Subject: San Diego, California: Comprehensive Guide to Sample Letter Collections Dear [Recipient's Name], I hope this letter finds you well. As business professionals, we understand the importance of dealing with debt collection efficiently and effectively. Today, I would like to provide you with a comprehensive guide to San Diego, California's sample letter for collection, tailored to suit your needs and aid in your debt recovery endeavors. San Diego, nestled on the southern coast of California, is a vibrant and diverse city known for its stunning beaches, idyllic climate, and vibrant culture. When it comes to debt collection, San Diego follows legal protocols outlined in the Fair Debt Collection Practices Act (FD CPA) to ensure a fair and impartial process, protecting both creditors and debtors. Sample Letters for Collection in San Diego, California: 1. Initial Debt Collection Letter: This sample letter is typically the first communication sent to debtors, notifying them of their outstanding debt and requesting immediate payment. It emphasizes the debt's details, including the amount owed, the creditor's contact information, and the consequences of failing to resolve the debt promptly. 2. Gentle Reminder Letter: If the debtor doesn't respond to the initial letter, a gentle reminder letter serves as a friendly nudge. It reiterates the outstanding obligations, potential consequences (such as credit score impact or legal action), and encourages prompt payment or communication to resolve the matter amicably. 3. Final Notice Letter: When previous attempts go unanswered, a final notice letter serves as a last-ditch effort to reclaim the owed debt before taking more serious action. It emphasizes the urgency of payment, highlights potential legal actions, and states the final deadline for payment. 4. Cease and Desist Letter: In cases where a debtor denies the alleged debt, a cease and desist letter demands that the creditor stops contacting them further regarding the matter. This is often used when the debtor believes the debt is invalid or that they are misidentified. 5. Settlement Offer Letter: Offered when the debtor shows willingness to negotiate, a settlement offer letter proposes a mutually agreed-upon reduced amount or a revised payment plan. This letter aims to establish collaboration and reach a compromise, avoiding further debt escalation. 6. Debt Validation Letter: If a debtor disputes the validity or accuracy of the debt, a debt validation letter demands the creditor provide proper documentation to verify the debt, such as original contract, account statements, and proof of ownership. When drafting any of these sample letters for collection in San Diego, ensure they adhere to the FD CPA guidelines: maintain professionalism, refrain from intimidation, misrepresentation, or disclosing sensitive information. Remember, it is prudent to consult a legal professional or debt collection agency for personalized assistance in crafting collection letters that adhere to both state and federal regulations, maximizing your chances of successful debt recovery. In conclusion, San Diego, California's collection letters serve as vital tools to effectively manage debt recovery. Understanding the intricacies of each letter type and adhering to legal guidelines ensures a fair and ethical process, benefiting both businesses and debtors. Thank you for your attention, and may your debt collection efforts in San Diego be fruitful. Sincerely, [Your Name]

San Diego California Sample Letter for Collection

Description

How to fill out San Diego California Sample Letter For Collection?

Preparing paperwork for the business or individual demands is always a huge responsibility. When drawing up a contract, a public service request, or a power of attorney, it's important to take into account all federal and state regulations of the particular region. However, small counties and even cities also have legislative provisions that you need to consider. All these details make it stressful and time-consuming to draft San Diego Sample Letter for Collection without expert help.

It's possible to avoid spending money on lawyers drafting your documentation and create a legally valid San Diego Sample Letter for Collection on your own, using the US Legal Forms web library. It is the largest online catalog of state-specific legal documents that are professionally cheched, so you can be sure of their validity when selecting a sample for your county. Previously subscribed users only need to log in to their accounts to save the required document.

If you still don't have a subscription, adhere to the step-by-step instruction below to obtain the San Diego Sample Letter for Collection:

- Look through the page you've opened and check if it has the document you require.

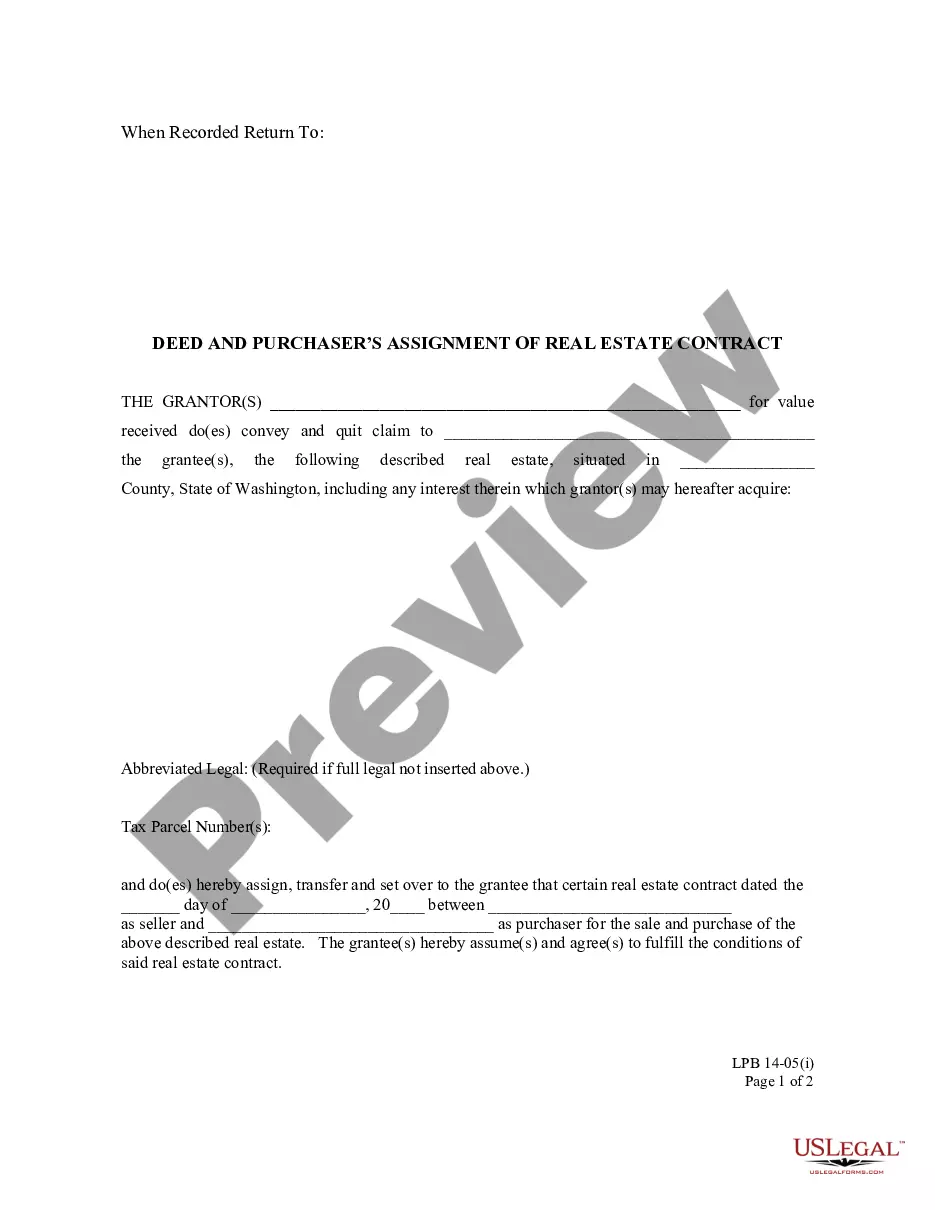

- To do so, use the form description and preview if these options are available.

- To locate the one that suits your requirements, use the search tab in the page header.

- Double-check that the template complies with juridical criteria and click Buy Now.

- Choose the subscription plan, then sign in or create an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the chosen file in the preferred format, print it, or complete it electronically.

The exceptional thing about the US Legal Forms library is that all the documentation you've ever purchased never gets lost - you can get it in your profile within the My Forms tab at any moment. Join the platform and quickly get verified legal forms for any scenario with just a few clicks!