Dear [Collector's Name], I am writing to address the outstanding balance on my account with [Company Name]. I am fully aware of my financial responsibilities and regret the delay in making the payment on time. However, due to unforeseen circumstances, I have encountered some temporary financial difficulties, which have affected my ability to settle the outstanding amount promptly. After careful consideration and evaluation of my current financial situation, I am committed to resolving this matter as soon as possible. I would appreciate your understanding and cooperation during this time. Please find enclosed a proposed payment plan for your review. This plan outlines how I intend to repay the debt in manageable installments, taking into account my current income and expenses. I would like to highlight that my intention is to honor my financial obligations, and I firmly believe this payment plan will help restore our business relationship. I am confident that with your approval of this arrangement, it will allow me to make consistent payments towards the outstanding balance, ultimately leading to its full settlement. Furthermore, I kindly request you to consider this proposal as a sincere effort on my part to fulfill my financial commitment promptly. Furthermore, I understand the impact unpaid debts can have on credit ratings, and I am eager to avoid any further negative consequences. Furthermore, I value our business relationship and wish to rectify this situation in a mutually beneficial manner. Acknowledging Mecklenburg County's stance on fair debt collection practices, I expect open and transparent communication throughout this process. If you have any concerns or questions regarding the payment plan or require additional documentation, please do not hesitate to contact me at the provided phone number or email address. I hope for a favorable response from your end regarding this proposal. I am eager to work in cooperation with you to resolve this matter and regain financial stability. Furthermore, I look forward to receiving your written confirmation of the accepted payment plan at your earliest convenience. Thank you for your understanding and patience. Sincerely, [Your Name] [Your Address] [City, State, ZIP Code] [Phone Number] [Email Address] Alternate Mecklenburg North Carolina Sample Letters for Collection: 1. Delinquent Account Letter: This letter is used to inform the debtor about the overdue payment, reminding them of their financial obligations and requesting immediate action to settle the debt. 2. Final Notice Letter: A final notice letter is sent as a last attempt to collect the unpaid debt before initiating any further legal action. It emphasizes the urgency of payment and outlines the consequences of continued non-payment. 3. Cease and Desist Letter: This letter is utilized when a debtor believes they are being subjected to unfair or abusive debt collection practices. It requests the collector to stop all communication related to the debt. 4. Settlement Offer Letter: A settlement offer letter is sent by debtors proposing a reduced amount to be paid in full settlement of the outstanding balance. It provides a rationale for the reduced payment and seeks the creditor's agreement on the proposed terms. 5. Demand Letter: This letter is typically sent by an attorney on behalf of a creditor, demanding immediate payment of the outstanding debt. It serves as a firm reminder of the debtor's legal obligations and warns of potential legal action if the debt is not settled promptly.

Mecklenburg North Carolina Sample Letter for Collection

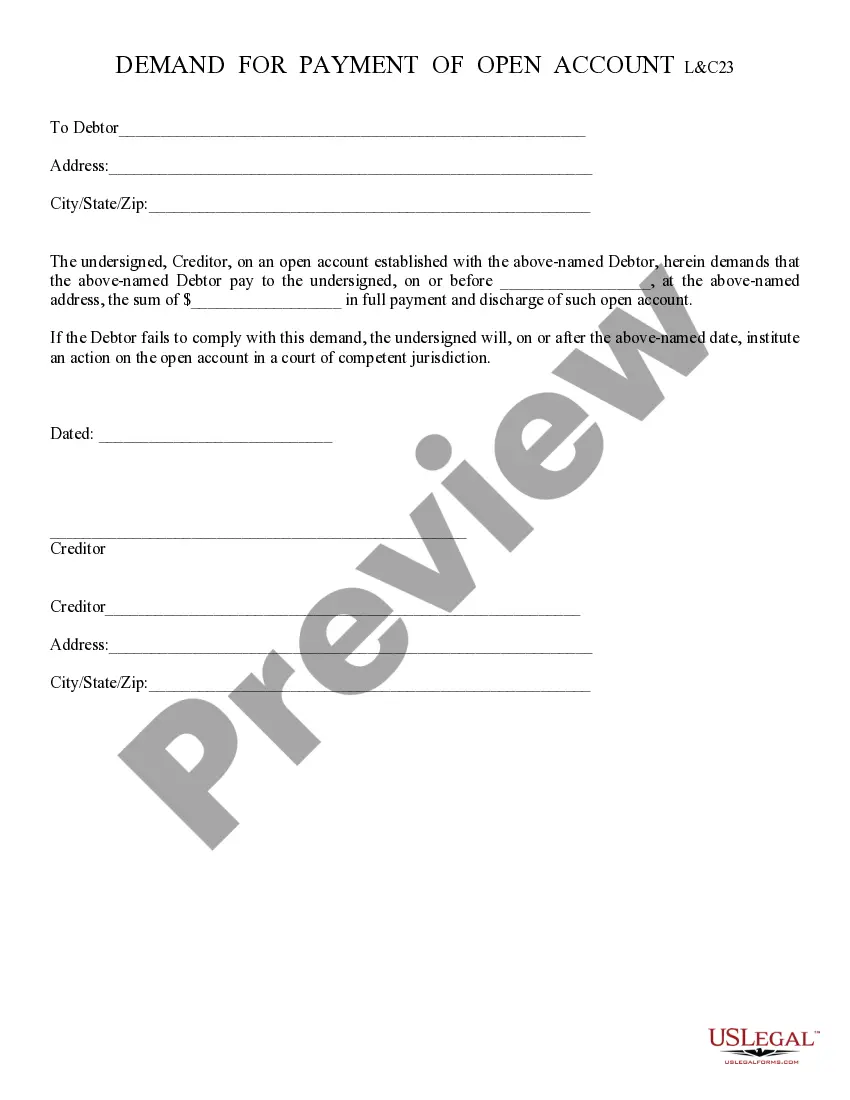

Description

How to fill out Mecklenburg North Carolina Sample Letter For Collection?

Drafting paperwork for the business or personal demands is always a huge responsibility. When creating a contract, a public service request, or a power of attorney, it's important to consider all federal and state laws of the particular region. Nevertheless, small counties and even cities also have legislative provisions that you need to consider. All these aspects make it burdensome and time-consuming to create Mecklenburg Sample Letter for Collection without expert help.

It's easy to avoid spending money on attorneys drafting your paperwork and create a legally valid Mecklenburg Sample Letter for Collection by yourself, using the US Legal Forms web library. It is the biggest online collection of state-specific legal documents that are professionally cheched, so you can be certain of their validity when selecting a sample for your county. Previously subscribed users only need to log in to their accounts to download the needed form.

If you still don't have a subscription, follow the step-by-step guide below to obtain the Mecklenburg Sample Letter for Collection:

- Examine the page you've opened and verify if it has the sample you require.

- To achieve this, use the form description and preview if these options are presented.

- To find the one that suits your needs, use the search tab in the page header.

- Double-check that the template complies with juridical standards and click Buy Now.

- Opt for the subscription plan, then sign in or create an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the selected file in the preferred format, print it, or fill it out electronically.

The exceptional thing about the US Legal Forms library is that all the paperwork you've ever purchased never gets lost - you can get it in your profile within the My Forms tab at any time. Join the platform and quickly obtain verified legal templates for any use case with just a couple of clicks!

Form popularity

FAQ

To obtain Charlotte-Mecklenburg Police Department (CMPD) records, please contact CMPD's Crime Records section at 704-336-2848....The following inquiries can be accessed online: arrest inquiries. civil inquiries. inmate inquiries. warrant inquiries.

In North Carolina, a lien claimant has 120 days from the date of last furnishing to complete these 3 steps: Fill out a mechanics lien form that meets NC requirements.File the lien with the county recorder's office.Serve a copy of the lien on the property owner.

Mecklenburg County Officials County Manager's Office 980-314-2900. Board of County Commissioners 704-336-2559. Press Contact 704-336-2475200b

Requirements for Filing a Mechanic's or Construction Lien Most states have a 90 day filing deadline, while North Carolina's is 120 days, measured from the last substantial furnishing of labor and/or materials on the property. Any lien filed after this deadline will not be enforceable against the property.

Whether you're a contractor or a subcontractor can have an immense effect on your lien rights. Under North Carolina law, only contractors can file a claim of lien on real property.

Can you pay someone's delinquent taxes and become the owner of the property? No. Paying someone else's taxes will not entitle you to any legal ownership to the property.

How can I get a copy of my divorce decree? 200bYou can obtain information regarding a divorce, along with other court-related records by contacting the Mecklenburg County Clerk of Court.

200b200bContact Us 200bPlease contact us at 704-432-9300 if you have any questions.

The Board of Commissioners sets the County's property tax rate, regulates land use and zoning outside municipal jurisdictions, and adopts the annual budget. The Board meets monthly on the first and third Mondays.

County Commissioners Vilma D. Leake, District 2. Mark Jerrell, District 4. Laura Meier, District 5. Susan Rodriguez-McDowell, District 6. Pat Cotham, At-Large. Wilhelmenia I. Rembert, 200bTemporary At-Large. Leigh Altman, At-Large.