A Contra Costa California Loan Agreement for Family Member is a legally binding contract between two individuals within the family, where one member agrees to lend a certain amount of money to another family member. This agreement outlines the terms and conditions of the loan, including the repayment schedule, interest (if any), and consequences for non-payment. In Contra Costa County, California, there are several types of loan agreements for family members that can be used depending on the specific circumstances: 1. Secured Loan Agreement: This agreement involves the borrower securing the loan with collateral, such as property or a valuable asset. In case of non-payment, the lender has the right to claim the collateral as repayment. 2. Unsecured Loan Agreement: In this type of agreement, the loan is not backed by collateral. The borrower is solely responsible for repaying the loan, and if they fail to do so, the lender may have to take legal action to recover the debt. 3. Promissory Note: While not technically a loan agreement, a promissory note is a written promise to repay a debt by a specific date. It includes details such as the loan amount, interest rate, repayment schedule, and any penalties for late payment. 4. Notarized Loan Agreement: This type of loan agreement is notarized, meaning it has been certified by a notary public. This provides an extra level of authenticity and can be especially useful if the loan involves a significant amount of money. 5. Family Loan Agreement with Interest: In some cases, family members may choose to charge interest on the loan, similar to a traditional lending institution. This type of agreement specifies the interest rate and how it will be calculated. When drafting a Contra Costa California Loan Agreement for Family Member, it is important to include vital elements such as the names, addresses, and contact information of both parties, the loan amount, the purpose of the loan, the repayment schedule, any interest rates or fees, and any consequences for default or late payment. Consulting a legal professional is recommended to ensure the agreement complies with local laws and provides appropriate protection for both parties involved.

Contra Costa California Loan Agreement for Family Member

Description

How to fill out Contra Costa California Loan Agreement For Family Member?

Whether you plan to open your business, enter into an agreement, apply for your ID renewal, or resolve family-related legal concerns, you need to prepare specific paperwork corresponding to your local laws and regulations. Locating the correct papers may take a lot of time and effort unless you use the US Legal Forms library.

The service provides users with more than 85,000 professionally drafted and verified legal templates for any personal or business occurrence. All files are collected by state and area of use, so opting for a copy like Contra Costa Loan Agreement for Family Member is fast and easy.

The US Legal Forms website users only need to log in to their account and click the Download key next to the required template. If you are new to the service, it will take you a couple of more steps to obtain the Contra Costa Loan Agreement for Family Member. Follow the guidelines below:

- Make certain the sample fulfills your individual needs and state law regulations.

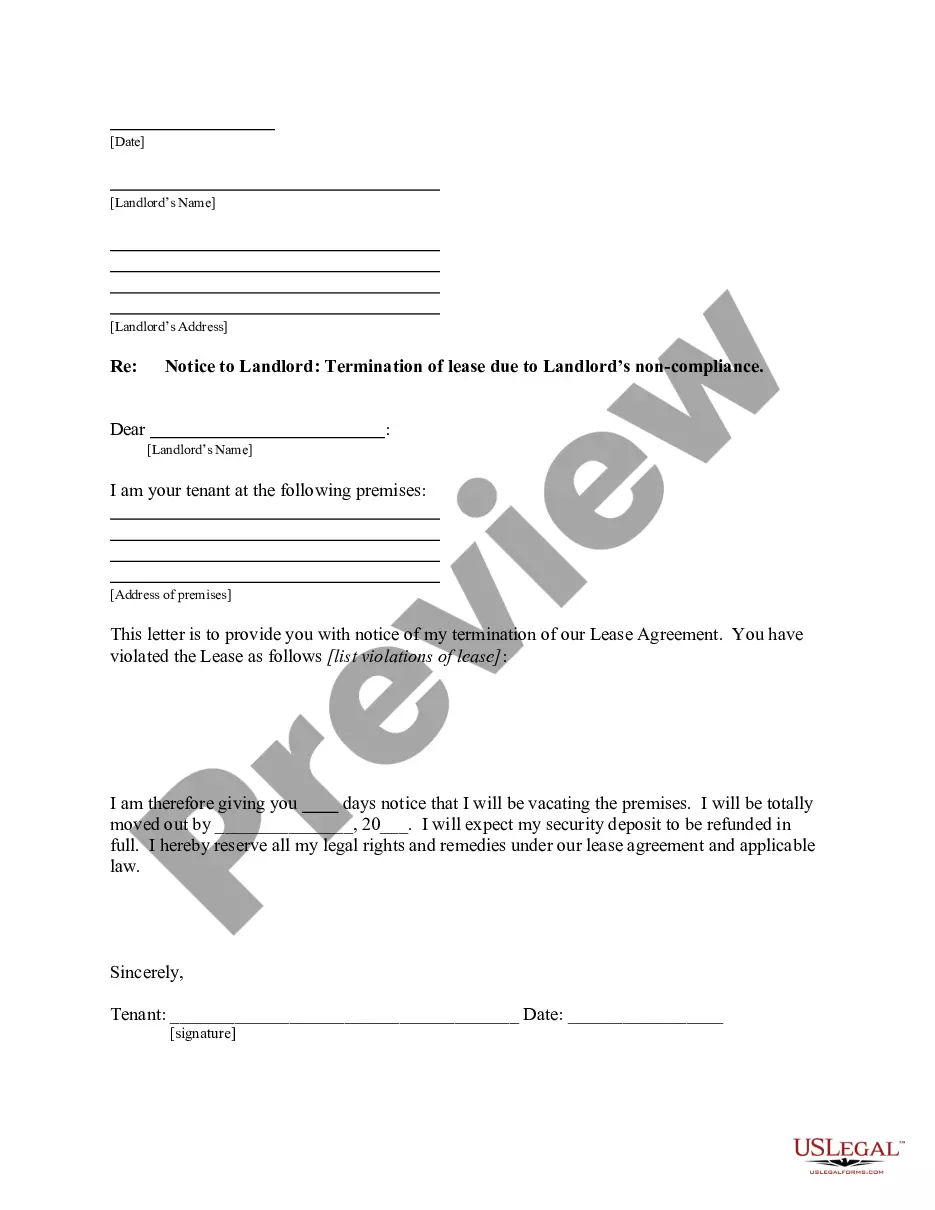

- Look through the form description and check the Preview if there’s one on the page.

- Utilize the search tab providing your state above to find another template.

- Click Buy Now to get the file once you find the correct one.

- Select the subscription plan that suits you most to proceed.

- Log in to your account and pay the service with a credit card or PayPal.

- Download the Contra Costa Loan Agreement for Family Member in the file format you prefer.

- Print the copy or complete it and sign it electronically via an online editor to save time.

Forms provided by our website are multi-usable. Having an active subscription, you can access all of your earlier acquired paperwork whenever you need in the My Forms tab of your profile. Stop wasting time on a constant search for up-to-date official documentation. Join the US Legal Forms platform and keep your paperwork in order with the most comprehensive online form collection!

Form popularity

FAQ

Nothing in the tax law prevents you from making loans to family members (or unrelated people for that matter). However, unless you charge what the IRS considers an adequate interest rate, the so-called below-market loan rules come into play.

At a minimum, the agreement should include the following information: Loan amount ($); The date the money was lent to the borrower; Both the names and addresses of the lender and borrower; The repayment structure for the loan;Whether interest will be charged (and if so, how much interest); and.

To draft a Loan Agreement, you should include the following: The addresses and contact information of all parties involved. The conditions of use of the loan (what the money can be used for) Any repayment options. The payment schedule. The interest rates. The length of the term. Any collateral. The cancellation policy.

A family loan agreement is made between a borrower and lender that are related by blood or marriage. It is set up to be a simple agreement between the parties that outlines the money borrowed and the repayment terms. Generally speaking, interest is not commonly charged between family members.

For a personal loan agreement to be enforceable, it must be documented in writing and signed by both parties. You may choose to keep a copy in your county recorder's office if you wish, though it's not legally necessary. It's sufficient for both parties to store their own copy, ideally in a safe place.

At a minimum, the agreement should include the following information: Loan amount ($); The date the money was lent to the borrower; Both the names and addresses of the lender and borrower; The repayment structure for the loan;Whether interest will be charged (and if so, how much interest); and.

The IRS will deem any forgone interest on an interest-free loan between family members as a gift for federal tax purposes, regardless of how the loans are structured or documented. Interest will be imputed if it is interest-free or at a rate below the AFR.

If you lend money to a family member it is important that you make it clear in writing whether you intend to give the money as a gift or whether you expect the money to be repaid at some time. The written agreement should be signed by both of you.

More info

What happens when you miss a payment? A borrower may stop making their student loan payments for a variety of reasons. The most common is that a borrower no longer needs the borrowed money to pay for their current education. If that is the case, there is no penalty associated with the missed payment; it is simply a delayed payoff. There are some cases where default must occur. Here is the difference between missing a student loan payment versus other kinds of payments. For example, if a borrower is going to graduate school but their parents' finances are unstable, the borrower's parents are liable for paying the entire amount of the loan balance. This means that they could lose their home even if the borrower stops making their overdue payments. Some borrowers with financial emergencies may also be on a repayment plan. If the loan is current, but they could not pay if the emergency did not occur, their loan may need to be deferred by the lender.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.