Orange California Loan Agreement for Investment is a legal contract between a lender and a borrower, specifically designed for investment purposes in the Orange County, California area. It outlines the terms, conditions, and obligations associated with lending money for investment purposes. Keywords: Orange California, Loan Agreement, Investment, lender, borrower, terms, conditions, obligations, money. There are various types of Orange California Loan Agreements for Investment, each serving different purposes and catering to specific investment needs. Here are some notable types: 1. Real Estate Investment Loan Agreement: This type of loan agreement is tailored for individuals or businesses looking to invest in real estate properties in Orange County, California. It includes terms related to property acquisition, maintenance, rental income sharing, and profit distribution. 2. Small Business Investment Loan Agreement: This loan agreement caters to entrepreneurs and small business owners seeking financial support to start or expand their businesses in Orange County, California. It may include provisions related to business plans, repayment schedules, interest rates, and collateral. 3. Startup Investment Loan Agreement: Startups in Orange County, California may enter into this type of loan agreement to secure funding for their early-stage operations. It typically outlines the terms regarding equity shares, milestones, exit strategies, and intellectual property rights. 4. Venture Capital Investment Loan Agreement: Venture capitalists and angel investors use this loan agreement to fund high-growth potential businesses in Orange County, California. It includes terms pertaining to funding rounds, equity ownership, management control, and exit strategies. 5. Green Investment Loan Agreement: This loan agreement focuses on financing environmentally friendly and sustainable projects in Orange County, California. It may cover renewable energy installations, energy-efficient building upgrades, or green technology advancements. 6. Personal Investment Loan Agreement: Individuals looking to invest their personal savings in various investment opportunities can use this type of loan agreement. Terms may include interest rates, repayment periods, and investment performance expectations. Regardless of the specific type, Orange California Loan Agreements for Investment protect the rights and interests of both lenders and borrowers, ensuring a mutually beneficial financial arrangement while adhering to local and state laws and regulations.

Orange California Loan Agreement for Investment

Description

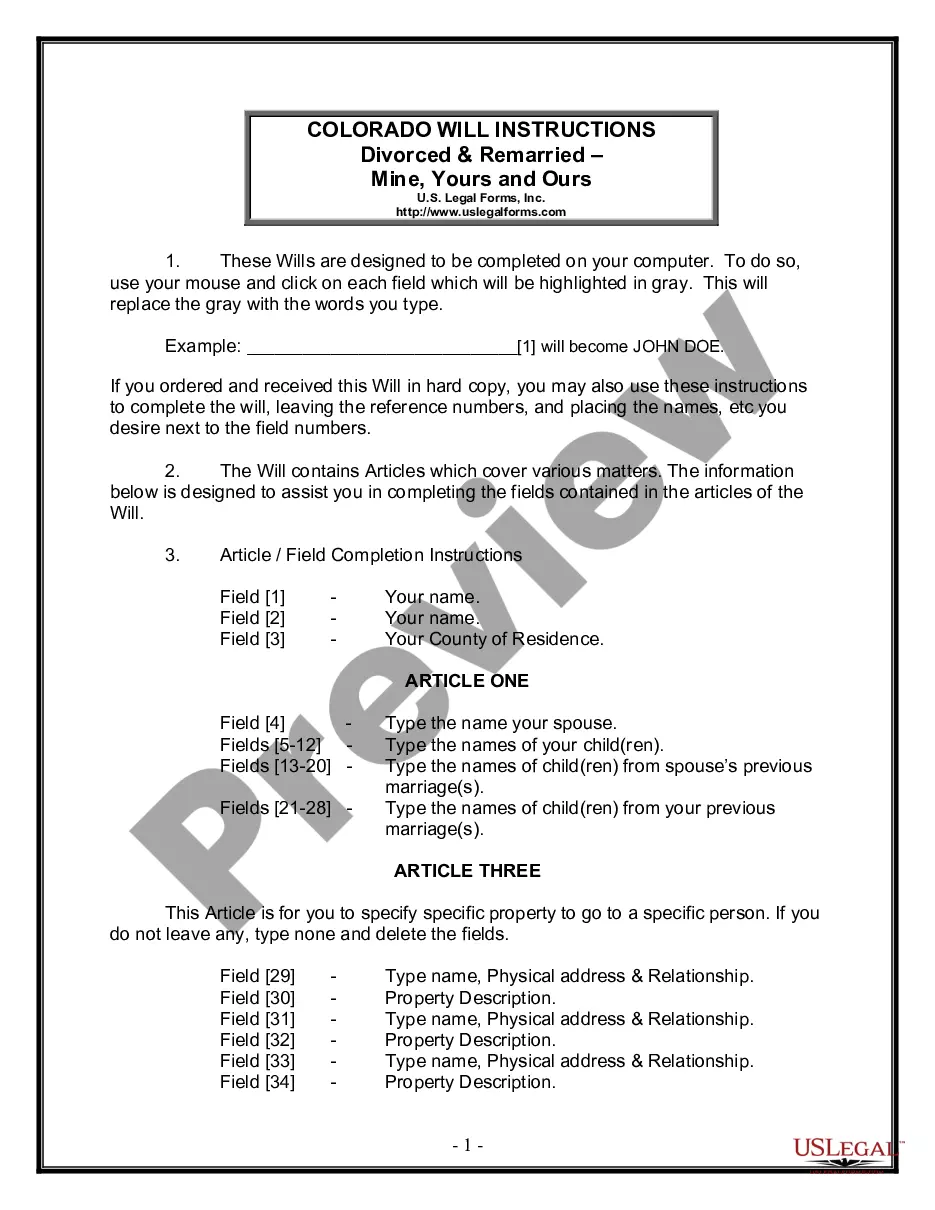

How to fill out Orange California Loan Agreement For Investment?

Do you need to quickly draft a legally-binding Orange Loan Agreement for Investment or probably any other form to manage your personal or corporate affairs? You can go with two options: hire a legal advisor to draft a valid document for you or draft it entirely on your own. The good news is, there's an alternative option - US Legal Forms. It will help you receive neatly written legal documents without paying unreasonable fees for legal services.

US Legal Forms offers a huge collection of more than 85,000 state-specific form templates, including Orange Loan Agreement for Investment and form packages. We provide documents for an array of life circumstances: from divorce papers to real estate documents. We've been out there for more than 25 years and got a rock-solid reputation among our clients. Here's how you can become one of them and get the needed document without extra troubles.

- First and foremost, carefully verify if the Orange Loan Agreement for Investment is tailored to your state's or county's laws.

- In case the document has a desciption, make sure to check what it's intended for.

- Start the searching process again if the template isn’t what you were seeking by utilizing the search box in the header.

- Select the subscription that best suits your needs and move forward to the payment.

- Select the format you would like to get your document in and download it.

- Print it out, fill it out, and sign on the dotted line.

If you've already registered an account, you can simply log in to it, find the Orange Loan Agreement for Investment template, and download it. To re-download the form, simply head to the My Forms tab.

It's effortless to find and download legal forms if you use our services. In addition, the paperwork we offer are updated by law professionals, which gives you greater peace of mind when dealing with legal matters. Try US Legal Forms now and see for yourself!