A Contra Costa California Deed Conveying Condominium Unit to Charity with Reservation of Life Tenancy in Donor and Donor's Spouse is a legal instrument used when a property owner wishes to donate their condominium unit to a charity while retaining the right to live in the property for the duration of their life, as well as the right for their spouse to reside in the unit after their passing. This type of deed allows the property owner to make a charitable contribution and retain the use and occupancy of their home until their demise. The Contra Costa County area in California has numerous types of deeds for conveying real estate to charity with a reservation of life tenancy for the donor and donor's spouse. Some variations of these deeds may include: 1. Irrevocable Deed Conveying Condominium Unit to Charity with Reservation of Life Tenancy: This type of deed relinquishes ownership of the condominium unit to the charity, while guaranteeing the donor and their spouse the right to continue living in the property until their death. It is an irrevocable arrangement, meaning the donor cannot reclaim ownership of the property once transferred. 2. Revocable Deed Conveying Condominium Unit to Charity with Reservation of Life Tenancy: In contrast to the irrevocable deed, this type of conveyance allows the donor to revoke or cancel the deed if circumstances change. The donor and spouse still enjoy the right to reside in the condominium unit until their passing. 3. Partial Interest Deed Conveying Condominium Unit to Charity with Reservation of Life Tenancy: This type of deed enables the donor to retain partial ownership and enjoyment of the condo while donating a fractional interest to the charity. The donor and their spouse can continue living in the property for the duration of their lives, but they hold only a percentage of ownership in the unit. It is important to consult with a qualified estate planning attorney when considering Contra Costa California Deeds Conveying Condominium Unit to Charity with Reservation of Life Tenancy in Donor and Donor's Spouse. They can guide individuals through the legal nuances and provide advice tailored to their specific circumstances. Remember to conduct thorough research and seek professional advice to ensure compliance with applicable laws and maximize the benefits of such charitable donations.

Contra Costa California Deed Conveying Condominium Unit to Charity with Reservation of Life Tenancy in Donor and Donor's Spouse

Description

How to fill out Contra Costa California Deed Conveying Condominium Unit To Charity With Reservation Of Life Tenancy In Donor And Donor's Spouse?

Drafting documents for the business or personal demands is always a big responsibility. When drawing up a contract, a public service request, or a power of attorney, it's important to consider all federal and state regulations of the specific region. Nevertheless, small counties and even cities also have legislative provisions that you need to consider. All these aspects make it burdensome and time-consuming to generate Contra Costa Deed Conveying Condominium Unit to Charity with Reservation of Life Tenancy in Donor and Donor's Spouse without professional help.

It's easy to avoid spending money on lawyers drafting your paperwork and create a legally valid Contra Costa Deed Conveying Condominium Unit to Charity with Reservation of Life Tenancy in Donor and Donor's Spouse by yourself, using the US Legal Forms web library. It is the largest online catalog of state-specific legal templates that are professionally cheched, so you can be sure of their validity when picking a sample for your county. Previously subscribed users only need to log in to their accounts to download the required form.

In case you still don't have a subscription, follow the step-by-step guide below to obtain the Contra Costa Deed Conveying Condominium Unit to Charity with Reservation of Life Tenancy in Donor and Donor's Spouse:

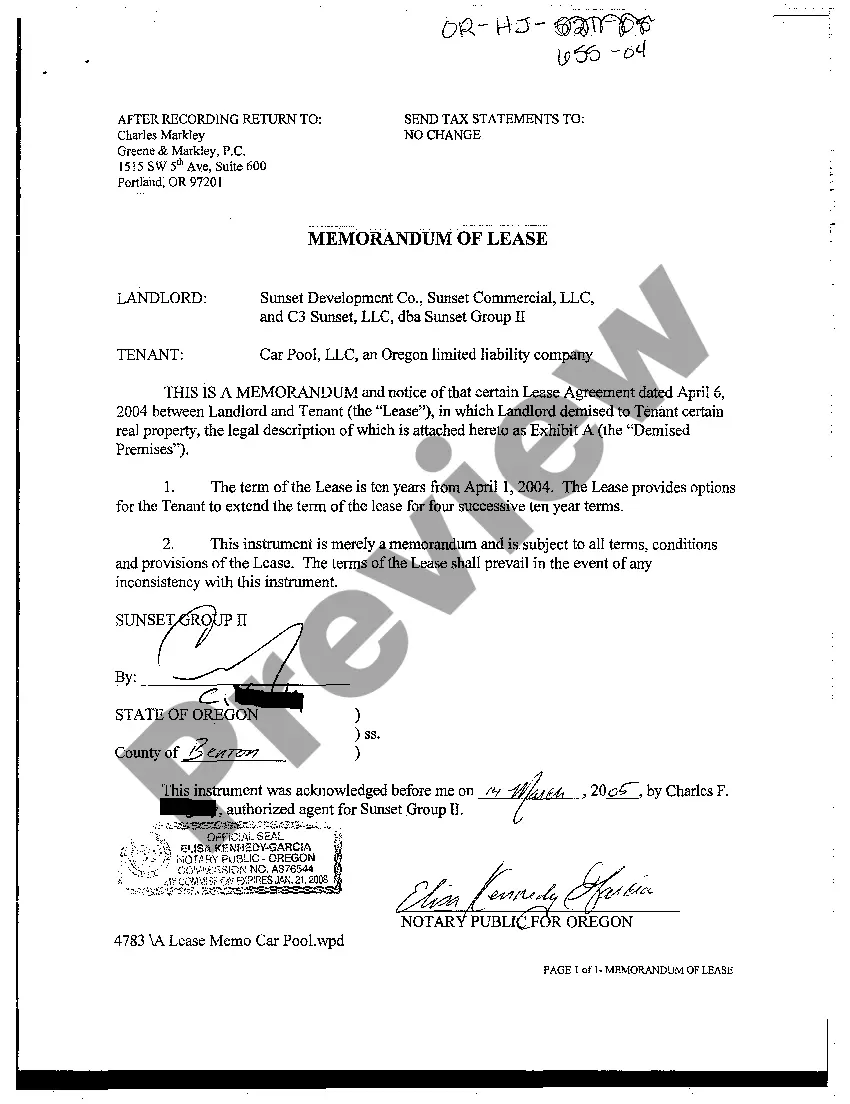

- Examine the page you've opened and check if it has the document you need.

- To achieve this, use the form description and preview if these options are available.

- To locate the one that fits your needs, use the search tab in the page header.

- Double-check that the sample complies with juridical standards and click Buy Now.

- Opt for the subscription plan, then sign in or create an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the selected document in the preferred format, print it, or complete it electronically.

The great thing about the US Legal Forms library is that all the paperwork you've ever acquired never gets lost - you can get it in your profile within the My Forms tab at any moment. Join the platform and easily get verified legal templates for any use case with just a couple of clicks!