Title: Contra Costa California Sample Letter for Distribution of Estate Assets: A Comprehensive Guide for Executors Introduction: Being entrusted as an executor of an estate in Contra Costa County, California is a significant responsibility. After fulfilling the necessary legal and administrative obligations, the next crucial step is the distribution of estate assets to the rightful beneficiaries. This article aims to provide a detailed description of the Contra Costa California Sample Letter for Distribution of Estate Assets, along with different types of distribution letters that may be required. Content: 1. Understanding the Contra Costa California Sample Letter for Distribution of Estate Assets: — Exploring the Purpose and Importance: A distribution letter acts as the official communication from the executor to the beneficiaries, outlining the asset distribution plan in accordance with the decedent's will and California probate laws. — Components of a Distribution Letter: Highlight the necessary details that should be included in the letter, such as the executor's contact information, deceased individual's name, date of death, beneficiary names, their respective shares, and a comprehensive listing of identifiable assets. — Tailoring the Distribution Plan: Emphasize the executor's role in ensuring a fair and equitable distribution plan while considering any specific instructions or conditions outlined in the will. — Clear Explanation of Distribution Process: Explain the steps involved in collecting and distributing assets, including valuing assets, resolving outstanding debts, and obtaining necessary appraisals or court approvals. — Timelines and Potential Challenges: Discuss the importance of adhering to the legal timelines for asset distribution while addressing any potential challenges that may arise during the process. 2. Types of Contra Costa California Sample Letters for Distribution of Estate Assets: — Interim Distribution Letter: This letter is used when the executor decides to distribute a portion of the estate assets before the finalization of the entire estate administration process. — Final Distribution Letter: This letter is sent when all outstanding obligations, debts, and claims against the estate are settled, and the remaining assets are ready for distribution as per the will. — Partial Distribution Letter: In situations where specific bequests or partial distributions are allowed by law, this letter is sent to communicate the partial distribution of certain assets to beneficiaries. — Residuary Distribution Letter: This letter outlines the distribution plan for assets that remain after specific bequests and debts are settled, distributing the remainder as per the residuary clause of the will. Conclusion: Executing the distribution of estate assets in Contra Costa, California involves careful planning and adherence to legal requirements and timelines. Providing beneficiaries with a well-crafted and detailed Contra Costa California Sample Letter for Distribution of Estate Assets ensures transparency, accountability, and the smooth transfer of assets according to the decedent's wishes. Executors must understand the types of distribution letters and tailor them accordingly, ensuring a fair and lawful asset distribution process.

Contra Costa California Sample Letter for Distribution of Estate Assets

Description

How to fill out Contra Costa California Sample Letter For Distribution Of Estate Assets?

Drafting paperwork for the business or personal demands is always a huge responsibility. When creating a contract, a public service request, or a power of attorney, it's essential to consider all federal and state laws of the particular area. However, small counties and even cities also have legislative provisions that you need to consider. All these details make it tense and time-consuming to create Contra Costa Sample Letter for Distribution of Estate Assets without professional assistance.

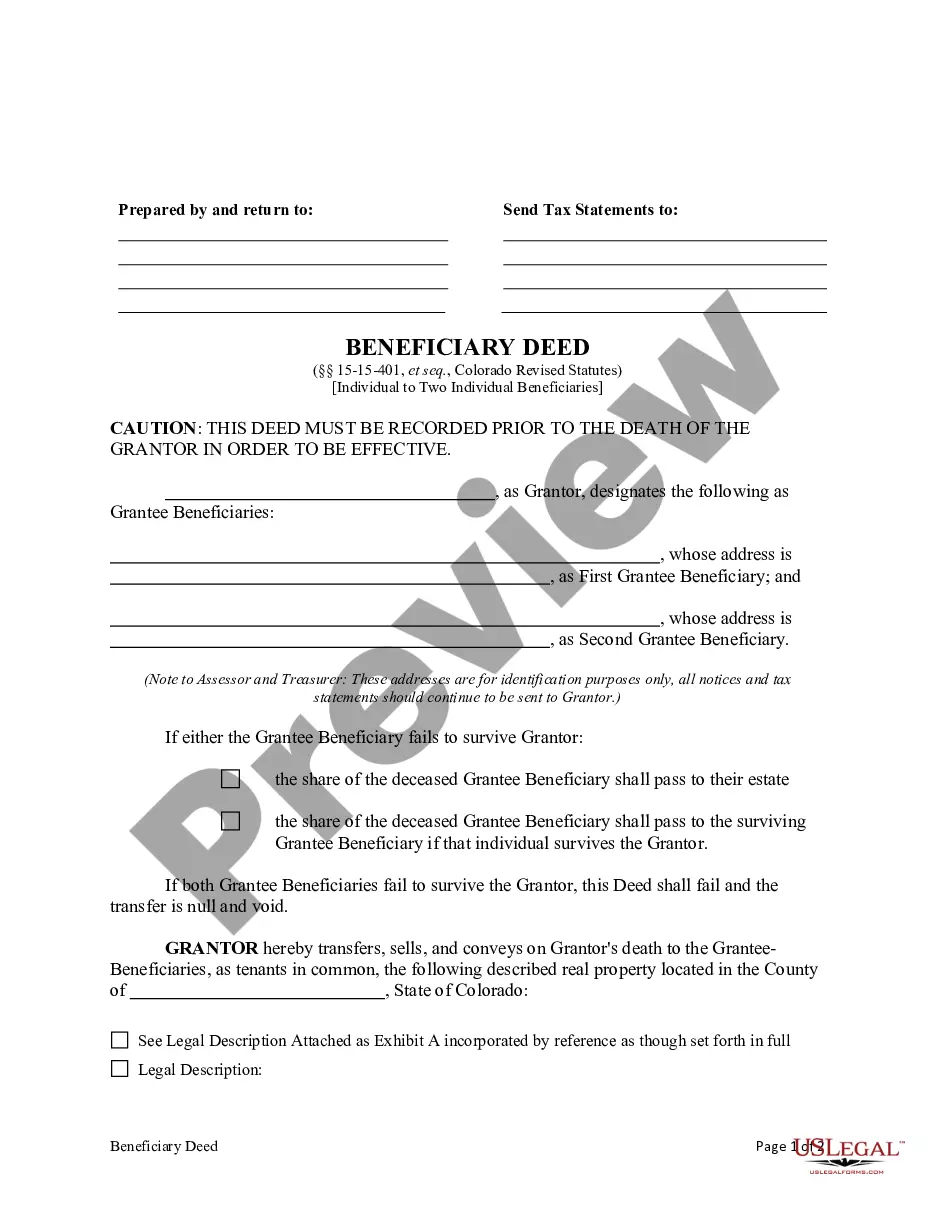

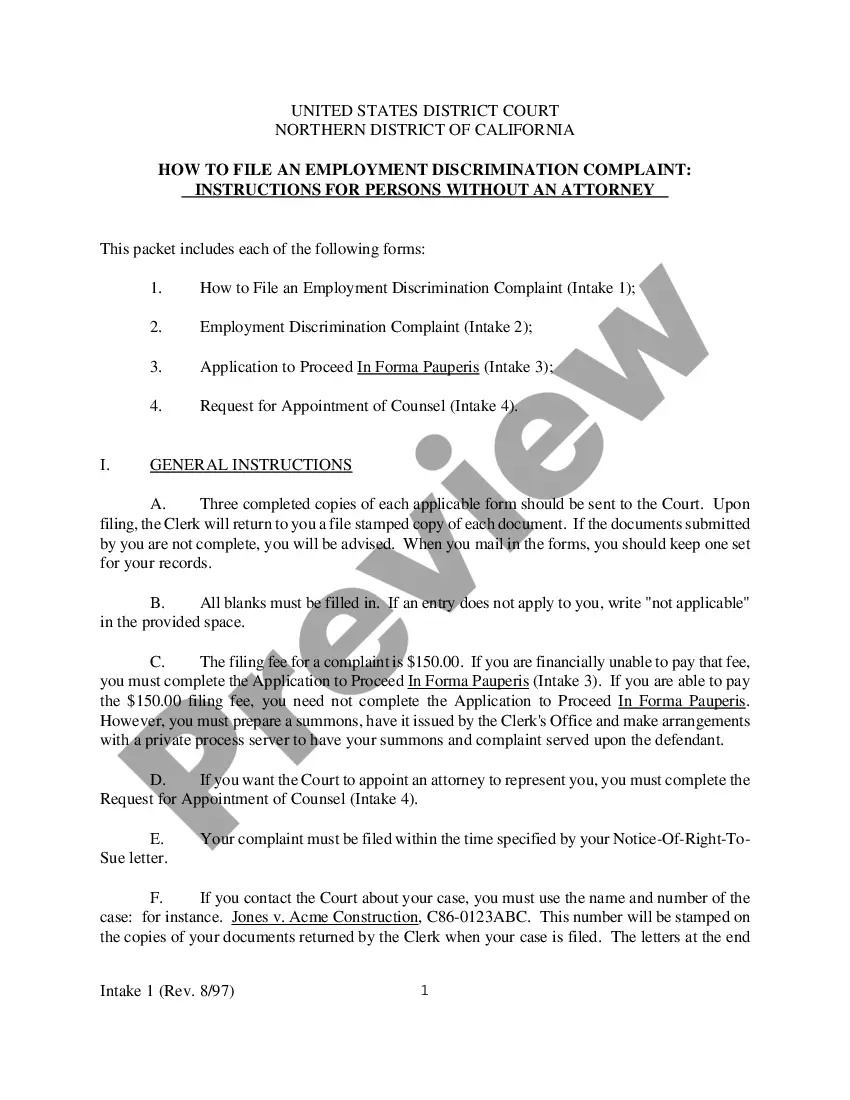

It's possible to avoid spending money on attorneys drafting your paperwork and create a legally valid Contra Costa Sample Letter for Distribution of Estate Assets on your own, using the US Legal Forms web library. It is the largest online catalog of state-specific legal templates that are professionally cheched, so you can be certain of their validity when selecting a sample for your county. Previously subscribed users only need to log in to their accounts to download the needed form.

If you still don't have a subscription, follow the step-by-step guideline below to get the Contra Costa Sample Letter for Distribution of Estate Assets:

- Look through the page you've opened and verify if it has the sample you require.

- To accomplish this, use the form description and preview if these options are available.

- To find the one that suits your requirements, utilize the search tab in the page header.

- Recheck that the sample complies with juridical criteria and click Buy Now.

- Choose the subscription plan, then log in or create an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the selected file in the preferred format, print it, or fill it out electronically.

The exceptional thing about the US Legal Forms library is that all the paperwork you've ever acquired never gets lost - you can access it in your profile within the My Forms tab at any moment. Join the platform and easily get verified legal templates for any use case with just a few clicks!

Form popularity

FAQ

State deciding the distribution rules Although state laws dictate the exact process, generally the people in your bloodline will get the preference. In other words, spouse, children, parents, and siblings are in line to receive your assets. Friends and charities get nothing.

You should wait 10 months before distributing the estate because claimants who want to challenge a Will have six months from the issue of a Grant of Probate to bring a claim under the Inheritance (Provision for Family and Dependants) Act 1975 (the Act).

After all the assets have been gathered, the estate's creditors have been paid, and taxes have been filed, the Executor or Administrator can begin to make distributions. If there was a Will, the Executor will make the distributions according to the Will.

Most assets can be distributed by preparing a new deed, changing the account title, or by giving the person a deed of distribution. For example: To transfer a bank account to a beneficiary, you will need to provide the bank with a death certificate and letters of administration.

The asset distribution to the descendants of a deceased owner of an estate is determined during the estate planning process. In this process, the owner of the estate identifies all their heirs who are due to receive a portion of the inheritance. The owner lists all the assets that he/she owns.

Paying Debts and Taxes Illinois, for example, requires executors to allow six months. California requires a bit less, with four months.

Giving adult beneficiaries their inheritances in one lump sum is often the simplest way to go because there are no issues of control or access. It's just a matter of timing. The balance of the estate is distributed directly to the beneficiaries after all the decedent's final bills and taxes are paid.

Most Estates are open about a year since the various tasks of paying taxes, selling property, locating heirs, etc, often take that long. At the very least, one can expect six to nine months of time before the Estate can close and if there is litigation outstanding, the Estate can stay open for years.

Executors must not unreasonably delay distributing the estate for their own gain or any other party. However, even after the executor's year, the court will not order a distribution of the estate if the executors can show there is good reason to wait.

How Long Do You Have to File Probate After Death in California? According to the California Probate Code, the executor must file the will within 30 days of the person's death.