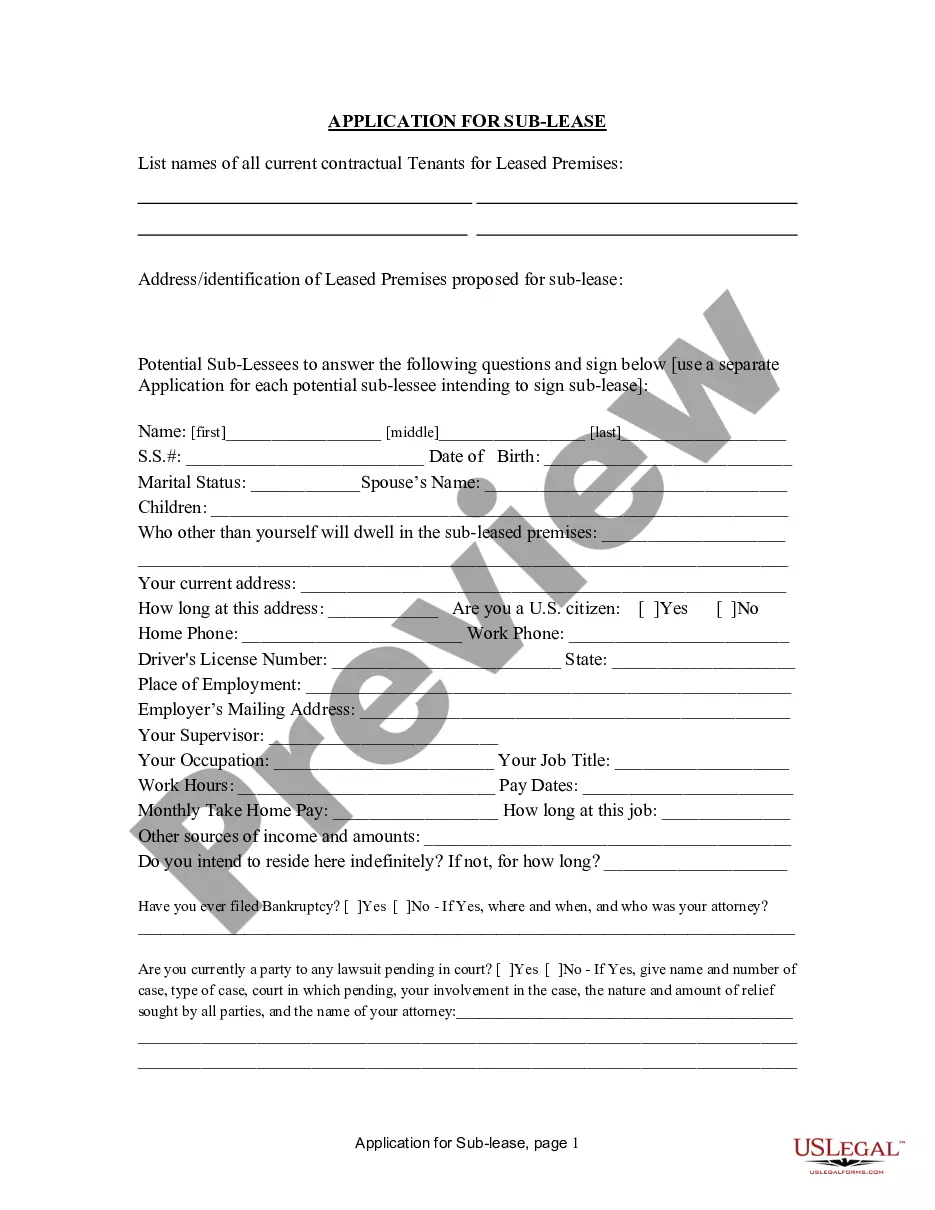

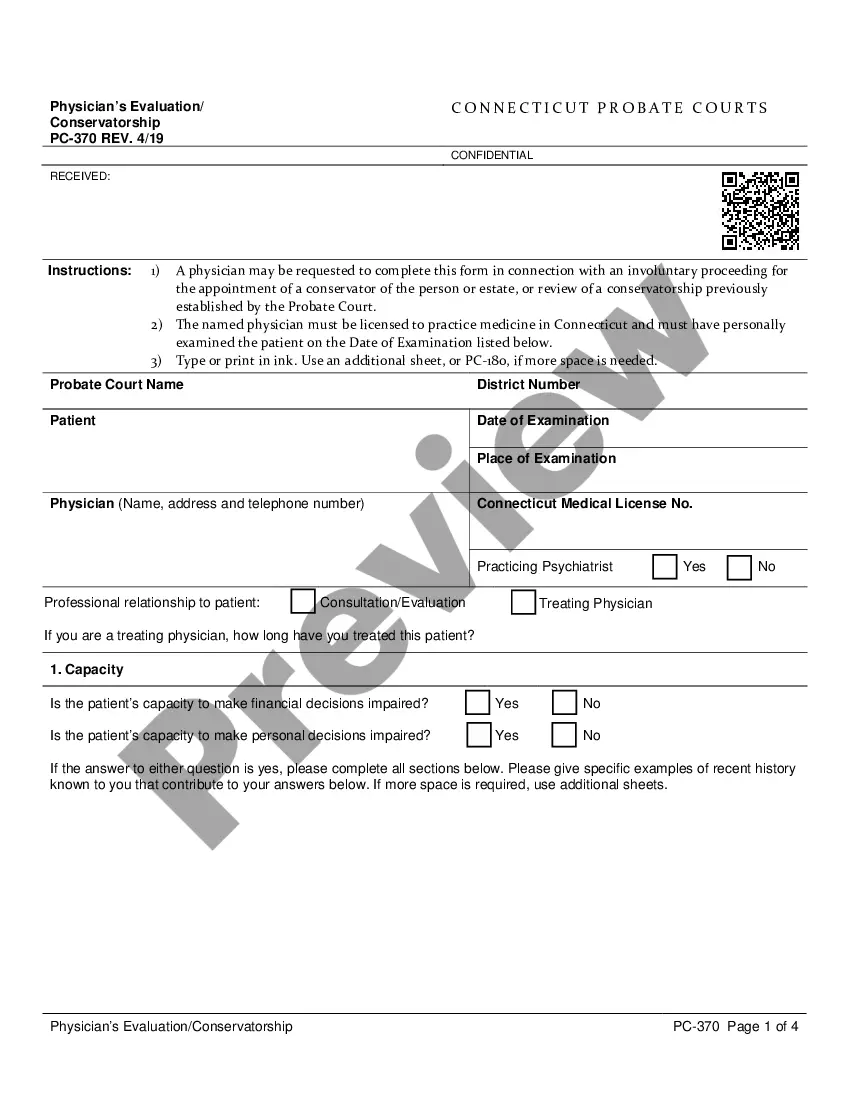

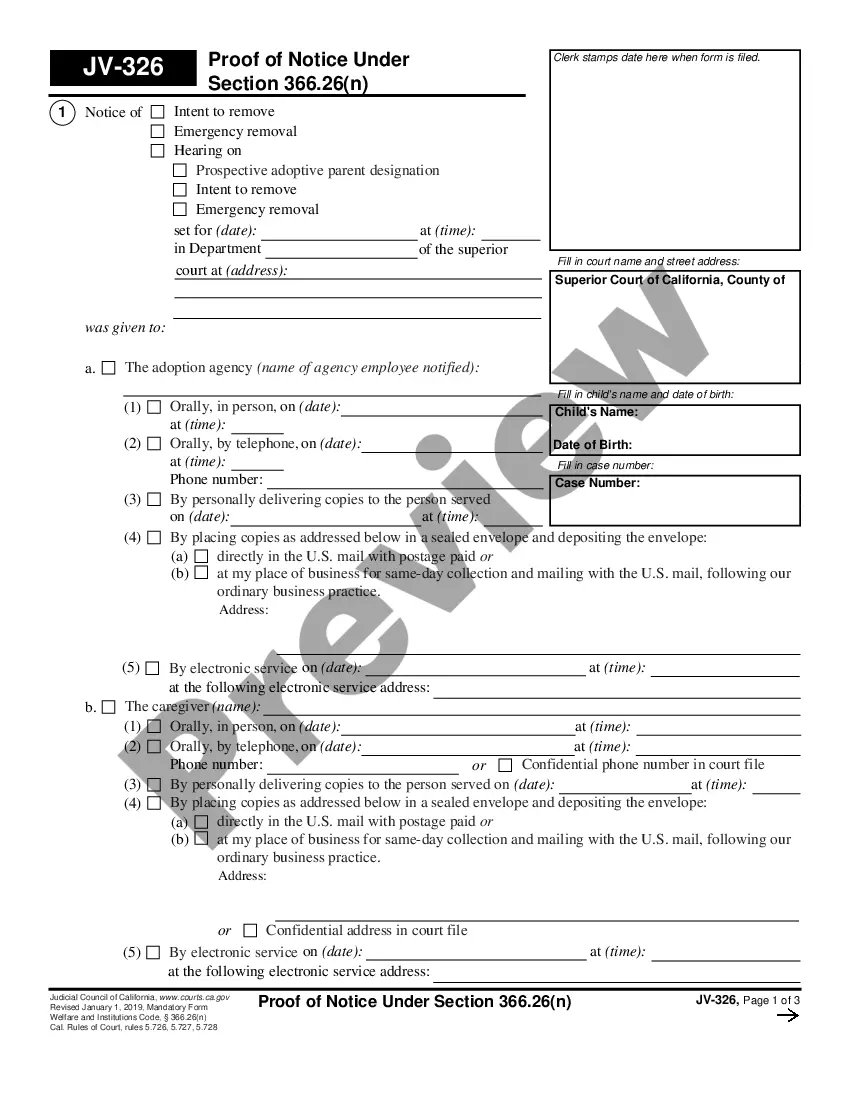

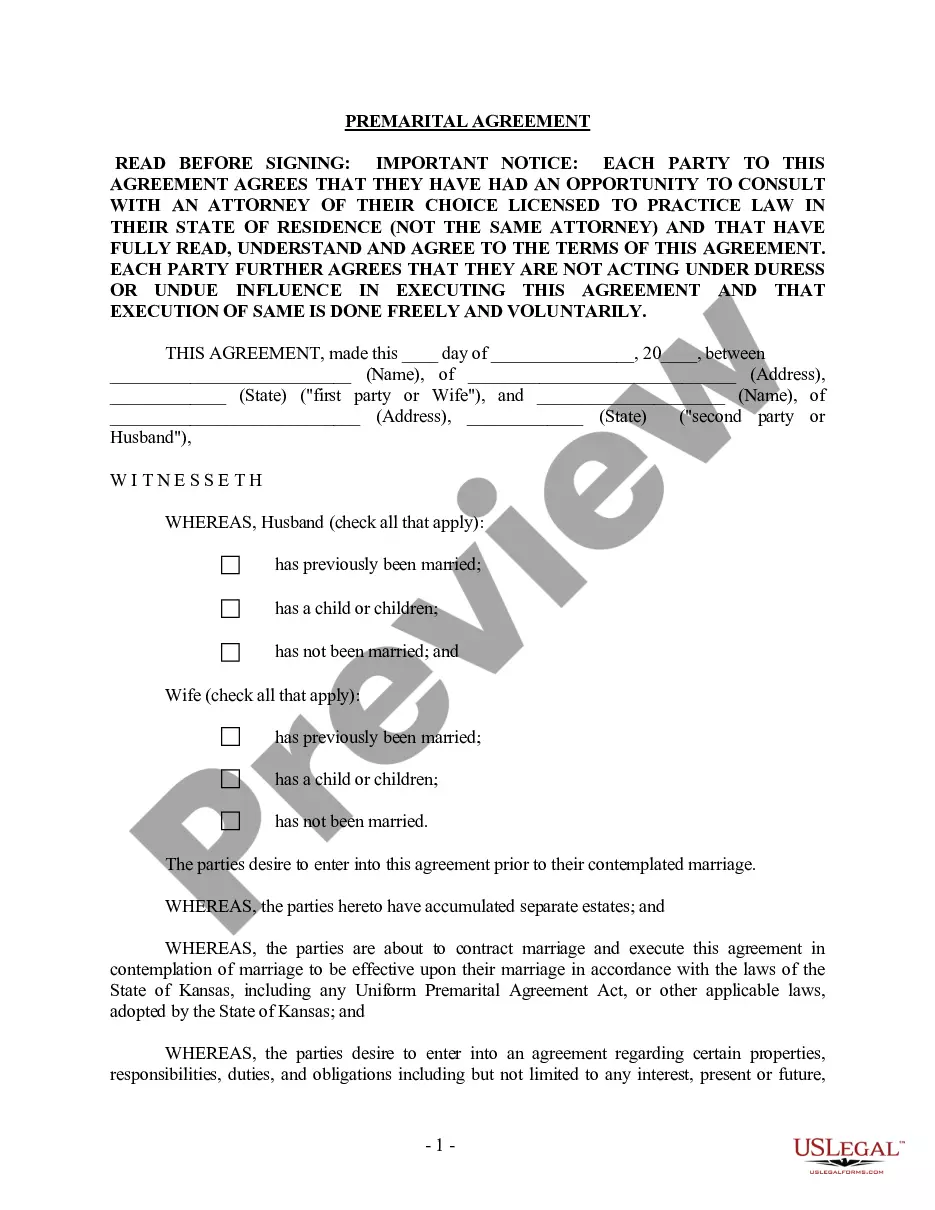

A Riverside California Loan Agreement for Employees is a legal contract that outlines the terms and conditions under which employees can obtain loans from their employer. This agreement details the loan amount, repayment terms, interest rate, and any other relevant provisions. One key type of Riverside California Loan Agreement for Employees is a Personal Loan Agreement. This agreement allows employees to borrow money for personal expenses such as medical bills, education expenses, or home repairs. It establishes the loan terms, repayment schedule, and interest rate. Another type is an Emergency Loan Agreement. This agreement is designed to provide financial assistance to employees in times of unexpected and urgent financial needs, such as medical emergencies or sudden vehicle repairs. It typically offers expedited approval and flexible repayment options. There may also be Debt Consolidation Loan Agreements available for Riverside California employees. This agreement allows employees to combine multiple debts into a single loan with a lower interest rate, simplifying their payments and potentially saving money in the long run. Additionally, some companies offer Home Loan Agreements to their employees. This type of loan agreement helps employees finance the purchase or renovation of residential properties. It includes terms specific to real estate transactions, such as loan-to-value ratios, mortgage terms, and property appraisal requirements. Employees interested in obtaining a loan through a Riverside California Loan Agreement should carefully review the agreements' terms and conditions. They should consider factors such as interest rates, repayment schedules, and any associated fees or penalties. Seeking legal advice before signing the agreement is prudent to ensure complete understanding and protection of one's rights. Ultimately, a Riverside California Loan Agreement for Employees serves as a formal contract that establishes the parameters for borrowing funds from an employer. It facilitates financial assistance and provides a clear understanding of repayment terms, making it a valuable tool for employees in need of financial support.

Riverside California Loan Agreement for Employees

Description

How to fill out Riverside California Loan Agreement For Employees?

Dealing with legal forms is a necessity in today's world. Nevertheless, you don't always need to look for professional help to draft some of them from the ground up, including Riverside Loan Agreement for Employees, with a platform like US Legal Forms.

US Legal Forms has more than 85,000 forms to select from in different categories varying from living wills to real estate papers to divorce papers. All forms are arranged according to their valid state, making the searching experience less frustrating. You can also find detailed resources and guides on the website to make any activities associated with paperwork completion simple.

Here's how to purchase and download Riverside Loan Agreement for Employees.

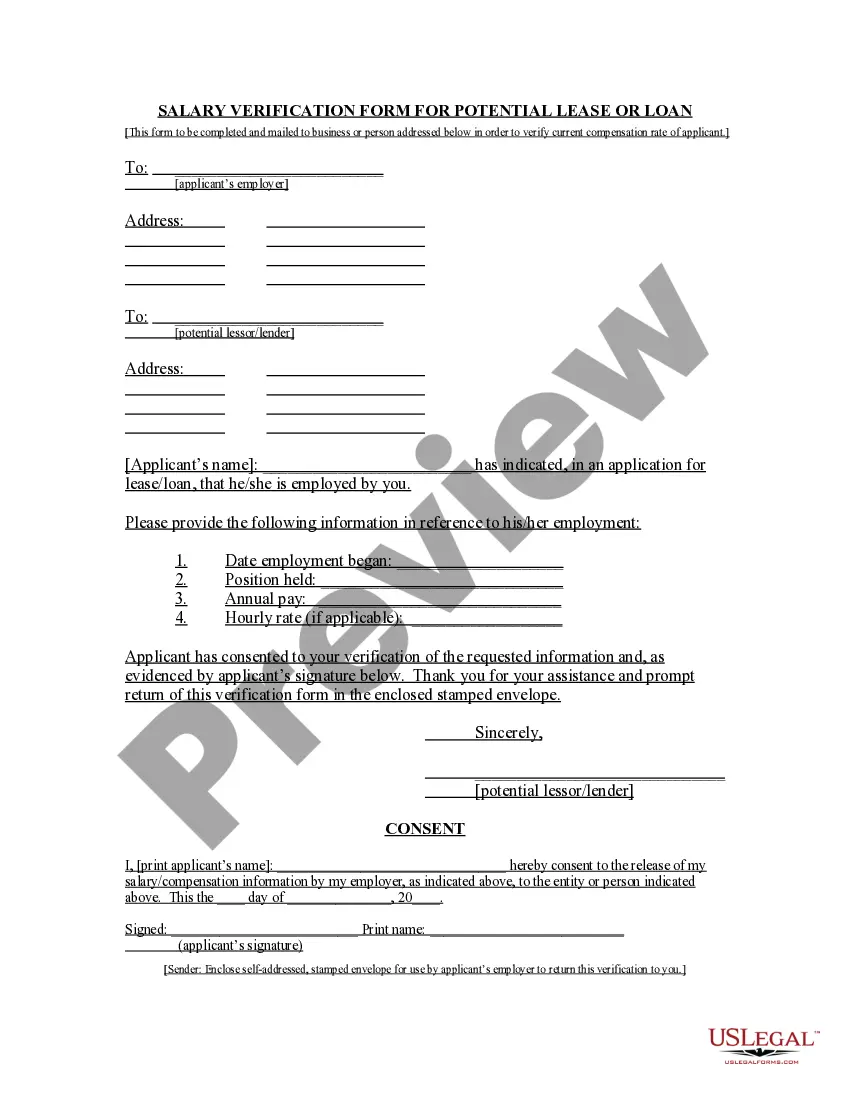

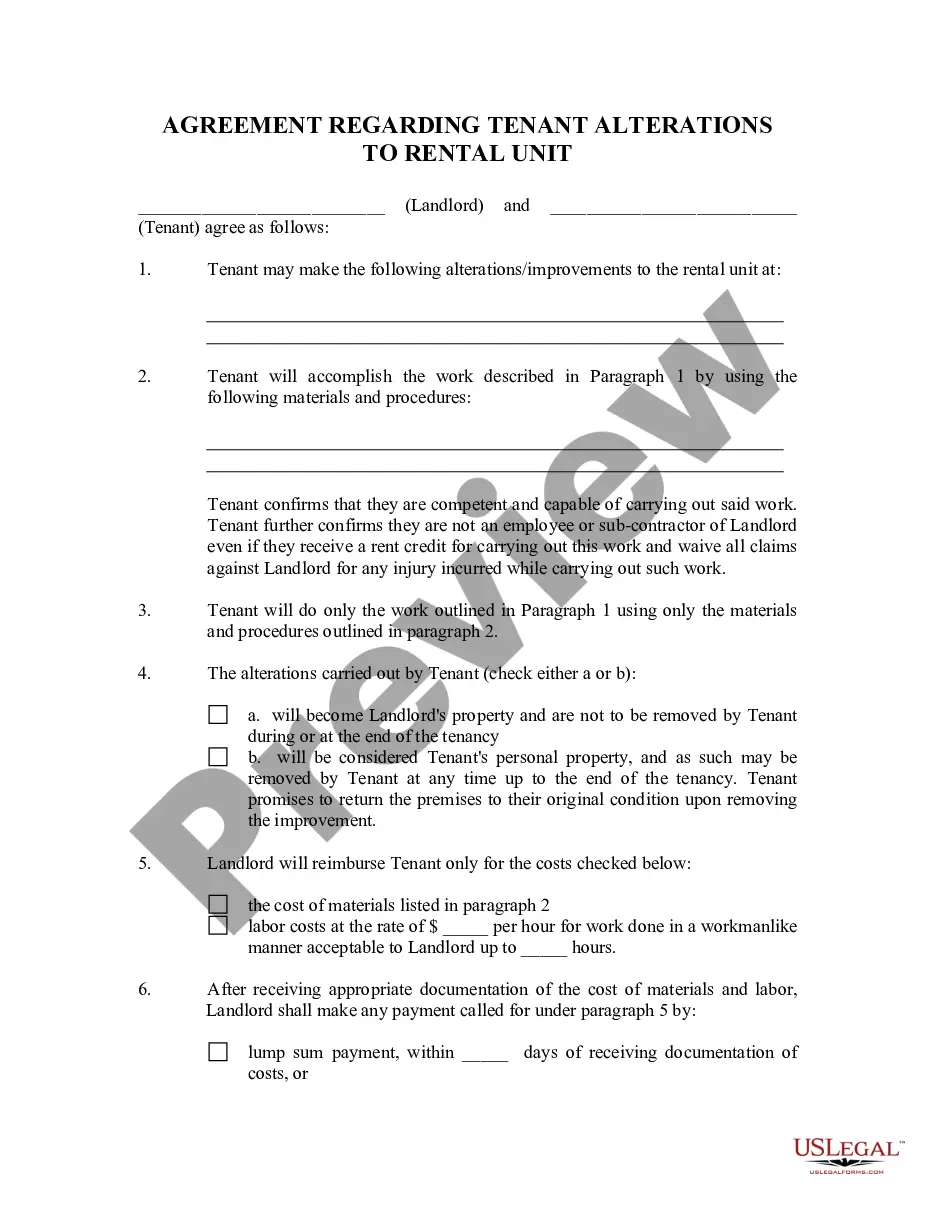

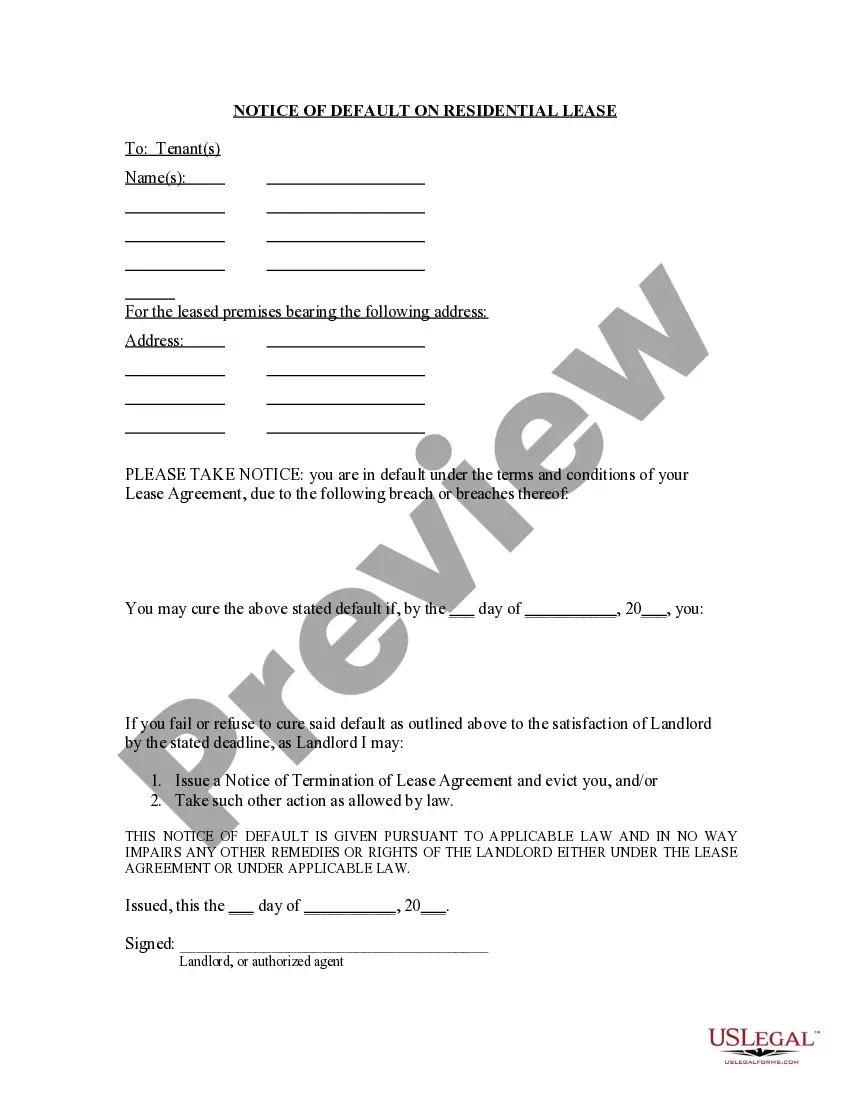

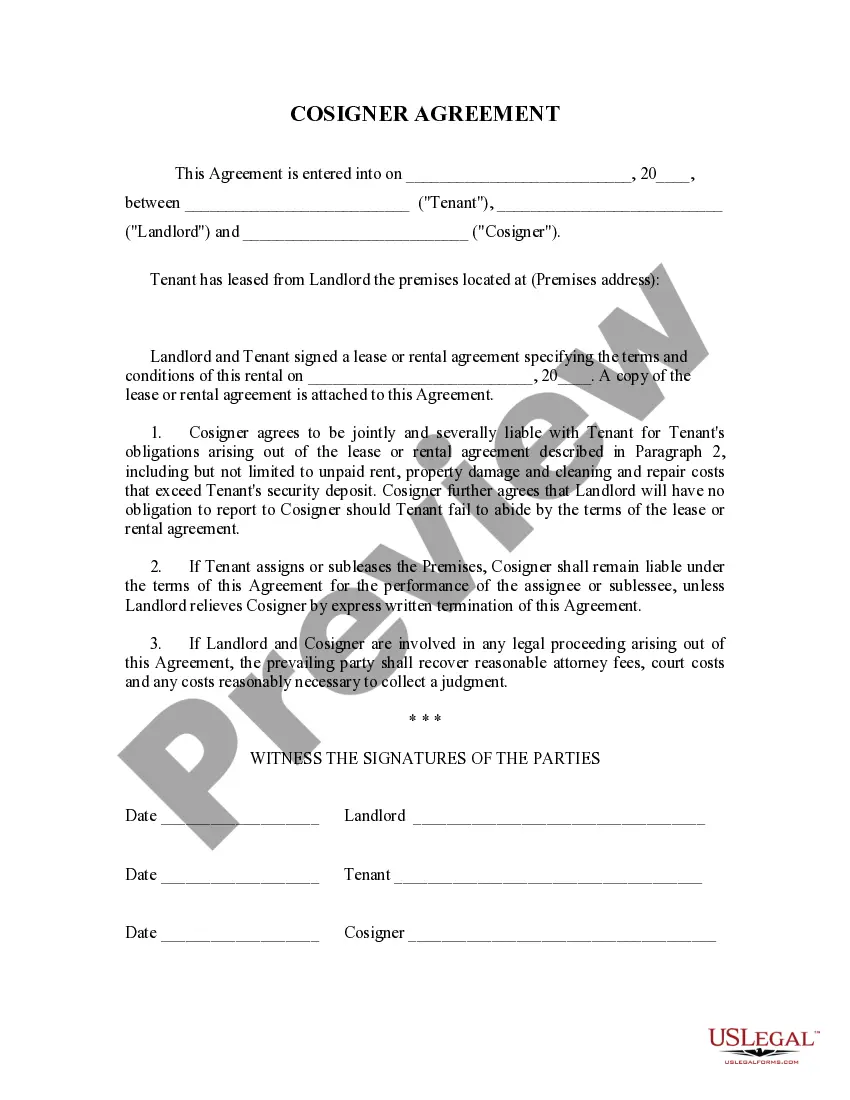

- Take a look at the document's preview and outline (if provided) to get a basic idea of what you’ll get after getting the document.

- Ensure that the document of your choosing is specific to your state/county/area since state regulations can impact the validity of some records.

- Examine the related document templates or start the search over to find the correct document.

- Click Buy now and create your account. If you already have an existing one, select to log in.

- Choose the option, then a needed payment gateway, and purchase Riverside Loan Agreement for Employees.

- Select to save the form template in any offered file format.

- Visit the My Forms tab to re-download the document.

If you're already subscribed to US Legal Forms, you can find the appropriate Riverside Loan Agreement for Employees, log in to your account, and download it. Of course, our website can’t replace an attorney completely. If you have to cope with an extremely difficult case, we advise using the services of a lawyer to examine your form before signing and submitting it.

With over 25 years on the market, US Legal Forms proved to be a go-to platform for many different legal forms for millions of users. Join them today and get your state-specific paperwork effortlessly!