The King Washington Loan Agreement for Investment is a comprehensive financial contract that outlines the terms and conditions between a lender and a borrower who seek financial assistance in their investment endeavors. This loan agreement facilitates the provision of funds by the lender to the borrower, enabling the borrower to pursue various investment opportunities. This binding agreement serves as a legal document defining the rights, responsibilities, and obligations of both parties involved. It ensures transparency and establishes a mutual understanding regarding the loan proceedings and investment objectives. The King Washington Loan Agreement for Investment acts as a safeguard for both the lender and the borrower, offering a reliable framework to govern the financial transactions related to the investment venture. There are different types of King Washington Loan Agreements for Investment, each catering to specific investment scenarios. These variations include: 1. Secured Loan Agreement: This type of loan agreement requires the borrower to provide collateral as security against the loan amount. The collateral could be in the form of real estate, stocks, or other valuable assets. In case of default, the lender has the right to seize the collateral to recover the loan amount. 2. Unsecured Loan Agreement: Unlike the secured loan agreement, an unsecured loan agreement does not necessitate collateral. This type of agreement is typically based on the borrower's creditworthiness, and the lender relies on the borrower's reputation and financial history. 3. Term Loan Agreement: This loan agreement specifies a fixed loan term, during which the borrower is expected to repay the loan amount along with the agreed-upon interest. The terms can range from a few months to several years, depending on the nature of the investment and the borrower's financial capacity. 4. Revolving Loan Agreement: In this type of agreement, the lender provides a predetermined credit limit to the borrower which can be utilized repeatedly. The borrower can withdraw funds up to the specified limit, repay the borrowed amount, and withdraw again, similar to a revolving line of credit. 5. Bridge Loan Agreement: Bridge loans are short-term loans that bridge the gap between the borrower's immediate financial need and a long-term funding solution. This type of agreement allows the borrower to proceed with an investment before securing permanent financing. 6. Mezzanine Loan Agreement: Mezzanine loans are a mix of debt and equity financing. They provide the lender a conditional right to convert their loan amount into an ownership or equity stake in the borrower's company if certain conditions are met, like the company's future success or an IPO. Overall, the King Washington Loan Agreement for Investment ensures a structured and legal framework for lenders and borrowers engaging in investment ventures. It offers various options based on the borrower's requirements and financial circumstances, allowing them to choose the most suitable loan agreement type for their specific investment needs.

King Washington Loan Agreement for Investment

Description

How to fill out King Washington Loan Agreement For Investment?

Whether you plan to open your company, enter into a contract, apply for your ID renewal, or resolve family-related legal issues, you need to prepare certain paperwork corresponding to your local laws and regulations. Locating the right papers may take a lot of time and effort unless you use the US Legal Forms library.

The platform provides users with more than 85,000 expertly drafted and verified legal templates for any personal or business occurrence. All files are collected by state and area of use, so opting for a copy like King Loan Agreement for Investment is quick and easy.

The US Legal Forms library users only need to log in to their account and click the Download key next to the required form. If you are new to the service, it will take you a few more steps to get the King Loan Agreement for Investment. Follow the guide below:

- Make sure the sample fulfills your personal needs and state law regulations.

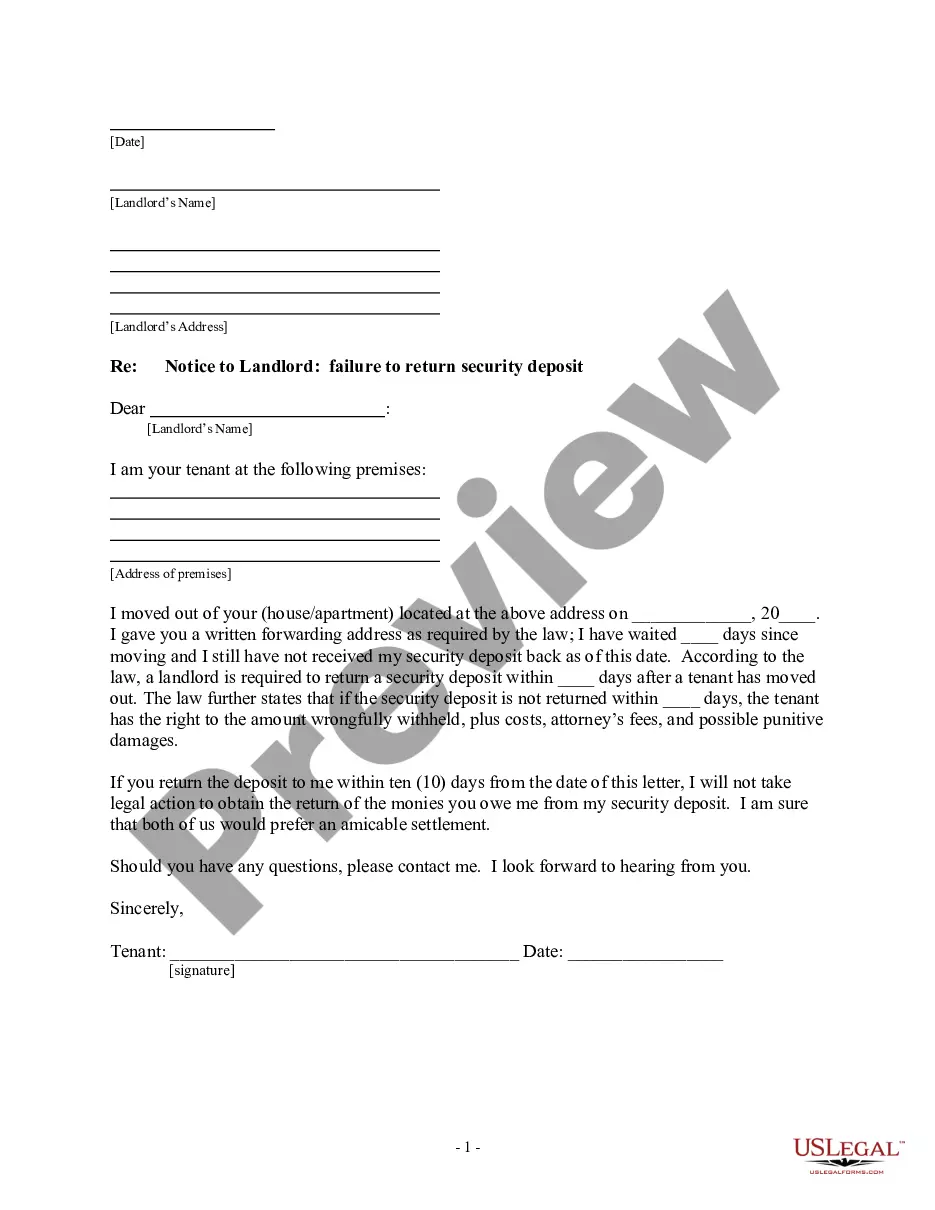

- Read the form description and check the Preview if there’s one on the page.

- Make use of the search tab specifying your state above to find another template.

- Click Buy Now to get the file once you find the proper one.

- Select the subscription plan that suits you most to proceed.

- Sign in to your account and pay the service with a credit card or PayPal.

- Download the King Loan Agreement for Investment in the file format you need.

- Print the copy or fill it out and sign it electronically via an online editor to save time.

Documents provided by our library are multi-usable. Having an active subscription, you can access all of your earlier acquired paperwork at any moment in the My Forms tab of your profile. Stop wasting time on a constant search for up-to-date official documentation. Join the US Legal Forms platform and keep your paperwork in order with the most comprehensive online form collection!