A Riverside California Deed Conveying Property to Charity with Reservation of Life Estate is a legal document that transfers ownership of a property to a charitable organization while reserving the right to live on the property for the rest of the granter's life. This type of deed enables the granter to contribute to a charitable cause while still retaining the use and enjoyment of their property during their lifetime. It offers potential tax benefits and allows the granter to support a cause close to their heart. There are different variations of the Riverside California Deed Conveying Property to Charity with Reservation of Life Estate, each catering to specific circumstances and goals: 1. Charitable Remainder Trust (CRT): This type of deed allows the granter to transfer the property to a trust, which will provide income to the granter or other beneficiaries for a specific term or until death. Afterward, the remaining assets are directed to the designated charity. 2. Charitable Lead Trust (CLT): In this scenario, the property ownership is transferred to a trust that pays income to the charity for a predetermined period. Once the period ends, the property is returned to the granter or passes to other beneficiaries specified in the deed. 3. Charitable Gift Annuity (CGA): This type of deed involves the transfer of the property to a charity in exchange for a lifetime annuity paid to the granter. The annuity amount is calculated based on factors such as the granter's age and the property's value. 4. Pooled Income Fund (PIF): With a PIF, the granter donates the property to a fund managed by the charitable organization. The fund combines multiple donations and invests them to generate income. The granter and other beneficiaries receive a share of the fund's income for life, and upon their passing, the remaining assets are distributed to the charity. Riverside California Deeds Conveying Property to Charity with Reservation of Life Estate accommodate various estate planning goals and offer a means for individuals to support charitable causes while still retaining the right to reside on their property. It is crucial to consult with legal professionals experienced in estate planning and charitable giving to determine the most suitable option based on individual circumstances and objectives.

Riverside California Deed Conveying Property to Charity with Reservation of Life Estate

Description

How to fill out Riverside California Deed Conveying Property To Charity With Reservation Of Life Estate?

Creating legal forms is a necessity in today's world. Nevertheless, you don't always need to look for qualified assistance to draft some of them from scratch, including Riverside Deed Conveying Property to Charity with Reservation of Life Estate, with a platform like US Legal Forms.

US Legal Forms has over 85,000 forms to choose from in different categories varying from living wills to real estate paperwork to divorce documents. All forms are organized according to their valid state, making the searching experience less challenging. You can also find detailed resources and tutorials on the website to make any activities related to document completion straightforward.

Here's how to purchase and download Riverside Deed Conveying Property to Charity with Reservation of Life Estate.

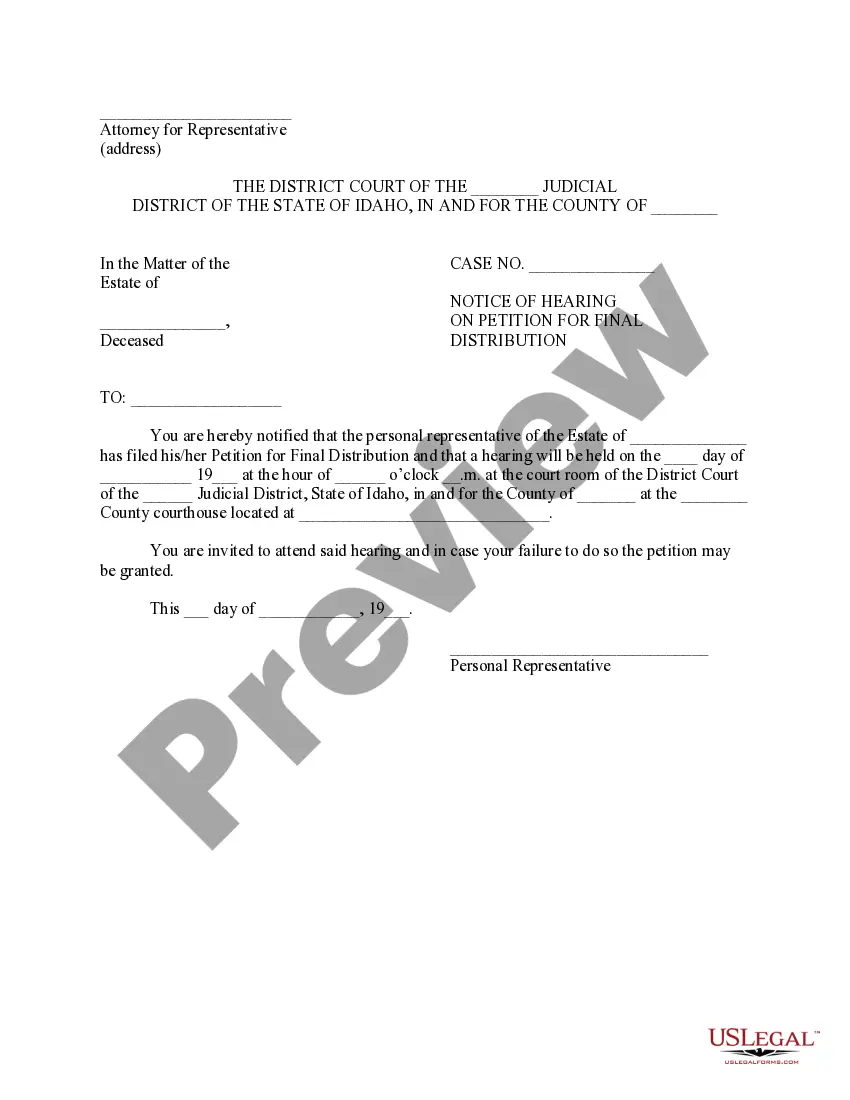

- Take a look at the document's preview and description (if provided) to get a basic information on what you’ll get after getting the form.

- Ensure that the template of your choice is specific to your state/county/area since state regulations can affect the validity of some records.

- Examine the similar forms or start the search over to find the right document.

- Hit Buy now and register your account. If you already have an existing one, select to log in.

- Choose the pricing {plan, then a suitable payment gateway, and purchase Riverside Deed Conveying Property to Charity with Reservation of Life Estate.

- Select to save the form template in any available file format.

- Visit the My Forms tab to re-download the document.

If you're already subscribed to US Legal Forms, you can find the needed Riverside Deed Conveying Property to Charity with Reservation of Life Estate, log in to your account, and download it. Needless to say, our platform can’t replace a legal professional completely. If you need to cope with an extremely difficult case, we recommend using the services of an attorney to check your form before executing and filing it.

With over 25 years on the market, US Legal Forms proved to be a go-to platform for many different legal forms for millions of users. Become one of them today and get your state-compliant paperwork effortlessly!