Subject: Update on Trust Money Distribution — San Diego California Dear [Beneficiary's Name], I hope this letter finds you in good health and high spirits. I am writing to provide you with an important update on the distribution of funds from the [Trust Name] in San Diego, California. As you may be aware, the [Trust Name] was established by [Settler's Name] in [Year] to ensure the orderly management and distribution of assets to the named beneficiaries. After meticulous management by our entrusted team of professionals, I am pleased to inform you that the trust is now ready for distribution. Before proceeding, let me briefly outline the process for the distribution of trust funds: 1. Verification of Trust Fulfillment: Our legal team has diligently assessed the trust's terms and conditions, confirming that all requirements have been met in accordance with applicable laws and regulations of San Diego, California. 2. Evaluation of Beneficiaries: To ensure accuracy, our team has gathered necessary information and reviewed the list of beneficiaries named in the trust. Please note that if your contact details have changed during the course of the trust's administration, kindly notify us immediately to update our records. 3. Preparation of Financial Statements: Our accounting department has prepared an overview of the trust's financial situation, detailing the exact amount available for distribution to each beneficiary. We have also taken into account any outstanding expenses or taxes that may affect the final distribution. 4. Distribution Schedule: To ensure a systematic and efficient process, we have devised a detailed distribution schedule outlining the dates and methods through which funds will be disbursed to each beneficiary. Types of San Diego California Sample Letters to Beneficiaries regarding Trust Money: — Trust Fund Disbursement Update: This letter provides a comprehensive update on the status of the trust, the verification process, and the timeframe for disbursement to beneficiaries. — Change of Beneficiary Contact Details: In case a beneficiary's contact information has changed, this letter requests them to promptly provide updated details to ensure smooth communication throughout the distribution process. — Tax Considerations and Trust Distribution: When necessary, a letter may address tax implications, informing beneficiaries of any applicable taxes and clarifying the responsibility for fulfilling tax obligations related to the trust distribution. It is of utmost importance that you understand the significance of the trust administration process, balancing the timely disbursement of funds with careful adherence to legal procedures. We want to assure you that our team is taking every necessary step to ensure a fair and transparent distribution of trust money to all entitled beneficiaries. Should you have any questions or concerns regarding the trust or the distribution process, please do not hesitate to contact our team at [Contact Information]. We are here to provide further assistance and clarity to all beneficiaries. Once again, I extend my gratitude for your patience throughout this process. I am confident that this distribution will honor the intentions of [Settler's Name] while bestowing financial stability upon each beneficiary. Wishing you continued well-being and success. Warm regards, [Your Name] [Your Title/Position] [Trust Management Company Name] [Contact Information]

San Diego California Sample Letter to Beneficiaries regarding Trust Money

Description

How to fill out San Diego California Sample Letter To Beneficiaries Regarding Trust Money?

Preparing papers for the business or individual needs is always a huge responsibility. When creating an agreement, a public service request, or a power of attorney, it's important to take into account all federal and state regulations of the specific region. However, small counties and even cities also have legislative provisions that you need to consider. All these aspects make it tense and time-consuming to generate San Diego Sample Letter to Beneficiaries regarding Trust Money without professional help.

It's possible to avoid wasting money on attorneys drafting your documentation and create a legally valid San Diego Sample Letter to Beneficiaries regarding Trust Money by yourself, using the US Legal Forms web library. It is the largest online catalog of state-specific legal templates that are professionally cheched, so you can be sure of their validity when selecting a sample for your county. Previously subscribed users only need to log in to their accounts to download the required form.

If you still don't have a subscription, adhere to the step-by-step guideline below to obtain the San Diego Sample Letter to Beneficiaries regarding Trust Money:

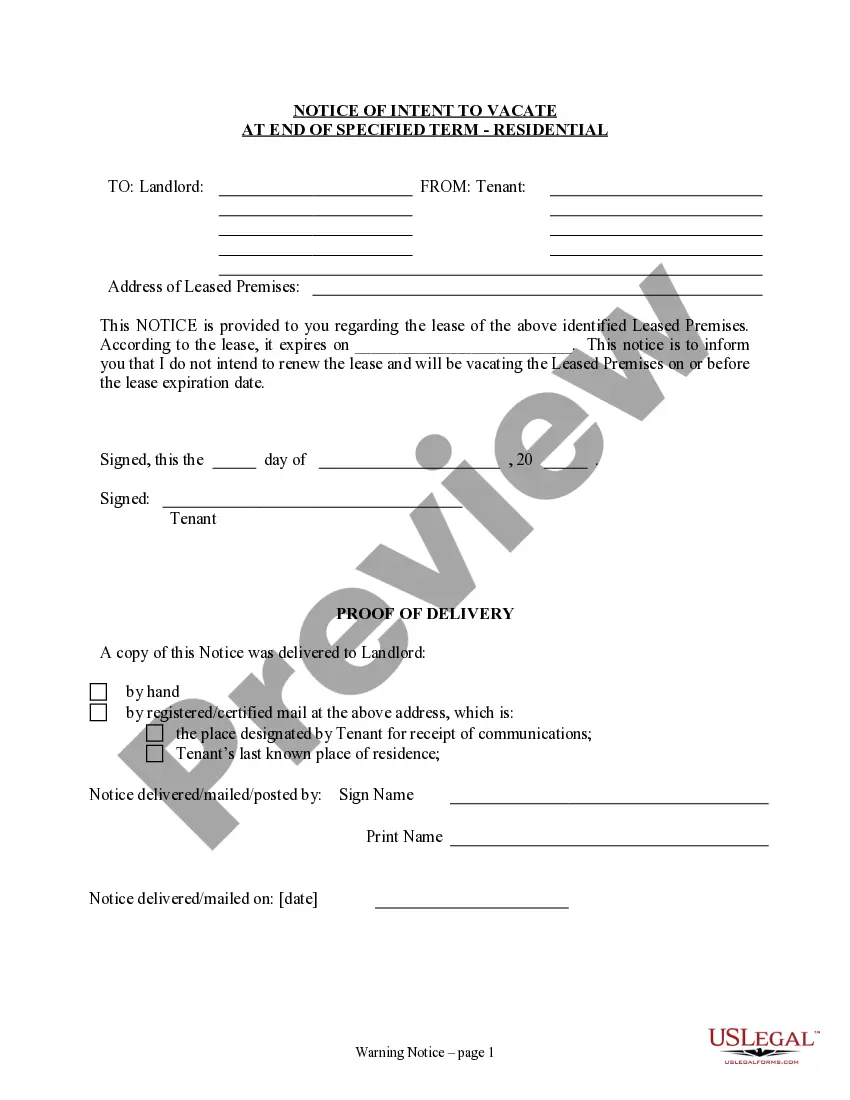

- Look through the page you've opened and verify if it has the document you need.

- To accomplish this, use the form description and preview if these options are available.

- To locate the one that satisfies your requirements, use the search tab in the page header.

- Recheck that the template complies with juridical criteria and click Buy Now.

- Choose the subscription plan, then log in or create an account with the US Legal Forms.

- Use your credit card or PayPal account to pay for your subscription.

- Download the selected document in the preferred format, print it, or fill it out electronically.

The exceptional thing about the US Legal Forms library is that all the documentation you've ever obtained never gets lost - you can access it in your profile within the My Forms tab at any time. Join the platform and quickly obtain verified legal templates for any use case with just a couple of clicks!