Kings New York Loan Agreement for Employees is a comprehensive contract that outlines the terms and conditions of a loan extended to employees by Kings New York, a reputable financial institution. This agreement plays a pivotal role in ensuring transparency and establishing a clear understanding between the employee borrower and the lending institution. By adhering to this agreement, both parties can avoid any misunderstandings or disputes regarding the loan. The Kings New York Loan Agreement for Employees covers various crucial aspects, including loan amount, interest rate, repayment schedule, and any applicable fees or penalties. The loan amount specifies the sum borrowed by the employee, which can be used for personal or professional purposes, such as refurbishing a home, consolidating debts, or financing educational expenses. One of the key elements of this agreement is the interest rate, which determines the additional cost of borrowing. Kings New York ensures competitive interest rates to provide affordable financing options for their employees. The interest rate may vary based on factors like the employee's creditworthiness, the loan's purpose, and the duration of the repayment period. The repayment schedule is an integral part of the loan agreement, as it outlines the specific dates and amounts to be repaid by the employee borrower. This schedule offers clarity and enables the borrower to plan their finances accordingly. Kings New York typically offers flexible repayment options, accommodating both weekly and monthly installments based on the borrower's preference and financial situation. In addition to the loan amount, interest rate, and repayment schedule, the loan agreement may also include details about any applicable fees or penalties. These can include origination fees, prepayment penalties, late payment fees, or charges associated with loan modifications or extensions. It is crucial for employees to carefully review the agreement and understand these additional costs to avoid any surprises or financial burden. Regarding different types of Kings New York Loan Agreements for Employees, the institution offers a range of loan products tailored to meet diverse employee needs. Some common types may include personal loans, auto loans, home improvement loans, educational loans, or even small business loans for entrepreneurial employees. Overall, Kings New York Loan Agreement for Employees reaffirms the institution's commitment to assisting their workforce's financial well-being by offering competitive loan solutions. It emphasizes transparency, accountability, and mutually beneficial terms that ensure a harmonious lending experience, empowering employees to achieve their financial goals and aspirations.

Kings New York Loan Agreement for Employees

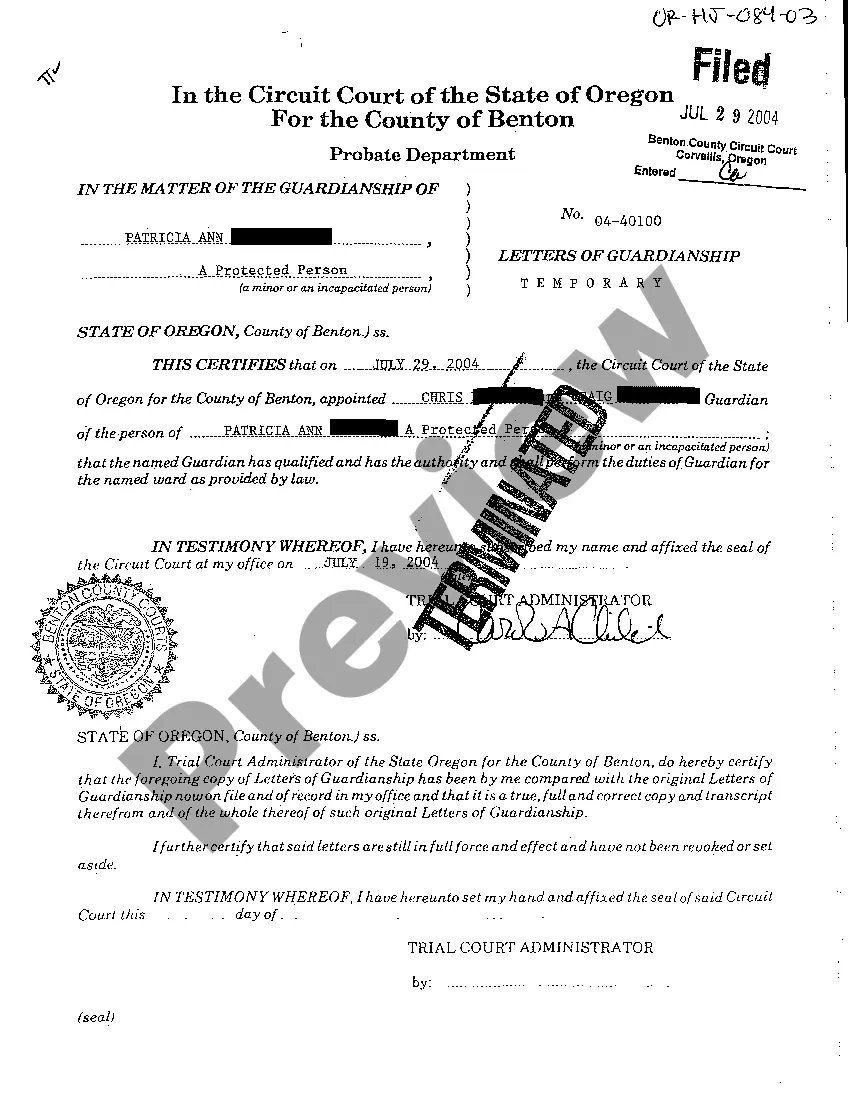

Description

How to fill out Kings New York Loan Agreement For Employees?

Laws and regulations in every sphere differ around the country. If you're not a lawyer, it's easy to get lost in various norms when it comes to drafting legal documents. To avoid pricey legal assistance when preparing the Kings Loan Agreement for Employees, you need a verified template valid for your region. That's when using the US Legal Forms platform is so beneficial.

US Legal Forms is a trusted by millions online catalog of more than 85,000 state-specific legal forms. It's a great solution for professionals and individuals looking for do-it-yourself templates for different life and business situations. All the documents can be used multiple times: once you purchase a sample, it remains available in your profile for subsequent use. Thus, if you have an account with a valid subscription, you can just log in and re-download the Kings Loan Agreement for Employees from the My Forms tab.

For new users, it's necessary to make a couple of more steps to obtain the Kings Loan Agreement for Employees:

- Analyze the page content to make sure you found the correct sample.

- Take advantage of the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your requirements.

- Use the Buy Now button to obtain the template when you find the proper one.

- Opt for one of the subscription plans and log in or create an account.

- Decide how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the document in and click Download.

- Fill out and sign the template on paper after printing it or do it all electronically.

That's the simplest and most cost-effective way to get up-to-date templates for any legal reasons. Locate them all in clicks and keep your documentation in order with the US Legal Forms!