A Tarrant Texas Purchase Agreement by a Corporation of Assets of a Partnership refers to a legal document that outlines the terms and conditions for the acquisition of assets owned by a partnership by a corporation based in Tarrant County, Texas. This agreement is a crucial instrument that governs the transaction between the involved parties, specifying the rights, obligations, and contingencies associated with the purchase of assets. The Tarrant Texas Purchase Agreement by a Corporation of Assets of a Partnership typically contains various key elements. Firstly, it identifies and describes the parties involved in the transaction, including the purchasing corporation and the partnership whose assets are being acquired. This section also outlines the effective date of the agreement and any background information that contextualizes the transaction. Secondly, the agreement provides a comprehensive list of the assets being acquired by the corporation. These assets can encompass tangible items like equipment, inventory, real estate, or intellectual property such as trademarks, copyrights, or patents. The agreement must establish the valuation and condition of these assets to ensure transparency and enable an accurate determination of the purchase price. Thirdly, the agreement stipulates the purchase price, payment terms, and any additional financial arrangements involved in the transaction. This section may include provisions for the allocation of the purchase price among different assets, potential adjustments based on post-closing audits, and the method of payment, such as cash, stock, or a combination of both. Furthermore, the Tarrant Texas Purchase Agreement by a Corporation of Assets of a Partnership outlines the representations and warranties made by both the corporation and the partnership. These representations and warranties are assurances about the accuracy of the information provided, ownership of the assets, absence of any undisclosed liabilities, compliance with laws, and the authority of the involved parties to execute the agreement. The agreement also addresses various closing conditions that must be fulfilled for the transaction to be completed successfully. These may include obtaining necessary consents and approvals, the absence of any pending litigation or material adverse changes, and the delivery of required documents and assets. As every transaction is unique, there might be different types of Tarrant Texas Purchase Agreement by a Corporation of Assets of a Partnership tailored to specific circumstances and industries. These could include agreements related to the acquisition of technology-based assets or those specific to real estate transactions. In conclusion, a Tarrant Texas Purchase Agreement by a Corporation of Assets of a Partnership is a legally binding document that acts as a roadmap for the acquisition of partnership assets by a corporation in Tarrant County, Texas. It establishes the terms, conditions, and rights associated with the transaction, aiming to provide clarity, transparency, and protection for all parties involved.

Tarrant Texas Purchase Agreement by a Corporation of Assets of a Partnership

Description

How to fill out Tarrant Texas Purchase Agreement By A Corporation Of Assets Of A Partnership?

Laws and regulations in every sphere differ from state to state. If you're not a lawyer, it's easy to get lost in a variety of norms when it comes to drafting legal documentation. To avoid pricey legal assistance when preparing the Tarrant Purchase Agreement by a Corporation of Assets of a Partnership, you need a verified template legitimate for your region. That's when using the US Legal Forms platform is so beneficial.

US Legal Forms is a trusted by millions web catalog of more than 85,000 state-specific legal forms. It's a perfect solution for specialists and individuals looking for do-it-yourself templates for various life and business occasions. All the documents can be used many times: once you obtain a sample, it remains available in your profile for further use. Therefore, when you have an account with a valid subscription, you can just log in and re-download the Tarrant Purchase Agreement by a Corporation of Assets of a Partnership from the My Forms tab.

For new users, it's necessary to make several more steps to get the Tarrant Purchase Agreement by a Corporation of Assets of a Partnership:

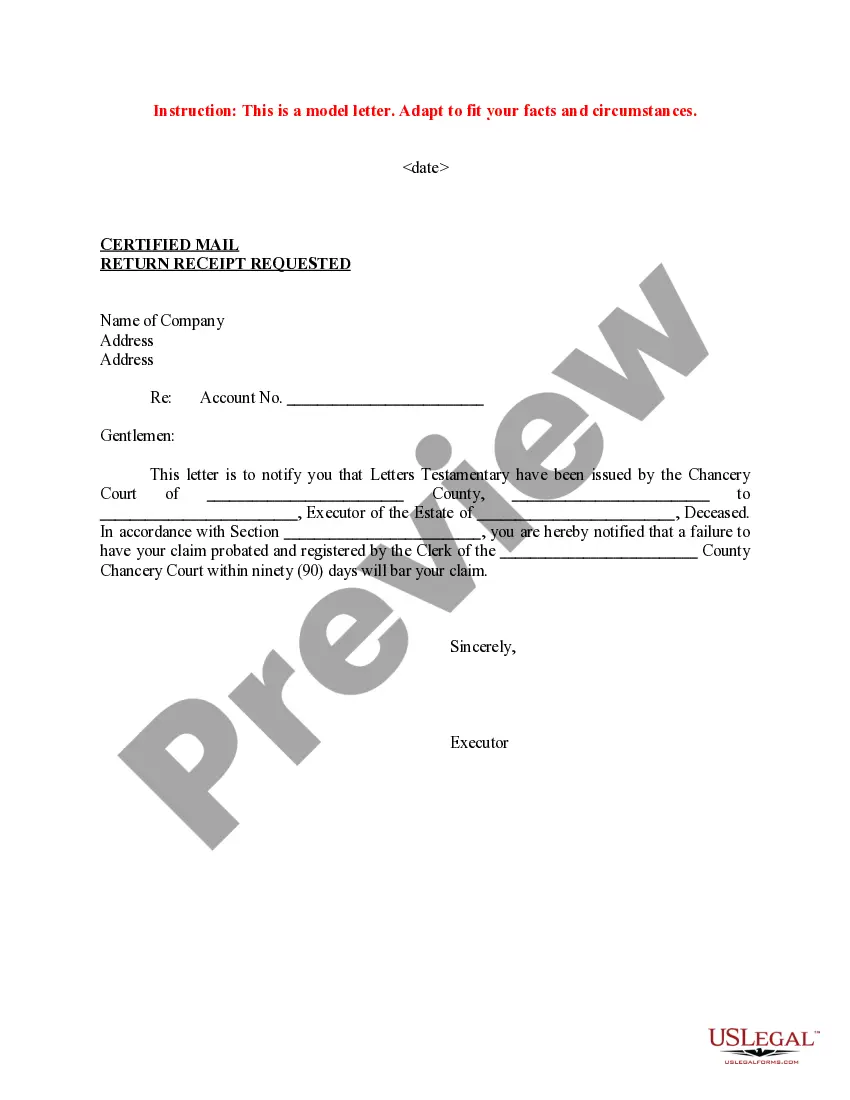

- Examine the page content to ensure you found the right sample.

- Take advantage of the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your requirements.

- Click on the Buy Now button to obtain the document when you find the right one.

- Choose one of the subscription plans and log in or create an account.

- Choose how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the file in and click Download.

- Fill out and sign the document on paper after printing it or do it all electronically.

That's the simplest and most affordable way to get up-to-date templates for any legal scenarios. Locate them all in clicks and keep your documentation in order with the US Legal Forms!