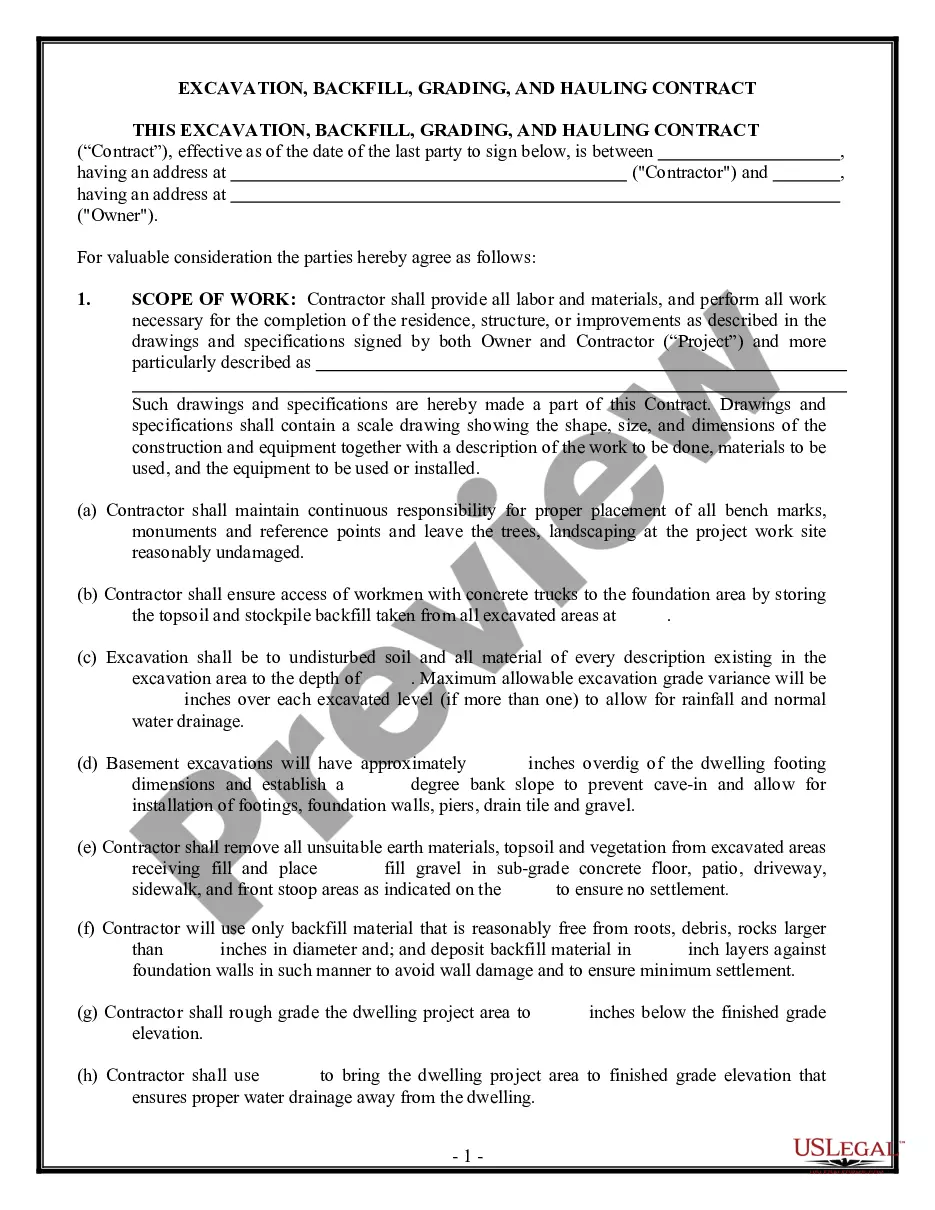

Houston, Texas Loan Commitment Agreement is a legally binding document that outlines the terms and conditions of a loan between a lender and a borrower. It serves as a guarantee by the lender that they are committed to providing the agreed-upon loan amount to the borrower, subject to the fulfillment of certain conditions. This agreement is a crucial step in the loan process as it signifies the lender's willingness to lend the funds and the borrower's acceptance of the terms and conditions. The Houston, Texas Loan Commitment Agreement specifies various key aspects of the loan, including the loan amount, interest rate, repayment terms, collateral requirements, and any additional fees or charges associated with the loan. It also highlights the rights and responsibilities of both the lender and the borrower throughout the loan term. Houston, Texas Loan Commitment Agreements can come in different forms based on the type of loan being offered. Some common types of Loan Commitment Agreements in Houston, Texas include: 1. Residential Mortgage Loan Commitment Agreement: This type of agreement is specific to home loans or mortgages, which are used by individuals or families to purchase or refinance residential properties in Houston, Texas. 2. Commercial Loan Commitment Agreement: This agreement is tailored for commercial loans extended to businesses for purposes such as expanding operations, purchasing equipment, or investing in real estate in Houston, Texas. 3. Construction Loan Commitment Agreement: Construction loans are designed for financing the construction or renovation of properties. This type of agreement outlines the terms for funding the project's different phases, disbursement schedule, and requirements for project completion. 4. Small Business Administration (SBA) Loan Commitment Agreement: SBA loans are government-backed loans aimed at supporting small businesses in Houston, Texas. The commitment agreement for SBA loans may have additional clauses specific to the SBA program's requirements and regulations. Regardless of the specific type, a Loan Commitment Agreement in Houston, Texas ensures transparency and clarity for both parties involved, providing a clear understanding of the loan terms and ensuring a smooth borrowing process. It is crucial for borrowers to carefully review and understand the terms outlined in the agreement to ensure compliance and avoid any potential disputes or challenges in the future.

Houston Texas Loan Commitment Agreement

Description

How to fill out Houston Texas Loan Commitment Agreement?

How much time does it normally take you to draft a legal document? Considering that every state has its laws and regulations for every life scenario, locating a Houston Loan Commitment Agreement meeting all regional requirements can be stressful, and ordering it from a professional lawyer is often pricey. Many web services offer the most popular state-specific templates for download, but using the US Legal Forms library is most advantegeous.

US Legal Forms is the most extensive web collection of templates, collected by states and areas of use. In addition to the Houston Loan Commitment Agreement, here you can find any specific document to run your business or individual affairs, complying with your county requirements. Specialists verify all samples for their validity, so you can be certain to prepare your paperwork properly.

Using the service is remarkably easy. If you already have an account on the platform and your subscription is valid, you only need to log in, opt for the required sample, and download it. You can pick the document in your profile at any time in the future. Otherwise, if you are new to the website, there will be some extra actions to complete before you obtain your Houston Loan Commitment Agreement:

- Check the content of the page you’re on.

- Read the description of the template or Preview it (if available).

- Look for another document using the corresponding option in the header.

- Click Buy Now when you’re certain in the selected document.

- Select the subscription plan that suits you most.

- Sign up for an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Change the file format if needed.

- Click Download to save the Houston Loan Commitment Agreement.

- Print the sample or use any preferred online editor to fill it out electronically.

No matter how many times you need to use the acquired template, you can locate all the files you’ve ever downloaded in your profile by opening the My Forms tab. Give it a try!

Form popularity

FAQ

Exactly when you'll receive the letter varies, but it typically takes between 20 and 45 days. The commitment letter is issued after you submit your application with all the required documents, such as pay stubs, bank statements, etc.

The loan commitment is not some legally binding guarantee of a mortgage. It's simply a signal from the lender to all parties in the transaction that the deal is on track and can proceed to the final stage of the mortgage process as planned.

A loan commitment is an agreement by a commercial bank or other financial institution to lend a business or individual a specified sum of money. Loan commitments are useful for consumers looking to buy a home or businesses planning to make a major purchase.

Because commitment letters are legally binding agreements, terms should be precise and detailed and include all material terms. Any ambiguity in the terms outlined in the commitment letter will often be construed against the lender.

Key Takeaways Unlike a prequalification letter, a loan commitment means that the borrower has been approved for the loan. Loan commitments may be made for secured or unsecured loans.

You will sign paperwork that indicates that you accept the terms of the mortgage loan. The funds for the home purchase will be transferred once you have received and signed all of the paperwork. The deed, which is proof of the ownership to your home, should be transferred to your name.

Once your mortgage commitment letter has been submitted, you've entered the final stage of the mortgage process. The letter is not a final approval, but more so a pledge to the borrower that the mortgage lender will grant the loan if all conditions are met. If there are no loose ends, you should be approved.

A loan commitment is like any other contract: a binding agreement enforceable in accordance with its terms. A borrower often relies heavily on the lender's funding commitment.

What's the difference between commitment and final approval? Commitment letters are a pledge that a lender will loan money to a borrower assuming all final conditions are met. A final approval, clear to close, means everything is complete; there are no loose ends.