Subject: Request for Verification of Debt and Cease Foreclosure in Salt Lake City, Utah [Your Name] [Your Address] [City, State, ZIP] [Email Address] [Phone Number] [Date] [Attorney's Name] [Law Firm Name] [Address] [City, State, ZIP] Re: Request for Verification of Debt and Cease Foreclosure — [Property Address] Dear [Attorney's Name], I hope this letter finds you in good health. I am writing to request your immediate attention regarding the foreclosure proceedings initiated against my property located at [Property Address] in Salt Lake City, Utah. I believe that there may be errors and discrepancies regarding the debt owed, and I kindly request that you provide necessary verification, documentation, and halt any foreclosure actions until these matters are resolved. Furthermore, I understand that as the attorney overseeing this foreclosure case, you have an obligation to ensure the accuracy and validity of the debt being claimed against my property. Therefore, I kindly request that you provide me with the following information for review: 1. Full Validation of Debt: a) Detailed breakdown of the principal balance, interest, fees, and any other charges. b) Proof of ownership and the chain of title, including all loan assignments. c) Copies of all loan applications, agreements, and disclosures signed by both parties. d) Documentation of any service, escrow, or handling fees relevant to the loan. e) Confirmation that the creditor has legal standing to foreclose on the property. 2. Verification of the Foreclosure Proceedings: a) Verification that all required notifications and legal procedures were accurately followed. b) Proof that the foreclosure was initiated by the proper party and complied with Utah state laws. c) Certification that a thorough examination of the loan account history has been conducted. d) Any correspondence or documentation regarding attempts to modify or resolve the loan prior to foreclosure. I would also like to stress the importance of your attention to the legal requirements and time-sensitive nature of this matter. I kindly request that you provide the requested documentation within [timeline, e.g., 30 days] of receiving this letter to ensure a proper evaluation of the situation. In the meantime, I kindly request that you halt any foreclosure actions or attempts to take possession of the property until we have had an opportunity to resolve the issues surrounding the verification of debt. Please consider this letter as an effort on my part to rectify any potential discrepancies and establish a fair resolution to this matter. I am more than willing to work diligently towards finding a suitable solution if it can be demonstrated that my debt and foreclosure proceedings are legitimate and supported by convincing evidence. Thank you for your prompt attention to this matter. I believe that open communication and cooperation can assist in resolving this issue amicably. I look forward to receiving your response within the specified timeframe. Sincerely, [Your Name]

Salt Lake Utah Sample Letter to Foreclosure Attorney to Provide Verification of Debt and Cease Foreclosure

Description

How to fill out Salt Lake Utah Sample Letter To Foreclosure Attorney To Provide Verification Of Debt And Cease Foreclosure?

Dealing with legal forms is a necessity in today's world. Nevertheless, you don't always need to seek qualified assistance to draft some of them from scratch, including Salt Lake Sample Letter to Foreclosure Attorney to Provide Verification of Debt and Cease Foreclosure, with a platform like US Legal Forms.

US Legal Forms has more than 85,000 templates to pick from in different types ranging from living wills to real estate papers to divorce documents. All forms are arranged according to their valid state, making the searching process less overwhelming. You can also find detailed materials and guides on the website to make any activities related to document execution straightforward.

Here's how to find and download Salt Lake Sample Letter to Foreclosure Attorney to Provide Verification of Debt and Cease Foreclosure.

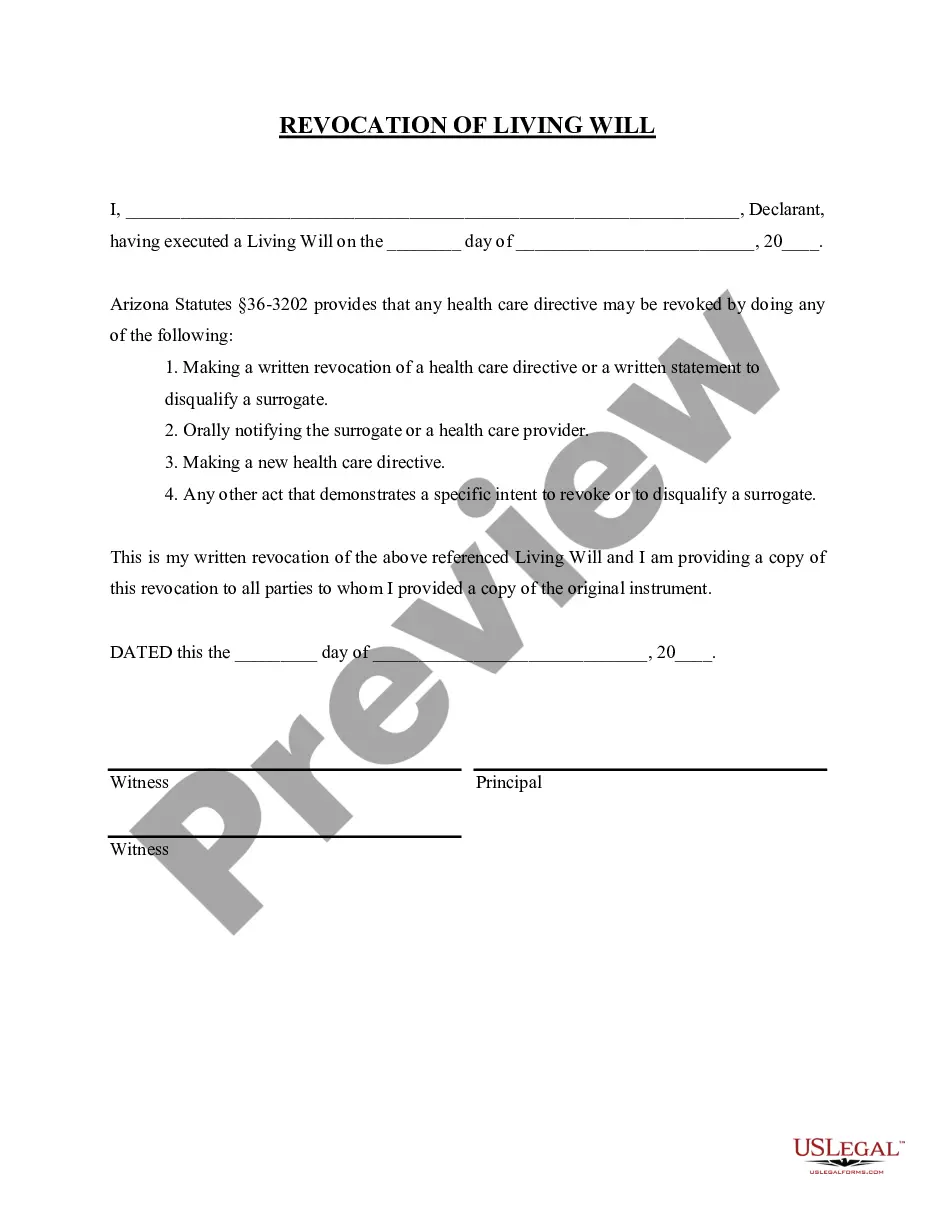

- Take a look at the document's preview and description (if provided) to get a basic idea of what you’ll get after downloading the form.

- Ensure that the document of your choosing is specific to your state/county/area since state regulations can impact the validity of some documents.

- Check the related document templates or start the search over to find the correct document.

- Hit Buy now and register your account. If you already have an existing one, choose to log in.

- Pick the pricing {plan, then a needed payment method, and purchase Salt Lake Sample Letter to Foreclosure Attorney to Provide Verification of Debt and Cease Foreclosure.

- Select to save the form template in any available file format.

- Visit the My Forms tab to re-download the document.

If you're already subscribed to US Legal Forms, you can find the appropriate Salt Lake Sample Letter to Foreclosure Attorney to Provide Verification of Debt and Cease Foreclosure, log in to your account, and download it. Of course, our platform can’t take the place of a legal professional completely. If you have to deal with an extremely challenging case, we advise getting an attorney to examine your form before signing and filing it.

With over 25 years on the market, US Legal Forms proved to be a go-to platform for various legal forms for millions of users. Join them today and get your state-specific paperwork with ease!

Form popularity

FAQ

A debt validation letter should include the name of your creditor, how much you supposedly owe, and information on how to dispute the debt. After receiving a debt validation letter, you have 30 days to dispute the debt and request written evidence of it from the debt collector.

How to Write a Debt Verification Letter Determine the exact amounts you owe. Gather documents that verify your debt. Get information on who you owe. Determine how old the debt is. Place a pause on the collection proceedings.

Unfortunately, a debt collection agency can take as long as they want to respond to your request to validate an existing debt. I would say, generally, the usual range is between 130 days or they never respond. Here's a video with more info on Debt Validation Letters.

According to the above FDCPA Section, Debt Validation is defined as the debt collector contacting the original creditor to affirm the debt amount being requested is correct. It is highly doubtful the debt collector ever contacts the original creditor for any debt validation purposes.

I am requesting that you provide verification of this debt. Please send the following information: The name and address of the original creditor, the account number, and the amount owed. Verification that there is a valid basis for claiming I am required to pay the current amount owed.

When a debt collector makes contact with you about an unpaid debt, you may request a debt validation letter be sent to you that explains the due amount. This letter will include: Name and address of the creditor. Debt amount. Explanation that unless you dispute the debt within 30 days, it will be considered valid.

The term "debt validation letter" refers to a letter that an individual sends to their creditor or collection agency requesting proof that the debt in question is valid and not outside the statute of limitations for collecting the debt.

While a debt validation letter provides information about the debt the collection agency claims you owe, a verification letter must prove it. In other words, if the collection agency doesn't have enough evidence to prove you owe it, their hands may be tied.

Do Debt Validation Letters really work? Yes, they do. When a debt collector receives a Debt Validation Letter, they are legally required to provide validation of the debt. Debt Validation Letter's work best when they include a cease and desist clause that forces a lawsuit.