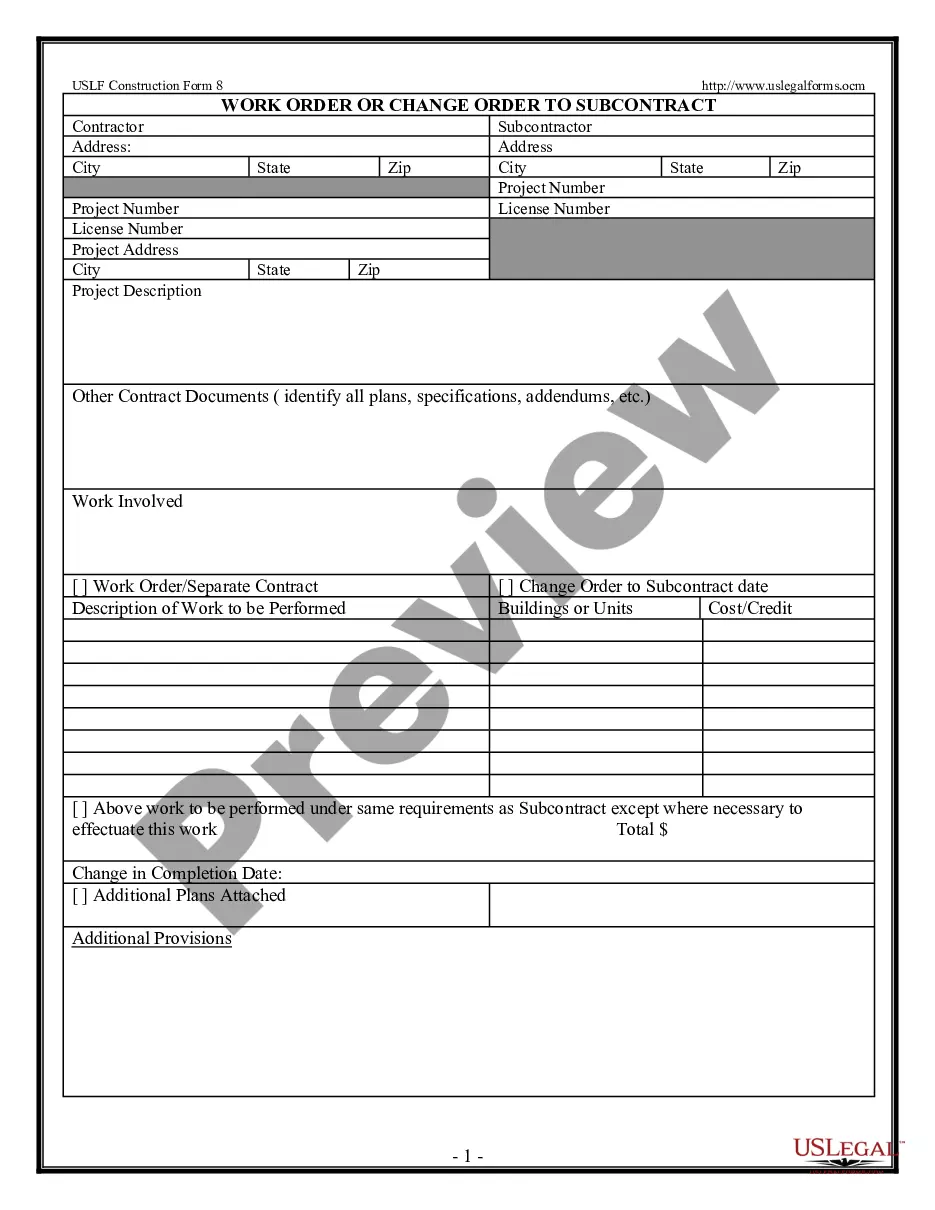

A Chicago Illinois Loan Agreement for Employees is a legally binding agreement between an employer and an employee in the city of Chicago, Illinois, outlining the terms and conditions of a loan provided by the employer to the employee. This agreement ensures that both parties fully understand their obligations and rights regarding the loan. In the agreement, various relevant keywords can be included to specify the loan's purpose, repayment terms, interest rate, and other essential details. These keywords may include: 1. Loan amount: The loan agreement must clearly state the exact amount of money that the employee will borrow from the employer. It specifies the principal sum that needs to be repaid. 2. Interest rate: The agreement should mention the interest rate that will be applied to the loan amount. This rate often depends on factors such as prevailing market rates, creditworthiness, and employer policies. 3. Repayment terms: The agreement outlines the timeline over which the employee is required to repay the loan. This includes specifying the frequency of payments (e.g., monthly, quarterly), the due dates, and the method of repayment. 4. Installments: If the loan is to be repaid in installments, the agreement mentions the specific amount to be paid at each installment and any consequences for missed or late payments. 5. Purpose of the loan: The loan agreement can specify the purpose for which the loan is being granted, such as a home purchase, education, medical expenses, or emergency funds. 6. Collateral (if applicable): If the loan is secured, meaning that the employee pledges collateral as a guarantee for repayment, this will be detailed in the agreement. The collateral could be the employee's personal property, such as a vehicle or real estate. 7. Prepayment: The agreement can state whether the employee has the option to make early or partial repayments and any applicable penalties or fees. 8. Termination clauses: The agreement may outline the conditions under which the loan can be terminated, such as the employee leaving or being terminated from the company. Some common types of Chicago Illinois Loan Agreements for Employees are: 1. Personal Loan Agreement: This type of loan agreement is used when the employee borrows money for personal reasons, such as debt consolidation, home repair, or medical expenses. 2. Relocation Loan Agreement: If an employee is being relocated by their employer, a relocation loan agreement may be established to provide financial assistance for various expenses related to the move, such as housing, transportation, or temporary accommodation. 3. Educational Loan Agreement: In cases where an employee wishes to pursue further education or training to enhance their skills, an educational loan agreement may be created by the employer to support the employee's educational expenses. 4. Emergency Loan Agreement: An emergency loan agreement is employed when an employee is facing unforeseen financial difficulties and requires immediate financial assistance from the employer. It is important to consult with a legal professional or attorney to ensure that the loan agreement complies with all local and state laws, as well as any specific regulations that may apply in Chicago, Illinois.

Chicago Illinois Loan Agreement for Employees

Description

How to fill out Chicago Illinois Loan Agreement For Employees?

Dealing with legal forms is a necessity in today's world. However, you don't always need to seek qualified assistance to draft some of them from the ground up, including Chicago Loan Agreement for Employees, with a service like US Legal Forms.

US Legal Forms has more than 85,000 templates to pick from in various types varying from living wills to real estate paperwork to divorce papers. All forms are organized according to their valid state, making the searching experience less frustrating. You can also find information materials and tutorials on the website to make any tasks related to document completion straightforward.

Here's how you can find and download Chicago Loan Agreement for Employees.

- Take a look at the document's preview and description (if provided) to get a basic idea of what you’ll get after downloading the document.

- Ensure that the template of your choosing is adapted to your state/county/area since state laws can affect the legality of some documents.

- Check the related forms or start the search over to locate the appropriate document.

- Click Buy now and create your account. If you already have an existing one, choose to log in.

- Pick the pricing {plan, then a suitable payment method, and purchase Chicago Loan Agreement for Employees.

- Select to save the form template in any available file format.

- Visit the My Forms tab to re-download the document.

If you're already subscribed to US Legal Forms, you can locate the appropriate Chicago Loan Agreement for Employees, log in to your account, and download it. Of course, our platform can’t take the place of a legal professional completely. If you need to cope with an extremely difficult case, we advise getting an attorney to review your form before executing and submitting it.

With over 25 years on the market, US Legal Forms proved to be a go-to provider for many different legal forms for millions of users. Become one of them today and purchase your state-compliant paperwork effortlessly!