The Alameda California Loan Commitment Agreement is a legal document that outlines the terms and conditions between a lender and a borrower for a loan in Alameda, California. This agreement serves as a binding contract, providing a comprehensive understanding of the loan's specifics, expectations, and obligations for both parties involved. The Loan Commitment Agreement in Alameda, California covers various aspects of the loan arrangement, including the principal amount, interest rate, payment schedule, and any applicable fees or charges. It sets out the rights and responsibilities of the lender and borrower, ensuring transparency and clarity throughout the loan process. Key clauses often found in an Alameda California Loan Commitment Agreement include: 1. Loan Details: This section provides an overview of the loan, including the principal amount, loan term, interest rate, and any conditions or requirements that must be fulfilled for the loan to be disbursed. 2. Repayment Terms: The agreement specifies the repayment schedule, outlining when and how the borrower is obligated to make payments. It may include details on late payment penalties, grace periods, and acceptable payment methods. 3. Default and Remedies: This clause highlights the consequences of loan default and the available remedies for the lender. It may cover scenarios such as missed payments, breach of contract, or failure to meet specific loan obligations. 4. Collateral and Security: If the loan is secured, the agreement defines the collateral provided by the borrower to secure the loan. It lays out the lender's rights in the event of default and the process for repossession or sale of collateral. 5. Conditions Precedent: This section outlines any conditions that must be met before the loan is deemed effective. Common conditions may include obtaining insurance coverage, providing financial statements, or obtaining necessary approvals or permits. 6. Governing Law and Jurisdiction: The agreement specifies that the laws of California govern the interpretation and enforcement of the agreement. It may also designate a specific jurisdiction for resolving disputes or filing legal actions. While there may not be different types of Loan Commitment Agreements specific to Alameda, California, the content and structure of the agreement can vary depending on the nature of the loan, such as personal loans, mortgage loans, or commercial loans. However, the essential elements described above generally apply to all types of loan commitment agreements in Alameda, California.

Alameda California Loan Commitment Agreement

Description

How to fill out Alameda California Loan Commitment Agreement?

Dealing with legal forms is a must in today's world. However, you don't always need to seek professional help to create some of them from scratch, including Alameda Loan Commitment Agreement, with a platform like US Legal Forms.

US Legal Forms has over 85,000 forms to pick from in various categories varying from living wills to real estate paperwork to divorce documents. All forms are arranged based on their valid state, making the searching process less challenging. You can also find detailed resources and guides on the website to make any tasks related to paperwork completion simple.

Here's how you can find and download Alameda Loan Commitment Agreement.

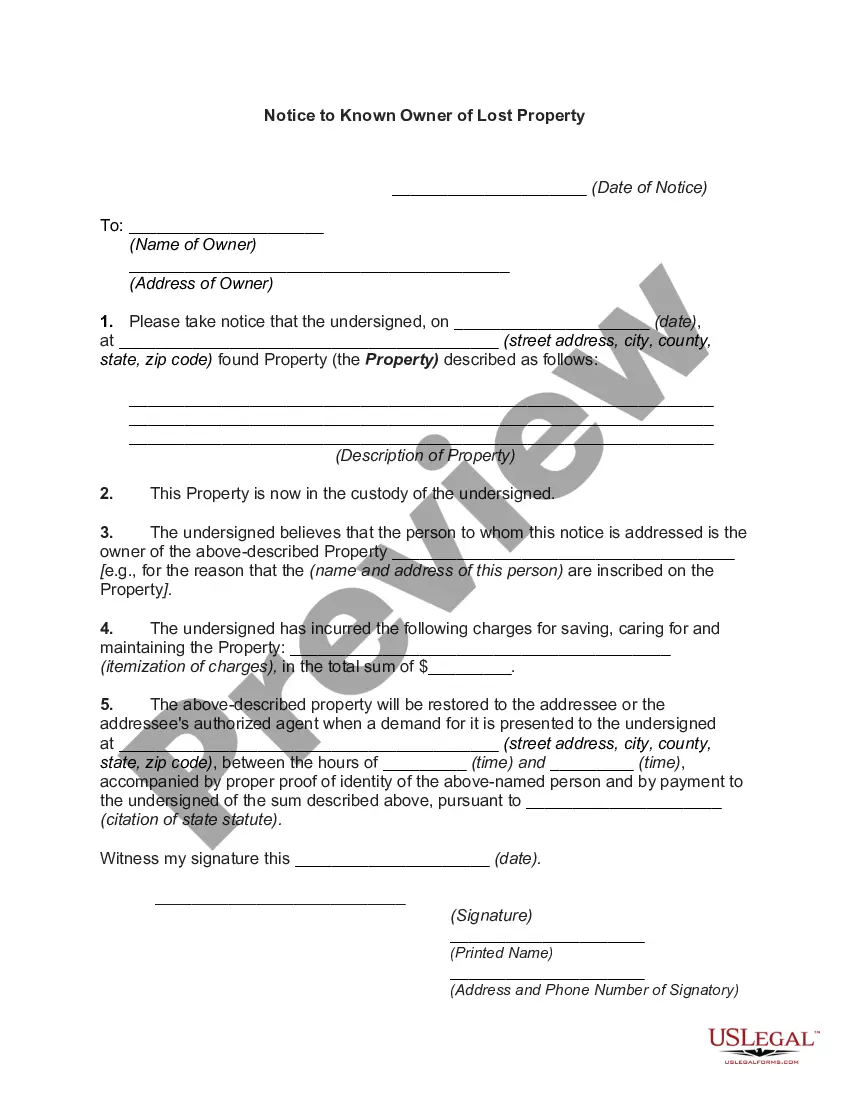

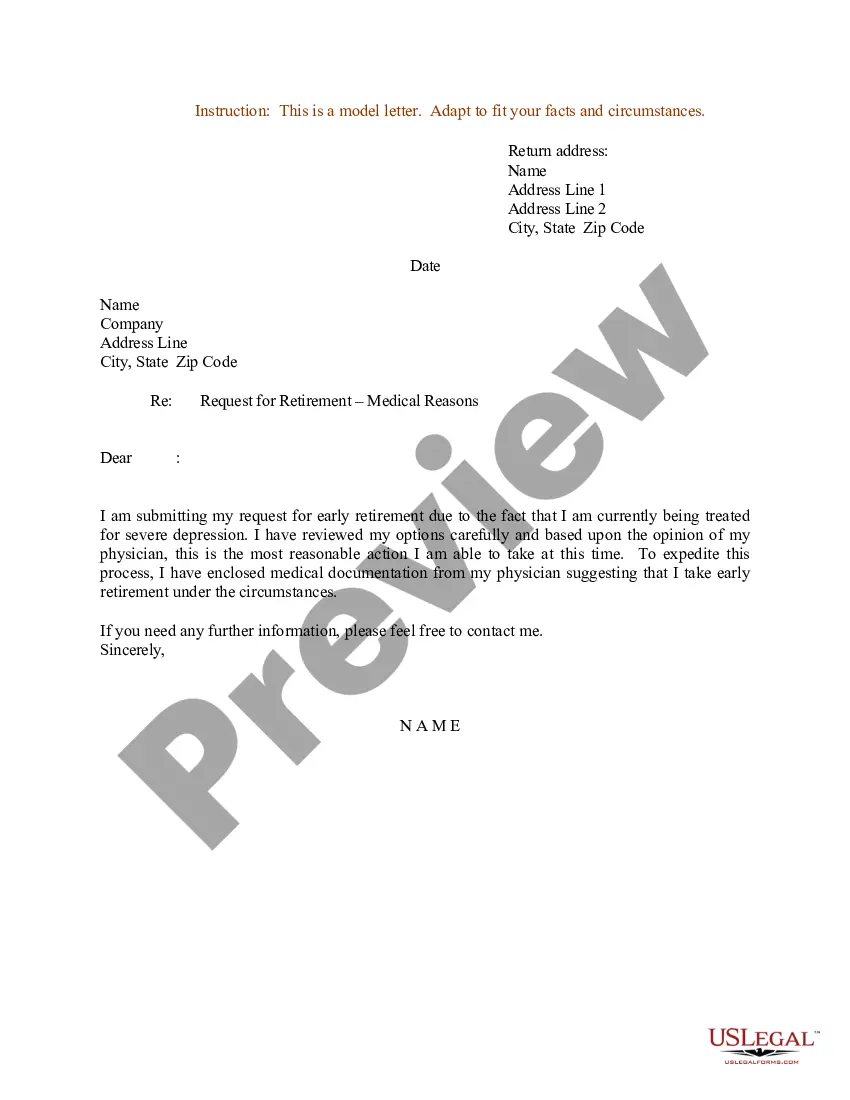

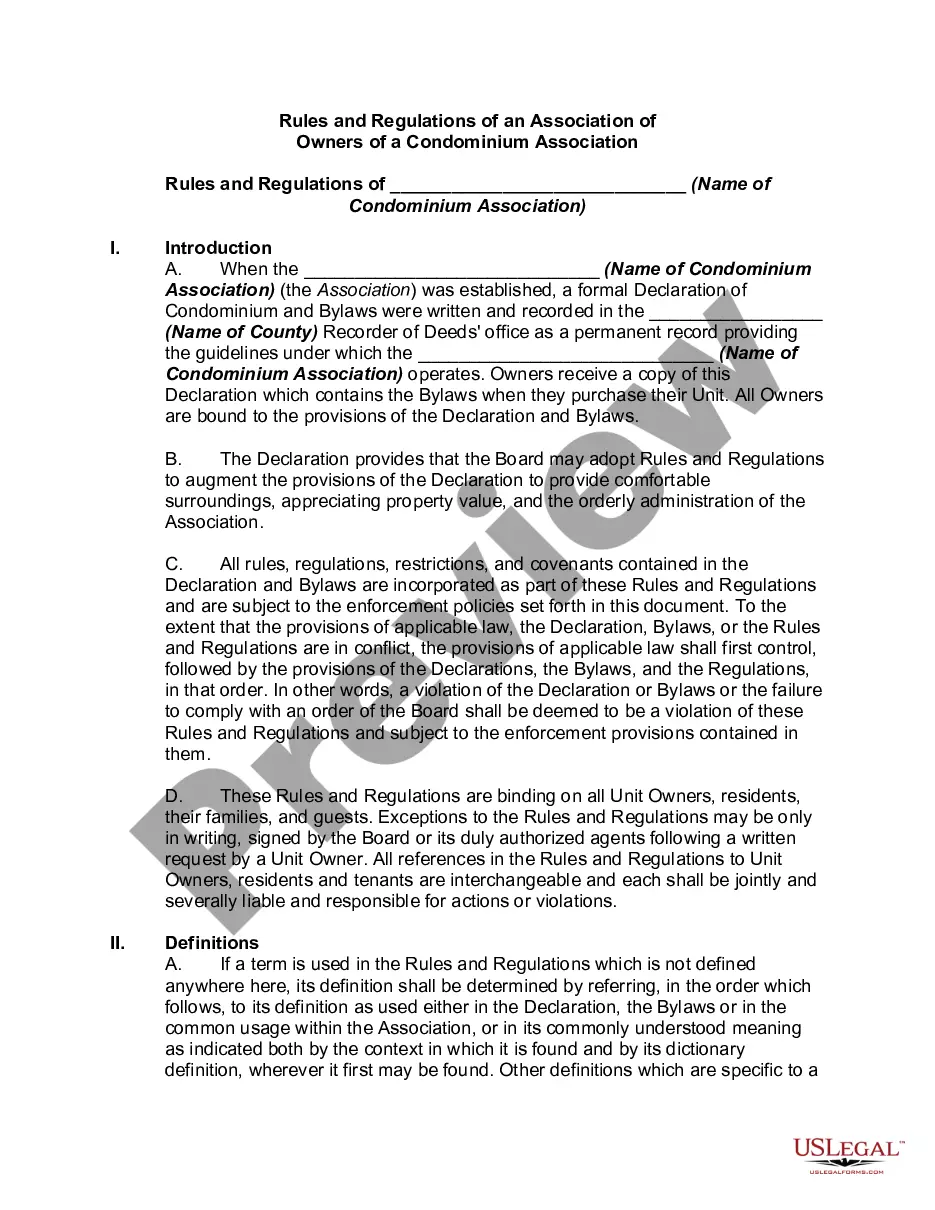

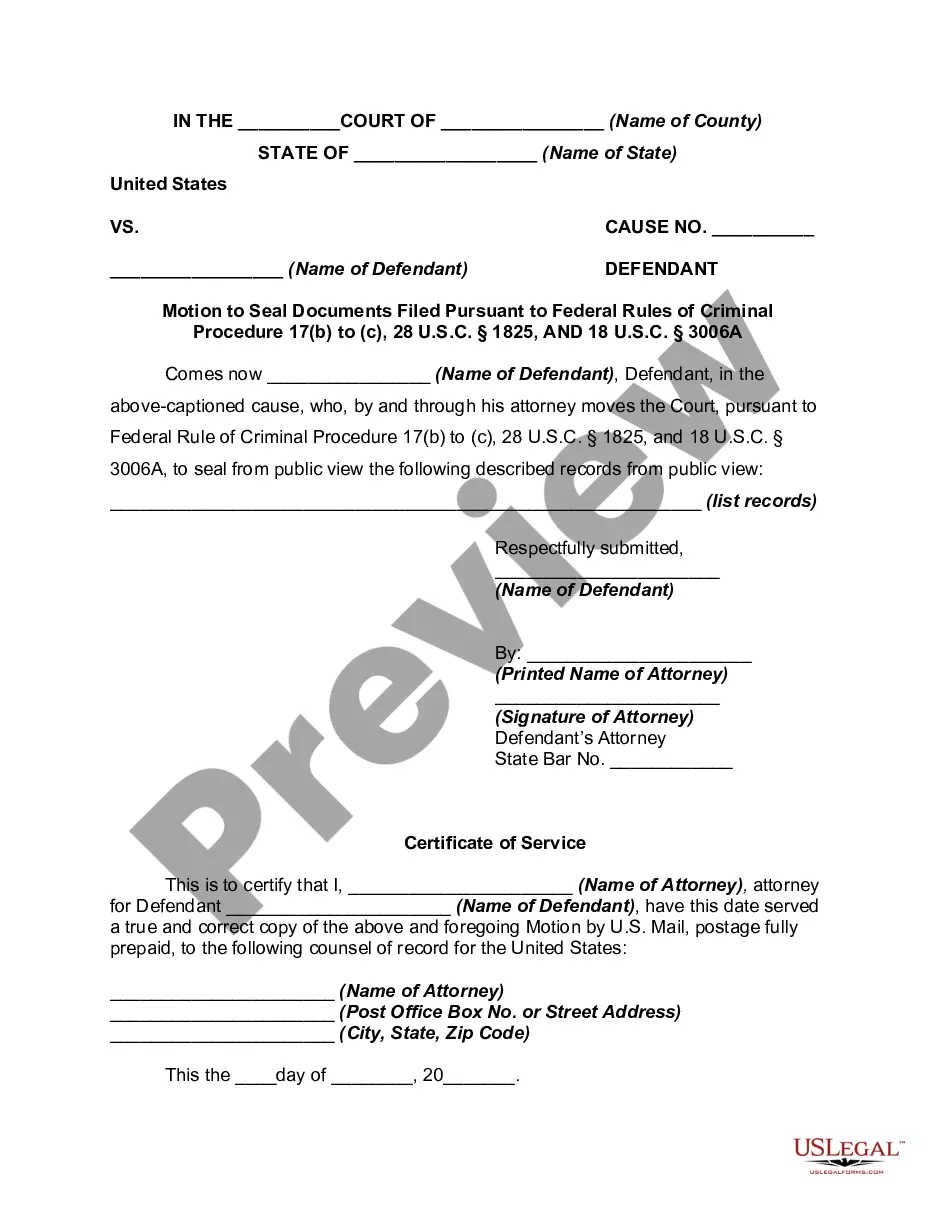

- Take a look at the document's preview and outline (if available) to get a basic information on what you’ll get after getting the form.

- Ensure that the document of your choosing is specific to your state/county/area since state laws can affect the legality of some records.

- Examine the related forms or start the search over to find the right file.

- Click Buy now and register your account. If you already have an existing one, choose to log in.

- Pick the pricing {plan, then a needed payment gateway, and buy Alameda Loan Commitment Agreement.

- Choose to save the form template in any offered format.

- Go to the My Forms tab to re-download the file.

If you're already subscribed to US Legal Forms, you can find the needed Alameda Loan Commitment Agreement, log in to your account, and download it. Of course, our website can’t replace a legal professional completely. If you need to cope with an exceptionally difficult situation, we recommend using the services of a lawyer to examine your form before signing and filing it.

With more than 25 years on the market, US Legal Forms proved to be a go-to platform for many different legal forms for millions of users. Join them today and purchase your state-specific paperwork with ease!