A Clark Nevada Deed Conveying Property to Charity with Reservation of Life Estate is a legal document used to transfer a property to a charitable organization while allowing the original owner (also known as the granter) to retain a life estate in the property. This type of deed is primarily used as a charitable planning tool where a person wishes to donate their property to a charity while still enjoying the benefits of living in it until their death. The deed effectively allows the granter to continue living in the property for the duration of their life, ensuring they have a comfortable and secure place to reside. Meanwhile, the charity is given the gift of the property and becomes its eventual full owner upon the granter's passing. The Clark Nevada Deed Conveying Property to Charity with Reservation of Life Estate has various types, including: 1. Charitable Remainder Life Estate Deed: This type of deed allows the granter to retain the right to receive income generated from the property during their lifetime. Upon the granter's death, the property is transferred to the designated charity. 2. Charitable Lead Trust Life Estate Deed: In this variation, the granter retains a life estate but designates that the income generated from the property goes to the charity for a specific period. After that period ends, the property is transferred to a non-charitable beneficiary, such as a family member or loved one. 3. Charitable Gift Annuity Life Estate Deed: This type involves the granter transferring the property while retaining a life estate, and in return, the charity agrees to pay them a fixed income for a set period. After the granter's passing, the property becomes the sole possession of the charitable organization. The Clark Nevada Deed Conveying Property to Charity with Reservation of Life Estate is a valuable tool for individuals who desire to support a charitable cause while still maintaining their right to occupy and derive benefits from their property during their lifetime. By utilizing this legal instrument, individuals can leave a lasting legacy and provide financial support to organizations or causes they care deeply about. It is essential to consult with an experienced attorney or legal professional to ensure compliance with Nevada state laws and to accurately draft the deed to suit individual needs and goals.

Clark Nevada Deed Conveying Property to Charity with Reservation of Life Estate

Description

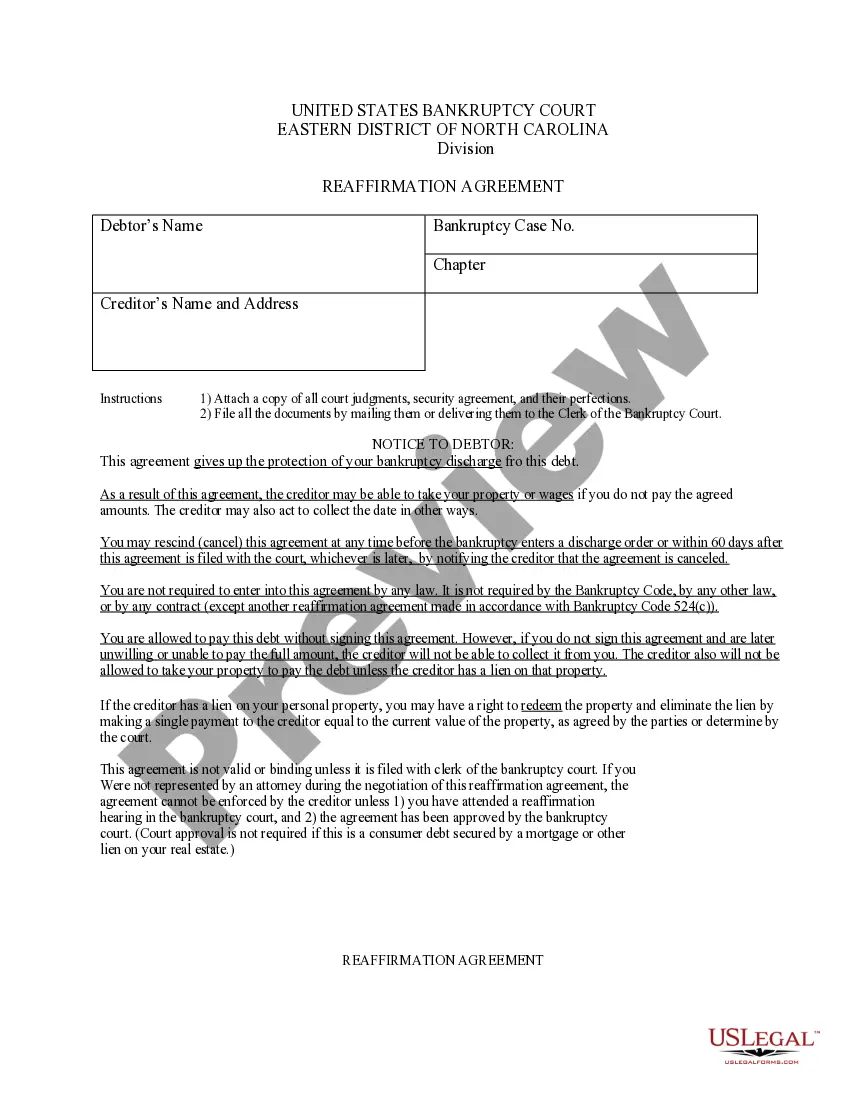

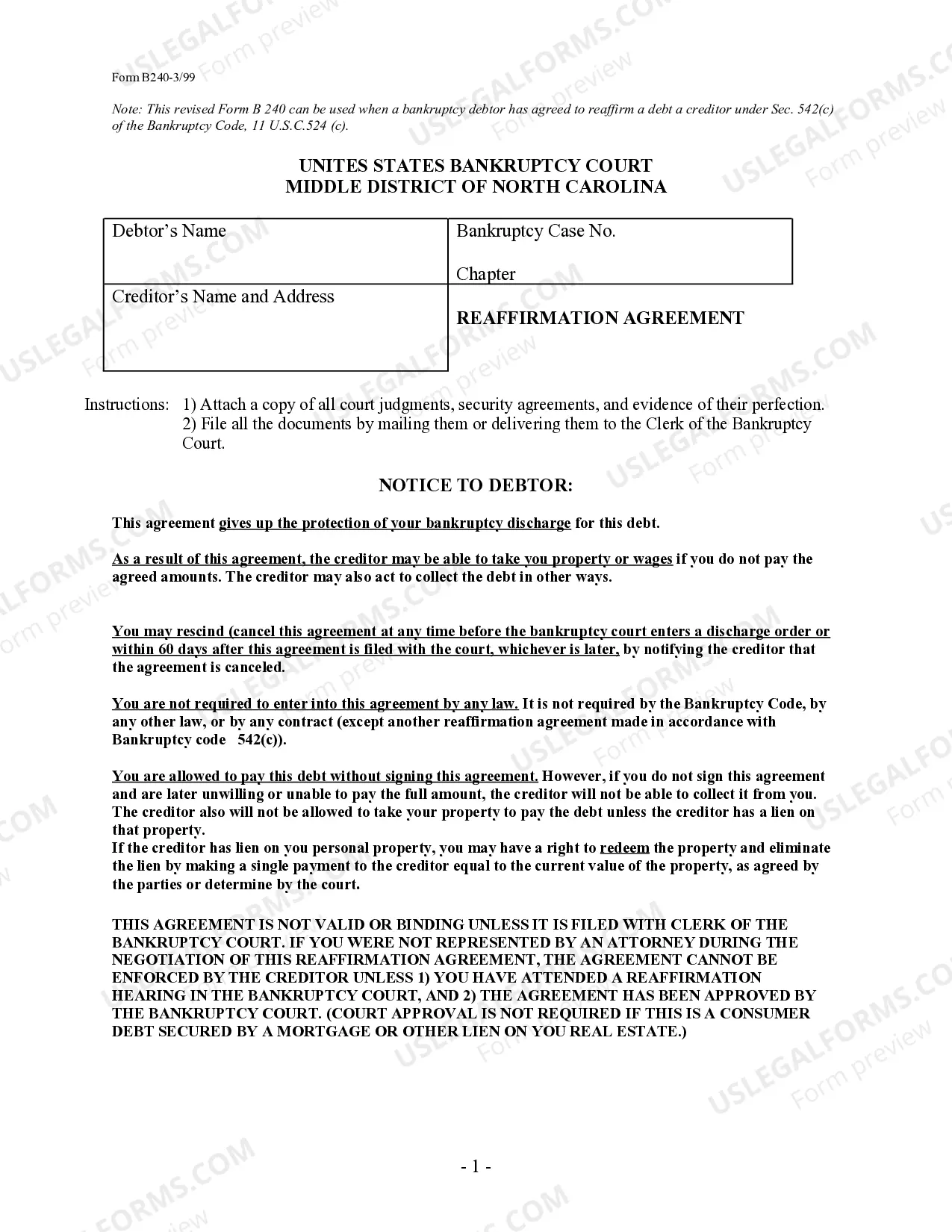

How to fill out Clark Nevada Deed Conveying Property To Charity With Reservation Of Life Estate?

Laws and regulations in every area differ from state to state. If you're not an attorney, it's easy to get lost in various norms when it comes to drafting legal documentation. To avoid high priced legal assistance when preparing the Clark Deed Conveying Property to Charity with Reservation of Life Estate, you need a verified template legitimate for your county. That's when using the US Legal Forms platform is so helpful.

US Legal Forms is a trusted by millions online catalog of more than 85,000 state-specific legal templates. It's a perfect solution for specialists and individuals searching for do-it-yourself templates for different life and business occasions. All the forms can be used many times: once you obtain a sample, it remains available in your profile for further use. Thus, when you have an account with a valid subscription, you can just log in and re-download the Clark Deed Conveying Property to Charity with Reservation of Life Estate from the My Forms tab.

For new users, it's necessary to make a few more steps to obtain the Clark Deed Conveying Property to Charity with Reservation of Life Estate:

- Analyze the page content to make sure you found the appropriate sample.

- Take advantage of the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your requirements.

- Utilize the Buy Now button to get the template when you find the proper one.

- Opt for one of the subscription plans and log in or sign up for an account.

- Choose how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the file in and click Download.

- Complete and sign the template on paper after printing it or do it all electronically.

That's the easiest and most cost-effective way to get up-to-date templates for any legal purposes. Find them all in clicks and keep your paperwork in order with the US Legal Forms!