[Your Name] [Your Address] [City, State, ZIP Code] [Email Address] [Phone Number] [Date] [Foreclosure Attorney's Name] [Law Firm's Name] [Address] [City, State, ZIP Code] Subject: Request for Verification of Debt and Cease Foreclosure — Account [Loan/Account Number] Dear [Foreclosure Attorney's Name], I hope this letter finds you well. I am writing to seek your assistance and clarification regarding the foreclosure proceedings related to my property located at [Your Property Address] in Nassau County, New York. First and foremost, I request that you provide me with verification of the debt that allegedly led to the foreclosure action. As a consumer protected by the Fair Debt Collection Practices Act (FD CPA), I have a lawful right to request validation of the alleged debt before further actions can be taken against me. Therefore, I kindly ask for the following documents and information to establish the validity of the debt: 1. Proof of written agreement signed by myself and [Lender's Name]. 2. Complete payment history demonstrating the exact amount allegedly owed, including principal, interest, fees, and any additional charges. 3. Copies of all correspondence related to the alleged debt, including notifications, notices of default, or any other relevant communication exchanged between [Lender's Name] and me. 4. Proof of assignment of the mortgage or deed of trust to [Current Servicing Company] if applicable. Kindly provide the requested documentation within the timeframe prescribed by the FD CPA, which is thirty (30) days from the date of your receipt of this letter. Failure to provide proper verification will render any foreclosure proceedings invalid and may subject you to legal consequences under the FD CPA. Furthermore, I respectfully request that you cease all foreclosure activity until the requested debt validation has been provided and duly reviewed. Pursuant to the FD CPA, if a consumer disputes a debt's validity in writing, the debt collector must cease all collection efforts until they have provided the requested verification. This request extends to any foreclosure proceedings, auction notices, or eviction attempts related to the aforementioned property. I strongly urge you to handle this matter transparently and in adherence to the laws and regulations governing debt collection practices. It is my intention to resolve any valid debt obligations I may have, but I require precise and verified information to accomplish this in a fair and just manner. Please direct all future communication regarding this matter, including any responses or documentations, to the address stated above or via email at [Your Email Address]. I appreciate your prompt attention to this matter and hope for a swift resolution. Thank you for your cooperation. Sincerely, [Your Name]

Nassau New York Sample Letter to Foreclosure Attorney to Provide Verification of Debt and Cease Foreclosure

Description

How to fill out Nassau New York Sample Letter To Foreclosure Attorney To Provide Verification Of Debt And Cease Foreclosure?

Creating legal forms is a must in today's world. However, you don't always need to look for qualified assistance to create some of them from scratch, including Nassau Sample Letter to Foreclosure Attorney to Provide Verification of Debt and Cease Foreclosure, with a platform like US Legal Forms.

US Legal Forms has over 85,000 templates to select from in various types ranging from living wills to real estate papers to divorce papers. All forms are organized according to their valid state, making the searching process less challenging. You can also find detailed resources and tutorials on the website to make any activities related to paperwork execution simple.

Here's how you can purchase and download Nassau Sample Letter to Foreclosure Attorney to Provide Verification of Debt and Cease Foreclosure.

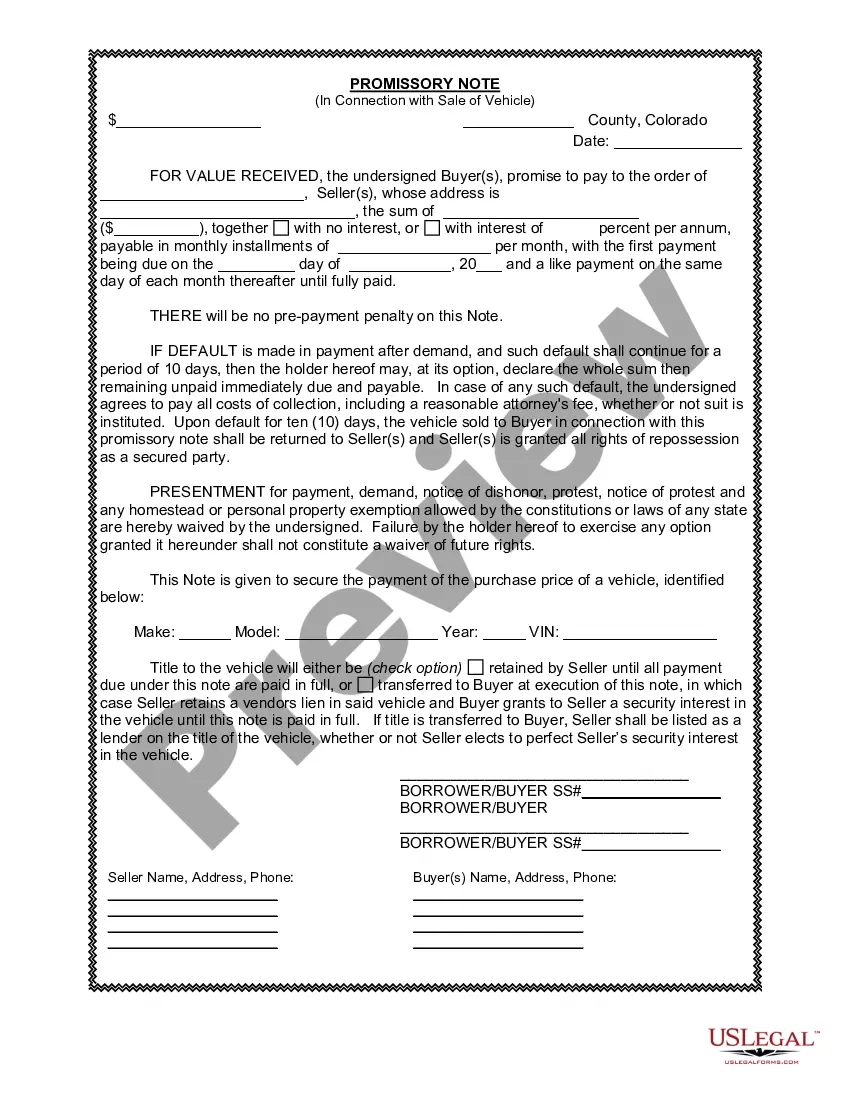

- Take a look at the document's preview and outline (if provided) to get a basic information on what you’ll get after downloading the form.

- Ensure that the document of your choice is specific to your state/county/area since state laws can impact the legality of some documents.

- Examine the similar forms or start the search over to find the appropriate document.

- Hit Buy now and register your account. If you already have an existing one, select to log in.

- Pick the option, then a suitable payment method, and buy Nassau Sample Letter to Foreclosure Attorney to Provide Verification of Debt and Cease Foreclosure.

- Select to save the form template in any offered file format.

- Go to the My Forms tab to re-download the document.

If you're already subscribed to US Legal Forms, you can find the needed Nassau Sample Letter to Foreclosure Attorney to Provide Verification of Debt and Cease Foreclosure, log in to your account, and download it. Needless to say, our website can’t replace a legal professional completely. If you need to cope with an extremely difficult situation, we advise getting an attorney to examine your document before executing and filing it.

With over 25 years on the market, US Legal Forms became a go-to provider for various legal forms for millions of users. Join them today and purchase your state-compliant documents effortlessly!