Fairfax Virginia Shareholders Buy-Sell Agreement of Stock in a Close Corporation with Agreement of Spouse and Stock Transfer Restrictions: A Comprehensive Guide Introduction: A Fairfax Virginia Shareholders Buy-Sell Agreement of Stock in a Close Corporation with Agreement of Spouse and Stock Transfer Restrictions is a legally binding document that outlines the terms and conditions for buying and selling stock in a close corporation. This agreement plays a vital role in protecting the rights and interests of shareholders, especially in cases of death, disability, retirement, or voluntary exit from the corporation. In Fairfax, Virginia, specific variations of this agreement are prevalent and cater to various business needs. Key Features and Benefits: 1. Protection of Shareholder Interests: The primary goal of the buy-sell agreement is to ensure fair treatment of all shareholders and protect their investments by establishing clear guidelines for the sale and transfer of stock. 2. Agreement of Spouse: In some cases, Shareholders Buy-Sell Agreements in Fairfax, Virginia, require the agreement of a shareholder's spouse or significant other. This provision ensures the stability of ownership by preventing stock transfers without proper consent, thus avoiding potential disputes and complications. 3. Stock Transfer Restrictions: Stock transfer restrictions are an integral part of any buy-sell agreement. These limitations are designed to maintain control and stability within the close corporation, enabling existing shareholders to have the right of first refusal or establish a fair valuation mechanism for stock transfers. Types of Fairfax Virginia Shareholders Buy-Sell Agreement of Stock in a Close Corporation with Agreement of Spouse and Stock Transfer Restrictions: 1. Cross-Purchase Agreement: In this type of agreement, each shareholder has the right and obligation to purchase the stock from a departing shareholder. The remaining shareholders individually acquire the stock proportionate to their existing ownership interests. 2. Stock Redemption Agreement: This agreement allows the close corporation to repurchase stock directly from a departing shareholder. The corporation becomes the purchaser, and the shares are retired or redistributed among the remaining shareholders. 3. Hybrid Agreement: A hybrid agreement combines elements of both the cross-purchase and stock redemption agreements. Shareholders have the option to buy the departing shareholder's stock individually or allow the corporation to repurchase it. 4. Wait-and-See Agreement: This agreement provides flexibility by delaying the selection of a specific method until a triggering event occurs. It allows shareholders to evaluate the financial and tax implications before deciding whether to proceed with a cross-purchase or stock redemption agreement. Conclusion: A Fairfax Virginia Shareholders Buy-Sell Agreement of Stock in a Close Corporation with Agreement of Spouse and Stock Transfer Restrictions is a vital tool for preserving the integrity and smooth functioning of a close corporation. It prevents discord and potential disputes, ensures fair treatment of all shareholders, and protects their investments. By complying with Fairfax, Virginia's legal requirements, businesses can establish a solid foundation for their operations and provide shareholders with peace of mind, knowing their interests are safeguarded.

Fairfax Virginia Shareholders Buy Sell Agreement of Stock in a Close Corporation with Agreement of Spouse and Stock Transfer Restrictions

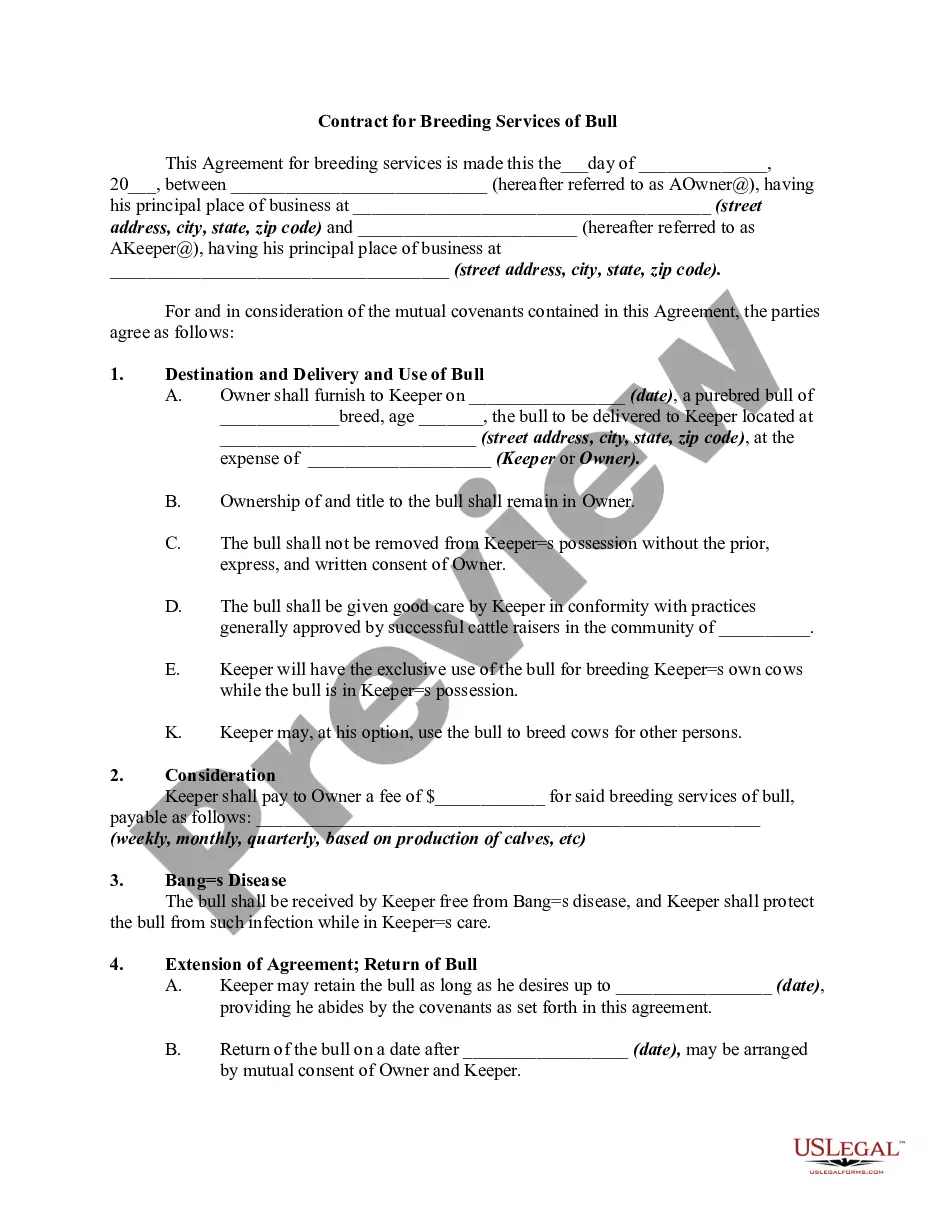

Description

How to fill out Fairfax Virginia Shareholders Buy Sell Agreement Of Stock In A Close Corporation With Agreement Of Spouse And Stock Transfer Restrictions?

If you need to find a trustworthy legal form supplier to get the Fairfax Shareholders Buy Sell Agreement of Stock in a Close Corporation with Agreement of Spouse and Stock Transfer Restrictions, consider US Legal Forms. Whether you need to launch your LLC business or manage your belongings distribution, we got you covered. You don't need to be knowledgeable about in law to locate and download the appropriate form.

- You can browse from more than 85,000 forms categorized by state/county and case.

- The intuitive interface, number of learning resources, and dedicated support make it easy to get and execute different papers.

- US Legal Forms is a reliable service offering legal forms to millions of customers since 1997.

Simply select to search or browse Fairfax Shareholders Buy Sell Agreement of Stock in a Close Corporation with Agreement of Spouse and Stock Transfer Restrictions, either by a keyword or by the state/county the form is created for. After locating required form, you can log in and download it or save it in the My Forms tab.

Don't have an account? It's simple to get started! Simply locate the Fairfax Shareholders Buy Sell Agreement of Stock in a Close Corporation with Agreement of Spouse and Stock Transfer Restrictions template and take a look at the form's preview and description (if available). If you're comfortable with the template’s language, go ahead and hit Buy now. Register an account and select a subscription plan. The template will be instantly available for download once the payment is processed. Now you can execute the form.

Handling your legal matters doesn’t have to be expensive or time-consuming. US Legal Forms is here to prove it. Our comprehensive variety of legal forms makes these tasks less costly and more affordable. Set up your first company, organize your advance care planning, draft a real estate agreement, or execute the Fairfax Shareholders Buy Sell Agreement of Stock in a Close Corporation with Agreement of Spouse and Stock Transfer Restrictions - all from the comfort of your home.

Join US Legal Forms now!