A Franklin Ohio Deed Conveying Property to Charity with Reservation of Life Estate is a legal document that transfers ownership of a property in Franklin, Ohio, to a charitable organization, while allowing the original owner to retain a life estate. This type of deed is commonly used when individuals wish to support philanthropic causes while still benefiting from the property during their lifetime. The "Deed Conveying Property to Charity with Reservation of Life Estate" is designed specifically for individuals in Franklin, Ohio, who wish to donate their property to a charity of their choice. By executing this deed, the property owner can contribute to a cause they feel passionately about, while also securing the right to occupy the property until their death. The reservation of a life estate ensures that the individual retains the right to live on and use the property throughout their lifetime. This means they can continue to reside in the house, receive rental income from tenants, or utilize the property for any other lawful purpose. However, upon the individual's passing, ownership of the property is automatically transferred to the designated charitable organization. Different types of Franklin Ohio Deed Conveying Property to Charity with Reservation of Life Estate may include variations in the specific terms and conditions outlined in the deed. These variations may depend on factors such as the nature of the property, the chosen charitable organization, and the individual's specific desires for the property's use after their death. Some key considerations when preparing a Franklin Ohio Deed Conveying Property to Charity with Reservation of Life Estate are the valuation of the property being donated, the tax implications associated with the transfer, and the legal requirements of the state of Ohio regarding charitable transfers and life estates. Seeking professional legal advice from an attorney or legal expert with experience in charitable donations and real estate transactions is highly recommended ensuring compliance with all relevant laws and regulations. In summary, a Franklin Ohio Deed Conveying Property to Charity with Reservation of Life Estate is a legal instrument that transfers ownership of a property to a charitable organization while allowing the original owner to retain the right to live on and use the property until their death. It is an effective way for individuals in Franklin, Ohio, to support philanthropic causes while enjoying the benefits of their property during their lifetime.

Franklin Ohio Deed Conveying Property to Charity with Reservation of Life Estate

Description

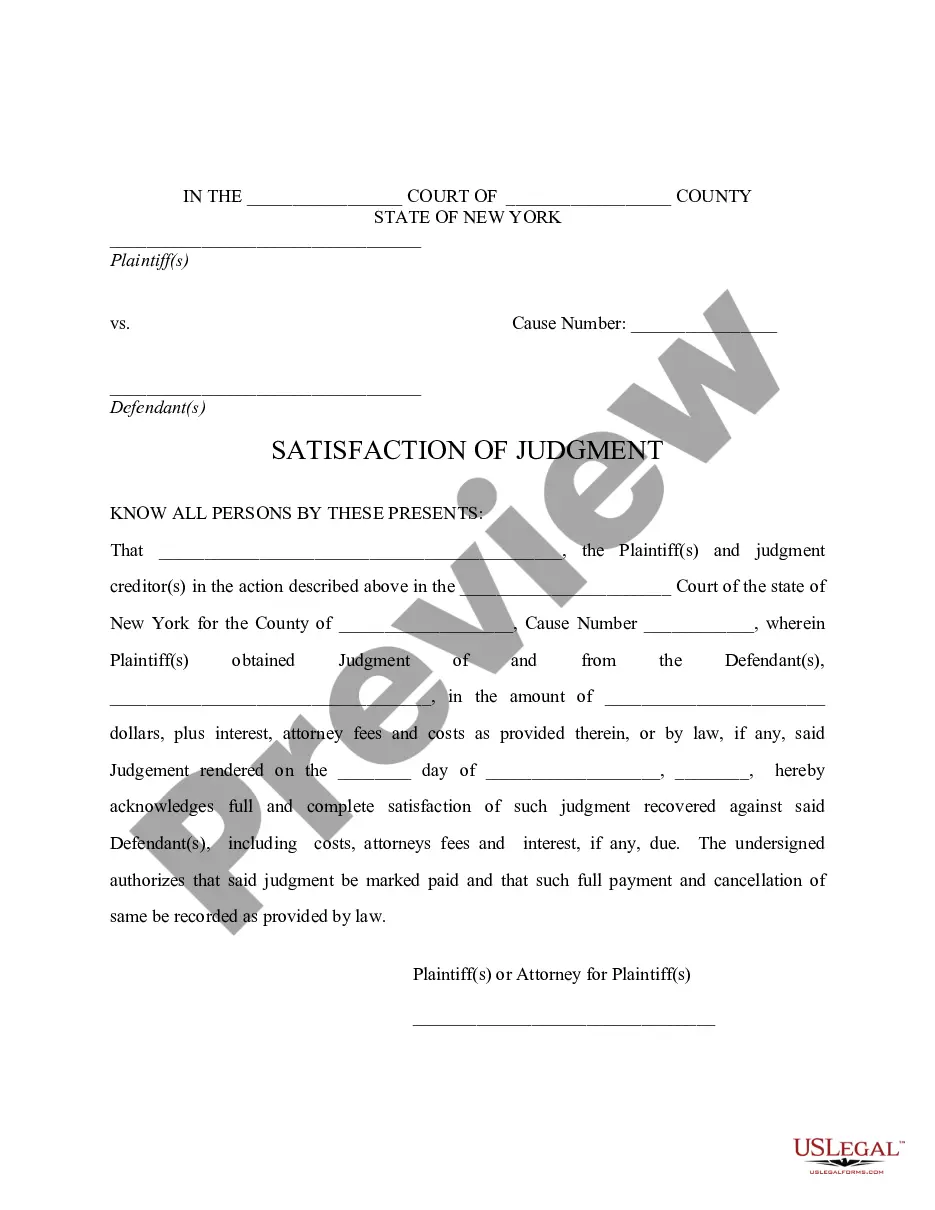

How to fill out Franklin Ohio Deed Conveying Property To Charity With Reservation Of Life Estate?

How much time does it typically take you to draft a legal document? Since every state has its laws and regulations for every life sphere, locating a Franklin Deed Conveying Property to Charity with Reservation of Life Estate suiting all local requirements can be tiring, and ordering it from a professional attorney is often pricey. Numerous web services offer the most popular state-specific documents for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most extensive web collection of templates, grouped by states and areas of use. Apart from the Franklin Deed Conveying Property to Charity with Reservation of Life Estate, here you can find any specific document to run your business or individual affairs, complying with your county requirements. Specialists check all samples for their validity, so you can be sure to prepare your paperwork correctly.

Using the service is pretty simple. If you already have an account on the platform and your subscription is valid, you only need to log in, select the required form, and download it. You can get the document in your profile anytime in the future. Otherwise, if you are new to the platform, there will be some extra steps to complete before you obtain your Franklin Deed Conveying Property to Charity with Reservation of Life Estate:

- Check the content of the page you’re on.

- Read the description of the sample or Preview it (if available).

- Look for another document using the corresponding option in the header.

- Click Buy Now once you’re certain in the chosen document.

- Choose the subscription plan that suits you most.

- Create an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Switch the file format if necessary.

- Click Download to save the Franklin Deed Conveying Property to Charity with Reservation of Life Estate.

- Print the sample or use any preferred online editor to complete it electronically.

No matter how many times you need to use the acquired template, you can locate all the samples you’ve ever downloaded in your profile by opening the My Forms tab. Give it a try!

Form popularity

FAQ

For Medicaid eligibility purposes, the Social Security Life Expectancy table is used to value the life estate and remainder interest. Pursuant to IRC ' 2702 if the homestead is transferred to a non-family member, the use of a traditional life estate will result in a completed gift of the remainder interest.

When you create a life estate, a gift is automatically made to your children. The gift is known as the remainder interest. This gift disqualifies you for medical assistance (help with nursing home bills) for the then applicable "look back" period.

A retained life interest, or retained life estate as it is commonly called, allows a donor to claim a charitable deduction at the present time for the gift of the remainder value of real property donated to charity. The transfer of a personal residence, second home, or farm qualifies for a retained life estate.

The major forms of legal life estate are the homestead, dower and curtesy, and elective share.

Life estate cons The life tenant cannot change the remainder beneficiary without their consent. If the life tenant applies for any loans, they cannot use the life estate property as collateral. There's no creditor protection for the remainderman.You can't minimize estate tax.

The transfer by deed of the residence with a retained life estate will therefore be taxed for gift tax purposes at the fair market value of the entire residence, without reduction for the value of the retained life estate and without the annual $10,000 exclusion.

Advantages of a Life Estate Cost and Ease: A life estate is simple and inexpensive to establish. Transferring title after your death is also quick and easy. Probate Avoidance: Life estates avoid a California probate. When the last surviving Life Tenant dies, the property automatically transfers to your heirs.

What are the pros and cons of life estates? Avoid probate. Possible tax breaks for the life tenant. Reduced capital gains taxes for remainderman after death of life tenant. Capital gains taxes for remainderman if property sold while life tenant still alive. Remainderman's financial problems can affect the life tenant.

Gary Schatsky, a Manhattan financial planner, said it is possible for an individual or couple to give a home to charity and still remain in the home for as long as they live.

A life estate helps avoid the probate process upon the life tenant's death. The property will automatically transfer to the remainderman, making the process simple and easy a will isn't needed for the transfer to happen.