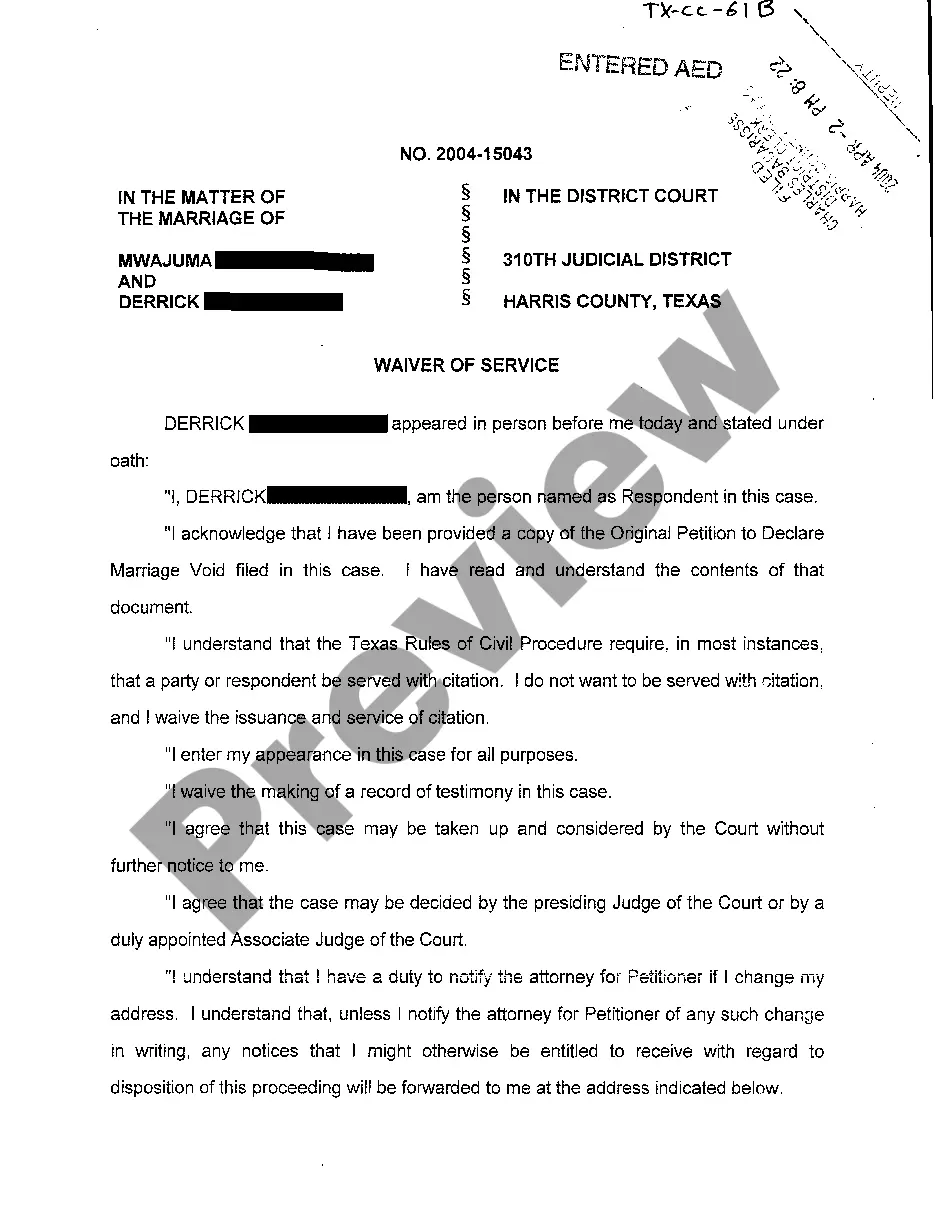

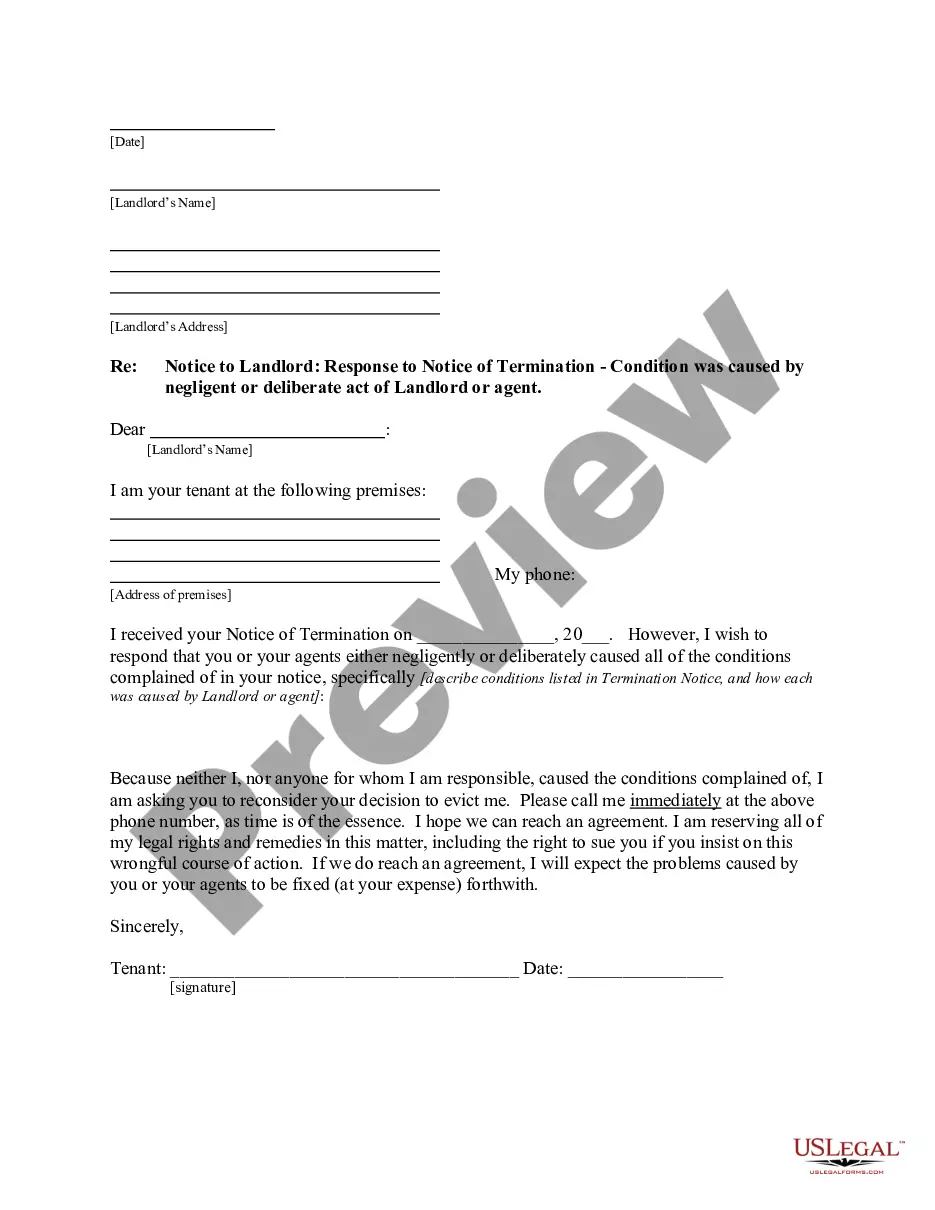

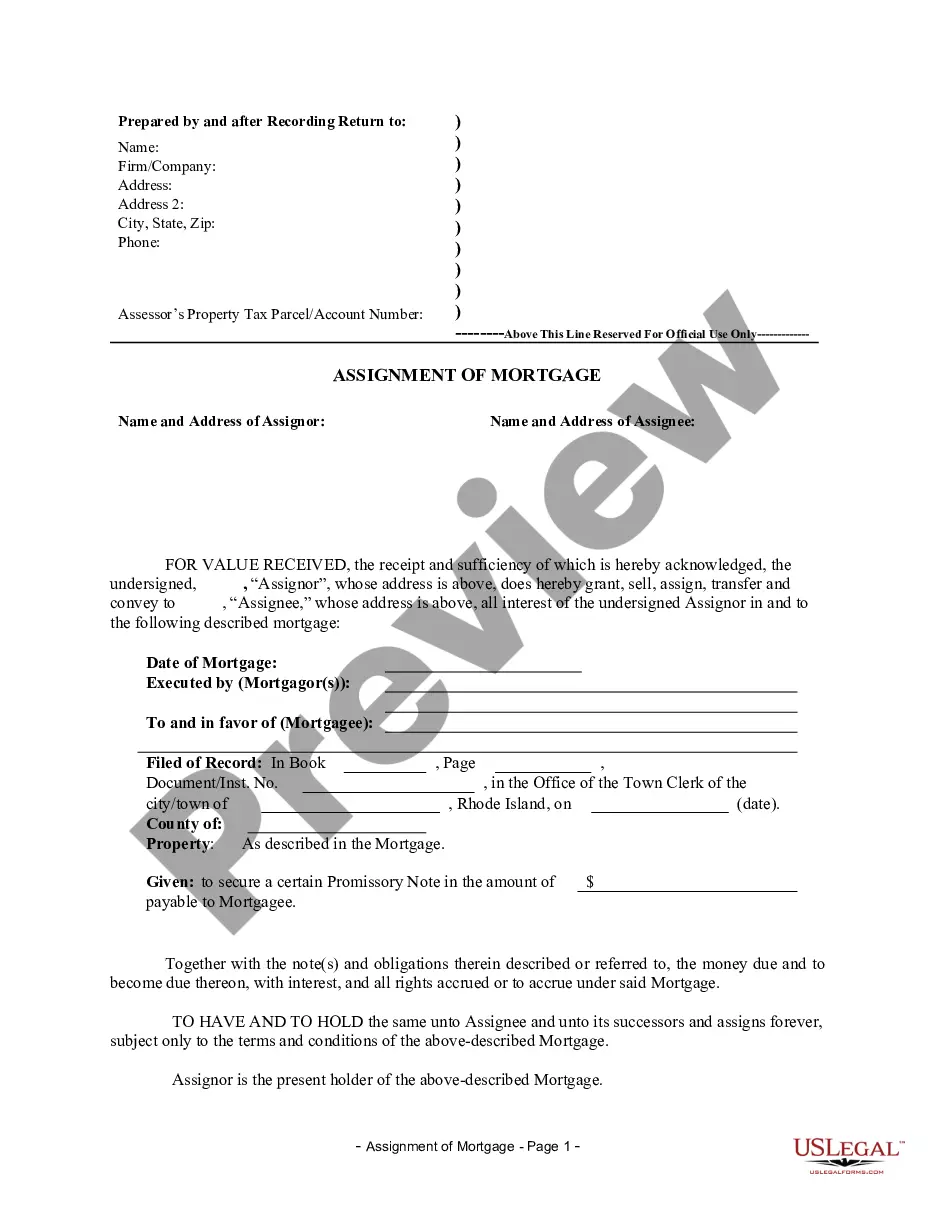

Travis Texas Sample Letter to Foreclosure Attorney — AfteForeclosureur— - Did not Receive Notice can be a crucial tool for homeowners who are facing foreclosure but did not receive proper notice. This letter template is specifically designed to address this specific situation and assert the homeowner's rights. Key elements to include in the Travis Texas Sample Letter to Foreclosure Attorney — AfteForeclosureur— - Did not Receive Notice: 1. Introduction: Begin by addressing the foreclosure attorney or law firm responsible for the foreclosure proceedings. Provide essential details such as the homeowner's name, property address, loan account number, and any relevant dates. 2. Explanation of the situation: Clearly state that the homeowner is writing because they were not properly informed or served notice regarding the foreclosure. Emphasize the importance of receiving proper legal notices to ensure a fair and lawful process. 3. Request for information: Assert the homeowner's right to know why they did not receive any notice regarding the foreclosure process. Request an explanation for this failure and any supporting documents that validate the validity of the foreclosure. 4. Demand for proof: Request that the foreclosing party provides evidence proving that proper notices were sent but not received by the homeowner. Ask for copies of the certified mail receipts, registered mail slips, or other proof of mailing. 5. Reminder of legal requirements: Highlight relevant statutes, laws, or regulations in Travis Texas that explicitly outline the necessity for proper notice during foreclosure procedures. Mention the potential consequences faced by the foreclosing party for failure to comply with these legal requirements. 6. Preservation of homeowner's rights: Clearly state that the homeowner is actively seeking legal counsel and will take necessary action to protect their rights under Texas foreclosure laws, including filing complaints or legal challenges if necessary. 7. Request for resolution: Politely request that the foreclosure attorney takes immediate action to rectify the situation. This can include halting the foreclosure proceedings until proper notice is given and ensuring all subsequent communication adheres to legal requirements. 8. Contact information: Provide the homeowner's complete contact details, including home address, phone number, and email address. Encourage the foreclosure attorney to respond promptly to avoid any further legal complications. Different types of Travis Texas Sample Letter to Foreclosure Attorney — AfteForeclosureur— - Did not Receive Notice might include variations based on the specific circumstances, homeowner's concerns, or foreclosure laws relevant to the state of Texas. However, the general structure and content mentioned above should be maintained to ensure a comprehensive and effective communication to the recipient.

Travis Texas Sample Letter to Foreclosure Attorney - After Foreclosure - Did not Receive Notice

Description

How to fill out Travis Texas Sample Letter To Foreclosure Attorney - After Foreclosure - Did Not Receive Notice?

How much time does it normally take you to draft a legal document? Considering that every state has its laws and regulations for every life situation, locating a Travis Sample Letter to Foreclosure Attorney - After Foreclosure - Did not Receive Notice meeting all regional requirements can be tiring, and ordering it from a professional lawyer is often costly. Numerous web services offer the most common state-specific templates for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most comprehensive web catalog of templates, grouped by states and areas of use. Apart from the Travis Sample Letter to Foreclosure Attorney - After Foreclosure - Did not Receive Notice, here you can get any specific document to run your business or personal deeds, complying with your county requirements. Experts check all samples for their validity, so you can be sure to prepare your paperwork correctly.

Using the service is pretty straightforward. If you already have an account on the platform and your subscription is valid, you only need to log in, choose the needed form, and download it. You can retain the document in your profile at any time later on. Otherwise, if you are new to the platform, there will be a few more actions to complete before you obtain your Travis Sample Letter to Foreclosure Attorney - After Foreclosure - Did not Receive Notice:

- Check the content of the page you’re on.

- Read the description of the sample or Preview it (if available).

- Look for another document utilizing the related option in the header.

- Click Buy Now once you’re certain in the chosen document.

- Choose the subscription plan that suits you most.

- Create an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Switch the file format if necessary.

- Click Download to save the Travis Sample Letter to Foreclosure Attorney - After Foreclosure - Did not Receive Notice.

- Print the doc or use any preferred online editor to complete it electronically.

No matter how many times you need to use the purchased template, you can find all the samples you’ve ever saved in your profile by opening the My Forms tab. Try it out!

Form popularity

FAQ

The 90day delinquency rate is a measure of serious delinquencies. It captures borrowers that have missed three or more payments. This rate measures more severe economic distress.

Your letter should start with an introduction of who you are and what kind of loan you are applying for. Lead into your story with something like "We want to explain our foreclosure from six years ago." Then, launch right into the details that led you to lose your home. This is not the time to be shy or modest.

If you do not pay what you owe, a Notice of Sale is recorded (at least 90 days after the Notice of Default is recorded). The Notice of Sale states that the trustee will sell your home at auction in 21 days.

The foreclosure sale date for non-agricultural property is set between 110 and 125 calendar days after the recording of the Notice of Election and Demand, for agricultural property the sale date is set between 215 and 230 calendar days. Agricultural property is based on assessment by the County Assessors Office.

Your letter should start with an introduction of who you are and what kind of loan you are applying for. Lead into your story with something like "We want to explain our foreclosure from six years ago." Then, launch right into the details that led you to lose your home. This is not the time to be shy or modest.

How to obtain a loan foreclosure letter from bank? Firstly you need to write an application to the lender regarding the foreclosing of the loan.Once the lender receives the application form the amount you need to pay will be calculated till the date of foreclosing.

The trustee's sale or auction occurs approximately three weeks after the Notice of Sale. The opening bid is typically the amount owed on the note plus foreclosure fees. Foreclosure auctions are usually cash or cashier's check only. Typically, the lender bids the first bid for this amount.

Home Loan Foreclosure Letter Dear Madam, I am Nisha Mittal, and I currently have a home loan against my account number 123456789098. I want to foreclose my home loan this month by paying the outstanding amount in a single payment. I have paid 8 EMIs as of now, and there are 5 EMIs pending until this year.

A demand letter is a formal business communication that states that due to late payment(s), the borrower is officially in breach of the terms of their loan, and that a failure to cure that breach will result in PeerStreet initiating the foreclosure process.

Second Mortgages Although a primary mortgage lender's ability to come after an individual following a foreclosure depends directly on the type of loan the borrower had and the laws in her state of residence, second mortgage lenders can almost always file a lawsuit after foreclosure.