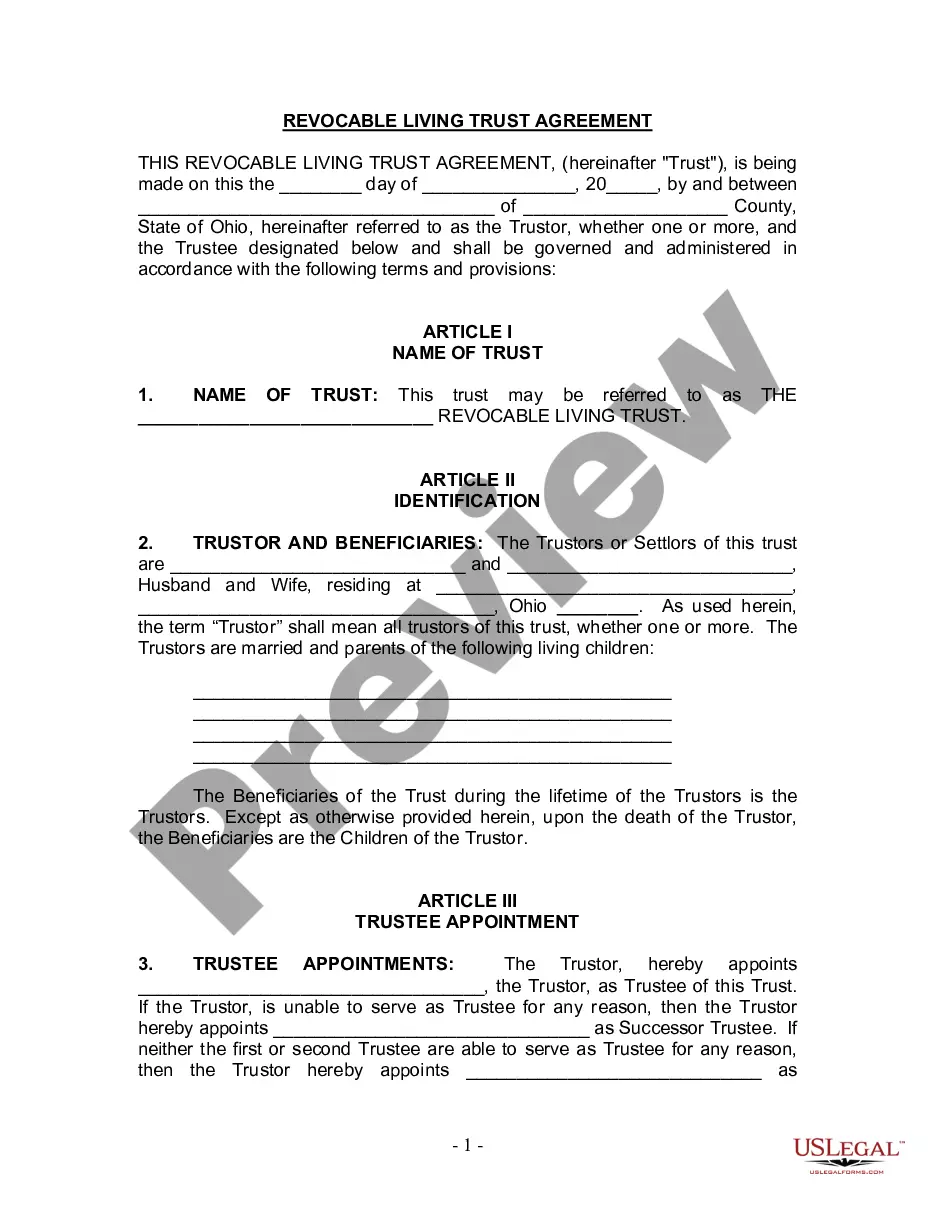

A Riverside California loan agreement for a personal loan is a legally binding document that outlines the terms and conditions between a lender and a borrower for a personal loan in Riverside, California. This agreement serves as a protection for both parties involved in the loan transaction. Keywords: Riverside California, loan agreement, personal loan, terms and conditions, lender, borrower, protection. There are different types of Riverside California loan agreements for personal loans, including: 1. Fixed-Rate Personal Loan Agreement: This type of loan agreement establishes a fixed interest rate that remains unchanged throughout the loan term. The borrower knows exactly how much they need to repay each month, providing certainty and predictability. 2. Variable-Rate Personal Loan Agreement: Unlike the fixed-rate agreement, a variable-rate personal loan agreement allows the interest rate to fluctuate throughout the loan term. The rate is usually tied to a benchmark, such as the prime rate, and can increase or decrease depending on market conditions. 3. Secured Personal Loan Agreement: In a secured personal loan agreement, the borrower pledges collateral, such as a vehicle or real estate, as security for the loan. This reduces the lender's risk and often results in a lower interest rate. 4. Unsecured Personal Loan Agreement: Unlike a secured personal loan agreement, an unsecured agreement doesn't require collateral. The lender relies solely on the borrower's creditworthiness to determine eligibility and offers a higher interest rate due to the increased risk. 5. Installment Personal Loan Agreement: This type of loan agreement breaks the loan amount into equal installments, which are repaid over a set period. Each installment includes both principal and interest, allowing the borrower to have a clear repayment schedule. 6. Line of Credit Agreement: A line of credit agreement is a revolving loan that grants the borrower access to a predetermined credit limit. The borrower can withdraw funds as needed, similar to a credit card, and only pays interest on the amount borrowed. In conclusion, a Riverside California loan agreement for a personal loan is a legally binding document that outlines the terms and conditions between a lender and a borrower. It offers various types of agreements, including fixed-rate, variable-rate, secured, unsecured, installment, and line of credit agreements, catering to different preferences and financial needs.

Riverside California Loan Agreement for Personal Loan

Description

How to fill out Riverside California Loan Agreement For Personal Loan?

Whether you intend to start your business, enter into a contract, apply for your ID renewal, or resolve family-related legal concerns, you need to prepare certain documentation meeting your local laws and regulations. Locating the correct papers may take a lot of time and effort unless you use the US Legal Forms library.

The service provides users with more than 85,000 expertly drafted and verified legal documents for any personal or business occasion. All files are grouped by state and area of use, so picking a copy like Riverside Loan Agreement for Personal Loan is quick and straightforward.

The US Legal Forms library users only need to log in to their account and click the Download button next to the required form. If you are new to the service, it will take you several additional steps to obtain the Riverside Loan Agreement for Personal Loan. Adhere to the instructions below:

- Make sure the sample meets your personal needs and state law requirements.

- Read the form description and check the Preview if available on the page.

- Use the search tab specifying your state above to find another template.

- Click Buy Now to get the file when you find the correct one.

- Select the subscription plan that suits you most to proceed.

- Log in to your account and pay the service with a credit card or PayPal.

- Download the Riverside Loan Agreement for Personal Loan in the file format you require.

- Print the copy or complete it and sign it electronically via an online editor to save time.

Documents provided by our library are multi-usable. Having an active subscription, you can access all of your previously purchased paperwork at any time in the My Forms tab of your profile. Stop wasting time on a endless search for up-to-date official documents. Join the US Legal Forms platform and keep your paperwork in order with the most extensive online form library!

Form popularity

FAQ

To draft a Loan Agreement, you should include the following: The addresses and contact information of all parties involved. The conditions of use of the loan (what the money can be used for) Any repayment options. The payment schedule. The interest rates. The length of the term. Any collateral. The cancellation policy.

All loan agreements must specify general terms that define the legal obligations of each party. For instance, the terms regarding repayment schedule, default or contract breach, interest rate, loan security, as well as collateral offered must be clearly outlined.

Does a loan agreement need to be witnessed? We recommend executing the agreement in front of an independent witness (not a party to the agreement) if you are entering into the agreement as an individual.

How to Write a Loan Agreement Step 1 Loan Amount, Borrower, and Lender.Step 2 Payment.Step 3 Interest.Step 4 Expenses.Step 5 Governing Law.Step 6 Signing.

Your loan agreement should clearly outline the interest rate that you will pay, allow you to repay the loan early, detail what will occur in the event of default and specify whether the loan is secured or unsecured.

A personal loan agreement should include the following information: Names and addresses of the lender and the borrower. Information about the loan cosigner, if applicable. Amount borrowed. Date the loan was provided. Expected repayment date. Interest rate, if applicable. Annual percentage rate (APR), if applicable.

A loan agreement does not require a notary signature. The purpose of a notary seal is to provide evidence that the signature is genuinely the signature of the person signing.

A personal loan agreement is a legal document that is completed by a lender and a borrower to establish the terms and conditions of a loan. The loan agreement, or note, is legally binding.

For a personal loan agreement to be enforceable, it must be documented in writing and signed by both parties. You may choose to keep a copy in your county recorder's office if you wish, though it's not legally necessary. It's sufficient for both parties to store their own copy, ideally in a safe place.