A Hillsborough Florida Deed Conveying Condominium Unit to Charity with Reservation of Life Tenancy in Donor and Donor's Spouse is a legally binding document that transfers ownership of a condominium unit to a charitable organization while allowing the donor and their spouse to retain the right to occupy and use the property for the duration of their lives. This type of deed is often used by individuals who wish to support charitable causes while still maintaining the right to live in their property during their lifetime. By conveying the condominium unit to a charity, the donor can make a meaningful contribution to a cause they care about, while also benefiting from potential tax advantages and the satisfaction of giving back to their community. The Hillsborough Florida Deed Conveying Condominium Unit to Charity with Reservation of Life Tenancy in Donor and Donor's Spouse comes in different forms, depending on the specific circumstances and preferences of the donor. Some variations include: 1. Life Estate Deed to Charity: This type of deed grants the charity ownership of the condominium unit upon the donor's passing, while allowing the donor and their spouse to continue residing in the property until that time. 2. Remainder Interest Deed to Charity: With this deed, the donor conveys the remainder interest in the condominium unit to the charity, meaning that the charity assumes ownership immediately but the donor and spouse can still use and reside in the property until their passing. 3. Charitable Remainder Trust: This option involves placing the condominium unit into a trust, with the charitable organization named as the beneficiary. The donor and spouse as the trust beneficiaries retain the right to occupy the property for their lifetimes, and upon their passing, the trust assets are transferred to the charity. It is important to consult with legal professionals who specialize in estate planning, real estate, and charitable giving to determine the most suitable type of deed for your unique circumstances. They can guide you through the process, ensuring that all legal requirements are met and your intentions are properly documented. By utilizing a Hillsborough Florida Deed Conveying Condominium Unit to Charity with Reservation of Life Tenancy in Donor and Donor's Spouse, individuals can leave a lasting philanthropic legacy while enjoying the benefits of property ownership during their lifetime.

Hillsborough Florida Deed Conveying Condominium Unit to Charity with Reservation of Life Tenancy in Donor and Donor's Spouse

Description

How to fill out Hillsborough Florida Deed Conveying Condominium Unit To Charity With Reservation Of Life Tenancy In Donor And Donor's Spouse?

Draftwing documents, like Hillsborough Deed Conveying Condominium Unit to Charity with Reservation of Life Tenancy in Donor and Donor's Spouse, to take care of your legal matters is a challenging and time-consumming task. A lot of cases require an attorney’s involvement, which also makes this task expensive. Nevertheless, you can get your legal affairs into your own hands and handle them yourself. US Legal Forms is here to save the day. Our website comes with over 85,000 legal documents intended for various scenarios and life circumstances. We ensure each form is in adherence with the regulations of each state, so you don’t have to be concerned about potential legal problems compliance-wise.

If you're already familiar with our website and have a subscription with US, you know how straightforward it is to get the Hillsborough Deed Conveying Condominium Unit to Charity with Reservation of Life Tenancy in Donor and Donor's Spouse form. Simply log in to your account, download the template, and personalize it to your requirements. Have you lost your form? Don’t worry. You can get it in the My Forms tab in your account - on desktop or mobile.

The onboarding process of new users is just as straightforward! Here’s what you need to do before downloading Hillsborough Deed Conveying Condominium Unit to Charity with Reservation of Life Tenancy in Donor and Donor's Spouse:

- Make sure that your document is specific to your state/county since the rules for writing legal paperwork may differ from one state another.

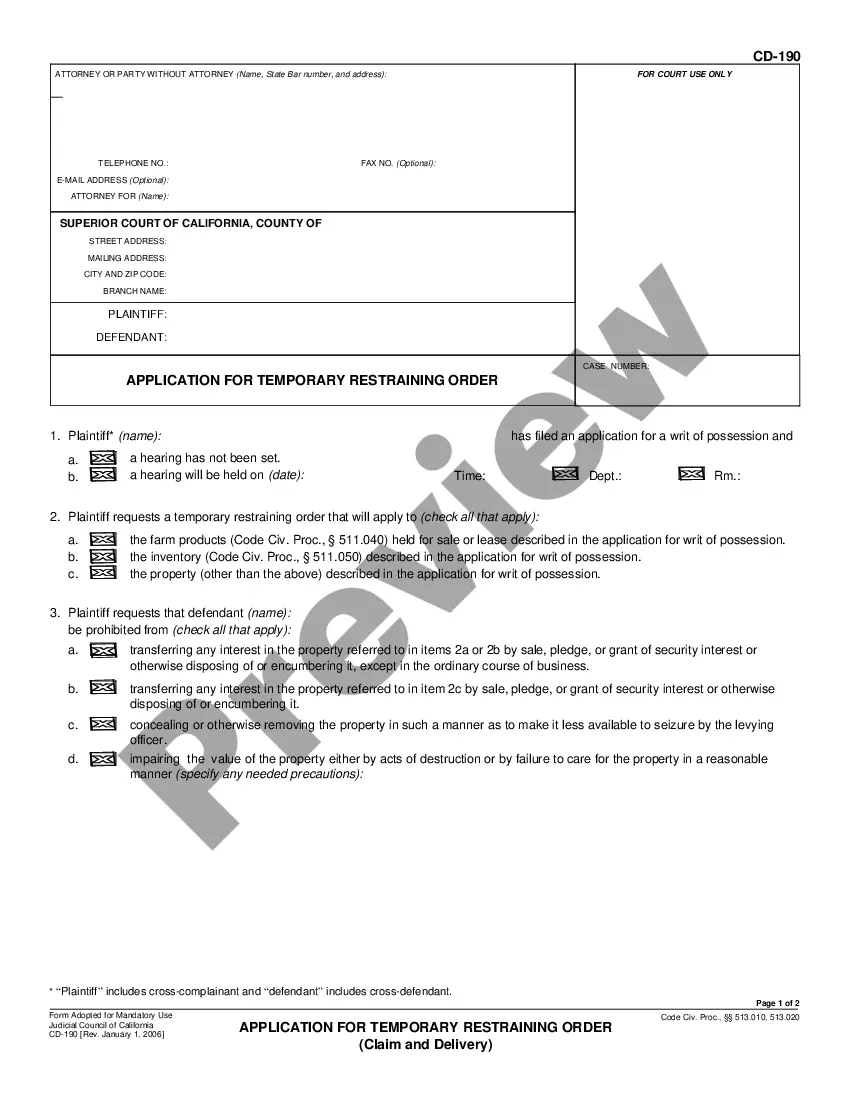

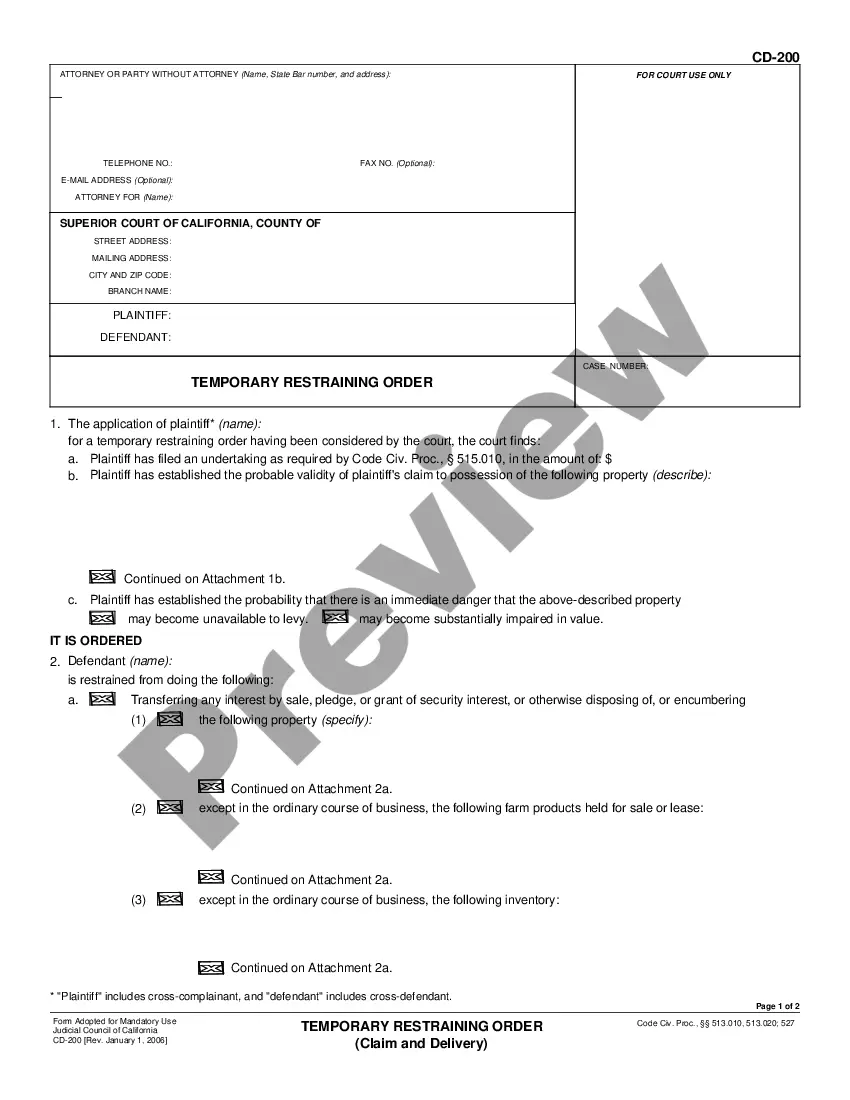

- Learn more about the form by previewing it or going through a quick description. If the Hillsborough Deed Conveying Condominium Unit to Charity with Reservation of Life Tenancy in Donor and Donor's Spouse isn’t something you were hoping to find, then take advantage of the search bar in the header to find another one.

- Sign in or create an account to start using our service and download the document.

- Everything looks good on your end? Click the Buy now button and select the subscription option.

- Select the payment gateway and type in your payment details.

- Your form is all set. You can try and download it.

It’s an easy task to locate and buy the appropriate template with US Legal Forms. Thousands of organizations and individuals are already benefiting from our extensive collection. Subscribe to it now if you want to check what other advantages you can get with US Legal Forms!