Clark Nevada Shareholders Buy Sell Agreement of Stock in a Close Corporation with Noncom petition Provisions refers to a legal contract that outlines the terms and conditions for buying and selling stock in a close corporation while also including noncom petition provisions. This agreement is designed to protect the interests of the corporation, its shareholders, and maintain the competitive advantage of the business. In a close corporation, where the ownership is limited to a few shareholders, a buy-sell agreement becomes crucial. It ensures a smooth transition of ownership in case of events such as a shareholder's retirement, death, disability, or desire to sell their shares. The agreement not only sets forth the procedure and mechanisms for the buyout but also includes noncom petition provisions that prevent selling shareholders from competing with the corporation after the sale of their shares. There are different types of Clark Nevada Shareholders Buy Sell Agreements of Stock in a Close Corporation with Noncom petition Provisions that may be suited for various situations: 1. Retirement Buy-Sell Agreement: This agreement specifically addresses the buyout of shares when a shareholder decides to retire and exit the business. It may include provisions to ensure a fair valuation of the shares, terms for payment, and noncom petition clauses to protect the corporation from potential competition. 2. Death or Disability Buy-Sell Agreement: This type of agreement outlines the procedures for buying out the shares of a deceased or disabled shareholder. It typically includes provisions for the valuation of shares, funding mechanisms for the buyout (such as life insurance), and noncom petition clauses to prevent the deceased shareholder's beneficiaries from competing. 3. Voluntary Sale Buy-Sell Agreement: In some cases, a shareholder might willingly decide to sell their shares. This agreement sets guidelines for the process of selling shares, including valuation methods and payment terms. It also includes noncom petition provisions to protect the corporation's interests after the sale. 4. Involuntary Sale Buy-Sell Agreement: This agreement considers scenarios where a shareholder's shares need to be sold due to circumstances such as a breach of contract, bankruptcy, or criminal activity. It outlines the procedures for the forced buyout, including valuation, payment terms, and noncom petition provisions to prevent the selling shareholder from harming the corporation through their actions. In conclusion, a Clark Nevada Shareholders Buy Sell Agreement of Stock in a Close Corporation with Noncom petition Provisions is a comprehensive legal document that governs the buying and selling of shares in a close corporation while also protecting the corporation from potential competition. Different types of agreements exist based on specific circumstances such as retirement, death or disability, voluntary or involuntary sales. These agreements play a vital role in ensuring a smooth transition of ownership and safeguarding the interests of the corporation and its shareholders.

Clark Nevada Shareholders Buy Sell Agreement of Stock in a Close Corporation with Noncompetition Provisions

Description

How to fill out Clark Nevada Shareholders Buy Sell Agreement Of Stock In A Close Corporation With Noncompetition Provisions?

If you need to get a trustworthy legal paperwork supplier to find the Clark Shareholders Buy Sell Agreement of Stock in a Close Corporation with Noncompetition Provisions, consider US Legal Forms. Whether you need to launch your LLC business or manage your belongings distribution, we got you covered. You don't need to be well-versed in in law to find and download the appropriate form.

- You can select from more than 85,000 forms arranged by state/county and situation.

- The intuitive interface, variety of learning materials, and dedicated support make it simple to get and execute different papers.

- US Legal Forms is a trusted service offering legal forms to millions of customers since 1997.

Simply select to look for or browse Clark Shareholders Buy Sell Agreement of Stock in a Close Corporation with Noncompetition Provisions, either by a keyword or by the state/county the form is created for. After locating needed form, you can log in and download it or save it in the My Forms tab.

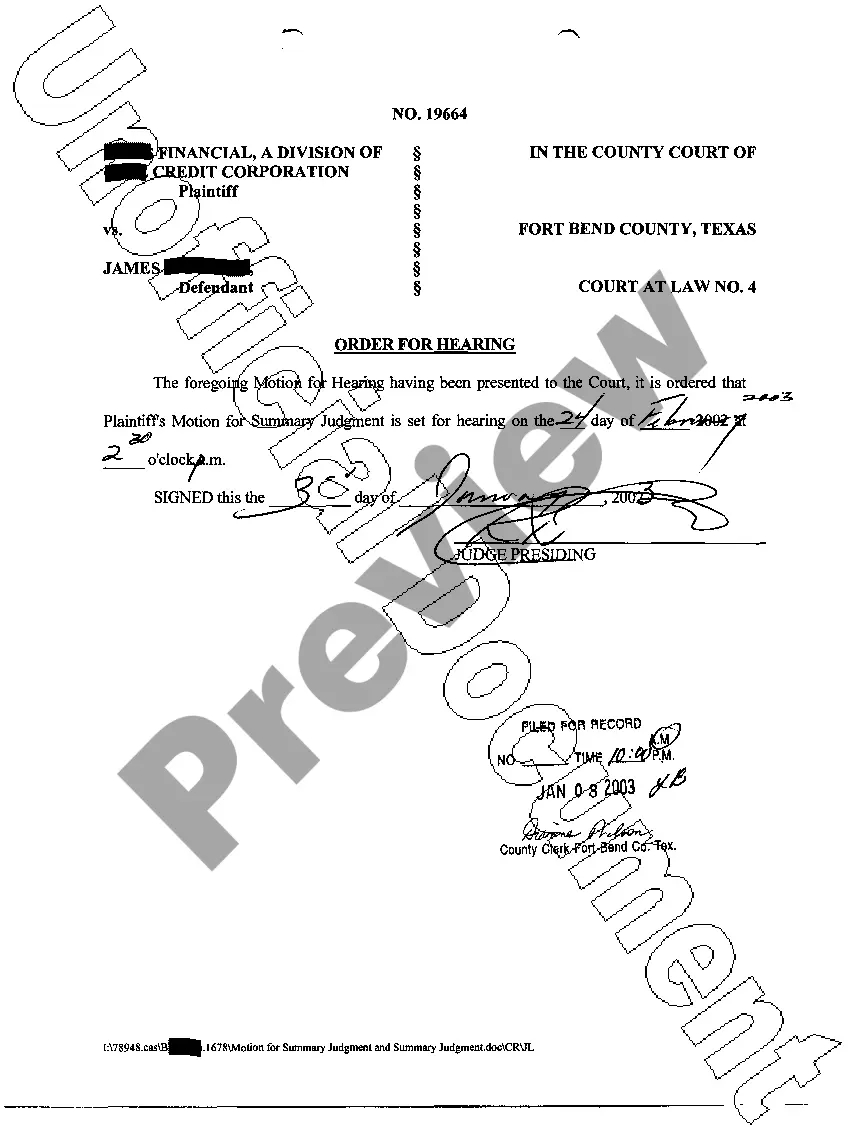

Don't have an account? It's easy to start! Simply locate the Clark Shareholders Buy Sell Agreement of Stock in a Close Corporation with Noncompetition Provisions template and check the form's preview and short introductory information (if available). If you're comfortable with the template’s legalese, go ahead and hit Buy now. Create an account and choose a subscription option. The template will be instantly available for download once the payment is completed. Now you can execute the form.

Taking care of your legal matters doesn’t have to be expensive or time-consuming. US Legal Forms is here to prove it. Our rich collection of legal forms makes these tasks less expensive and more affordable. Create your first company, arrange your advance care planning, create a real estate agreement, or execute the Clark Shareholders Buy Sell Agreement of Stock in a Close Corporation with Noncompetition Provisions - all from the comfort of your sofa.

Join US Legal Forms now!