Houston Texas Loan Agreement for Employees is a legally binding contract between an employer and an employee in Houston, Texas, that outlines the terms and conditions of a loan provided to the employee by the employer. This loan agreement serves to establish a clear understanding and agreement between the parties involved regarding the loan amount, repayment terms, and any other relevant provisions. In Houston, Texas, there are various types of loan agreements specifically designed to cater to the needs of the employees: 1. Personal Loan Agreement: This type of loan agreement is meant for personal financial needs, such as unexpected expenses, medical bills, or educational expenses. It outlines the loan amount, interest rate, repayment schedule, and any applicable fees. 2. Employee Relocation Loan Agreement: This loan agreement is applicable when an employer provides financial assistance to an employee who needs to relocate for job-related purposes. It covers expenses such as moving costs, temporary accommodations, and other related expenses during the transition period. 3. Educational Loan Agreement: This loan agreement is specifically designed to facilitate employees' professional development by financing their education and training programs. It lays out the terms and conditions related to the loan amount, repayment schedule, and any potential requirements for academic progress or employment regulations. 4. Home Loan Agreement: Houston, Texas, being a booming real estate market, offers home loan agreements to help employees fulfill their dream of homeownership. This agreement specifies the loan amount, interest rate, repayment duration, and any collateral requirements associated with purchasing a home in the area. 5. Emergency Loan Agreement: In cases of unforeseen emergencies where immediate financing is required, this type of loan agreement ensures that employees have access to funds quickly and efficiently. The terms of this agreement might include a short repayment duration and potentially higher interest rates to account for the urgency of the situation. Regardless of the type of loan agreement in Houston, Texas, there are key elements commonly found in these agreements. These include the names and contact details of both parties, the loan amount, the repayment schedule, the interest rate or fees charged, any collateral required, and provisions for default or early repayment. In summary, a Houston Texas Loan Agreement for Employees is a vital tool for employers and employees to formalize the terms and conditions of loans provided within the context of their professional relationship. Understanding the different types of loan agreements available can help both parties choose the most appropriate one based on their unique financial needs and circumstances.

Houston Texas Loan Agreement for Employees

Description

How to fill out Houston Texas Loan Agreement For Employees?

How much time does it normally take you to draft a legal document? Given that every state has its laws and regulations for every life scenario, locating a Houston Loan Agreement for Employees meeting all local requirements can be exhausting, and ordering it from a professional lawyer is often costly. Many web services offer the most popular state-specific templates for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most comprehensive web catalog of templates, gathered by states and areas of use. Apart from the Houston Loan Agreement for Employees, here you can find any specific document to run your business or individual deeds, complying with your county requirements. Experts verify all samples for their actuality, so you can be sure to prepare your documentation properly.

Using the service is remarkably simple. If you already have an account on the platform and your subscription is valid, you only need to log in, select the needed sample, and download it. You can get the file in your profile at any moment later on. Otherwise, if you are new to the platform, there will be some extra actions to complete before you obtain your Houston Loan Agreement for Employees:

- Check the content of the page you’re on.

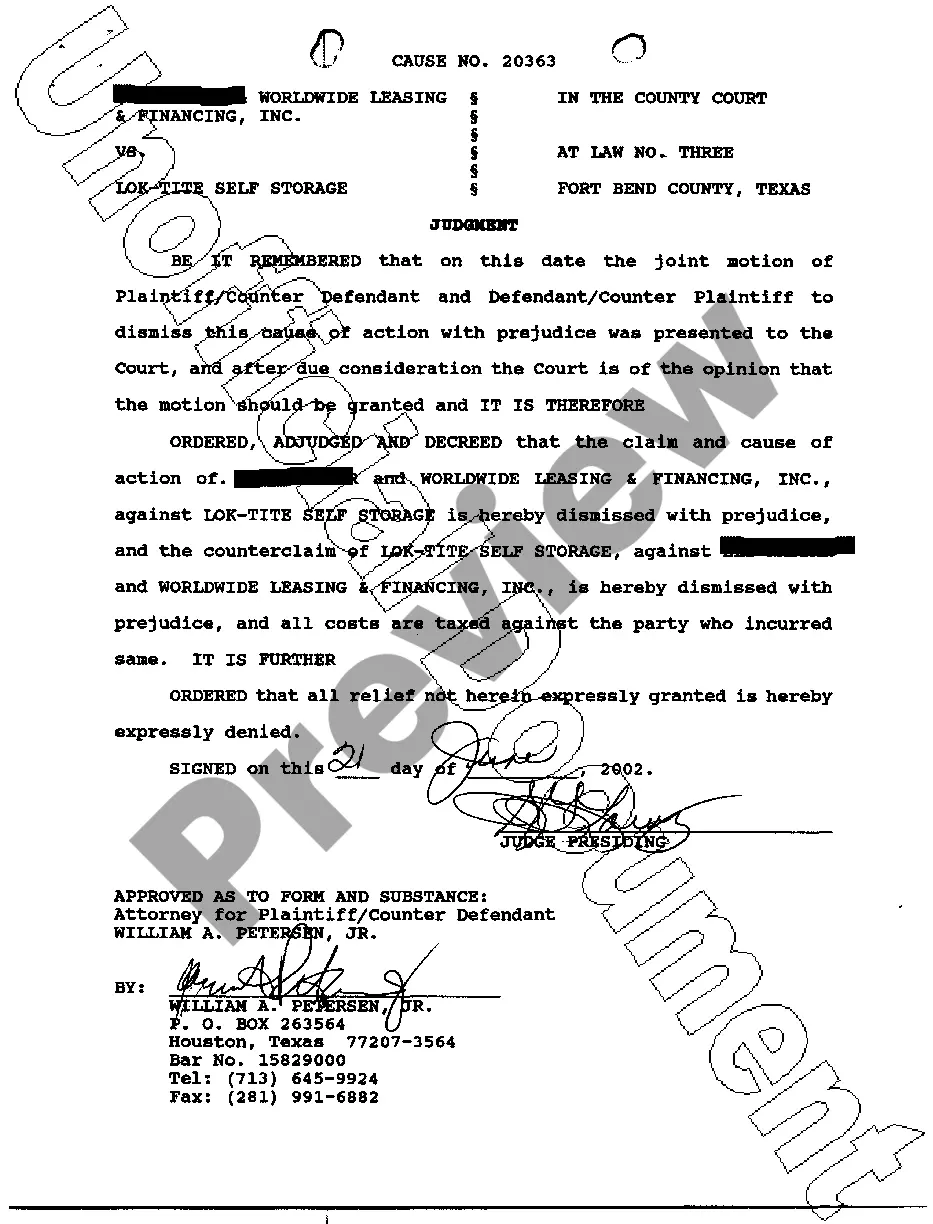

- Read the description of the sample or Preview it (if available).

- Search for another document using the corresponding option in the header.

- Click Buy Now once you’re certain in the chosen file.

- Select the subscription plan that suits you most.

- Create an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Change the file format if necessary.

- Click Download to save the Houston Loan Agreement for Employees.

- Print the doc or use any preferred online editor to fill it out electronically.

No matter how many times you need to use the purchased document, you can find all the samples you’ve ever downloaded in your profile by opening the My Forms tab. Give it a try!