Title: Harris Texas Sample Letter to Foreclosure Attorney: Verification of Debt and Cease Foreclosure Introduction: If you are a homeowner in Harris County, Texas, facing potential foreclosure, it is essential to be proactive and take action to protect your rights. One important step is to request verification of debt from your foreclosure attorney. By doing so, you are demanding that the attorney validate the debt owed and halt the foreclosure process until all required documentation is provided and reviewed. This comprehensive guide will provide you with a detailed description of what a Harris Texas Sample Letter to Foreclosure Attorney should contain, empowering you to protect your home and your interests. Keywords: Harris Texas, Sample Letter, Foreclosure Attorney, Verification of Debt, Cease Foreclosure, homeowner, proactive, rights, documentation, protect I. Purpose of the Sample Letter: Explaining the purpose of the sample letter to help homeowners understand its significance in protecting against foreclosure. II. Importance of Verification of Debt: Elaborating on the importance of verifying the debt, highlighting its role in ensuring the accuracy and legitimacy of the foreclosure process. III. Components of the Sample Letter: a. Introduction- Building rapport and establishing intent promptly. b. Homeowner's Identification- Including full name, property address, and contact details for clear identification. c. Description of Situation- Explaining the circumstances leading to the foreclosure and the need for debt verification. d. Demand for Debt Verification- Clearly stating the request for the attorney to provide proper documentation and supporting evidence of the debt. e. Cease and Desist Foreclosure Action- Urging the attorney to temporarily halt any foreclosure actions until the debt validation process is completed. f. Timeframe for Response- Setting a reasonable timeframe for the attorney to respond to the letter. g. Concluding Statements- Expressing appreciation for their attention and cooperation. IV. Types of Harris Texas Sample Letters: a. Basic Sample Letter: A comprehensive letter covering all the necessary elements required for debt verification and ceasing foreclosure actions. b. Attorney Collaboration Sample Letter: A letter designed to foster communication and collaboration between the homeowner's attorney and the foreclosure attorney. c. Notary Certified Sample Letter: A sample letter that includes a notary certification to add a layer of authenticity to the communication. V. Guidelines and Tips: Providing additional guidance on how to customize the sample letter, including relevant terms, specific details, and maintaining a professional tone. Conclusion: By utilizing a Harris Texas Sample Letter to Foreclosure Attorney, homeowners in Harris County can take a proactive step towards ensuring their rightful protection and verification of debt. It is essential to act promptly and assertively when faced with the potential loss of one's home. Remember to consult with legal professionals to understand the intricacies of the foreclosure process specific to Texas and tailor the sample letter accordingly. Take control of your situation and fight for your home.

Harris Texas Sample Letter to Foreclosure Attorney to Provide Verification of Debt and Cease Foreclosure

Description

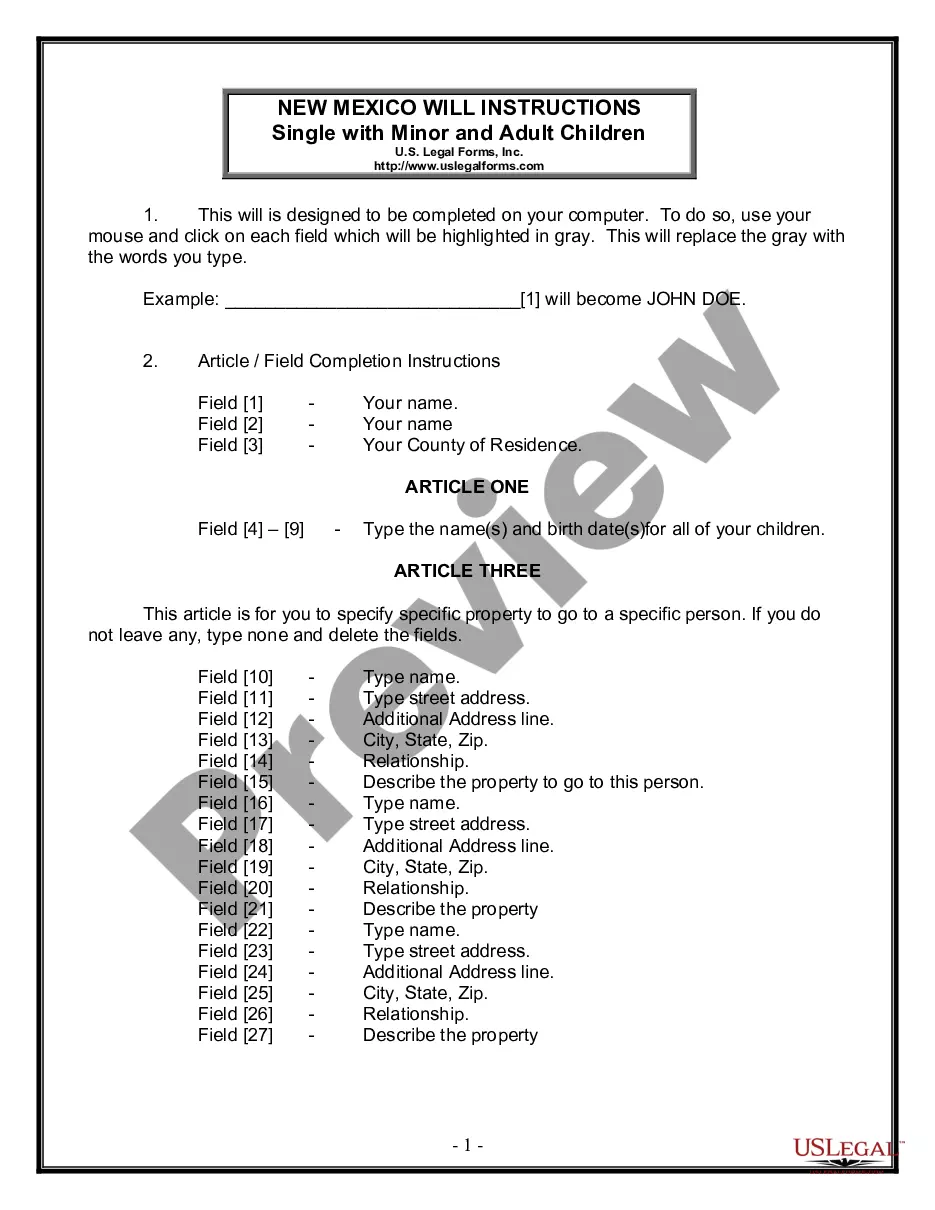

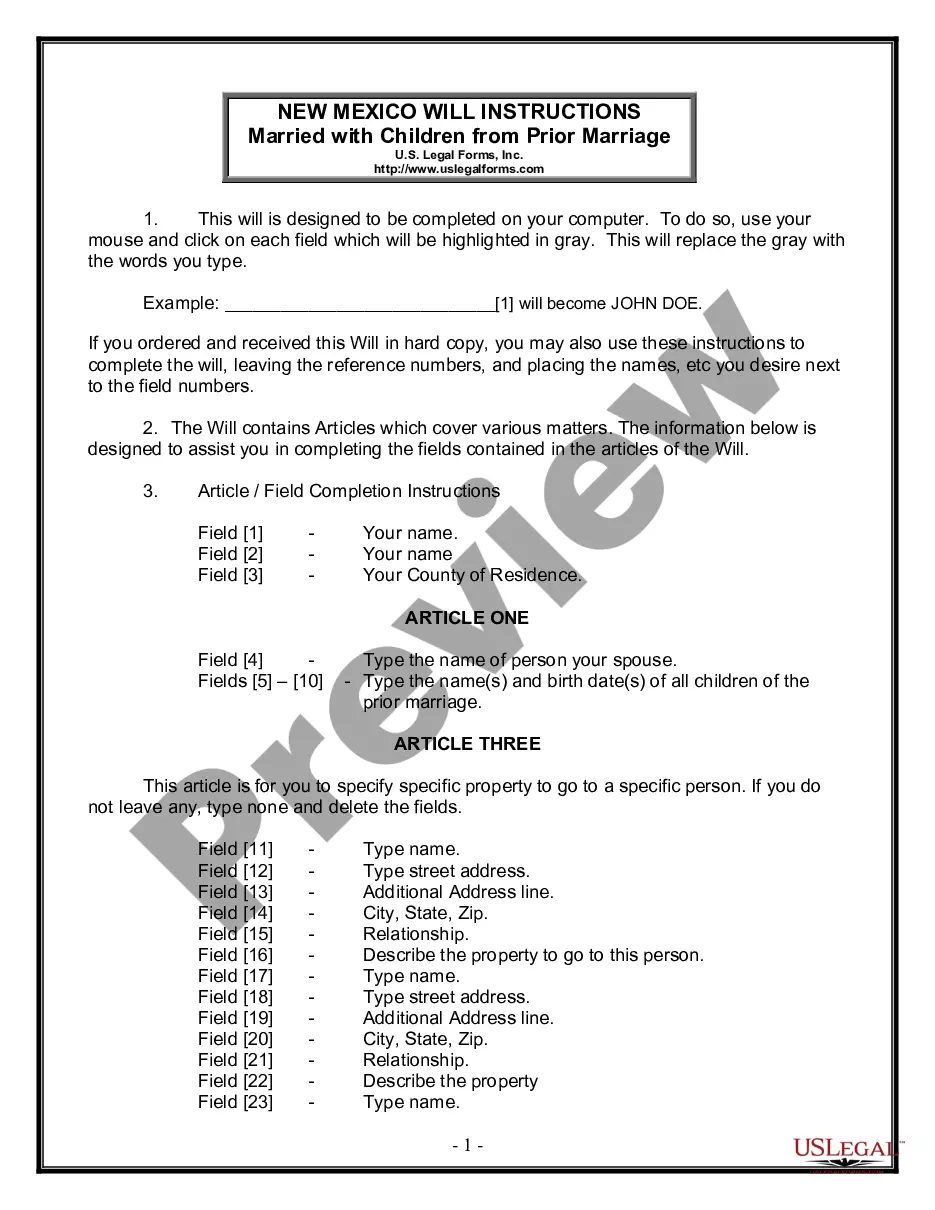

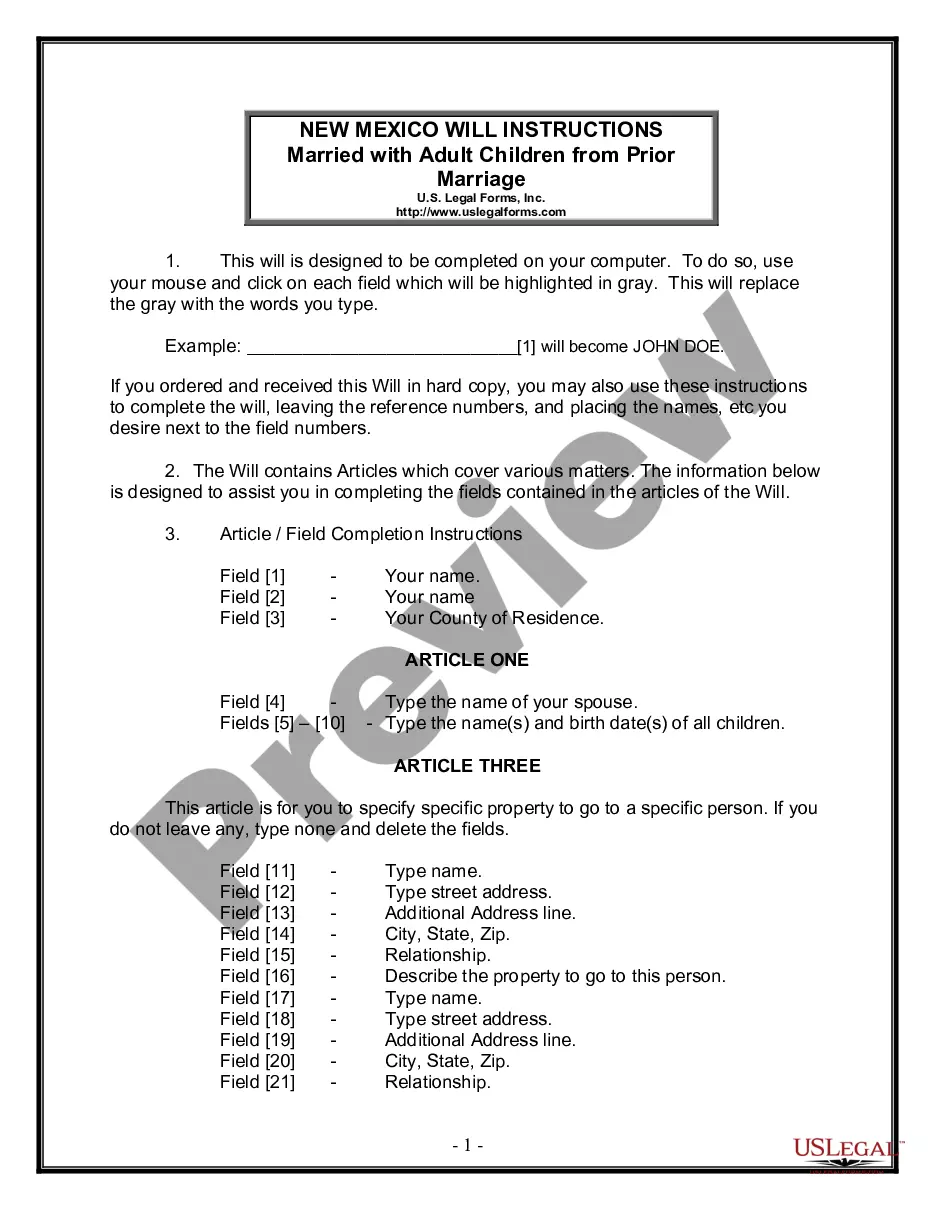

How to fill out Harris Texas Sample Letter To Foreclosure Attorney To Provide Verification Of Debt And Cease Foreclosure?

If you need to get a reliable legal document supplier to find the Harris Sample Letter to Foreclosure Attorney to Provide Verification of Debt and Cease Foreclosure, consider US Legal Forms. No matter if you need to start your LLC business or manage your asset distribution, we got you covered. You don't need to be knowledgeable about in law to find and download the appropriate form.

- You can search from more than 85,000 forms arranged by state/county and case.

- The intuitive interface, number of supporting resources, and dedicated support team make it easy to locate and complete various documents.

- US Legal Forms is a reliable service offering legal forms to millions of users since 1997.

Simply type to look for or browse Harris Sample Letter to Foreclosure Attorney to Provide Verification of Debt and Cease Foreclosure, either by a keyword or by the state/county the document is created for. After finding the required form, you can log in and download it or save it in the My Forms tab.

Don't have an account? It's simple to start! Simply locate the Harris Sample Letter to Foreclosure Attorney to Provide Verification of Debt and Cease Foreclosure template and take a look at the form's preview and short introductory information (if available). If you're confident about the template’s language, go ahead and hit Buy now. Create an account and choose a subscription option. The template will be instantly available for download as soon as the payment is processed. Now you can complete the form.

Handling your law-related matters doesn’t have to be pricey or time-consuming. US Legal Forms is here to demonstrate it. Our rich collection of legal forms makes this experience less costly and more affordable. Create your first company, organize your advance care planning, draft a real estate agreement, or complete the Harris Sample Letter to Foreclosure Attorney to Provide Verification of Debt and Cease Foreclosure - all from the convenience of your home.

Sign up for US Legal Forms now!

Form popularity

FAQ

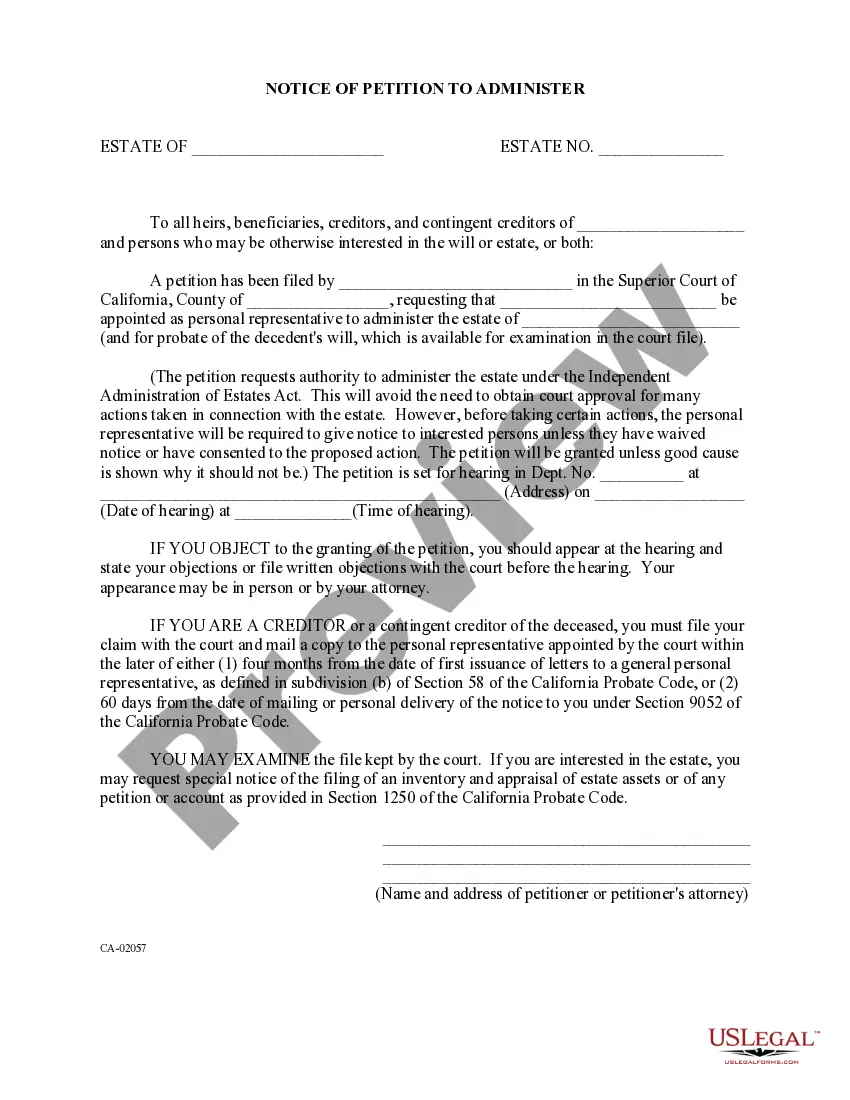

While a debt validation letter provides information about the debt the collection agency claims you owe, a verification letter must prove it. In other words, if the collection agency doesn't have enough evidence to prove you owe it, their hands may be tied.

Debt collectors are legally required to send you a debt validation letter, which outlines what the debt is, how much you owe and other information. If you're still uncertain about the debt you're being asked to pay, you can send the debt collector a debt verification letter requesting more information.

It is important to send your debt validation letter via certified mail because: You'll have proof of delivery with a time stamp and the debt collector can never claim gosh, we never received your debt validation request. You'll get their attention because only serious documents are sent via certified mail.

If you send the collector a Debt Validation Letter they will need to mail you validation of the debt. If you send them a Debt Validation Letter they will need to mail you the name and address of the original creditor.

I am requesting that you provide verification of this debt. Please send the following information: The name and address of the original creditor, the account number, and the amount owed. Verification that there is a valid basis for claiming I am required to pay the current amount owed.

Does a Debt Collector Have to Show Proof of a Debt? Yes, debt collectors do have to show proof of a debt if you ask them. Make sure you understand your rights under credit collection laws.

While a debt validation letter provides information about the debt the collection agency claims you owe, a verification letter must prove it. In other words, if the collection agency doesn't have enough evidence to prove you owe it, their hands may be tied.

To request verification, send a letter to the collection agency stating that you dispute the validity of the debt and that you want documentation verifying the debt. Also, request the name and address of the original creditor.

How to Write a Debt Verification Letter Determine the exact amounts you owe. Gather documents that verify your debt. Get information on who you owe. Determine how old the debt is. Place a pause on the collection proceedings.

Do Debt Validation Letters really work? Yes, they do. When a debt collector receives a Debt Validation Letter, they are legally required to provide validation of the debt. Debt Validation Letter's work best when they include a cease and desist clause that forces a lawsuit.