Dallas Texas Loan Agreement for Investment is a legally binding contract that governs the terms and conditions of a loan granted for investment purposes in Dallas, Texas. This type of loan agreement outlines the obligations and responsibilities of both the lender and borrower involved in an investment transaction. Keywords: Dallas Texas, loan agreement, investment, contract, terms and conditions, obligations, responsibilities, lender, borrower, investment transaction. There are several types of Dallas Texas Loan Agreement for Investment, including: 1. Fixed-Rate Loan Agreement: This type of loan agreement establishes a fixed interest rate that remains constant throughout the loan term. It provides stability for the borrower by ensuring consistent monthly payments, allowing for accurate financial planning. 2. Variable-Rate Loan Agreement: Unlike a fixed-rate loan, a variable-rate loan agreement includes an interest rate that fluctuates over time based on market conditions. This type of loan agreement exposes the borrower to risks associated with interest rate fluctuations, but it also allows for potential savings if rates decrease. 3. Secured Loan Agreement: A secured loan agreement involves collateral, such as property or assets, pledged by the borrower to secure the loan. In the event of default, the lender has the right to seize and sell the collateral to recover the outstanding loan amount. 4. Unsecured Loan Agreement: In contrast to a secured loan agreement, an unsecured loan agreement does not require collateral. Instead, the borrower's creditworthiness and financial history play a significant role in determining loan approval and terms. The lender faces higher risk in this type of agreement. 5. Bridge Loan Agreement: A bridge loan agreement provides short-term financing to bridge the gap between the purchase of an investment property and the sale of another property. It allows investors to quickly secure the funds needed for a new investment while awaiting the completion of a previous one. 6. Construction Loan Agreement: This type of loan agreement is specifically tailored for investment projects involving the construction or renovation of properties. The loan amount is disbursed in stages or draws as construction milestones are achieved. 7. Mezzanine Loan Agreement: Mezzanine loans are a hybrid of debt and equity financing. This agreement is often utilized to support investment transactions involving high-risk ventures or projects. It gives the lender the right to convert the loan into equity ownership if the borrower fails to meet repayment obligations. Dallas Texas Loan Agreement for Investment plays a crucial role in facilitating investment opportunities and establishing the legal framework for loan transactions. It is essential for both lenders and borrowers to thoroughly review and understand the terms and conditions outlined in the agreement before entering into an investment-based loan.

Dallas Texas Loan Agreement for Investment

Description

How to fill out Dallas Texas Loan Agreement For Investment?

Drafting documents for the business or personal demands is always a huge responsibility. When drawing up an agreement, a public service request, or a power of attorney, it's important to consider all federal and state laws of the particular area. Nevertheless, small counties and even cities also have legislative provisions that you need to consider. All these aspects make it burdensome and time-consuming to generate Dallas Loan Agreement for Investment without professional help.

It's possible to avoid wasting money on lawyers drafting your paperwork and create a legally valid Dallas Loan Agreement for Investment on your own, using the US Legal Forms online library. It is the most extensive online collection of state-specific legal documents that are professionally cheched, so you can be certain of their validity when picking a sample for your county. Previously subscribed users only need to log in to their accounts to save the required document.

In case you still don't have a subscription, adhere to the step-by-step guideline below to get the Dallas Loan Agreement for Investment:

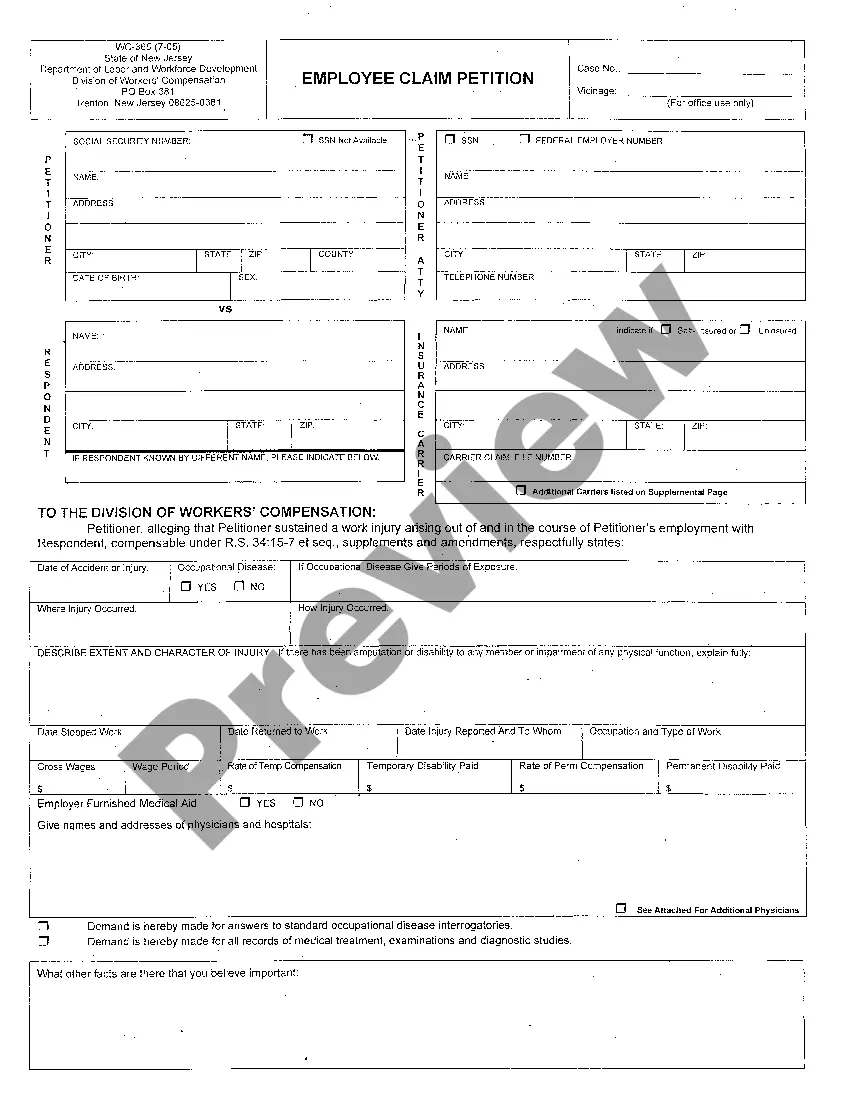

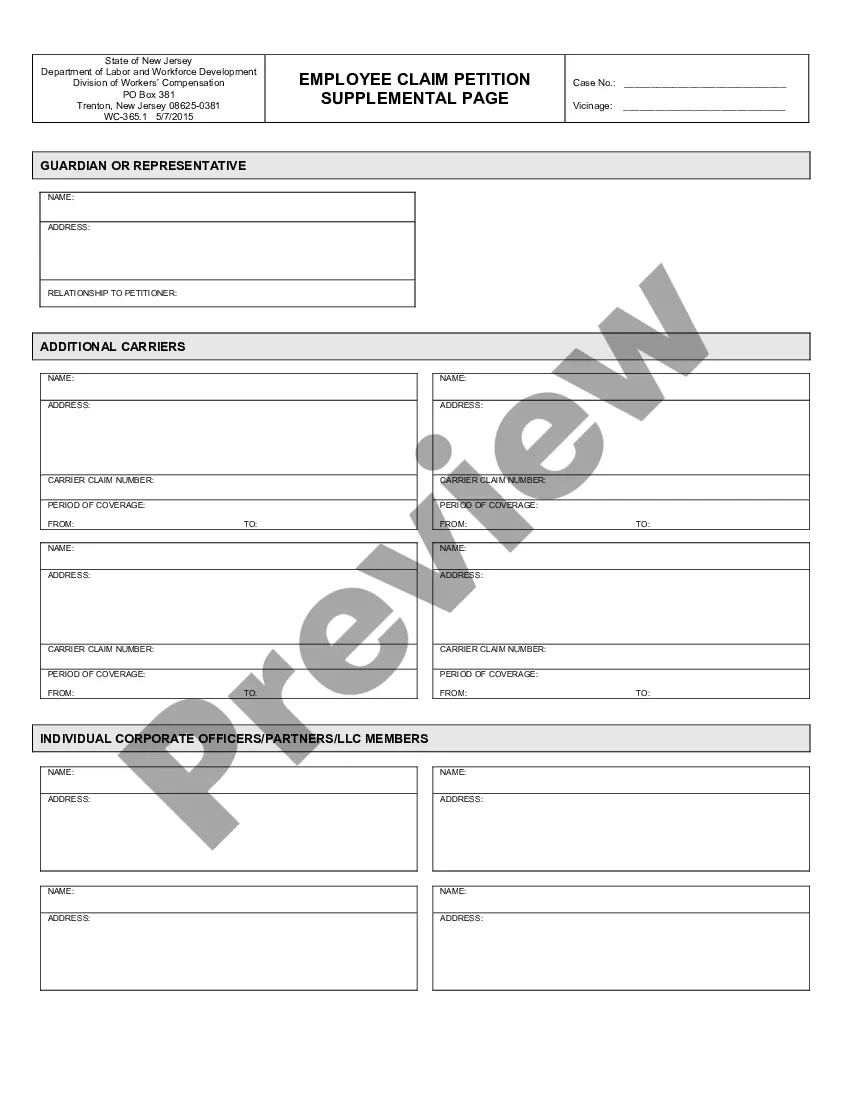

- Examine the page you've opened and check if it has the document you require.

- To achieve this, use the form description and preview if these options are available.

- To find the one that fits your needs, utilize the search tab in the page header.

- Recheck that the sample complies with juridical criteria and click Buy Now.

- Select the subscription plan, then sign in or register for an account with the US Legal Forms.

- Use your credit card or PayPal account to pay for your subscription.

- Download the chosen document in the preferred format, print it, or complete it electronically.

The great thing about the US Legal Forms library is that all the paperwork you've ever purchased never gets lost - you can access it in your profile within the My Forms tab at any moment. Join the platform and quickly obtain verified legal forms for any situation with just a few clicks!