Travis Texas Stock Option Agreement between Corporation and Officer or Key Employee is a legal contract that outlines the terms and conditions associated with the grant of stock options to an officer or key employee of a corporation in Travis County, Texas. This agreement serves as a means to incentivize and reward the employee's contribution to the company's growth and success. The Travis Texas Stock Option Agreement is a comprehensive document that includes various clauses and provisions to protect the rights and interests of both the corporation and the employee. It typically covers the following key elements: 1. Grant of Stock Options: This section specifies the number of stock options being granted to the officer or key employee. It defines the exercise price, which is the predetermined price at which the stock options can be exercised by the employee to acquire company shares. 2. Vesting Schedule: The agreement outlines the vesting schedule, which determines when and how the stock options become exercisable. This schedule may be based on the employee's tenure with the company or achievement of specific performance milestones. 3. Exercise Period: The exercise period refers to the window of time during which the employee can exercise their stock options. The agreement defines the length of this period, typically after a specified vesting period. 4. Exercise and Payment Terms: The agreement outlines the procedure for exercising the stock options, including any restrictions or limitations placed by the corporation. It may also specify the accepted methods of payment for the acquired shares, such as cash, check, or stock-for-stock exchange. 5. Termination and Forfeiture: This clause details the consequences of termination of employment or other specified events, which may result in the forfeiture or cancellation of invested stock options. It may also address scenarios such as retirement, disability, or death. 6. Rights and Restrictions: The agreement establishes the rights and restrictions associated with the stock options, including limitations on transferability, rights to dividends, and voting rights. 7. Tax Implications: The agreement may contain provisions addressing the tax treatment of stock options and any necessary withholding obligations imposed on the corporation or the employee. Different types or variations of Travis Texas Stock Option Agreements between Corporation and Officer or Key Employee may exist depending on the specific circumstances or goals of the parties involved. These variations can include incentive stock options (SOS), non-qualified stock options (SOS), restricted stock units (RSS), or phantom stock plans. Each type has its own unique features and tax considerations, which may be reflected in the agreement. Overall, a Travis Texas Stock Option Agreement between Corporation and Officer or Key Employee is a crucial legal document that defines the terms, rights, and restrictions for the issuance, exercise, and ownership of stock options, aiming to align the interests of the corporation and its key employees while fostering growth and motivation.

Travis Texas Stock Option Agreement between Corporation and Officer or Key Employee

Description

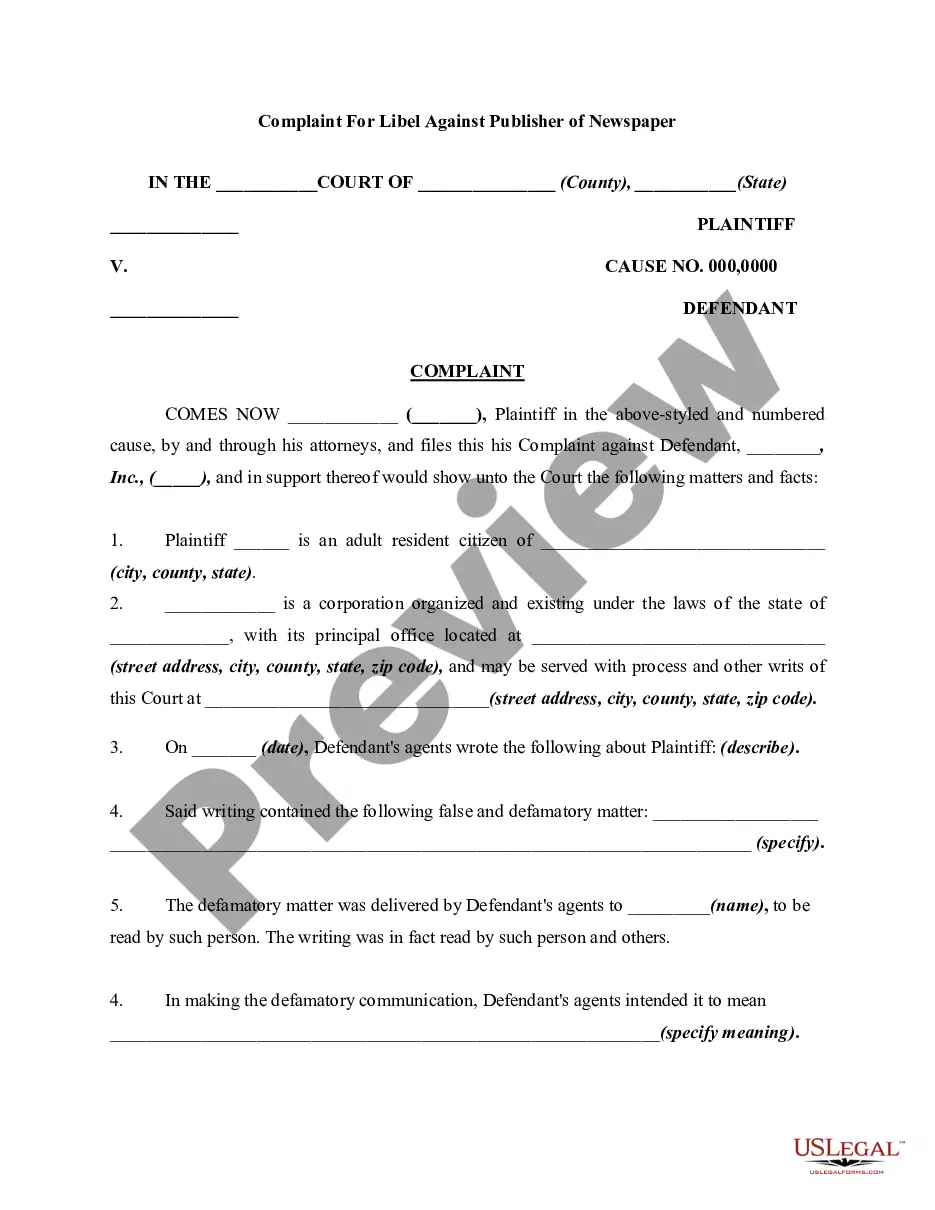

How to fill out Travis Texas Stock Option Agreement Between Corporation And Officer Or Key Employee?

If you need to find a trustworthy legal paperwork supplier to find the Travis Stock Option Agreement between Corporation and Officer or Key Employee, consider US Legal Forms. Whether you need to start your LLC business or manage your asset distribution, we got you covered. You don't need to be knowledgeable about in law to locate and download the appropriate template.

- You can browse from over 85,000 forms categorized by state/county and situation.

- The intuitive interface, number of learning resources, and dedicated support make it easy to locate and execute different documents.

- US Legal Forms is a reliable service providing legal forms to millions of customers since 1997.

Simply select to search or browse Travis Stock Option Agreement between Corporation and Officer or Key Employee, either by a keyword or by the state/county the form is intended for. After locating required template, you can log in and download it or save it in the My Forms tab.

Don't have an account? It's simple to start! Simply find the Travis Stock Option Agreement between Corporation and Officer or Key Employee template and check the form's preview and description (if available). If you're comfortable with the template’s language, go ahead and hit Buy now. Create an account and select a subscription plan. The template will be instantly ready for download once the payment is processed. Now you can execute the form.

Taking care of your legal affairs doesn’t have to be expensive or time-consuming. US Legal Forms is here to demonstrate it. Our comprehensive collection of legal forms makes this experience less costly and more affordable. Create your first business, arrange your advance care planning, draft a real estate agreement, or complete the Travis Stock Option Agreement between Corporation and Officer or Key Employee - all from the comfort of your home.

Join US Legal Forms now!