A Maricopa Arizona Deed Conveying Property to Charity with Reservation of Life Estate is a legal document that transfers real property ownership from an individual or entity to a charitable organization while reserving the right for the granter (person transferring the property) to retain a life estate. This means that the granter can continue to occupy and use the property during their lifetime. The purpose of this type of deed is to allow individuals to make a charitable contribution while still maintaining the right to use and enjoy the property until their death. Maricopa County, Arizona, offers various types of deeds for conveying property to charity with the reservation of a life estate, each serving specific purposes. One type is the Charitable Remainder Trust Deed, where the granter transfers the property to a trust, and the trust's income benefits the granter during their lifetime. After the granter's death, the remaining property proceeds are donated to the designated charity or charities. Another type is the Charitable Lead Trust Deed, which functions similarly to the Charitable Remainder Trust Deed but focuses on providing income to the charitable organization during the granter's life, with the remaining property passing to heirs or other beneficiaries upon the granter's death. The Maricopa Arizona Deed Conveying Property to Charity with Reservation of Life Estate offers several benefits. It allows individuals to support charitable causes while retaining their right to use and enjoy the property for the rest of their lives. Additionally, it can potentially provide tax advantages such as income tax deductions and avoidance of capital gains taxes. To execute this type of deed, it is crucial to consult with an attorney who specializes in estate planning and charitable giving. They can guide individuals through the necessary legal processes and ensure that the transaction aligns with state and federal laws. It is also essential to choose a reputable charitable organization that aligns with the granter's philanthropic goals. In conclusion, a Maricopa Arizona Deed Conveying Property to Charity with Reservation of Life Estate is a powerful tool for individuals looking to contribute to charitable causes while retaining their right to use and reside on the property during their lifetime. By exploring the various types of deeds available and seeking professional guidance, individuals can create a lasting impact on their community and support causes close to their heart.

Maricopa Arizona Deed Conveying Property to Charity with Reservation of Life Estate

Description

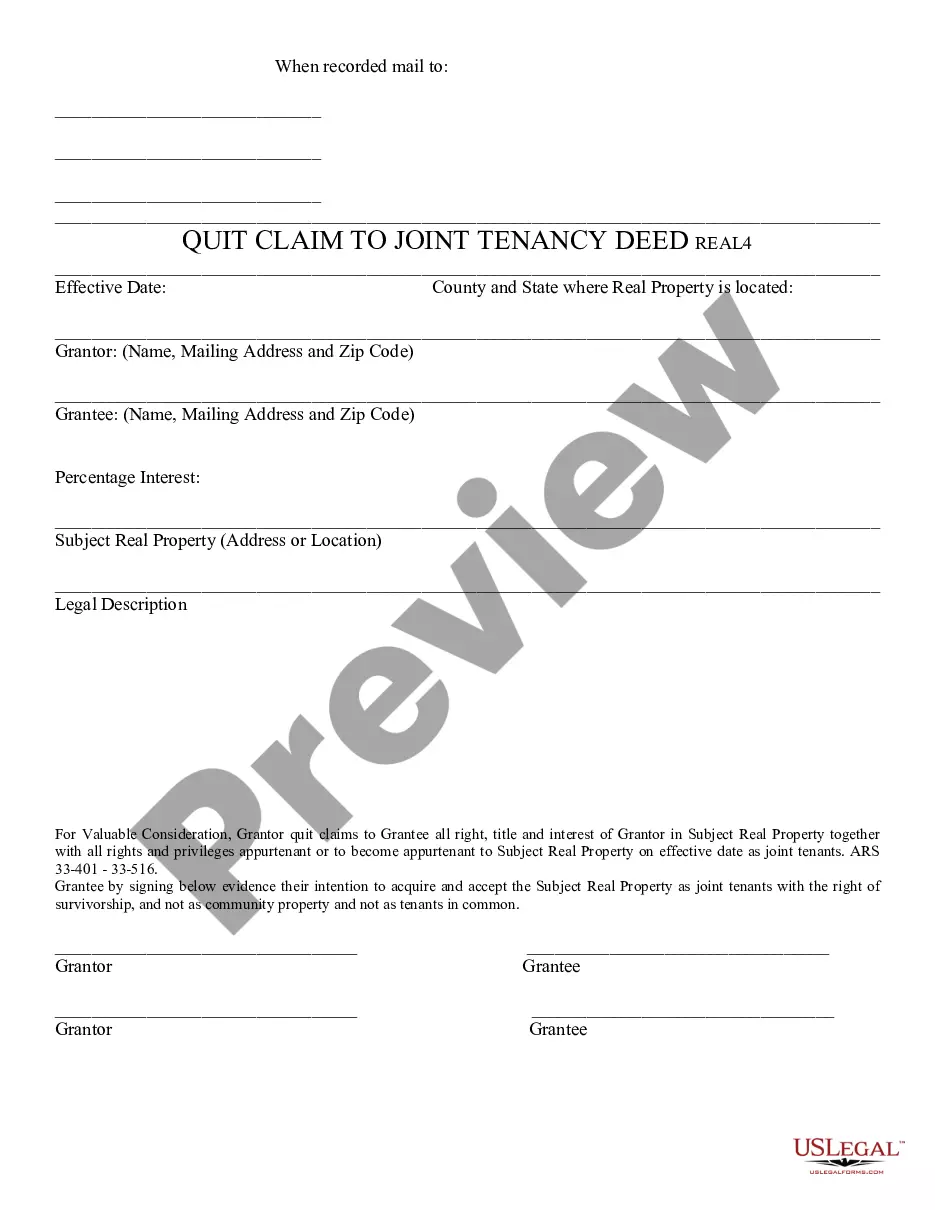

How to fill out Maricopa Arizona Deed Conveying Property To Charity With Reservation Of Life Estate?

Creating forms, like Maricopa Deed Conveying Property to Charity with Reservation of Life Estate, to take care of your legal matters is a tough and time-consumming process. Many situations require an attorney’s involvement, which also makes this task expensive. However, you can take your legal matters into your own hands and take care of them yourself. US Legal Forms is here to save the day. Our website comes with over 85,000 legal documents crafted for various scenarios and life situations. We make sure each form is compliant with the regulations of each state, so you don’t have to worry about potential legal problems compliance-wise.

If you're already familiar with our services and have a subscription with US, you know how straightforward it is to get the Maricopa Deed Conveying Property to Charity with Reservation of Life Estate template. Simply log in to your account, download the form, and personalize it to your requirements. Have you lost your form? Don’t worry. You can find it in the My Forms tab in your account - on desktop or mobile.

The onboarding process of new customers is fairly simple! Here’s what you need to do before downloading Maricopa Deed Conveying Property to Charity with Reservation of Life Estate:

- Ensure that your document is specific to your state/county since the regulations for creating legal papers may differ from one state another.

- Discover more information about the form by previewing it or reading a brief intro. If the Maricopa Deed Conveying Property to Charity with Reservation of Life Estate isn’t something you were looking for, then use the header to find another one.

- Log in or register an account to start utilizing our website and get the document.

- Everything looks good on your end? Hit the Buy now button and choose the subscription option.

- Pick the payment gateway and enter your payment information.

- Your form is good to go. You can go ahead and download it.

It’s easy to find and purchase the needed template with US Legal Forms. Thousands of businesses and individuals are already benefiting from our extensive library. Sign up for it now if you want to check what other perks you can get with US Legal Forms!