Nassau New York Loan Agreement for Employees is a legally binding document that outlines the terms and conditions of a loan offered by employers to their employees. This loan agreement is specific to employees working within Nassau County, New York. A Nassau New York Loan Agreement for Employees is designed to provide financial assistance to employees when they need financial support for various purposes, such as education, housing, medical emergencies, or personal expenses. By entering into this agreement, both the employer and employee agree to the terms and conditions set forth within the document. The loan agreement generally includes the following key elements: 1. Loan Amount: The agreement specifies the total amount of money that the employee will borrow from the employer. This amount is subject to negotiation and should be agreed upon by both parties. 2. Loan Terms and Conditions: The agreement includes details about the repayment schedule, interest rate, and any additional fees or charges associated with the loan. It outlines the duration of the loan and the frequency of repayments. 3. Repayment Method: The agreement outlines how the loan will be repaid. This could include automatic payroll deductions or direct debits from the employee's bank account. 4. Default and Consequences: The loan agreement specifies the consequences of defaulting on loan repayments, such as additional fees, penalties, or legal action that may be taken by the employer. Different types of Nassau New York Loan Agreements for Employees may include: 1. Emergency Loan Agreement: This type of loan agreement is designed to provide immediate financial assistance to employees during unexpected emergencies like medical emergencies, natural disasters, or family crises. 2. Education Loan Agreement: This agreement is specifically tailored to employees seeking financial support for their educational pursuits, such as college tuition fees, textbooks, or professional development courses. 3. Housing Loan Agreement: This type of loan agreement is intended to help employees secure housing, whether it be for purchasing or renting a property. It may cover down payments, security deposits, or other related expenses. 4. Personal Loan Agreement: This agreement is a more general loan arrangement that can be used by employees for various personal expenses, such as car repairs, home renovations, or debt consolidation. Nassau New York Loan Agreements for Employees are customizable, and the specific terms and conditions may vary depending on the employer's policies and the employee's needs. It is important for both parties to carefully review and understand the terms before signing the agreement to ensure clarity and mutual consent.

Nassau New York Loan Agreement for Employees

Description

How to fill out Nassau New York Loan Agreement For Employees?

Preparing documents for the business or personal demands is always a big responsibility. When creating a contract, a public service request, or a power of attorney, it's important to take into account all federal and state laws and regulations of the specific region. However, small counties and even cities also have legislative procedures that you need to consider. All these details make it tense and time-consuming to create Nassau Loan Agreement for Employees without expert help.

It's possible to avoid wasting money on attorneys drafting your documentation and create a legally valid Nassau Loan Agreement for Employees on your own, using the US Legal Forms web library. It is the biggest online catalog of state-specific legal templates that are professionally verified, so you can be sure of their validity when picking a sample for your county. Earlier subscribed users only need to log in to their accounts to download the required document.

If you still don't have a subscription, follow the step-by-step instruction below to obtain the Nassau Loan Agreement for Employees:

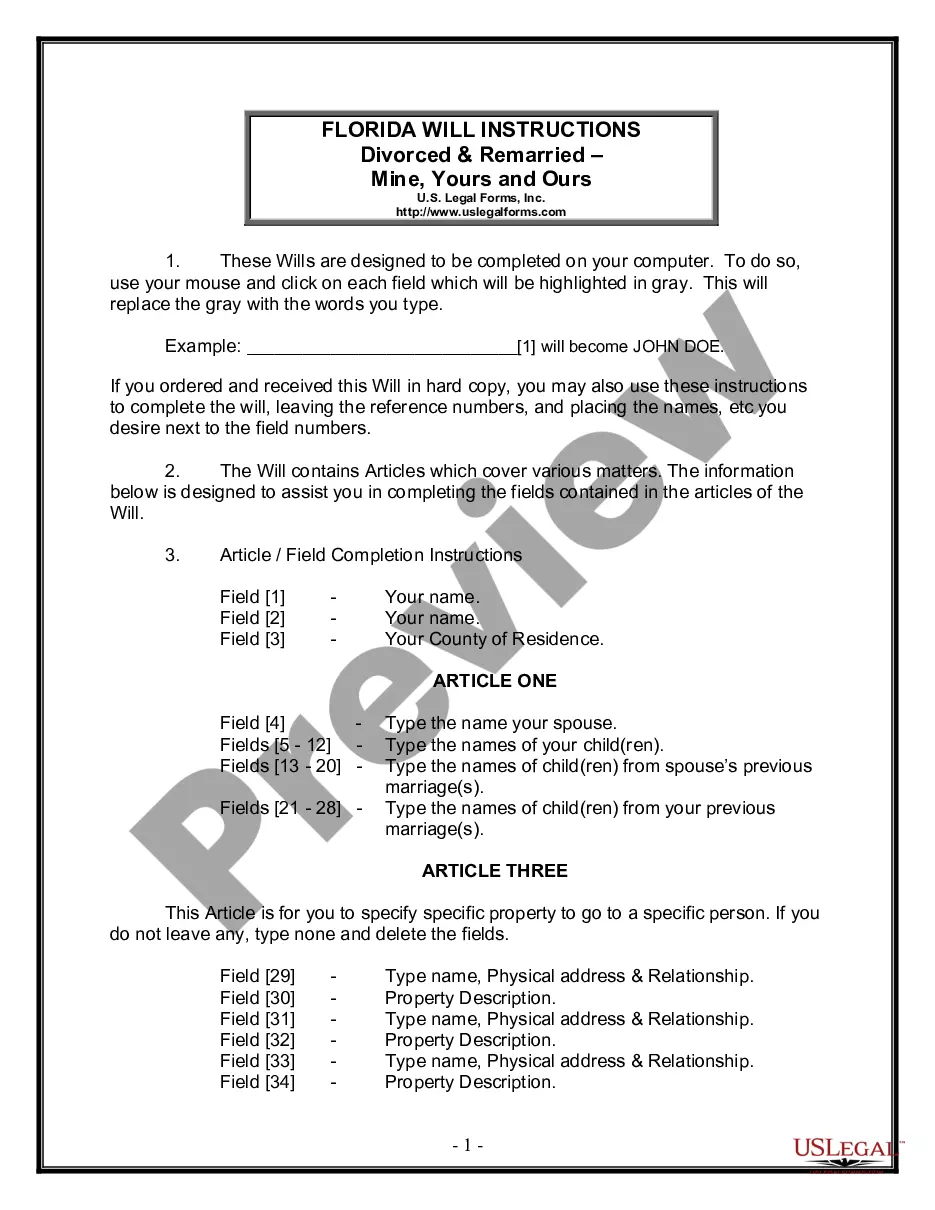

- Examine the page you've opened and check if it has the document you need.

- To accomplish this, use the form description and preview if these options are available.

- To find the one that satisfies your needs, use the search tab in the page header.

- Double-check that the template complies with juridical criteria and click Buy Now.

- Select the subscription plan, then sign in or register for an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the chosen file in the preferred format, print it, or complete it electronically.

The great thing about the US Legal Forms library is that all the documentation you've ever obtained never gets lost - you can access it in your profile within the My Forms tab at any time. Join the platform and quickly get verified legal templates for any scenario with just a couple of clicks!