Chicago Illinois Loan Commitment Agreement is a legal document that serves as a binding agreement between a lender and a borrower in the state of Illinois. This agreement outlines the terms and conditions associated with a loan commitment provided by the lender to the borrower. The Loan Commitment Agreement in Chicago Illinois is a crucial step in the loan process, as it defines the rights and responsibilities of both parties involved. It ensures both parties have a clear understanding of the loan terms and the expectations throughout the loan term. Key terms covered in the Chicago Illinois Loan Commitment Agreement include: 1. Loan Amount: The agreement specifies the principal amount that the lender commits to lend to the borrower. 2. Interest Rate: The agreement outlines the interest rate at which the loan will be charged, which determines the cost of borrowing for the borrower. 3. Repayment Terms: It defines the repayment schedule, including the frequency of payments (monthly, quarterly, etc.), the due dates, and the method of repayment (such as electronic transfer or check). 4. Loan Term: The agreement specifies the duration of the loan, typically expressed in months or years, after which it is expected to be fully repaid. 5. Loan Purpose: The agreement may specify the intended purpose for which the loan is being sought, such as business expansion, home purchase, or debt consolidation. 6. Collateral: If the loan is secured, the agreement identifies the collateral that the borrower pledges to secure the loan, such as real estate, vehicles, or other assets. 7. Conditions Precedent: It outlines any specific conditions that must be met by the borrower before the loan commitment becomes effective, such as providing additional financial documentation or securing additional insurance. It is important to note that there may be different types of Loan Commitment Agreements in Chicago, Illinois, tailored to different types of loans. For example: 1. Mortgage Loan Commitment Agreement: This agreement is specific to mortgage loans used for purchasing or refinancing real estate properties. 2. Business Loan Commitment Agreement: This agreement is designed for loans taken by businesses for various purposes, such as working capital, equipment purchase, or business expansion. 3. Personal Loan Commitment Agreement: This agreement is utilized for loans taken by individuals for personal reasons, such as education expenses, medical bills, or home renovations. In conclusion, the Chicago Illinois Loan Commitment Agreement is a legally binding document that outlines the terms and conditions of a loan commitment between a lender and a borrower. It ensures transparency and clarity regarding the loan terms, repayment obligations, and other pertinent details. Different types of Loan Commitment Agreements exist in Chicago, tailored to specific loan purposes, such as mortgage, business, or personal loans.

Chicago Illinois Loan Commitment Agreement

Description

How to fill out Chicago Illinois Loan Commitment Agreement?

How much time does it normally take you to draft a legal document? Given that every state has its laws and regulations for every life situation, finding a Chicago Loan Commitment Agreement meeting all regional requirements can be tiring, and ordering it from a professional attorney is often expensive. Many web services offer the most popular state-specific documents for download, but using the US Legal Forms library is most advantegeous.

US Legal Forms is the most extensive web collection of templates, grouped by states and areas of use. Aside from the Chicago Loan Commitment Agreement, here you can find any specific form to run your business or individual deeds, complying with your regional requirements. Specialists check all samples for their actuality, so you can be certain to prepare your documentation correctly.

Using the service is remarkably simple. If you already have an account on the platform and your subscription is valid, you only need to log in, choose the required sample, and download it. You can retain the document in your profile anytime in the future. Otherwise, if you are new to the platform, there will be some extra actions to complete before you obtain your Chicago Loan Commitment Agreement:

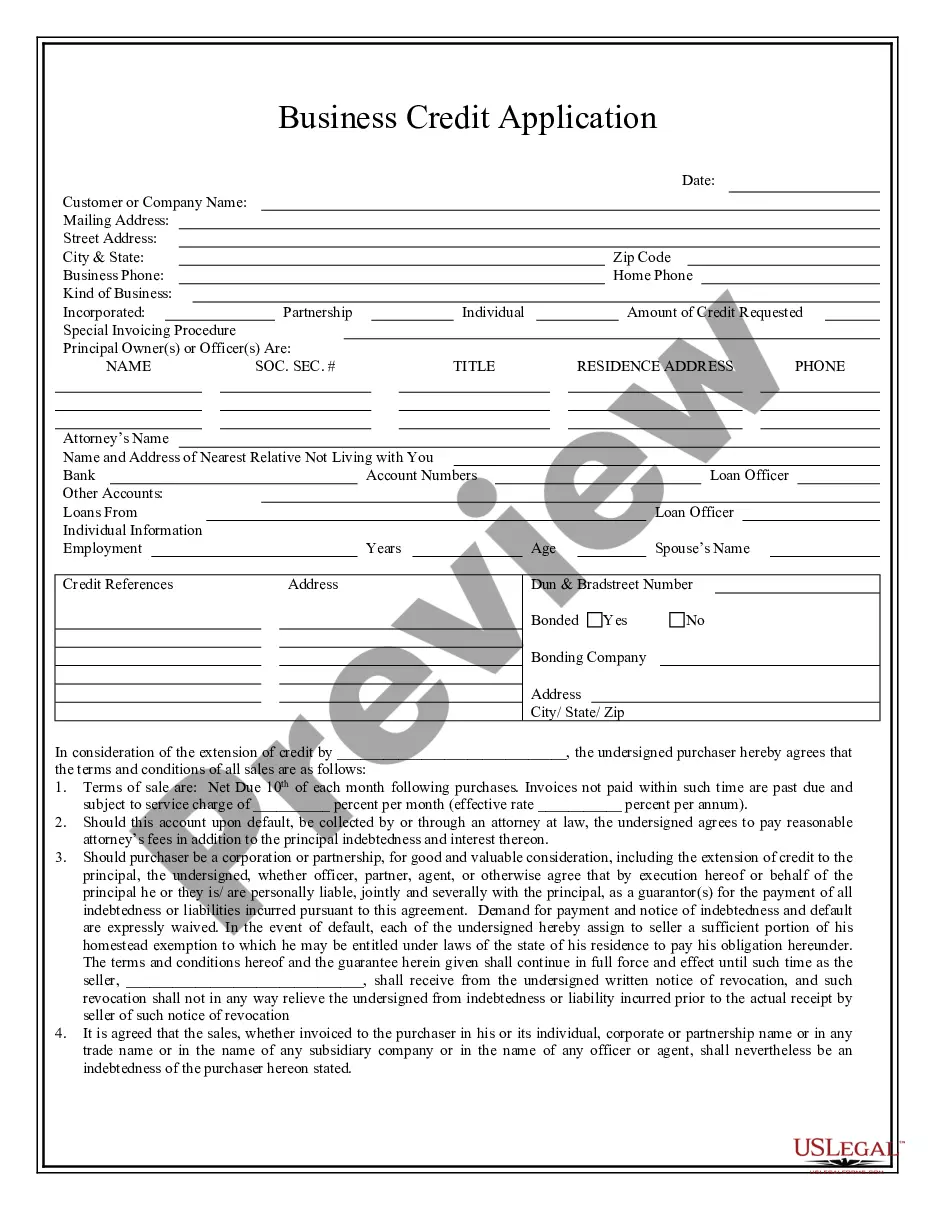

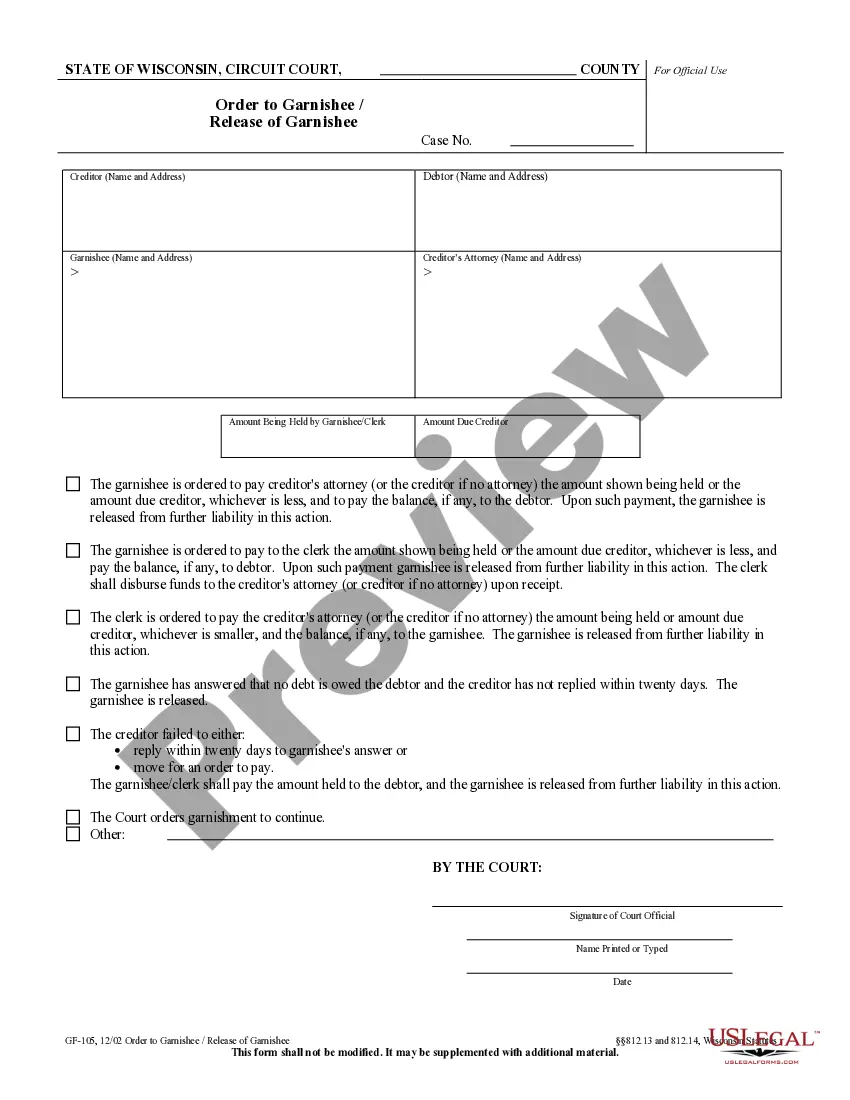

- Examine the content of the page you’re on.

- Read the description of the template or Preview it (if available).

- Look for another form using the corresponding option in the header.

- Click Buy Now once you’re certain in the chosen document.

- Select the subscription plan that suits you most.

- Register for an account on the platform or log in to proceed to payment options.

- Make a payment via PalPal or with your credit card.

- Switch the file format if necessary.

- Click Download to save the Chicago Loan Commitment Agreement.

- Print the sample or use any preferred online editor to complete it electronically.

No matter how many times you need to use the purchased template, you can locate all the samples you’ve ever downloaded in your profile by opening the My Forms tab. Give it a try!