Middlesex Massachusetts Purchase Agreement by a Corporation of Assets of a Partnership serves as a legally binding contract outlining the terms and conditions under which a corporation acquires the assets of a partnership located in Middlesex County, Massachusetts. This agreement ensures a smooth transaction and protects the interests of both the corporation and the partnership. The key components of this agreement include: 1. Identification of Parties: The agreement clearly identifies the corporation, the partnership, and any other relevant stakeholders involved in the transaction. It provides their legal names, addresses, and official contact details. 2. Asset Description: A detailed list of assets being transferred from the partnership to the corporation is included. These assets may include physical property, equipment, inventory, intellectual property rights, contracts, customer lists, or any other assets relevant to the partnership's operations. 3. Purchase Price and Payment Terms: The agreement specifies the purchase price for the assets and outlines the payment terms and conditions. This may include the total amount, installment options, due dates, and any additional considerations, such as assumption of liabilities or contingencies. 4. Representations and Warranties: Both parties make certain representations and warranties to ensure the accuracy and validity of the transaction. This may include assertions concerning the ownership of assets and their conditions, validity of contracts, absence of undisclosed liabilities, and compliance with laws and regulations. 5. Due Diligence: A provision for conducting due diligence is often included to allow the corporation to inspect the assets and verify their value, condition, and legal ownership. This enables the corporation to assess any potential risks associated with the acquisition. 6. Assumption of Liabilities: The agreement addresses whether the corporation assumes any liabilities or obligations of the partnership. This may include outstanding debts, obligations to employees, tax liabilities, or pending legal disputes. 7. Closing and Delivery: Details regarding the closing date, place, and procedure for completing the transaction are outlined. Both parties agree on the specific documents that need to be exchanged and delivered to ensure a legally valid transfer of assets. Different types of Middlesex Massachusetts Purchase Agreement by a Corporation of Assets of a Partnership may exist based on the specific industry, assets involved, or unique contractual requirements. Some examples could include technology partnership acquisitions, real estate partnership acquisitions, or franchise partnership acquisitions. Each of these agreements may require additional provisions relevant to their respective industries or specific assets being transferred.

Middlesex Massachusetts Purchase Agreement by a Corporation of Assets of a Partnership

Description

How to fill out Middlesex Massachusetts Purchase Agreement By A Corporation Of Assets Of A Partnership?

Whether you intend to open your company, enter into a contract, apply for your ID renewal, or resolve family-related legal issues, you need to prepare certain paperwork meeting your local laws and regulations. Locating the right papers may take a lot of time and effort unless you use the US Legal Forms library.

The service provides users with more than 85,000 expertly drafted and verified legal templates for any individual or business case. All files are grouped by state and area of use, so opting for a copy like Middlesex Purchase Agreement by a Corporation of Assets of a Partnership is fast and straightforward.

The US Legal Forms website users only need to log in to their account and click the Download button next to the required form. If you are new to the service, it will take you several additional steps to get the Middlesex Purchase Agreement by a Corporation of Assets of a Partnership. Adhere to the guide below:

- Make sure the sample meets your personal needs and state law requirements.

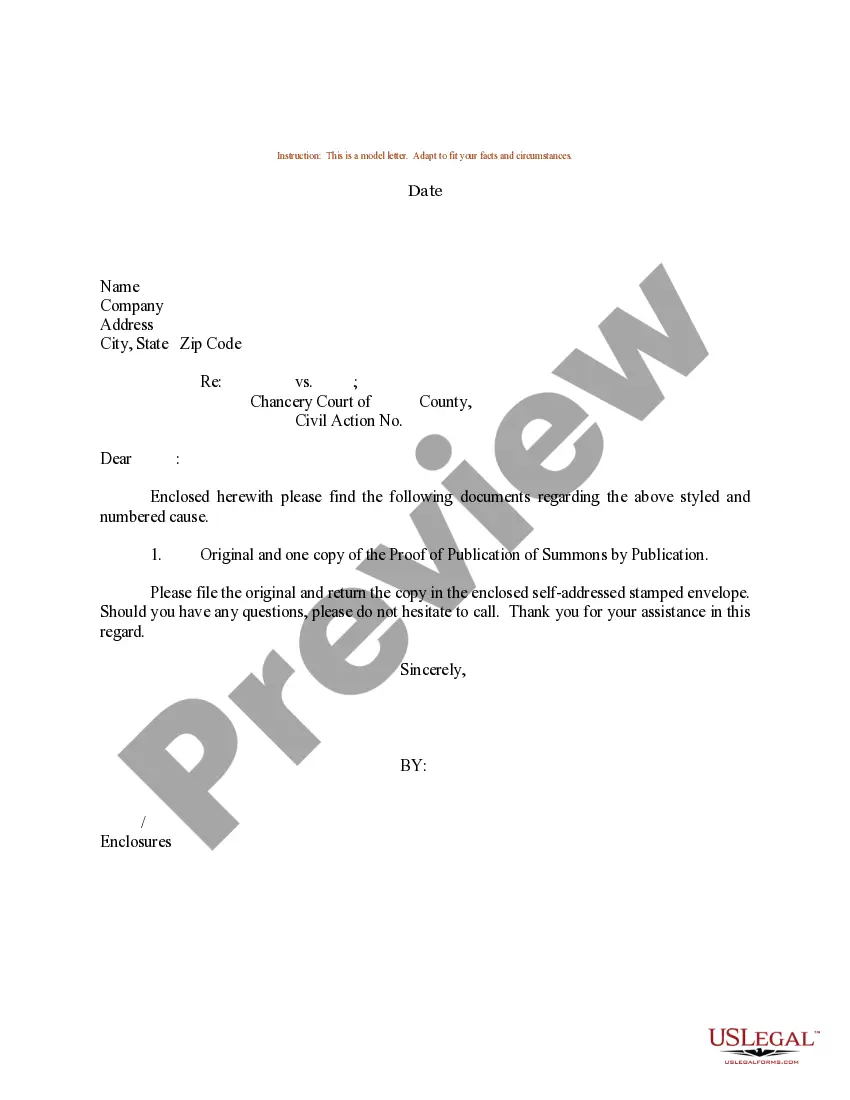

- Read the form description and check the Preview if there’s one on the page.

- Make use of the search tab providing your state above to find another template.

- Click Buy Now to get the sample when you find the proper one.

- Opt for the subscription plan that suits you most to proceed.

- Sign in to your account and pay the service with a credit card or PayPal.

- Download the Middlesex Purchase Agreement by a Corporation of Assets of a Partnership in the file format you require.

- Print the copy or complete it and sign it electronically via an online editor to save time.

Documents provided by our website are reusable. Having an active subscription, you can access all of your earlier acquired paperwork at any time in the My Forms tab of your profile. Stop wasting time on a constant search for up-to-date official documents. Sign up for the US Legal Forms platform and keep your paperwork in order with the most comprehensive online form collection!

Form popularity

FAQ

An asset purchase agreement, also known as an asset sale agreement, business purchase agreement, or APA, is a written legal instrument that formalizes the purchase of a business or significant business asset. It details the structure of the deal, price, limitations, and warranties.

The buyer's solicitor will prepare and draft the sale contract, no matter whether it is an Asset Purchase Agreement or an SPA, this is because the contract will provide for a number of warranties (and possibly indemnities) but it will also govern who the purchase will be carried out, the purchase price to be paid,

To obtain a sale and purchase agreement you'll need to contact your lawyer or conveyancer or a licenced real estate professional. You can also purchase printed and digital sale and purchase agreement forms online.

Either the seller or the buyer can prepare a purchase agreement. Like any contract, it can be a standard document that one party uses in the normal course of business or it can be the end result of back-and-forth negotiations.

The seller must represent its authority to sell the asset. Additionally, the seller represents that the purchase price of the asset is equal to its value, and that the seller is not in financial or legal trouble.

An asset purchase requires the sale of individual assets. A share purchase requires the purchase of 100 percent of the shares of a company, effectively transferring all of the company's assets and liabilities to the purchaser.

How to Write a Business Purchase Agreement? Step 1 Parties and Business Information. A business purchase agreement should detail the names of the buyer and seller at the start of the agreement.Step 2 Business Assets.Step 3 Business Liabilities.Step 4 Purchase Price.Step 6 Signatures.

An asset purchase agreement is a legal contract to buy the assets of a business. It can also be used to purchase specific assets from a business, especially if they are significant in value.

The buyer's solicitor will prepare and draft the sale contract, no matter whether it is an Asset Purchase Agreement or an SPA, this is because the contract will provide for a number of warranties (and possibly indemnities) but it will also govern who the purchase will be carried out, the purchase price to be paid,

In an asset purchase, the buyer agrees to purchase specific assets and liabilities. This means that they only take on the risks of those specific assets. This could include equipment, fixtures, furniture, licenses, trade secrets, trade names, accounts payable and receivable, and more.