Title: Allegheny, Pennsylvania Deed Conveying Property to Charity with Reservation of Life Estate: A Comprehensive Guide Introduction: In Allegheny, Pennsylvania, a Deed Conveying Property to Charity with Reservation of Life Estate allows property owners to transfer their real estate to a charitable organization while retaining the right to occupy and use the property for the duration of their lifetime. This comprehensive guide will explore the concept of this type of deed, its benefits, and the different variations it might entail. 1. Understanding Allegheny, Pennsylvania Deed Conveying Property to Charity with Reservation of Life Estate: a. Definition and Purpose: A Deed Conveying Property to Charity with Reservation of Life Estate is a legal document that enables property owners to donate their real estate while maintaining the right to live on and benefit from the property until their demise. b. Eligibility Criteria: Property owners, specifically in Allegheny, Pennsylvania, who are interested in making a charitable contribution while securing their lifelong living arrangements, can consider this type of deed. c. Legally Binding: When executed correctly by an attorney and all legal requirements are met, this deed becomes legally binding, ensuring the intent of the donation and protection of the property owner during their lifetime. 2. Benefits of Allegheny, Pennsylvania Deed Conveying Property to Charity with Reservation of Life Estate: a. Charitable Contribution: Property owners can feel a sense of philanthropy by donating their property to a charitable organization, contributing to the betterment of society. b. Tax Advantages: Depending on individual circumstances, this type of deed may provide tax benefits, such as reduced estate taxes or income tax deductions. c. Lifetime Rights and Benefits: Retaining a life estate allows property owners to continue living on the property, enjoying its benefits, and even receiving income from rentals or using the land for agricultural purposes. 3. Types of Allegheny Pennsylvania Deed Conveying Property to Charity with Reservation of Life Estate: a. Remainder Interest Life Estate: In this variation, the property owner retains the right to live on the property until their demise, after which ownership fully transfers to the charitable organization designated in the deed. b. Income Interest Life Estate: Here, the property owner retains the right to use the property and receive any income it generates during their lifetime, with the remaining interest passing to the charity upon their death. c. Qualified Personnel Residence Trust (PRT): This specific type of life estate involves the transfer of a primary residence to a charitable organization, with the property owner retaining the right to live in it for a specific term, usually years, after which it becomes the charity's property. d. Charitable Remainder Trust (CRT): Unlike the aforementioned options, a CRT involves the creation of a trust, allowing property owners to benefit from the property during their lifetime, with the remaining interest ultimately passing to the chosen charitable organization. Conclusion: Allegheny, Pennsylvania Deed Conveying Property to Charity with Reservation of Life Estate provides property owners with an opportunity to make a lasting impact while ensuring their current and future living arrangements. With various types of deeds available, individuals can select an option that best aligns with their goals, whether it be transferring full ownership to a charity postmortem or receiving an income during their lifetime. To proceed with this type of deed, consulting a qualified attorney is highly recommended ensuring compliance with legal requirements.

Allegheny Pennsylvania Deed Conveying Property to Charity with Reservation of Life Estate

Description

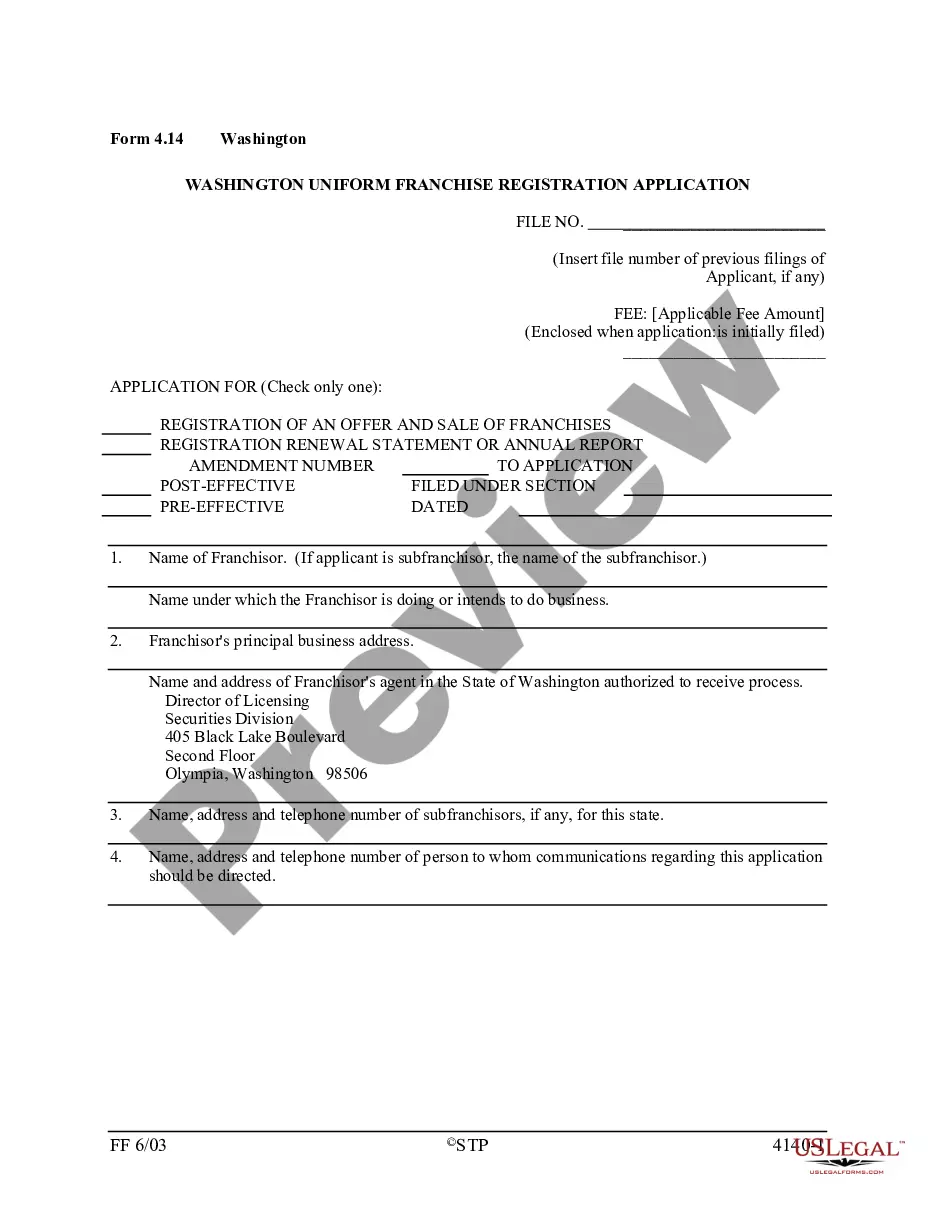

How to fill out Allegheny Pennsylvania Deed Conveying Property To Charity With Reservation Of Life Estate?

If you need to find a trustworthy legal document provider to find the Allegheny Deed Conveying Property to Charity with Reservation of Life Estate, consider US Legal Forms. No matter if you need to launch your LLC business or take care of your asset distribution, we got you covered. You don't need to be knowledgeable about in law to locate and download the appropriate template.

- You can search from over 85,000 forms categorized by state/county and situation.

- The intuitive interface, variety of supporting materials, and dedicated support team make it simple to locate and execute different paperwork.

- US Legal Forms is a trusted service providing legal forms to millions of customers since 1997.

Simply select to look for or browse Allegheny Deed Conveying Property to Charity with Reservation of Life Estate, either by a keyword or by the state/county the form is intended for. After locating needed template, you can log in and download it or retain it in the My Forms tab.

Don't have an account? It's easy to start! Simply locate the Allegheny Deed Conveying Property to Charity with Reservation of Life Estate template and check the form's preview and description (if available). If you're comfortable with the template’s legalese, go ahead and click Buy now. Register an account and choose a subscription plan. The template will be immediately ready for download once the payment is processed. Now you can execute the form.

Handling your legal matters doesn’t have to be expensive or time-consuming. US Legal Forms is here to demonstrate it. Our rich variety of legal forms makes these tasks less costly and more affordable. Set up your first business, arrange your advance care planning, draft a real estate contract, or complete the Allegheny Deed Conveying Property to Charity with Reservation of Life Estate - all from the convenience of your sofa.

Join US Legal Forms now!

Form popularity

FAQ

To transfer property in Pennsylvania, you'll need to prepare and execute a deed and record it in the county where the property is located. If the transfer was in exchange for money, you'll have to pay transfer tax.

Life estate cons The life tenant cannot change the remainder beneficiary without their consent. If the life tenant applies for any loans, they cannot use the life estate property as collateral. There's no creditor protection for the remainderman.You can't minimize estate tax.

A life estate is established when the owner of the property (the grantor, also known as life tenant, or tenant for life) deeds, grants or otherwise transfers ownership to another person (the remainderman). Basic characteristics of a life estate are: 55 Pa. Code § 178.4.

Recording Fees The fee to record a deed, mortgage or easement is $181.75. Or if there are over 30 parcels (only parcels that require deed certification, $10.00 per parcel). This does not apply to leases or mortgages. The Department of Real Estate will accept certified checks, business checks, or money orders.

The person holding the life estate the life tenant possesses the property during his or her life. The other owner the remainderman has a current ownership interest but cannot take possession until the death of the life estate holder.

MONTGOMERY COUNTY RECORDER OF DEEDS Document TypeBase Fee Up to 4 names, 4 pages, 1 parcelEach Add'l page over 4Deed Miscellaneous$73.75$2.00Assignments of Rents/Leases$73.75$2.00Condo Codes of Regulation$73.75$2.00Consent Form$73.75$2.0062 more rows

An owner of a property can retain a life estate and give the remainder of the property away. Here are a few of the reasons our clients use life estates as a part of their planning: To cause a piece of real property to avoid probate. To give a house to children without giving up the ability to live in the house.

Recording requirements in Pennsylvania require that all mortgages presented for recording must have the signature of the holder, owner, assignee on any mortgage presented for recording. The document should contain the full name, residence (including street number) and the address of such holder, owner or assignee.

A person with life interest generally (as we have not perused the Will) does not have the right to sell, transfer or alienate the property to the detriment of the absolute owner, which in your case is the son, i.e., you. It is a limited right to enjoy the property up to the death of the life holder.