Dear [Beneficiary's Name], I hope this letter finds you in good health and high spirits. I am writing to provide you with an update regarding the trust money you are entitled to receive from the Suffolk New York Trust. First and foremost, let me provide you with some background information about the Suffolk New York Trust. The trust was established by [Granter's Name] on [Date] with the intention of preserving and growing the assets for the benefit of the beneficiaries. The trust is governed by a board of trustees who are responsible for managing and distributing the funds in accordance with the terms and conditions outlined in the trust agreement. As one of the beneficiaries of the Suffolk New York Trust, you have a vested interest in the trust's assets. The trust money that you are entitled to receive represents a portion of the total funds held within the trust. The distribution of these funds is subject to certain guidelines and restrictions, as stipulated in the trust agreement. In order to ensure the smooth and efficient distribution of funds, the trustees are committed to adhering to a comprehensive distribution plan. This plan is designed to allocate funds to beneficiaries in a fair and equitable manner, taking into consideration individual needs and circumstances. The trustees have a fiduciary duty to act in your best interests, ensuring that your financial well-being is taken care of while upholding the trust's objectives. There are several types of letters that the beneficiaries of the Suffolk New York Trust may receive regarding trust money: 1. Notification of Distribution: This letter informs you about a forthcoming distribution of trust money to you. It includes details about the amount, timing, and method of payment, ensuring you are aware of when and how you can expect to receive your entitlement. 2. Request for Documentation: Occasionally, the trustees may require additional documentation to fulfill legal and administrative obligations before making a distribution. This letter will outline the specific documents needed and provide instructions on how to submit them. 3. Annual Trust Report: This letter provides an annual summary of the trust's financial performance and outlines any changes or updates that have occurred during the year. It may also include information about the overall investment strategy and any future plans regarding the management of trust funds. 4. Change in Trustee: If there is a change in the board of trustees, you may receive a letter informing you about the new trustee(s) responsible for managing the trust and overseeing the distribution of trust money. It is important to note that the distribution of trust money may be subject to taxation. You are advised to consult with a qualified tax professional to understand the potential tax implications associated with the funds received from the trust. If you have any questions or concerns regarding the Suffolk New York Trust or the distribution of trust money, please do not hesitate to reach out to our office. We are here to provide you with the necessary information and assistance. Thank you for your attention, and we appreciate your continued trust in the Suffolk New York Trust. Sincerely, [Your Name] [Your Title] [Contact Information]

Suffolk New York Sample Letter to Beneficiaries regarding Trust Money

Description

How to fill out Suffolk New York Sample Letter To Beneficiaries Regarding Trust Money?

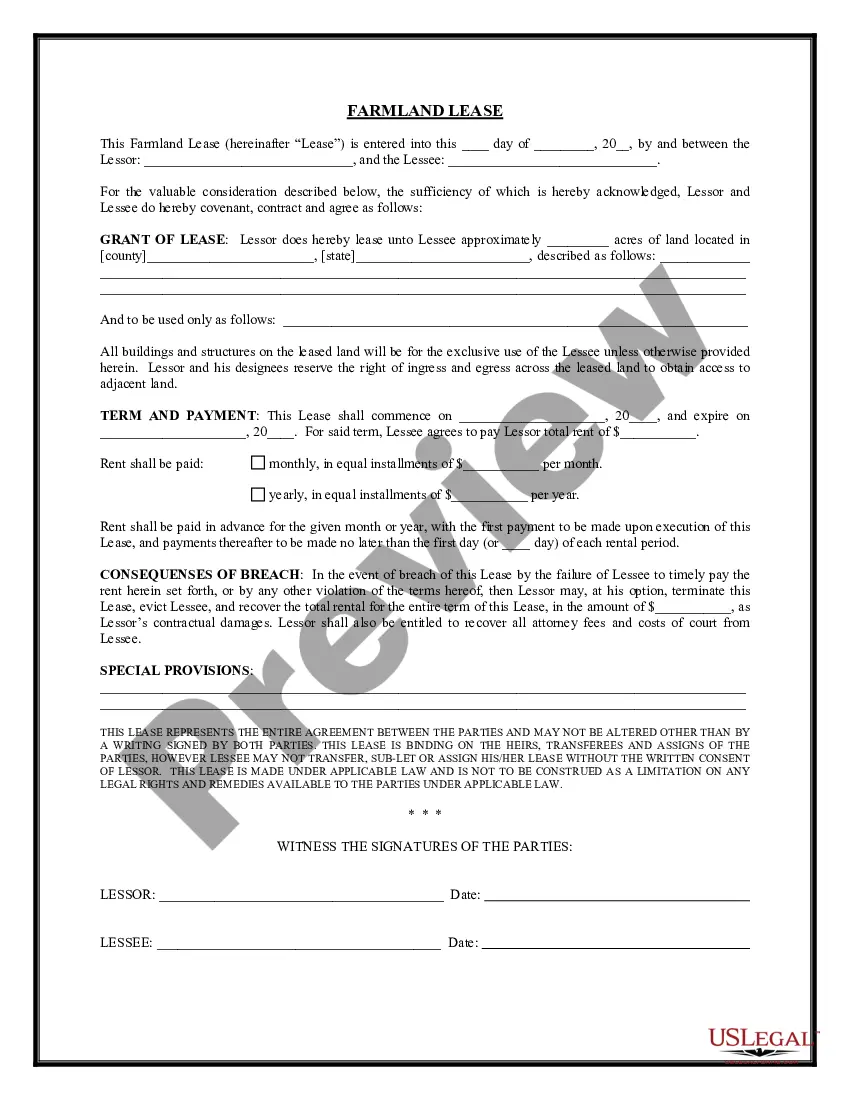

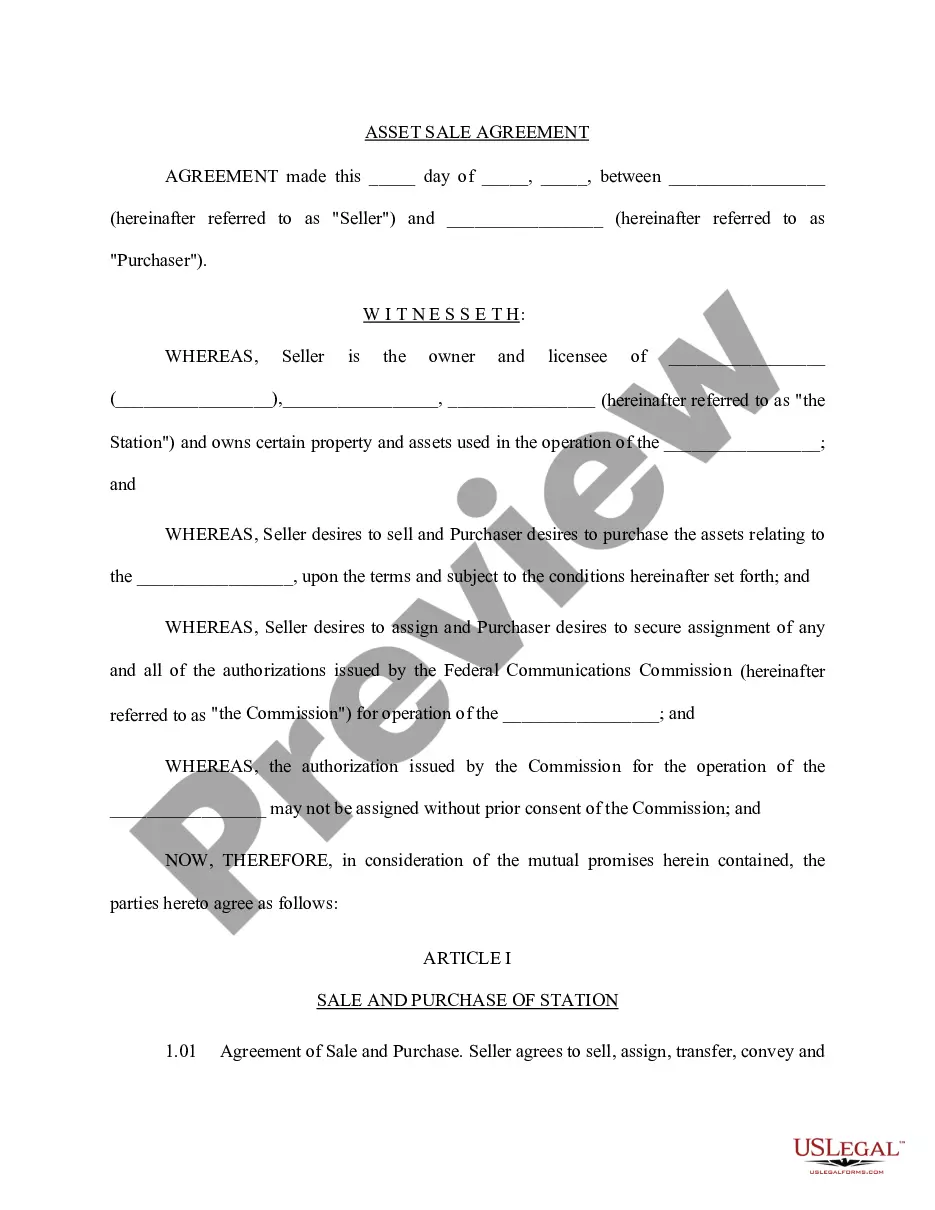

Whether you plan to start your business, enter into a contract, apply for your ID update, or resolve family-related legal issues, you need to prepare specific documentation corresponding to your local laws and regulations. Locating the right papers may take a lot of time and effort unless you use the US Legal Forms library.

The platform provides users with more than 85,000 professionally drafted and verified legal templates for any personal or business occasion. All files are collected by state and area of use, so opting for a copy like Suffolk Sample Letter to Beneficiaries regarding Trust Money is quick and easy.

The US Legal Forms library users only need to log in to their account and click the Download button next to the required form. If you are new to the service, it will take you a couple of more steps to obtain the Suffolk Sample Letter to Beneficiaries regarding Trust Money. Adhere to the guidelines below:

- Make sure the sample fulfills your personal needs and state law regulations.

- Read the form description and check the Preview if there’s one on the page.

- Use the search tab specifying your state above to find another template.

- Click Buy Now to get the sample once you find the proper one.

- Opt for the subscription plan that suits you most to continue.

- Log in to your account and pay the service with a credit card or PayPal.

- Download the Suffolk Sample Letter to Beneficiaries regarding Trust Money in the file format you need.

- Print the copy or complete it and sign it electronically via an online editor to save time.

Documents provided by our library are multi-usable. Having an active subscription, you are able to access all of your earlier acquired paperwork at any moment in the My Forms tab of your profile. Stop wasting time on a constant search for up-to-date formal documentation. Sign up for the US Legal Forms platform and keep your paperwork in order with the most comprehensive online form collection!