Orange California Stock Option Agreement between Corporation and Officer or Key Employee is a legally binding document that outlines the terms and conditions under which an officer or key employee of a corporation based in Orange, California, is granted stock options. In this agreement, the corporation offers the officer or key employee the opportunity to purchase a specific number of shares of the company's stock at a predetermined price, known as the exercise price. This agreement provides an incentive to the individual to contribute to the growth and success of the corporation and aligns their interests with those of the shareholders. Types of Orange California Stock Option Agreements between Corporation and Officer or Key Employee may include: 1. Non-Qualified Stock Option (NO) Agreement: This type of agreement grants stock options that do not qualify for special tax treatment under the Internal Revenue Code. It provides the officer or key employee with flexibility in terms of exercise timing and potential tax implications. 2. Incentive Stock Option (ISO) Agreement: Under this agreement, the officer or key employee is granted stock options that qualify for favorable tax treatment, subject to certain conditions outlined by the Internal Revenue Service. ISO agreements are typically subject to stricter regulations, such as holding periods and exercise limitations. 3. Restricted Stock Units (RSS) Agreement: Unlike traditional stock options, RSS represent a promise to deliver stock at a future date without requiring a purchase. This type of agreement grants the officer or key employee the right to receive a specified number of shares of the company's stock, usually subject to vesting conditions or performance goals. 4. Performance-Based Stock Option Agreement: This agreement is designed to reward the officer or key employee based on specific performance targets, such as achieving revenue milestones or increasing market share. The number of options granted and the exercise price may be tied to the attainment of these predetermined goals. Besides the above types, other variants may exist based on the specific needs and requirements of the corporation and the officer or key employee. Overall, an Orange California Stock Option Agreement between Corporation and Officer or Key Employee serves as a crucial component of an employee compensation package. It motivates talented individuals to remain committed to the success of the corporation while providing them with the opportunity to share in its growth and financial success.

Orange California Stock Option Agreement between Corporation and Officer or Key Employee

Description

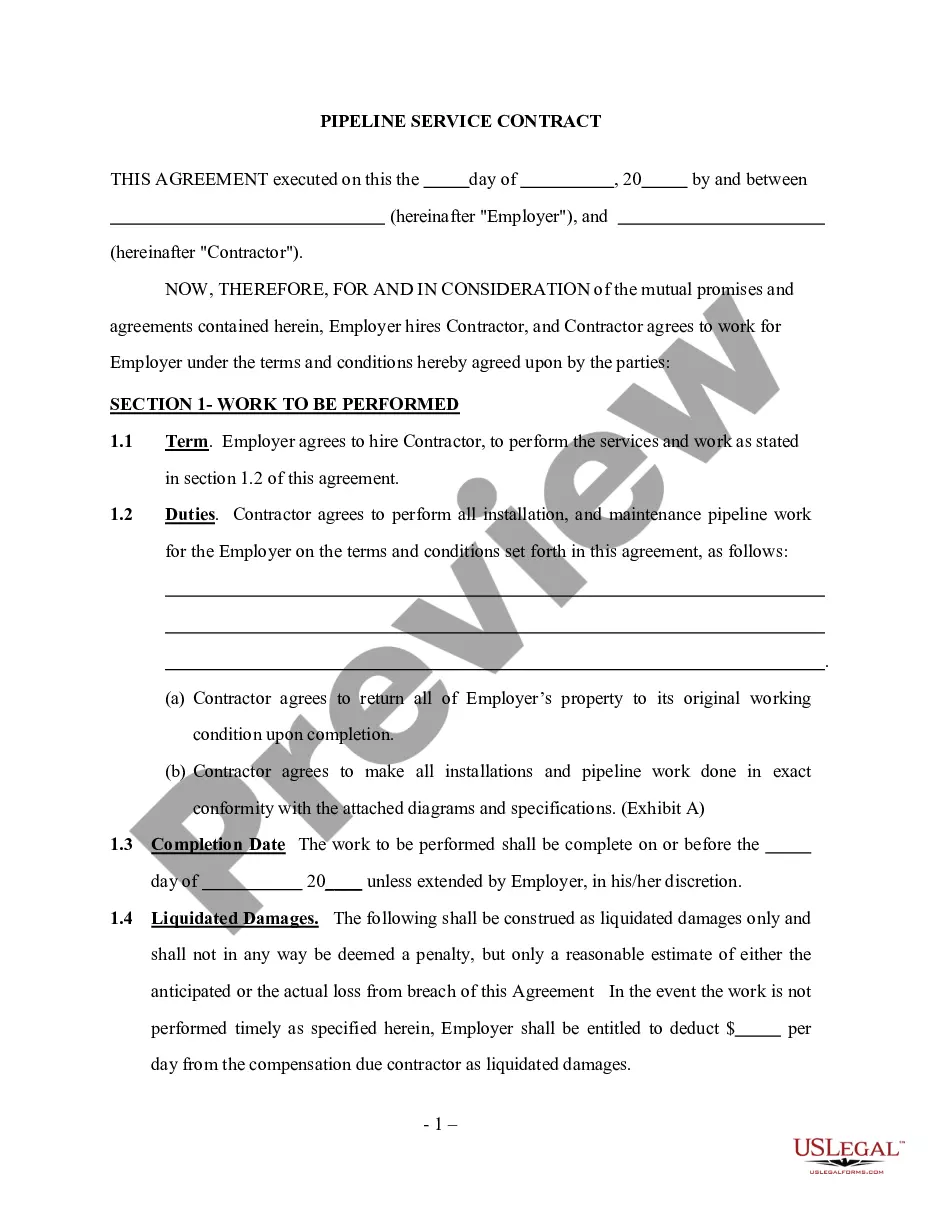

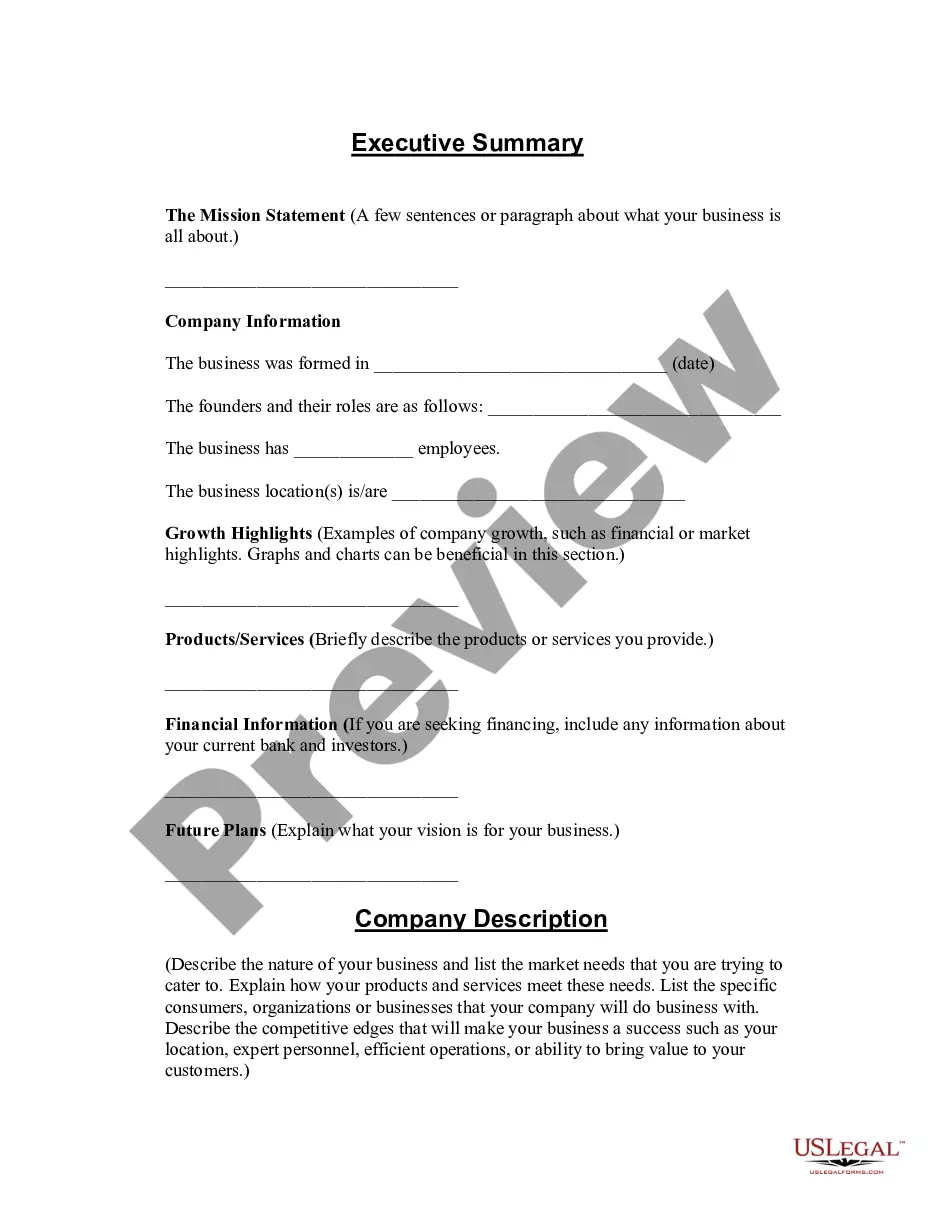

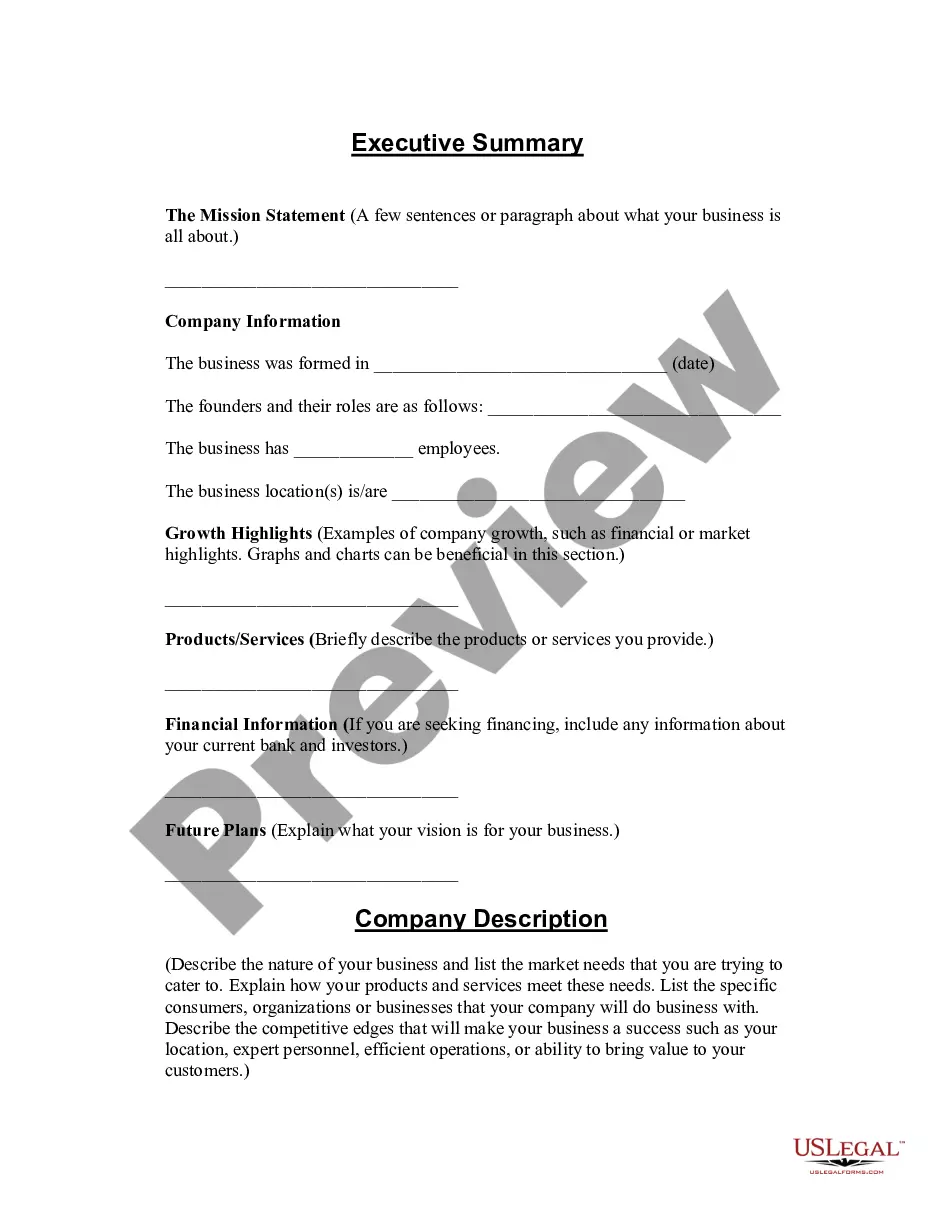

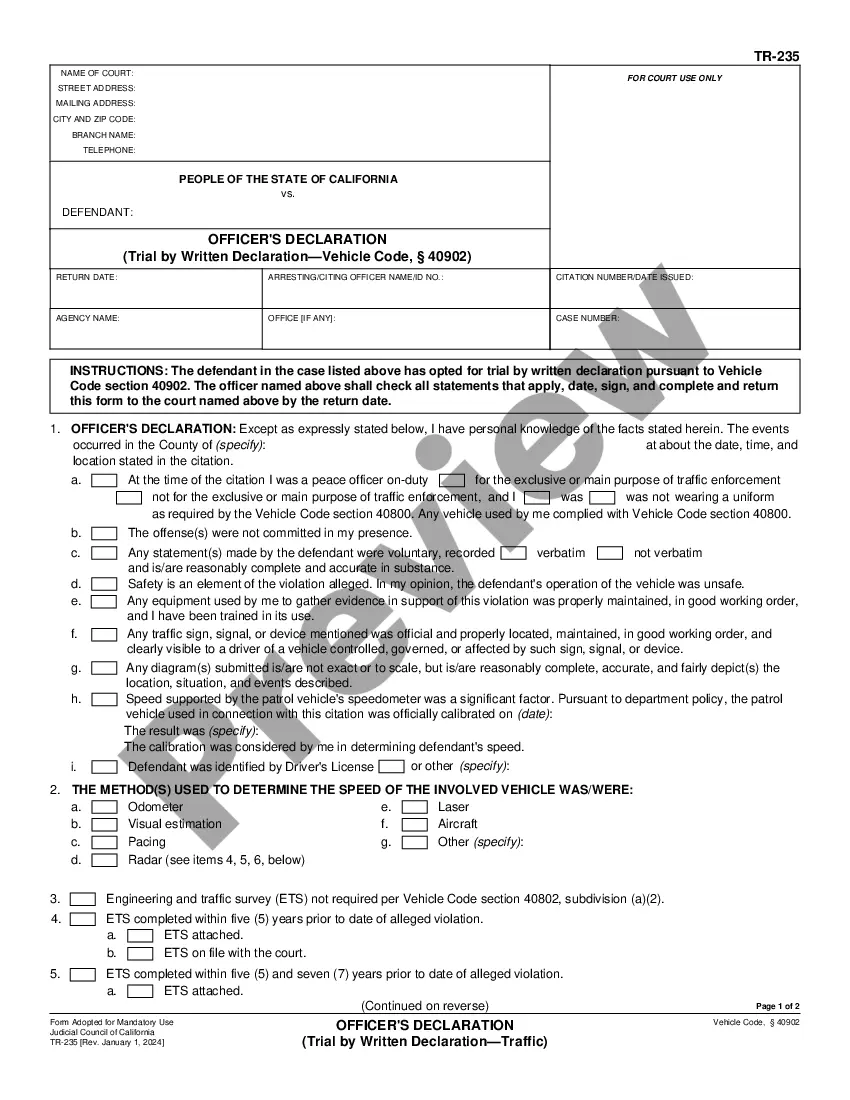

How to fill out Orange California Stock Option Agreement Between Corporation And Officer Or Key Employee?

Preparing legal paperwork can be cumbersome. In addition, if you decide to ask a lawyer to draft a commercial contract, papers for ownership transfer, pre-marital agreement, divorce paperwork, or the Orange Stock Option Agreement between Corporation and Officer or Key Employee, it may cost you a lot of money. So what is the most reasonable way to save time and money and create legitimate documents in total compliance with your state and local laws and regulations? US Legal Forms is a great solution, whether you're searching for templates for your individual or business needs.

US Legal Forms is the most extensive online catalog of state-specific legal documents, providing users with the up-to-date and professionally verified templates for any scenario gathered all in one place. Therefore, if you need the current version of the Orange Stock Option Agreement between Corporation and Officer or Key Employee, you can easily locate it on our platform. Obtaining the papers requires a minimum of time. Those who already have an account should check their subscription to be valid, log in, and pick the sample with the Download button. If you haven't subscribed yet, here's how you can get the Orange Stock Option Agreement between Corporation and Officer or Key Employee:

- Glance through the page and verify there is a sample for your region.

- Examine the form description and use the Preview option, if available, to make sure it's the template you need.

- Don't worry if the form doesn't satisfy your requirements - look for the right one in the header.

- Click Buy Now when you find the needed sample and pick the best suitable subscription.

- Log in or register for an account to pay for your subscription.

- Make a payment with a credit card or through PayPal.

- Opt for the file format for your Orange Stock Option Agreement between Corporation and Officer or Key Employee and save it.

When done, you can print it out and complete it on paper or import the template to an online editor for a faster and more practical fill-out. US Legal Forms enables you to use all the documents ever acquired many times - you can find your templates in the My Forms tab in your profile. Try it out now!