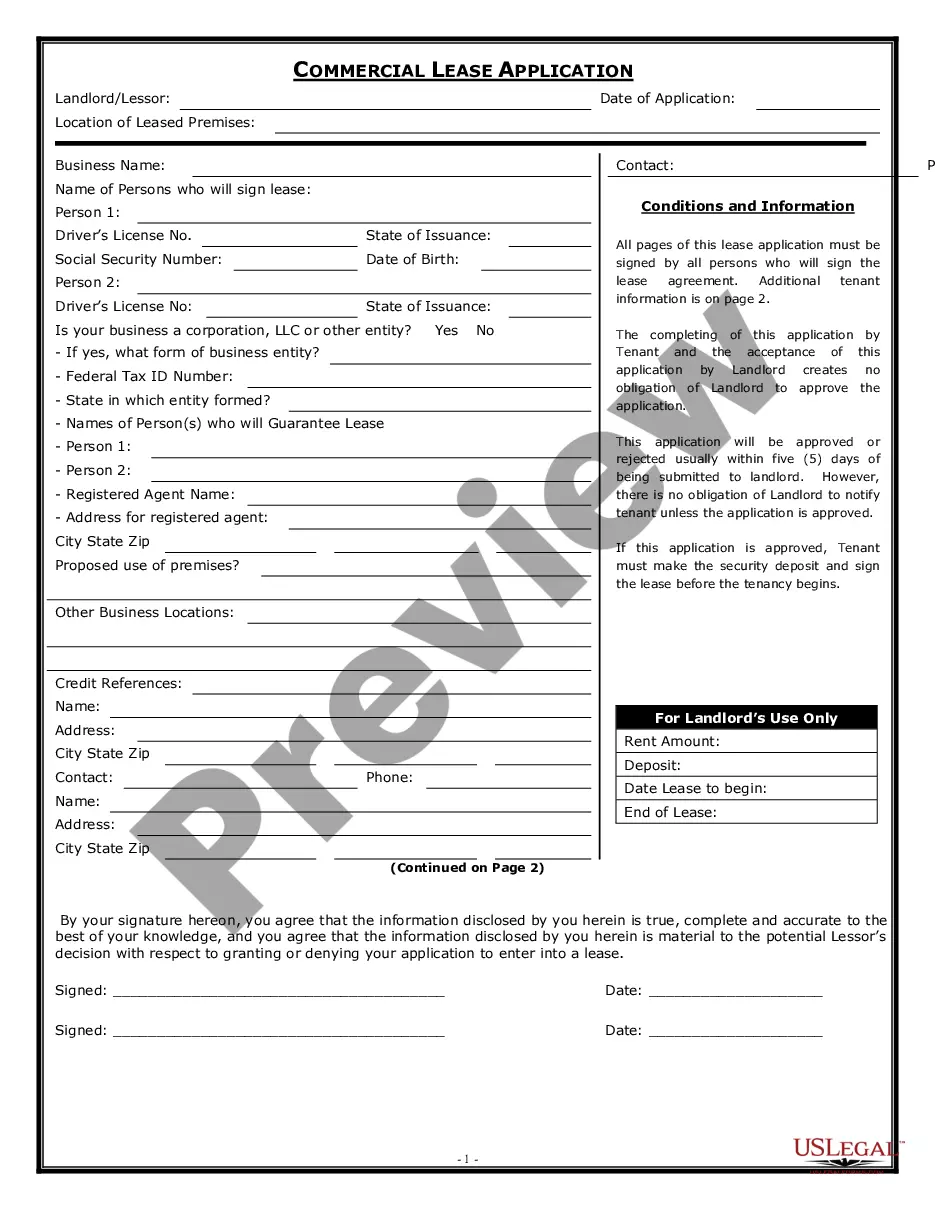

Allegheny Pennsylvania Receipt for Loan Funds is a legal document used to acknowledge the receipt of funds in the form of a loan in the Allegheny County of Pennsylvania. This receipt serves as proof for the borrower that they have received the agreed-upon amount of money, outlining the terms and conditions associated with the loan. The Allegheny Pennsylvania Receipt for Loan Funds typically includes the following information: 1. Parties Involved: The receipt identifies the lender (individual or institution) and the borrower, providing their names, addresses, and contact details. 2. Loan Amount: It specifies the total amount of money being lent, both in numerical and written formats, ensuring clarity to avoid any confusion or disputes. 3. Payment Terms: The receipt outlines the agreed-upon repayment terms, including the interest rate applied (if any), the frequency of payments (weekly, monthly, etc.), and the due date for each payment. 4. Usage of Funds: If applicable, the receipt may specify the purpose for which the loan funds will be used, such as home improvement, education, business expenses, or debt consolidation, among others. 5. Loan Duration: This section indicates the duration of the loan and whether it is a short-term or long-term loan, alongside any provisions for early repayment or extension. 6. Collateral: If the loan is secured by collateral, such as real estate, vehicles, or other valuable assets, the receipt will mention the details of the collateral provided. 7. Signatures and Dates: The document requires the borrower and lender to sign and date the receipt, making it legally binding and confirming their agreement to the terms laid out. Different types of Allegheny Pennsylvania Receipts for Loan Funds may exist depending on the specific purpose or nature of the loan. These may include: 1. Personal Loan Receipt: This type of receipt is used for loans provided by an individual to another individual for personal purposes, such as covering personal expenses or emergencies. 2. Mortgage Loan Receipt: When a loan is granted for real estate purposes, such as purchasing or refinancing a property, a mortgage loan receipt is issued. It includes specific terms related to the collateralized property. 3. Business Loan Receipt: In the case of loans dedicated to business ventures or financial requirements of a company, a business loan receipt is used. It outlines the intended use of loan funds for business purposes. 4. Student Loan Receipt: A student loan receipt is relevant when funds are borrowed to cover educational expenses, including tuition fees, books, and living costs. 5. Payday Loan Receipt: Payday loan receipts are used for short-term loans typically associated with smaller amounts, advanced against an individual's upcoming paycheck. Regardless of the type, the Allegheny Pennsylvania Receipt for Loan Funds is an essential document in the lending process, ensuring transparency and protection for both parties involved.

Allegheny Pennsylvania Receipt for loan Funds

Description

How to fill out Allegheny Pennsylvania Receipt For Loan Funds?

Do you need to quickly create a legally-binding Allegheny Receipt for loan Funds or probably any other form to manage your own or business matters? You can select one of the two options: contact a professional to draft a valid paper for you or draft it completely on your own. Luckily, there's another solution - US Legal Forms. It will help you get neatly written legal documents without having to pay sky-high prices for legal services.

US Legal Forms provides a huge collection of more than 85,000 state-compliant form templates, including Allegheny Receipt for loan Funds and form packages. We provide documents for an array of life circumstances: from divorce papers to real estate document templates. We've been on the market for more than 25 years and got a rock-solid reputation among our clients. Here's how you can become one of them and obtain the necessary template without extra troubles.

- To start with, carefully verify if the Allegheny Receipt for loan Funds is adapted to your state's or county's laws.

- If the document comes with a desciption, make sure to check what it's suitable for.

- Start the searching process again if the document isn’t what you were seeking by using the search bar in the header.

- Choose the plan that best suits your needs and proceed to the payment.

- Choose the file format you would like to get your document in and download it.

- Print it out, fill it out, and sign on the dotted line.

If you've already registered an account, you can simply log in to it, locate the Allegheny Receipt for loan Funds template, and download it. To re-download the form, simply head to the My Forms tab.

It's stressless to buy and download legal forms if you use our services. In addition, the templates we provide are reviewed by law professionals, which gives you greater peace of mind when writing legal affairs. Try US Legal Forms now and see for yourself!