[Your Name] [Your Address] [City, State, ZIP Code] [Email Address] [Phone Number] [Date] [Foreclosure Attorney's Name] [Law Firm's Name] [Address] [City, State, ZIP Code] Subject: Fair Debt Collection — Failure to Provide Notice Dear [Foreclosure Attorney's Name], I hope this letter finds you well. I am writing to bring to your attention a matter of concern regarding the foreclosure proceedings initiated against my property located in Fairfax, Virginia. Firstly, I must express my disappointment at the lack of proper notice provided to me in relation to this debt collection matter. It is my understanding, as a debtor, that I have specific rights and protections under the Fair Debt Collection Practices Act (FD CPA), enacted by the Federal Trade Commission (FTC) to safeguard consumers like myself from unfair debt collection practices. Specifically, the failure to provide adequate notice of the debt collection proceedings violates Section 809 of the FD CPA, which mandates that the creditor must provide written notice within five days of initial contact. I have not received such a notice from your law firm or the lending institution that you represent. Furthermore, as per the FD CPA regulations, I have the right to request validation of the debt being claimed against me. This includes a written statement outlining the total outstanding amount, the original creditor's name, and evidence of the assignment of debt to your client. However, I have not received any documentation supporting the validity of the debt or the authority of your client to pursue foreclosure actions against my property. In addition to the violation of my rights under the FD CPA, I would like to highlight the lack of adherence to the legal requirements specific to Fairfax, Virginia. In accordance with the Virginia Code § 55-59.1, both the mortgage holder and their attorney are required to provide the debtor with written notice of their intent to foreclose and hold a non-judicial foreclosure sale. To date, I have not received any such notice from your law firm or your client. Considering the aforementioned violations and failures to provide proper notice, I request that you immediately rectify this situation by providing the required notice and documentation as outlined under the FD CPA and the Virginia Code. Failure to comply with these legal obligations may result in legal action being pursued against your law firm and your client. I kindly request a prompt written response within 15 days from the receipt of this letter, confirming that the necessary actions have been taken to address my concerns. Furthermore, I request that you provide your contact information, including a direct phone number and email address, in order to facilitate effective communication moving forward. Thank you for your attention to this matter, and I trust that you will promptly rectify the deficiencies in the debt collection process. Sincerely, [Your Name]

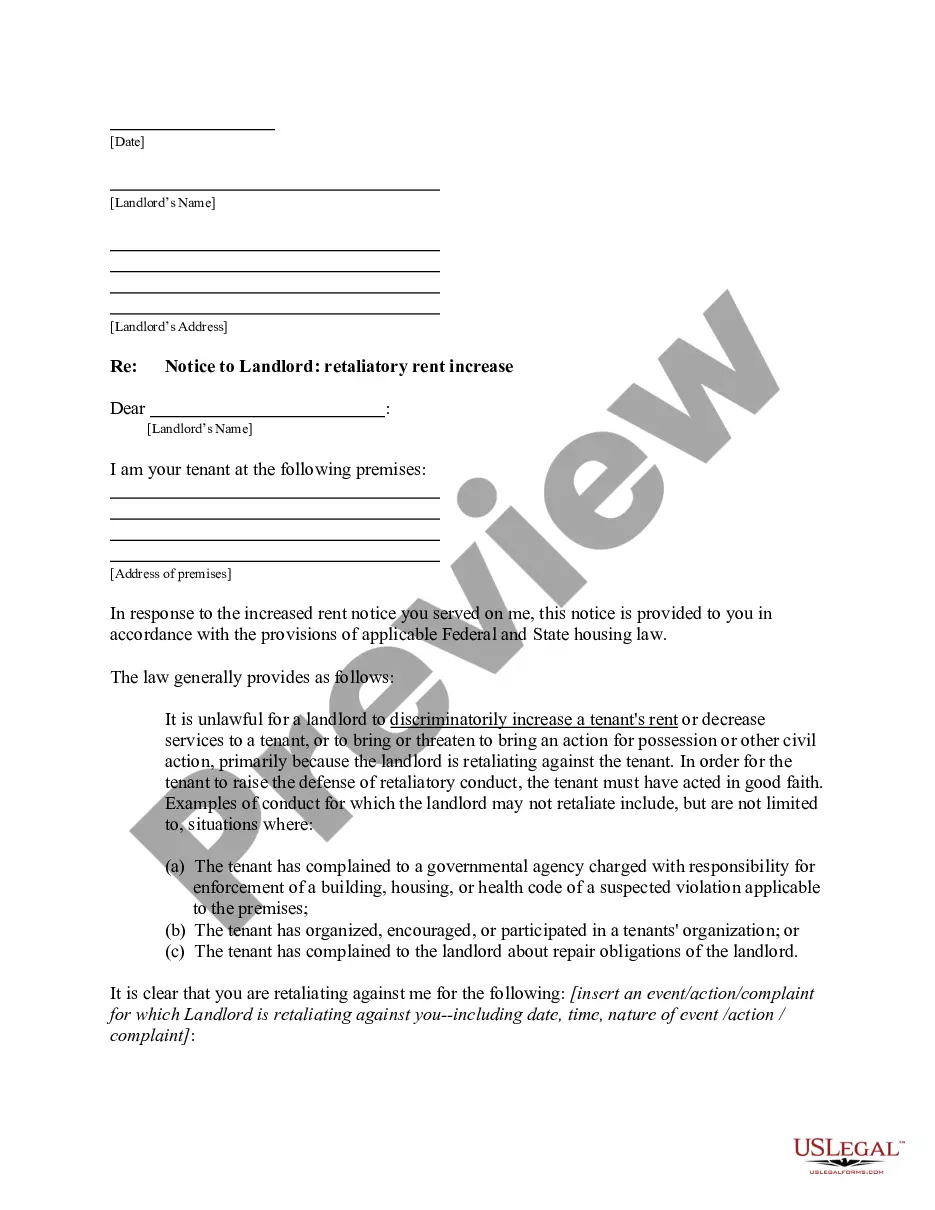

Fairfax Virginia Sample Letter to Foreclosure Attorney - Fair Debt Collection - Failure to Provide Notice

Description

How to fill out Fairfax Virginia Sample Letter To Foreclosure Attorney - Fair Debt Collection - Failure To Provide Notice?

Laws and regulations in every area vary around the country. If you're not an attorney, it's easy to get lost in a variety of norms when it comes to drafting legal documentation. To avoid high priced legal assistance when preparing the Fairfax Sample Letter to Foreclosure Attorney - Fair Debt Collection - Failure to Provide Notice, you need a verified template valid for your region. That's when using the US Legal Forms platform is so helpful.

US Legal Forms is a trusted by millions online library of more than 85,000 state-specific legal forms. It's an excellent solution for professionals and individuals searching for do-it-yourself templates for different life and business scenarios. All the documents can be used multiple times: once you obtain a sample, it remains available in your profile for further use. Thus, if you have an account with a valid subscription, you can just log in and re-download the Fairfax Sample Letter to Foreclosure Attorney - Fair Debt Collection - Failure to Provide Notice from the My Forms tab.

For new users, it's necessary to make a couple of more steps to obtain the Fairfax Sample Letter to Foreclosure Attorney - Fair Debt Collection - Failure to Provide Notice:

- Take a look at the page content to ensure you found the appropriate sample.

- Use the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your requirements.

- Use the Buy Now button to obtain the template when you find the proper one.

- Opt for one of the subscription plans and log in or sign up for an account.

- Select how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the file in and click Download.

- Complete and sign the template in writing after printing it or do it all electronically.

That's the simplest and most economical way to get up-to-date templates for any legal scenarios. Locate them all in clicks and keep your documentation in order with the US Legal Forms!

Form popularity

FAQ

The debt dispute letter should include your personal identifying information; verification of the amount of debt owed; the name of the creditor for the debt; and a request the debt not be reported to credit reporting agencies until the matter is resolved or have it removed from the report, if it already has been

(1) The false representation or implication that the debt collector is vouched for, bonded by, or affiliated with the United States or any State, including the use of any badge, uniform, or facsimile thereof.

The Australian Collectors & Debt Buyers Association Code of Practice (Code) is the industry code of the Australian Collectors & Debt Buyers Association (ACDBA). Compliance with this Code is a compulsory obligation for ACDBA members.

If you believe any account information is incorrect, you should dispute the information to have it either removed or corrected. If, for example, you have a collection or multiple collections appearing on your credit reports and those debts do not belong to you, you can dispute them and have them removed.

The Federal Trade Commission advises that you be as specific as possible in the letter about the reason why you think you do not owe this debt (or owe all of it, if you're disputing the amount), but you should give as little personal information as possible in the letter.

Within 30 days of receiving the written notice of debt, send a written dispute to the debt collection agency. You can use this sample dispute letter (PDF) as a model. Once you dispute the debt, the debt collector must stop all debt collection activities until it sends you verification of the debt.

Format the letter thusly: Your full name and address. The collections agency's name and address. A request for the amount of the debt claimed to be owed. A request for the name of the original creditor. A request for the judgment information (if applicable) A request for proof of the company's license.

Harassment of the debtor by the creditor More than 40 percent of all reported FDCPA violations involved incessant phone calls in an attempt to harass the debtor.

What Is an FDCPA Validation Letter? The FDCPA is a federal law that protects consumers from abusive collection practices by debt collectors and collection agencies. Whether the FDCPA applies to foreclosures generally depends on if the foreclosure is judicial or nonjudicial.

A debt validation letter should include the name of your creditor, how much you supposedly owe, and information on how to dispute the debt. After receiving a debt validation letter, you have 30 days to dispute the debt and request written evidence of it from the debt collector.