Maricopa Arizona Receipt for Loan Funds: A Comprehensive Overview Keywords: Maricopa Arizona, receipt for loan funds, detailed description Introduction: Maricopa, Arizona, is a vibrant city located in Pinal County, Arizona, United States. In the financial realm, Maricopa offers various options and documentation to ensure transparency and accountability when borrowing funds. One such crucial document is the "Receipt for Loan Funds." This detailed description aims to enlighten readers about the significance, types, and importance of these receipts in Maricopa, Arizona. 1. Importance of Receipt for Loan Funds: A receipt for loan funds serves as an official acknowledgment or confirmation of the receipt of borrowed money. It acts as a legal document providing proof of the transaction, the amount received, and the terms and conditions agreed upon between the lender and borrower. Maricopa, Arizona, emphasizes the use of this document to maintain financial transparency and enable individuals to track their loan repayments accurately. 2. Elements of Maricopa Arizona Receipt for Loan Funds: The receipt for loan funds in Maricopa, Arizona, typically contains the following essential elements: a. Loan Details: This includes the loan amount, interest rate, loan purpose, and the date on which the funds were disbursed. b. Borrower and Lender Information: The receipt states the identities of the borrower and lender, including their names, addresses, contact information, and any relevant identification numbers. c. Repayment Terms: The document includes details regarding the repayment schedule, such as the installment amounts, due dates, interest calculation methods, and any penalties or late fees applicable. d. Signatures: To validate the receipt, both the borrower and lender must sign it. The date of signing should also be stated clearly. e. Witness Signatures (optional): In certain cases, a witness might be required to sign the receipt, ensuring additional verification and legal authentication. 3. Types of Maricopa Arizona Receipts for Loan Funds: Maricopa, Arizona, recognizes various types of receipts for loan funds based on the specific loan agreements and purposes. Some common types include: a. Personal Loan Receipt: This receipt is used when borrowing funds for personal reasons, such as education, medical expenses, or home renovations. b. Business Loan Receipt: Businesses in Maricopa, Arizona, often require loans for expansion, purchasing assets, or working capital. A business loan receipt documents the disbursement of funds for such entrepreneurial purposes. c. Mortgage Loan Receipt: In the context of real estate, a mortgage loan receipt is provided to borrowers upon the disbursement of funds for purchasing a property or refinancing existing mortgage loans. d. Auto Loan Receipt: This receipt type pertains to loans taken for acquiring vehicles, be it new or used. It specifies the loan amount received and related terms. Conclusion: Maricopa, Arizona, places paramount importance on maintaining financial clarity and transparency in loan transactions. The receipt for loan funds serves as a crucial document in these transactions, providing borrowers with a record of their loan disbursements and associated terms. Understanding the various types and elements of these receipts is vital for individuals and businesses seeking financial assistance in Maricopa, Arizona.

Maricopa Arizona Receipt for loan Funds

Description

How to fill out Maricopa Arizona Receipt For Loan Funds?

How much time does it normally take you to draw up a legal document? Since every state has its laws and regulations for every life sphere, locating a Maricopa Receipt for loan Funds meeting all regional requirements can be stressful, and ordering it from a professional lawyer is often costly. Numerous web services offer the most common state-specific templates for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most extensive web catalog of templates, grouped by states and areas of use. Apart from the Maricopa Receipt for loan Funds, here you can get any specific form to run your business or individual deeds, complying with your county requirements. Experts verify all samples for their validity, so you can be sure to prepare your documentation correctly.

Using the service is remarkably easy. If you already have an account on the platform and your subscription is valid, you only need to log in, opt for the needed form, and download it. You can pick the document in your profile anytime later on. Otherwise, if you are new to the platform, there will be some extra steps to complete before you obtain your Maricopa Receipt for loan Funds:

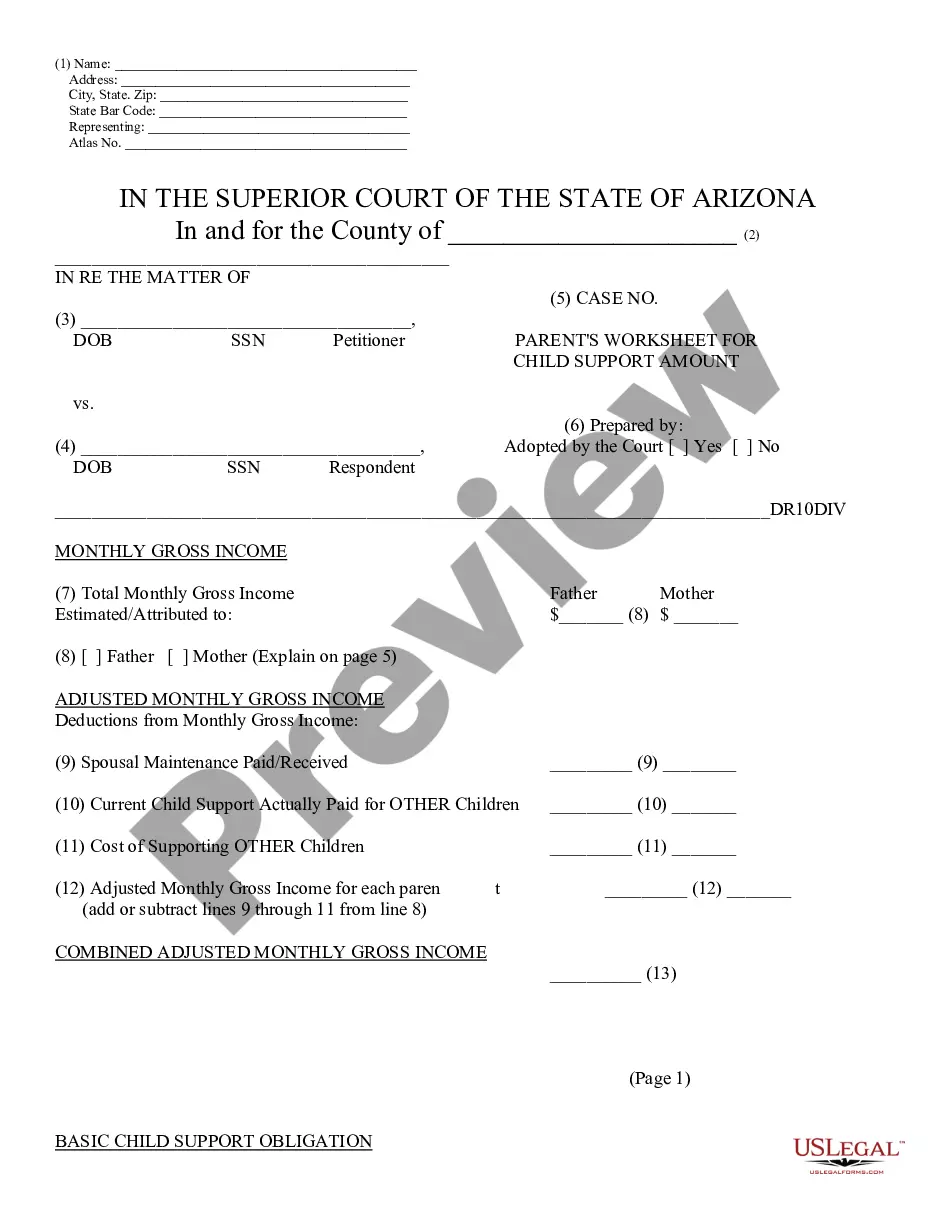

- Examine the content of the page you’re on.

- Read the description of the sample or Preview it (if available).

- Search for another form utilizing the corresponding option in the header.

- Click Buy Now once you’re certain in the selected document.

- Decide on the subscription plan that suits you most.

- Register for an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Switch the file format if needed.

- Click Download to save the Maricopa Receipt for loan Funds.

- Print the doc or use any preferred online editor to complete it electronically.

No matter how many times you need to use the acquired template, you can find all the files you’ve ever saved in your profile by opening the My Forms tab. Try it out!