consult legal professionals specializing in business transactions to ensure the agreement adequately protects their interests and complies with applicable laws and regulations.

Kings New York Purchase Agreement by a Corporation of Assets of a Partnership

Description

How to fill out Kings New York Purchase Agreement By A Corporation Of Assets Of A Partnership?

Laws and regulations in every sphere differ from state to state. If you're not a lawyer, it's easy to get lost in various norms when it comes to drafting legal paperwork. To avoid high priced legal assistance when preparing the Kings Purchase Agreement by a Corporation of Assets of a Partnership, you need a verified template valid for your county. That's when using the US Legal Forms platform is so beneficial.

US Legal Forms is a trusted by millions online collection of more than 85,000 state-specific legal forms. It's an excellent solution for specialists and individuals looking for do-it-yourself templates for different life and business scenarios. All the documents can be used many times: once you obtain a sample, it remains accessible in your profile for subsequent use. Thus, when you have an account with a valid subscription, you can simply log in and re-download the Kings Purchase Agreement by a Corporation of Assets of a Partnership from the My Forms tab.

For new users, it's necessary to make some more steps to get the Kings Purchase Agreement by a Corporation of Assets of a Partnership:

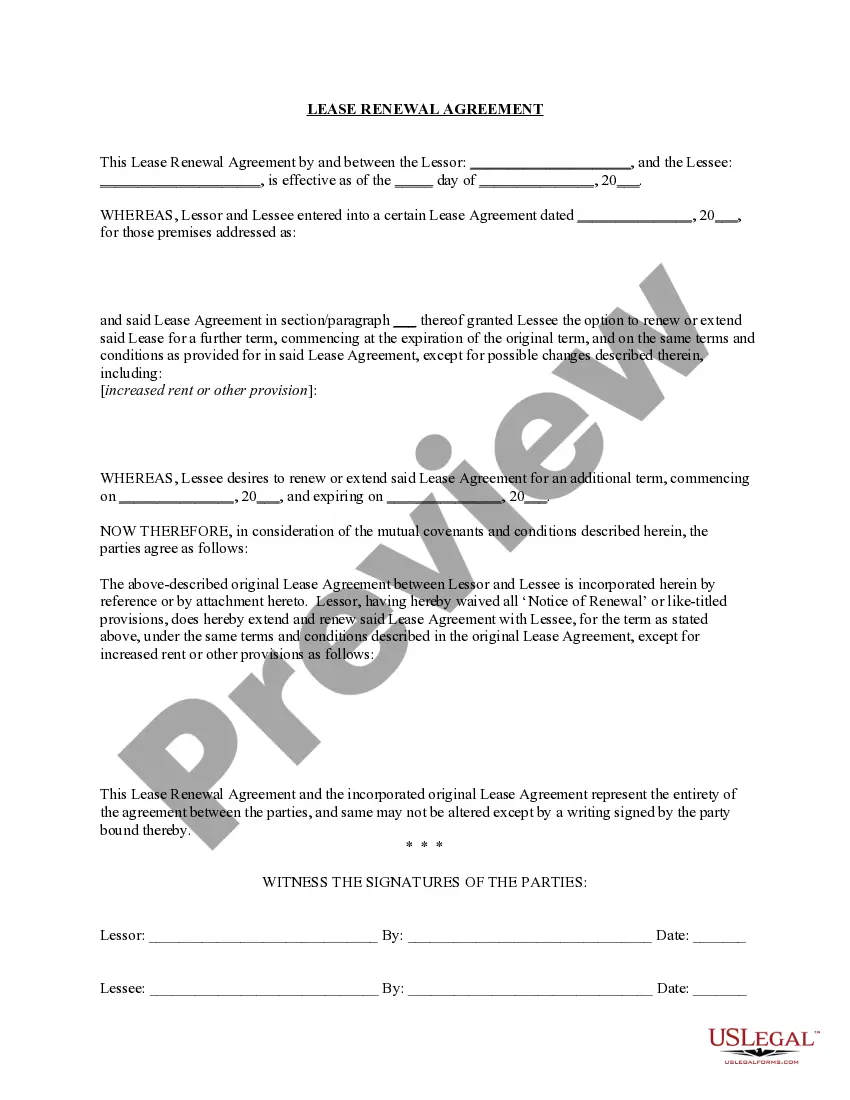

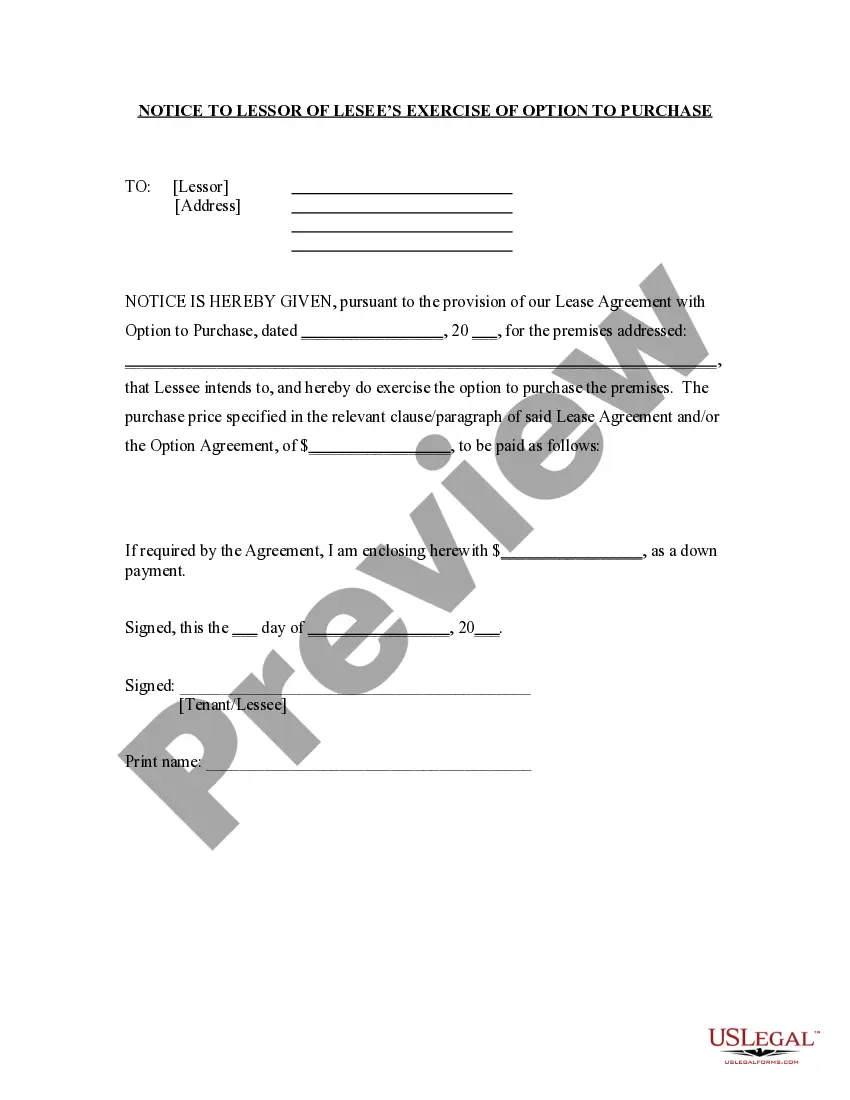

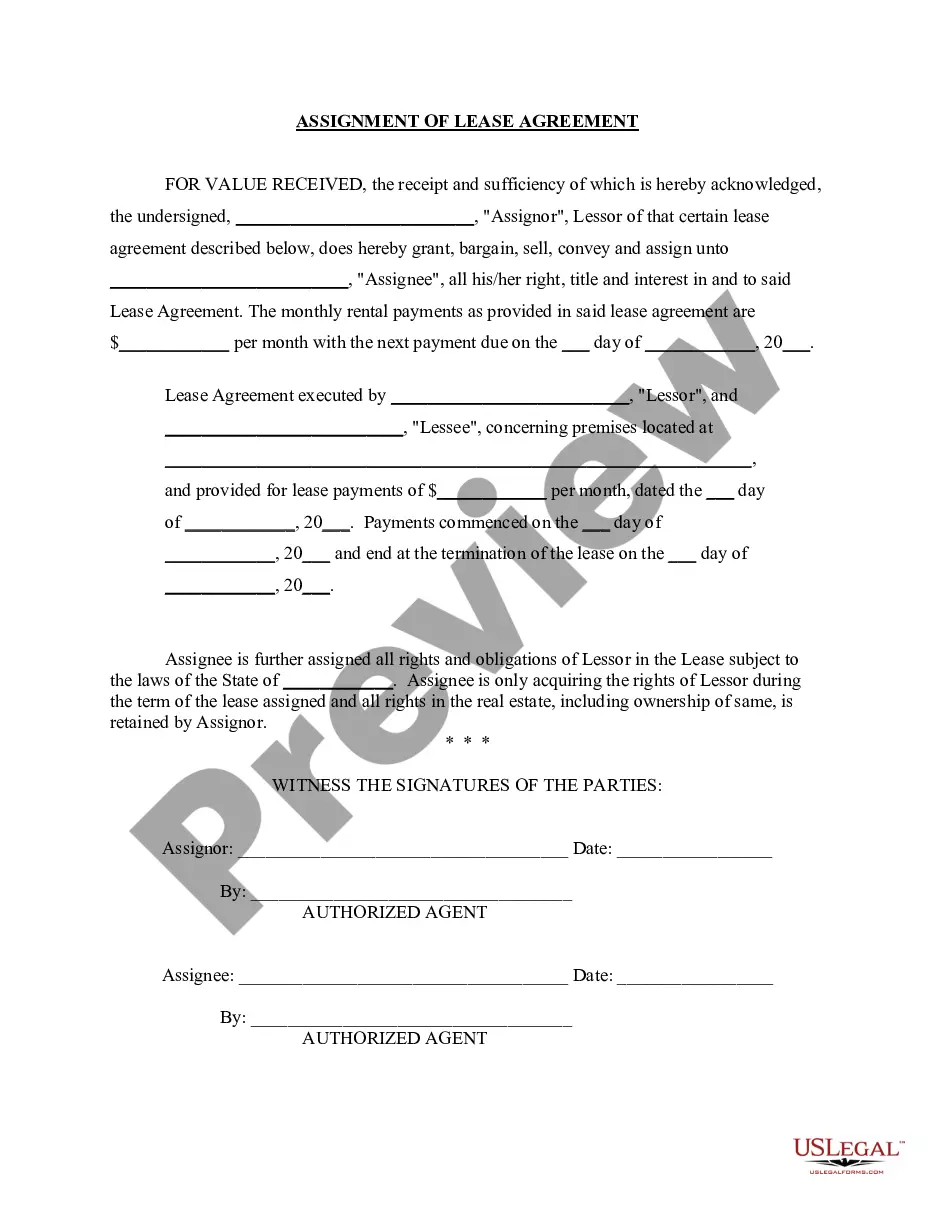

- Analyze the page content to ensure you found the correct sample.

- Take advantage of the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your criteria.

- Use the Buy Now button to obtain the template once you find the proper one.

- Opt for one of the subscription plans and log in or sign up for an account.

- Choose how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the file in and click Download.

- Complete and sign the template in writing after printing it or do it all electronically.

That's the easiest and most economical way to get up-to-date templates for any legal scenarios. Locate them all in clicks and keep your paperwork in order with the US Legal Forms!